Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In the dynamic world of business, staying ahead requires embracing efficiency and leveraging technology. One crucial aspect often overlooked is the seamless integration of systems to streamline operations and enhance customer experiences. This article delves deep into the powerful synergy of Customer Relationship Management (CRM) systems and PayPal, focusing on how integrating these two can revolutionize your business, boost your sales, and foster lasting customer relationships. We’ll explore the ‘how’ and ‘why’ of CRM integration with PayPal, providing you with actionable insights and practical strategies to unlock the full potential of this powerful combination.

Understanding the Power of CRM and PayPal

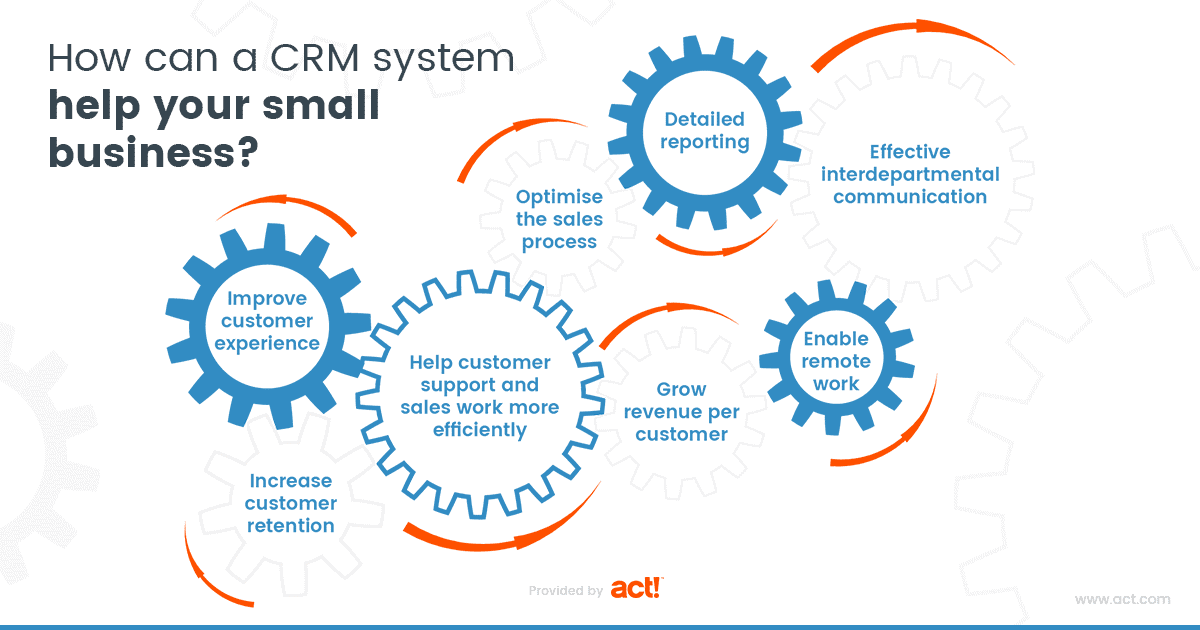

Before we dive into the specifics of integration, let’s establish a clear understanding of what CRM and PayPal bring to the table individually. CRM systems are the backbone of modern businesses, designed to manage and analyze customer interactions and data throughout the customer lifecycle. They provide a centralized platform for organizing customer information, tracking interactions, automating tasks, and improving overall customer service.

PayPal, on the other hand, is a globally recognized online payment processing service. It allows businesses to securely accept payments from customers worldwide, offering a convenient and reliable payment gateway. Its widespread adoption and ease of use make it a favorite among both businesses and consumers.

The true magic happens when you merge these two powerhouses. Integrating CRM with PayPal allows you to capture payment data directly within your CRM system. This creates a unified view of your customers, linking their payment history with their contact information, purchase behavior, and support interactions. This 360-degree view of your customers is invaluable for personalization, targeted marketing, and improving customer satisfaction.

Benefits of CRM Systems:

- Enhanced Customer Relationship Management: Centralized customer data, improved communication, and personalized interactions.

- Sales Automation: Streamlined sales processes, lead tracking, and automated follow-ups.

- Marketing Automation: Targeted campaigns, personalized messaging, and improved lead nurturing.

- Improved Customer Service: Faster response times, efficient issue resolution, and proactive support.

- Data-Driven Decision Making: Comprehensive reporting, analytics, and insights for informed business decisions.

Benefits of PayPal:

- Global Payment Acceptance: Accept payments from customers worldwide in multiple currencies.

- Secure Transactions: Advanced security features to protect customer payment information.

- Ease of Use: Simple setup and user-friendly interface for both businesses and customers.

- Fast Payments: Quick and efficient payment processing.

- Brand Recognition: Trusted and recognized payment gateway, increasing customer confidence.

Why Integrate CRM with PayPal? The Compelling Advantages

The benefits of integrating CRM with PayPal are far-reaching, impacting various aspects of your business. Let’s explore the key advantages in detail:

1. Streamlined Sales Processes and Enhanced Efficiency

Integrating PayPal with your CRM automates the payment tracking process, eliminating the need for manual data entry. Sales representatives can view payment statuses directly within the CRM, saving valuable time and reducing the risk of errors. This streamlined process allows your team to focus on more strategic activities, such as building relationships and closing deals.

2. Improved Customer Insights and Personalization

By linking payment data with customer profiles, you gain a deeper understanding of your customers’ purchasing habits and preferences. This allows you to personalize your marketing efforts, tailor product recommendations, and offer customized support. Personalization leads to increased customer satisfaction, loyalty, and ultimately, higher sales.

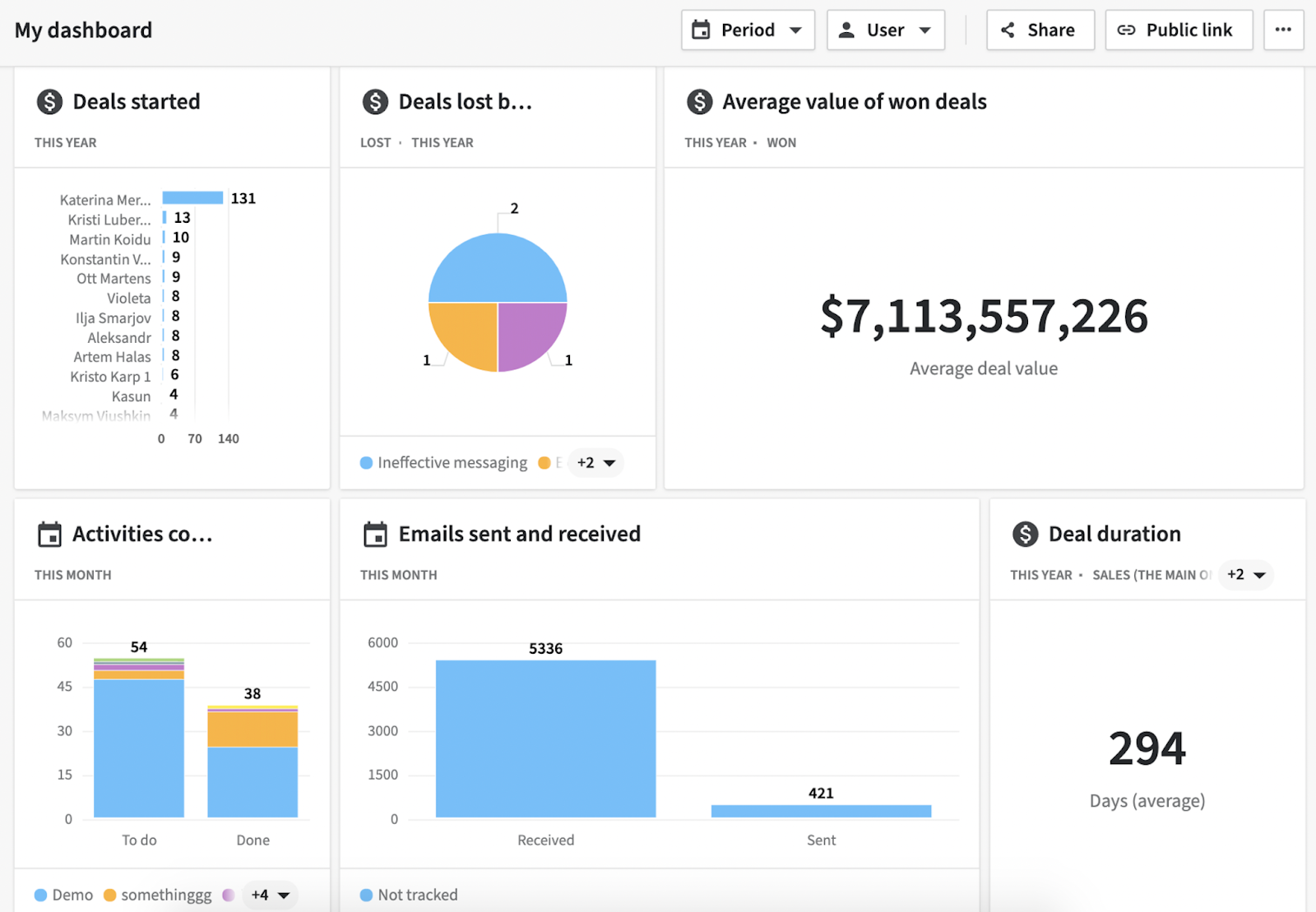

3. Enhanced Reporting and Analytics

Integrated systems provide a comprehensive view of your sales performance. You can track key metrics such as revenue, order volume, and customer lifetime value. This data-driven approach enables you to make informed decisions, identify areas for improvement, and optimize your sales and marketing strategies.

4. Reduced Manual Errors and Improved Accuracy

Automating the payment tracking process minimizes the risk of human error. Data is automatically synced between PayPal and your CRM, ensuring accuracy and consistency. This reduces the need for manual reconciliation and frees up your team to focus on more important tasks.

5. Faster Payment Processing and Improved Cash Flow

With integrated systems, you can quickly identify and track payments, accelerating the payment processing cycle. This can improve your cash flow and provide you with the financial resources you need to grow your business.

6. Enhanced Customer Experience

A seamless payment experience is crucial for customer satisfaction. CRM integration with PayPal allows you to provide customers with a smooth and secure checkout process, reducing friction and increasing the likelihood of repeat purchases. Furthermore, it allows you to easily process refunds, manage disputes, and offer personalized customer support based on their purchase history.

Step-by-Step Guide to Integrating CRM with PayPal

The integration process varies depending on the CRM system you use. However, the general steps remain consistent. Here’s a comprehensive guide to help you get started:

1. Choose the Right CRM and PayPal Integration Method

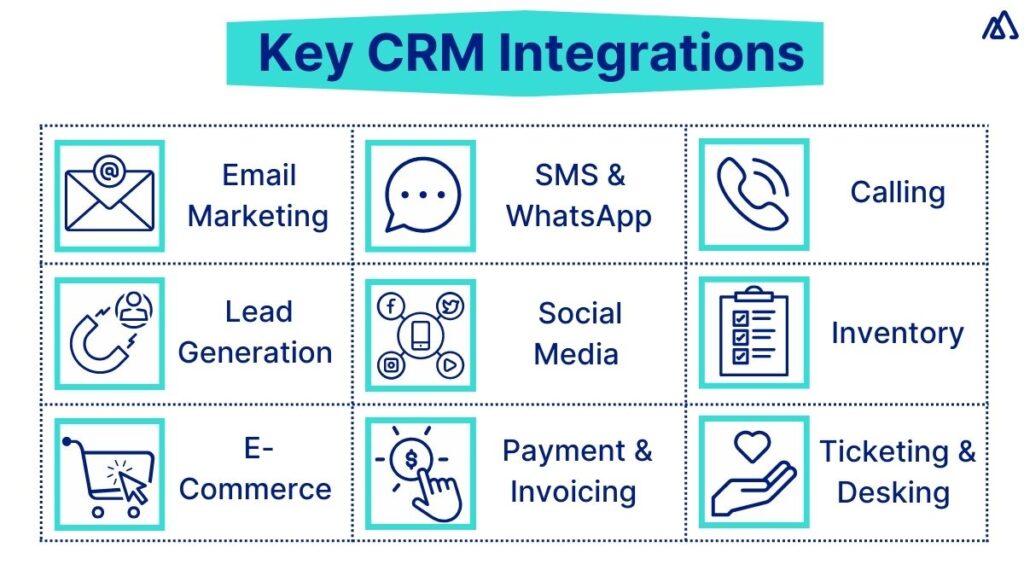

Several integration options are available, including:

- Native Integration: Some CRM systems offer native integrations with PayPal. This is often the easiest and most seamless option.

- Third-Party Apps/Plugins: Many third-party apps and plugins are designed to connect CRM systems with PayPal. These can be a good option if your CRM doesn’t have a native integration.

- Custom Integration (API): For more advanced customization, you can use the PayPal API to build a custom integration. This requires technical expertise.

Research your CRM system and explore the available integration options. Consider factors such as ease of use, features, and cost.

2. Set up Your PayPal Account

If you don’t already have one, create a PayPal Business account. Ensure your account is verified and configured to accept payments in the currencies you need.

3. Configure the Integration

Follow the specific instructions for your chosen integration method. This typically involves:

- Connecting your PayPal account to your CRM.

- Mapping the relevant fields, such as customer information, order details, and payment statuses.

- Configuring settings such as payment notifications and automated actions.

Most integrations provide clear instructions. If you’re using a third-party app, refer to its documentation.

4. Test the Integration

Before going live, thoroughly test the integration to ensure it’s working correctly. Create test orders, process payments, and verify that the data is being synced between PayPal and your CRM. Make sure to check for any errors or discrepancies.

5. Train Your Team

Once the integration is set up, train your team on how to use it effectively. Explain the new workflows, how to access payment information, and how to troubleshoot any issues that may arise.

6. Monitor and Optimize

After the integration is live, monitor its performance regularly. Track key metrics, such as payment processing times and data accuracy. Make adjustments and optimizations as needed to ensure the integration is working efficiently and meeting your business needs. Review the integration periodically to ensure it’s still aligned with your business goals and any updates from PayPal or your CRM provider.

Popular CRM Systems and Their PayPal Integration Options

The availability of PayPal integration varies depending on the CRM system. Here’s a look at some popular CRM systems and their integration options:

1. Salesforce

Salesforce offers various integration options with PayPal, including native integrations and third-party apps available on the AppExchange. These integrations allow you to seamlessly process payments, track transactions, and manage customer payment information within Salesforce.

2. HubSpot

HubSpot provides integrations with PayPal, allowing you to connect your payment gateway and track customer payments within the CRM. This integration enables you to streamline your sales process and gain valuable insights into your customers’ payment behavior.

3. Zoho CRM

Zoho CRM offers a native integration with PayPal, enabling you to accept payments directly within the CRM. This integration simplifies the payment process and allows you to track payment details, manage subscriptions, and automate payment reminders.

4. Pipedrive

Pipedrive typically integrates with PayPal through third-party apps and plugins. This allows you to connect your payment gateway and track payment information within the Pipedrive CRM, streamlining your sales process and improving your customer data management.

5. Freshsales

Freshsales often uses third-party integrations or APIs to connect with PayPal. The integration allows you to manage payment information and track transaction details within Freshsales, improving sales efficiency and customer relationship management.

Note: Integration options can change, so always check the latest information from your CRM provider and PayPal.

Troubleshooting Common Integration Issues

Even with the best-laid plans, you might encounter some hiccups during the integration process. Here are some common issues and how to troubleshoot them:

1. Connection Errors

Problem: The integration fails to connect to PayPal or your CRM. This might be due to incorrect credentials, network issues, or server problems.

Solution:

- Double-check your PayPal and CRM account credentials.

- Ensure your internet connection is stable.

- Contact your CRM provider or PayPal support for assistance.

2. Data Synchronization Issues

Problem: Payment data is not syncing correctly between PayPal and your CRM, or some data is missing.

Solution:

- Verify that the field mappings are correct.

- Check your CRM and PayPal logs for error messages.

- Ensure that the integration is running in the background and configured to synchronize data regularly.

- Contact the integration provider’s support if problems persist.

3. Payment Processing Errors

Problem: Payments are failing to process, or customers are experiencing issues during checkout.

Solution:

- Ensure your PayPal account is active and in good standing.

- Check for any restrictions or limitations on your PayPal account.

- Verify that the customer’s payment information is correct.

- Review the error messages from PayPal or your CRM to identify the root cause.

- Contact PayPal support for help.

4. Customization Difficulties

Problem: You are unable to customize the integration to meet your specific needs.

Solution:

- Review the documentation for your CRM and PayPal integration to see if customization options are available.

- Consider using a third-party app or plugin that offers more customization features.

- If you need advanced customization, explore using the PayPal API or hiring a developer.

5. Security Concerns

Problem: You are concerned about the security of your customer data or the integration itself.

Solution:

- Ensure the integration uses secure protocols, such as HTTPS.

- Review the privacy policies of your CRM provider and PayPal.

- Use strong passwords and enable multi-factor authentication.

- If in doubt, contact your CRM provider or PayPal support for security advice.

Best Practices for a Successful CRM and PayPal Integration

To maximize the benefits of your CRM and PayPal integration, consider these best practices:

1. Plan and Define Your Goals

Before you start the integration, define your goals and objectives. What do you hope to achieve with the integration? This will help you choose the right integration method and configure it effectively.

2. Choose the Right CRM and Integration Method

Select the CRM and integration method that best suits your business needs and budget. Consider factors such as ease of use, features, and scalability.

3. Test Thoroughly

Test the integration thoroughly before going live. Create test orders, process payments, and verify that the data is being synced correctly.

4. Train Your Team

Train your team on how to use the integration effectively. Provide them with clear instructions and ongoing support.

5. Monitor and Optimize

Monitor the performance of the integration regularly. Track key metrics, such as payment processing times and data accuracy. Make adjustments and optimizations as needed.

6. Stay Updated

Keep your CRM system, PayPal account, and integration methods up to date. This will help ensure compatibility and security.

7. Secure Your Data

Protect customer payment information and sensitive data by using secure protocols and following security best practices.

8. Provide Excellent Customer Support

Make sure your customers have a positive experience. Respond to their inquiries promptly and resolve any issues efficiently.

The Future of CRM and Payment Integration

The integration of CRM and payment gateways like PayPal is a constantly evolving landscape. As technology advances, we can expect even more sophisticated and seamless integrations in the future. Here are some trends to watch out for:

1. AI-Powered Automation

Artificial intelligence (AI) will play a more significant role in automating payment processes, such as fraud detection, payment reminders, and personalized offers.

2. Enhanced Personalization

CRM systems will leverage payment data to offer even more personalized experiences, such as targeted product recommendations and customized customer support.

3. Mobile Payment Integration

Mobile payment options will become even more integrated with CRM systems, making it easier for customers to pay on the go.

4. Blockchain Technology

Blockchain technology could be used to enhance the security and transparency of payment transactions within CRM systems.

5. Increased Focus on Data Security

With growing concerns about data privacy, there will be an increased focus on securing customer payment information and complying with data privacy regulations.

Conclusion: Embrace the Synergy for Business Success

Integrating CRM with PayPal is a strategic move that can significantly impact your business’s growth and success. By streamlining sales processes, improving customer insights, and enhancing customer experiences, you can unlock new opportunities for growth and build stronger customer relationships. By following the steps outlined in this article, you can successfully integrate your CRM with PayPal and reap the rewards of a more efficient, data-driven, and customer-centric business. Embrace the power of this synergy, and watch your business thrive.