Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Unlocking Growth: The Power of CRM Integration with PayPal

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and ultimately, boost revenue. One powerful strategy that achieves all these goals is the integration of a Customer Relationship Management (CRM) system with a leading payment gateway like PayPal. This article delves deep into the benefits, implementation strategies, and best practices of CRM integration with PayPal, providing a comprehensive guide for businesses of all sizes.

Why CRM Integration with PayPal Matters

At its core, CRM integration with PayPal is about connecting your sales, marketing, and customer service efforts with your payment processing capabilities. This connection unlocks a wealth of advantages that can significantly impact your bottom line. Let’s explore some of the key reasons why this integration is crucial:

- Enhanced Customer Experience: Imagine a scenario where a customer makes a purchase through your website, and all their payment information, order details, and contact information are automatically synced with your CRM. This allows you to provide personalized service, anticipate their needs, and build stronger relationships.

- Streamlined Operations: Manual data entry is a thing of the past. With CRM integration, payment data flows seamlessly between your PayPal account and your CRM, eliminating the need for tedious manual processes and reducing the risk of errors.

- Improved Sales Efficiency: Sales teams gain instant access to payment history, allowing them to quickly understand customer behavior, identify upsell and cross-sell opportunities, and close deals faster.

- Data-Driven Decision Making: Integrated data provides valuable insights into customer behavior, sales performance, and marketing campaign effectiveness. This empowers businesses to make informed decisions and optimize their strategies for maximum impact.

- Reduced Costs: Automation reduces the need for manual data entry and reconciliation, saving time and resources. Fewer errors also translate to lower costs associated with correcting mistakes.

- Increased Security: By leveraging PayPal’s secure payment processing infrastructure, businesses can enhance the security of their transactions and protect sensitive customer data.

Key Benefits of CRM Integration

The benefits of CRM integration with PayPal extend beyond simple convenience. They represent a fundamental shift in how businesses operate, enabling them to be more efficient, customer-centric, and data-driven. Here’s a closer look at the specific advantages:

1. Automated Data Synchronization

One of the most significant benefits is the automated synchronization of data. When a customer makes a payment via PayPal, the transaction details, including the amount, date, and customer information, are automatically updated in your CRM. This eliminates the need for manual data entry, which is time-consuming, prone to errors, and can lead to data inconsistencies. Automated synchronization ensures that your CRM is always up-to-date with the latest payment information.

2. Enhanced Customer Profiling

With integrated data, you can build more comprehensive customer profiles. By combining payment history with other customer data, such as purchase preferences, demographics, and interaction history, you gain a deeper understanding of each customer. This allows you to personalize your marketing efforts, tailor your sales pitches, and provide more relevant customer service.

3. Streamlined Sales Processes

CRM integration with PayPal streamlines the sales process by providing sales teams with instant access to payment information. Sales representatives can quickly see a customer’s payment history, identify potential upsell or cross-sell opportunities, and tailor their conversations to the customer’s specific needs. This leads to faster sales cycles and higher conversion rates.

4. Improved Reporting and Analytics

Integrated data provides a wealth of information for reporting and analytics. You can track key metrics, such as sales revenue, customer lifetime value, and the effectiveness of marketing campaigns. This data-driven approach allows you to make informed decisions about your business strategy, optimize your marketing efforts, and identify areas for improvement.

5. Reduced Manual Errors

Manual data entry is a major source of errors in business operations. With CRM integration, you eliminate the need for manual data entry, reducing the risk of errors and ensuring data accuracy. This not only saves time but also minimizes the costs associated with correcting mistakes.

6. Better Customer Service

By having access to a customer’s payment history and other relevant information, customer service representatives can provide faster and more efficient support. They can quickly understand a customer’s issue, resolve it promptly, and provide a more personalized experience. This leads to higher customer satisfaction and loyalty.

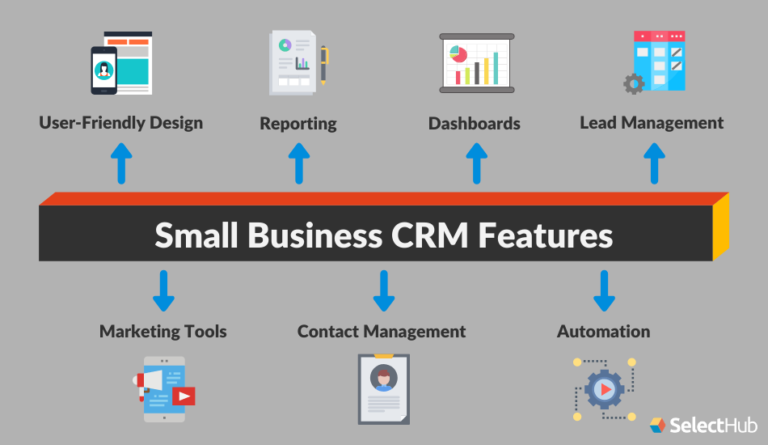

Choosing the Right CRM for PayPal Integration

The success of your CRM integration with PayPal depends heavily on choosing the right CRM system. Several CRM platforms offer seamless integration with PayPal, each with its own strengths and weaknesses. Here’s a guide to help you choose the right one for your business:

1. Consider Your Business Needs

Before selecting a CRM, carefully assess your business needs. What are your primary goals for implementing a CRM? What features are essential for your sales, marketing, and customer service teams? Do you need advanced features like lead scoring, marketing automation, or e-commerce integration? Understanding your needs will help you narrow down your options.

2. Research Available CRM Systems

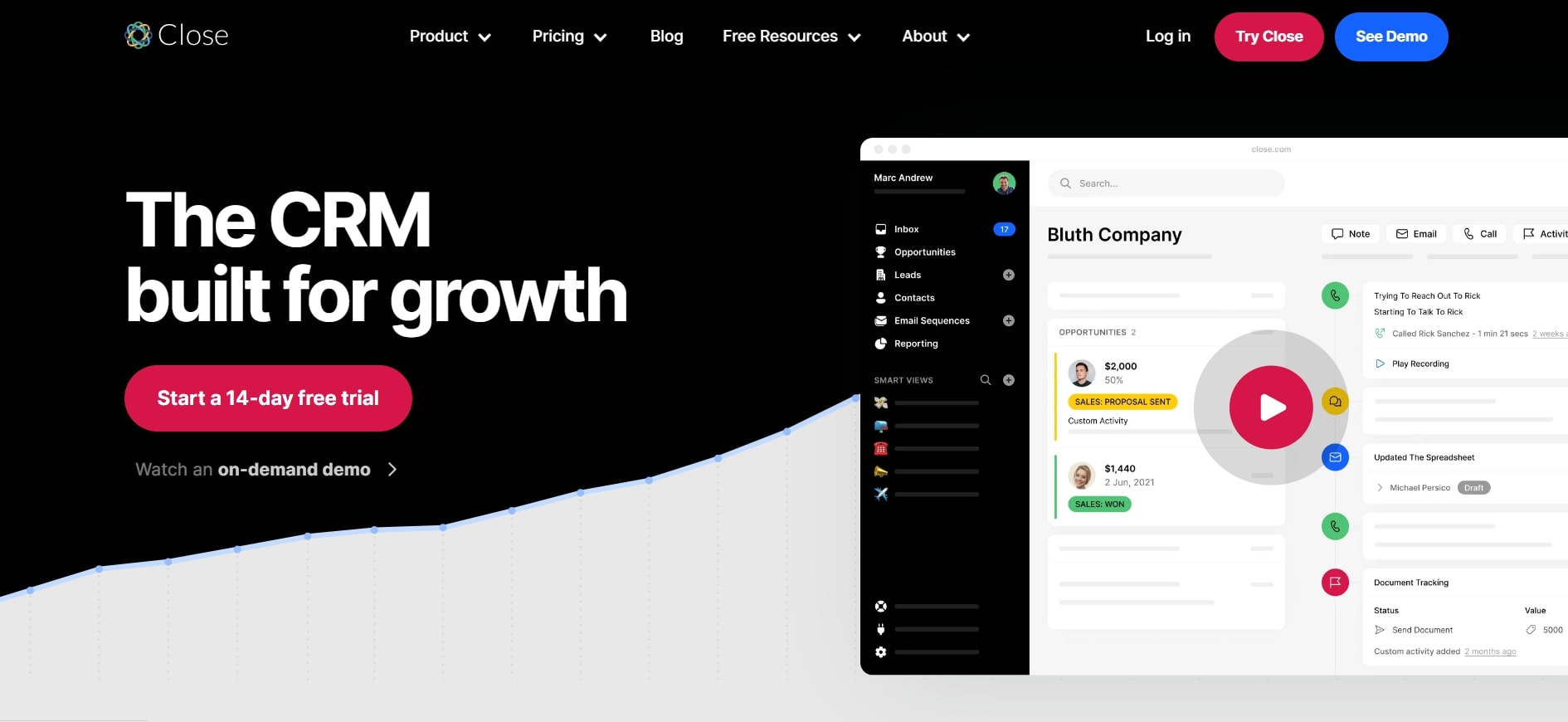

Once you have a clear understanding of your needs, research the available CRM systems. Some popular CRM platforms that offer excellent PayPal integration include:

- Salesforce: A leading CRM platform with robust features and a wide range of integrations.

- HubSpot CRM: A user-friendly CRM with powerful marketing and sales automation tools.

- Zoho CRM: A comprehensive CRM with a focus on affordability and ease of use.

- Pipedrive: A sales-focused CRM designed to help sales teams manage their pipelines effectively.

- Microsoft Dynamics 365: A powerful CRM platform with a suite of integrated business applications.

3. Evaluate PayPal Integration Capabilities

When evaluating CRM systems, pay close attention to their PayPal integration capabilities. Look for features such as:

- Automatic data synchronization: The ability to automatically sync payment data from PayPal to your CRM.

- Customizable fields and workflows: The ability to customize the data fields and workflows to meet your specific needs.

- Reporting and analytics: The ability to generate reports and analyze data related to PayPal transactions.

- Security features: The ability to ensure the security of your customer data.

4. Consider Scalability

Choose a CRM that can scale with your business. As your business grows, you’ll need a CRM that can handle increasing amounts of data and user activity. Consider the platform’s scalability and its ability to accommodate your future needs.

5. Read Reviews and Get Recommendations

Read reviews from other users and get recommendations from industry experts. This will give you valuable insights into the strengths and weaknesses of different CRM systems and help you make an informed decision.

6. Try Free Trials

Take advantage of free trials offered by different CRM systems. This will allow you to test the platform and see if it meets your needs before making a commitment.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

Implementing CRM integration with PayPal may seem daunting, but it’s a manageable process. Here’s a step-by-step guide to help you get started:

1. Choose a CRM System

As discussed earlier, choose a CRM system that meets your business needs and offers seamless integration with PayPal. Consider factors like features, scalability, and cost.

2. Create a PayPal Business Account

If you don’t already have one, create a PayPal Business account. This account allows you to accept payments online and access the necessary APIs for integration.

3. Connect Your PayPal Account to Your CRM

The specific steps for connecting your PayPal account to your CRM will vary depending on the CRM platform you choose. Generally, you’ll need to:

- Log in to your CRM.

- Navigate to the settings or integrations section.

- Find the PayPal integration option.

- Enter your PayPal account credentials.

- Authorize the integration.

Follow the on-screen instructions provided by your CRM platform.

4. Configure Data Mapping

Data mapping is the process of mapping data fields between your PayPal account and your CRM. This ensures that data is transferred correctly between the two systems. For example, you’ll need to map the customer’s name, email address, and payment amount from PayPal to the corresponding fields in your CRM.

5. Test the Integration

Once you’ve configured the integration, test it thoroughly to ensure that data is being synced correctly. Make a test payment through PayPal and verify that the transaction details are automatically updated in your CRM.

6. Customize Workflows and Automations

Take advantage of your CRM’s features to customize workflows and automations. For example, you can set up automated email notifications to be sent to customers after they make a payment or create automated tasks for your sales team based on payment status.

7. Train Your Team

Train your sales, marketing, and customer service teams on how to use the integrated system. Provide them with clear instructions on how to access and utilize the data from PayPal in their daily tasks.

8. Monitor and Optimize

After implementation, monitor the integration regularly to ensure that it’s functioning correctly. Identify any issues and make adjustments as needed. Continuously optimize your workflows and automations to maximize the benefits of the integration.

Best Practices for Successful CRM Integration with PayPal

To ensure a successful CRM integration with PayPal, follow these best practices:

1. Plan Your Integration Strategy

Before you begin the integration process, take the time to plan your strategy. Define your goals, identify the key data points you want to sync, and create a detailed implementation plan. This will help you avoid common pitfalls and ensure a smooth integration.

2. Choose the Right Integration Method

There are several methods for integrating CRM with PayPal, including:

- Native integrations: Some CRM systems offer native integrations with PayPal, which are often the easiest to set up.

- Third-party integrations: Third-party integration tools can connect your CRM to PayPal.

- Custom integrations: If you have specific requirements, you can create a custom integration using APIs.

Choose the integration method that best suits your needs and technical expertise.

3. Prioritize Data Security

Data security is paramount. Protect sensitive customer data by using secure payment processing methods and implementing robust security measures. Follow PayPal’s security guidelines and comply with all relevant data privacy regulations.

4. Maintain Data Consistency

Ensure data consistency between your PayPal account and your CRM. Regularly review the data to identify any discrepancies and take steps to resolve them. This will help you maintain accurate customer profiles and improve your decision-making.

5. Provide Ongoing Training

Provide ongoing training to your team on how to use the integrated system. As your business grows and your needs evolve, you’ll need to update your training materials and provide additional support.

6. Monitor Performance and Make Adjustments

Continuously monitor the performance of your CRM integration with PayPal. Track key metrics, such as sales revenue, customer satisfaction, and data accuracy. Make adjustments to your workflows and automations as needed to optimize performance.

7. Stay Updated

Keep up-to-date with the latest changes in both your CRM and PayPal. Software updates can introduce new features, improvements, and security patches. Regularly update your systems to ensure that you’re taking advantage of the latest advancements.

Troubleshooting Common Issues

Even with careful planning and implementation, you may encounter some common issues during CRM integration with PayPal. Here are some tips for troubleshooting these problems:

1. Data Synchronization Errors

If you experience data synchronization errors, check the following:

- Account Credentials: Verify that your PayPal account credentials are correct.

- API Permissions: Ensure that your CRM has the necessary API permissions to access your PayPal account.

- Data Mapping: Double-check your data mapping to ensure that all the relevant fields are correctly mapped.

- Network Connectivity: Ensure that your systems have a stable internet connection.

2. Payment Processing Errors

If you encounter payment processing errors, check the following:

- Payment Gateway: Verify that PayPal is functioning correctly.

- Account Balance: Ensure that your PayPal account has sufficient funds.

- Transaction Limits: Check your PayPal transaction limits.

- Payment Details: Verify that the customer’s payment details are correct.

3. Customer Data Issues

If you experience customer data issues, check the following:

- Data Accuracy: Verify that the customer data in your CRM is accurate.

- Data Duplication: Check for duplicate customer records.

- Data Privacy: Ensure that you are complying with data privacy regulations.

4. Integration Conflicts

If you experience integration conflicts, check the following:

- Other Integrations: Check if any other integrations are conflicting with your PayPal integration.

- CRM Settings: Review your CRM settings to ensure that they are configured correctly.

- Third-Party Tools: If you’re using third-party tools, ensure they are compatible with your CRM and PayPal.

Real-World Examples of Successful CRM Integration with PayPal

To further illustrate the power of CRM integration with PayPal, let’s look at some real-world examples of businesses that have successfully implemented this strategy:

1. E-commerce Businesses

E-commerce businesses can significantly benefit from CRM integration with PayPal. By automatically syncing payment data with their CRM, they can track customer purchases, manage orders, and provide personalized customer service. This allows them to:

- Improve customer retention: By understanding customer purchase history and preferences, e-commerce businesses can offer personalized recommendations and targeted promotions.

- Streamline order management: Automated data synchronization simplifies order fulfillment and reduces the risk of errors.

- Enhance marketing efforts: Integrated data provides valuable insights into customer behavior, allowing businesses to optimize their marketing campaigns and increase sales.

2. Subscription-Based Businesses

Subscription-based businesses can use CRM integration with PayPal to automate billing, manage subscriptions, and reduce churn. This allows them to:

- Automate billing: Automatically generate invoices and process payments.

- Manage subscriptions: Track subscription status, renewals, and cancellations.

- Reduce churn: Proactively identify and address customer issues to prevent churn.

3. Non-Profit Organizations

Non-profit organizations can use CRM integration with PayPal to manage donations, track donor engagement, and build stronger relationships with their donors. This allows them to:

- Track donations: Automatically record donations and generate reports.

- Manage donor relationships: Segment donors based on their giving history and preferences.

- Improve fundraising efforts: Optimize fundraising campaigns based on data-driven insights.

The Future of CRM and PayPal Integration

The integration of CRM systems with payment gateways like PayPal is constantly evolving. As technology advances, we can expect to see even more sophisticated integrations that offer greater efficiency, personalization, and security. Some potential future trends include:

- Artificial Intelligence (AI): AI-powered CRM systems will be able to analyze vast amounts of data to provide even more personalized recommendations, predict customer behavior, and automate tasks.

- Enhanced Security: As cyber threats become more sophisticated, we can expect to see even more robust security measures to protect customer data.

- Mobile Integration: With the increasing use of mobile devices, we can expect to see more seamless mobile integration, allowing businesses to manage their CRM and payment processing on the go.

- Integration with Emerging Payment Methods: As new payment methods emerge, such as cryptocurrencies and digital wallets, we can expect to see CRM systems adapt to support these payment options.

Conclusion: Embracing the Synergy of CRM and PayPal

CRM integration with PayPal is a powerful strategy for businesses seeking to streamline operations, enhance customer experiences, and drive revenue growth. By automating data synchronization, improving sales efficiency, and gaining valuable insights, businesses can unlock a wealth of benefits. By following the implementation steps, adhering to best practices, and staying updated on the latest advancements, businesses can harness the full potential of this powerful synergy. Embrace the future of business by integrating your CRM with PayPal and experience the transformative power of seamless transactions and enhanced customer relationships. It’s not just about processing payments; it’s about building a stronger, more successful business.