Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

In the dynamic world of business, efficiency and organization are the cornerstones of success. Companies are constantly seeking ways to streamline their operations, enhance customer relationships, and boost profitability. A powerful solution that addresses these needs is the integration of Customer Relationship Management (CRM) systems with accounting software like QuickBooks. This article delves into the intricacies of CRM integration with QuickBooks, exploring the benefits, implementation strategies, and best practices to help businesses of all sizes unlock their full potential.

Understanding the Power of CRM and QuickBooks Integration

Before diving into the specifics, let’s establish a clear understanding of the two key players: CRM and QuickBooks. CRM systems are designed to manage and analyze customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships and driving sales growth. They provide a centralized hub for storing customer information, tracking interactions, and automating sales and marketing processes.

QuickBooks, on the other hand, is a leading accounting software solution used by businesses to manage their finances. It helps with tasks like tracking income and expenses, generating invoices, managing payroll, and creating financial reports. While both systems are powerful on their own, their true potential is unleashed when they are integrated.

CRM integration with QuickBooks essentially means connecting the two systems to share data and automate processes. This integration allows for seamless data flow between sales, marketing, and customer service teams (using the CRM) and the accounting department (using QuickBooks). The result is a more unified, efficient, and data-driven business operation.

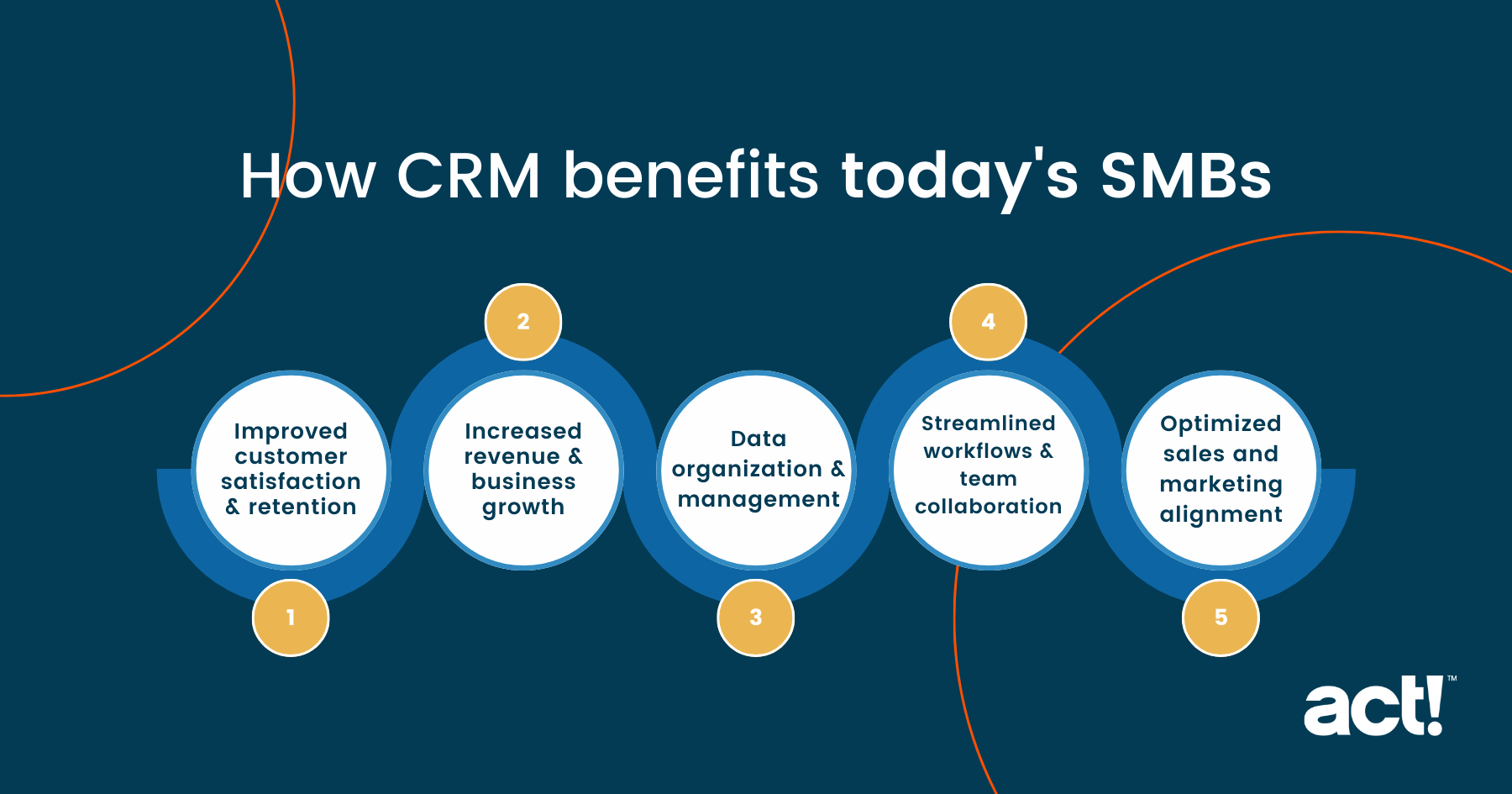

The Compelling Benefits of CRM Integration with QuickBooks

The advantages of integrating CRM with QuickBooks are numerous and far-reaching. Here are some of the most significant benefits:

1. Enhanced Data Accuracy and Reduced Errors

One of the biggest challenges in business is data entry errors. When data needs to be manually entered into multiple systems, the chances of errors increase exponentially. CRM integration eliminates the need for manual data entry by automatically syncing data between the two systems. This ensures that customer information, sales data, and financial information are always up-to-date and accurate. This is particularly critical for financial reporting and compliance.

2. Improved Efficiency and Productivity

Manual data entry is not only prone to errors but also incredibly time-consuming. By automating the data transfer process, CRM integration frees up valuable time for employees. Sales teams no longer have to manually input sales data into QuickBooks, and accounting teams don’t have to re-enter customer information from the CRM. This increased efficiency allows employees to focus on more strategic tasks, such as building customer relationships and analyzing financial performance.

3. Streamlined Sales and Accounting Processes

Integration streamlines the entire sales cycle, from lead generation to invoice payment. Sales teams can easily create quotes, generate invoices, and track payments directly from the CRM, which then automatically syncs with QuickBooks. This eliminates the need for separate systems and reduces the risk of errors. Accounting teams benefit from automated data entry, simplified reconciliation, and faster invoice processing.

4. Better Customer Relationship Management

A well-integrated system provides a 360-degree view of the customer. Sales teams can access customer financial information, such as payment history and outstanding balances, directly from the CRM. This allows them to provide better customer service, personalize interactions, and identify upsell and cross-sell opportunities. Customer service representatives also benefit from having access to both customer relationship details and financial data, allowing them to resolve issues quickly and efficiently.

5. Improved Financial Reporting and Analysis

Integrated systems enable more accurate and comprehensive financial reporting. With real-time data synchronization, businesses can generate financial reports that reflect the latest sales and customer data. This provides a more complete picture of financial performance, allowing for better decision-making. Businesses can also track key performance indicators (KPIs) and analyze trends to identify areas for improvement.

6. Reduced Costs

The efficiency gains and reduced errors that come with CRM integration can lead to significant cost savings. By automating data entry and streamlining processes, businesses can reduce labor costs and minimize the risk of costly errors. The improved financial reporting also allows for better financial planning and budgeting, leading to further cost savings.

7. Enhanced Collaboration

Integration fosters better collaboration between sales, marketing, and accounting teams. With all teams accessing the same data, communication becomes more efficient, and everyone is on the same page. This improved collaboration leads to better decision-making and a more cohesive business operation.

Step-by-Step Guide to Integrating CRM with QuickBooks

Implementing CRM integration with QuickBooks can seem daunting, but with a clear understanding of the process, it can be a straightforward and rewarding undertaking. Here’s a step-by-step guide to help you through the process:

1. Choose the Right CRM and Integration Method

The first step is to select a CRM system that meets your business needs and budget. There are many CRM options available, each with its own strengths and weaknesses. Consider factors such as the size of your business, the complexity of your sales processes, and the features you need. Popular CRM systems that integrate well with QuickBooks include:

- Salesforce

- Zoho CRM

- HubSpot CRM

- Microsoft Dynamics 365

- Pipedrive

Once you’ve chosen a CRM, you need to determine the best method for integration. There are generally three options:

- Native Integration: Some CRM systems offer native integration with QuickBooks, meaning the integration is built-in and ready to use. This is often the easiest and most straightforward option.

- Third-Party Integration: Several third-party integration platforms, such as Zapier, PieSync, and SyncApps, specialize in connecting CRM systems with QuickBooks. These platforms provide a user-friendly interface and offer a wide range of customization options.

- Custom Integration: For more complex integration requirements, you may need to develop a custom integration using APIs (Application Programming Interfaces). This option requires technical expertise but offers the most flexibility.

2. Plan and Prepare

Before you begin the integration process, it’s essential to plan and prepare. This includes:

- Defining Your Goals: What do you hope to achieve with the integration? Identify the specific data you want to sync and the processes you want to automate.

- Mapping Data Fields: Determine which data fields in your CRM will map to corresponding fields in QuickBooks. This is crucial for ensuring data accuracy.

- Cleaning Your Data: Before syncing data, clean up your CRM and QuickBooks data to ensure consistency and accuracy. Remove duplicates, correct errors, and standardize formatting.

- Backing Up Your Data: Always back up your CRM and QuickBooks data before starting the integration process. This will protect you from data loss in case of any unforeseen issues.

3. Set Up the Integration

The setup process will vary depending on the integration method you choose. However, the general steps include:

- Connecting Your Accounts: Connect your CRM and QuickBooks accounts to the integration platform or native integration. You will need to provide your login credentials for both systems.

- Mapping Data Fields: Map the data fields between the two systems. This tells the integration platform where to send the data.

- Configuring Sync Settings: Configure the sync settings, such as the direction of data flow (one-way or two-way), the sync frequency, and any filters you want to apply.

- Testing the Integration: Thoroughly test the integration by syncing a small amount of data to ensure it’s working correctly. Review the data in both systems to verify accuracy.

4. Train Your Team

Once the integration is set up, it’s important to train your team on how to use the integrated system. This includes providing training on the new workflows, data entry procedures, and reporting capabilities. Ensure that everyone understands how to use the system effectively and how to troubleshoot any issues that may arise.

5. Monitor and Maintain

After the integration is live, it’s essential to monitor its performance and maintain it regularly. This includes:

- Monitoring Data Synchronization: Regularly check the data synchronization logs to identify any errors or issues.

- Reviewing Data Accuracy: Periodically review the data in both systems to ensure accuracy.

- Updating the Integration: Keep the integration up-to-date with the latest versions of your CRM and QuickBooks.

- Providing Ongoing Support: Provide ongoing support to your team and address any questions or issues they may have.

Best Practices for Successful CRM and QuickBooks Integration

To ensure a successful CRM and QuickBooks integration, follow these best practices:

1. Start Small

Don’t try to integrate everything at once. Start with a small scope, such as syncing customer information and invoices. Once you’ve successfully integrated those core functions, you can gradually expand the integration to include other data and processes.

2. Prioritize Data Quality

Data quality is crucial for a successful integration. Clean your data before you start the integration process and establish data governance policies to ensure data accuracy and consistency going forward.

3. Choose the Right Integration Method

Select the integration method that best suits your business needs and technical capabilities. Consider the features, ease of use, and cost of each option.

4. Test Thoroughly

Test the integration thoroughly before going live. Sync a small amount of data and review it in both systems to ensure accuracy. Test different scenarios to identify any potential issues.

5. Provide Adequate Training

Train your team on how to use the integrated system. Ensure that everyone understands the new workflows and data entry procedures. Provide ongoing support to address any questions or issues.

6. Document Everything

Document the entire integration process, including the setup, configuration, and troubleshooting steps. This documentation will be invaluable for future maintenance and updates.

7. Stay Updated

Keep your CRM, QuickBooks, and integration platform up-to-date with the latest versions. This will ensure that you have access to the latest features and security updates.

8. Seek Expert Help

If you’re not comfortable with the technical aspects of integration, consider seeking help from a qualified consultant or integration specialist. They can provide expert guidance and help you navigate the process smoothly.

Real-World Examples of CRM Integration with QuickBooks in Action

To further illustrate the benefits and impact of CRM integration with QuickBooks, let’s look at some real-world examples:

Example 1: Small E-commerce Business

A small e-commerce business selling handmade jewelry was struggling with manual data entry and inefficient processes. They were manually entering customer information, order details, and payment information into both their CRM (Zoho CRM) and QuickBooks. This was time-consuming, prone to errors, and made it difficult to track sales and customer data accurately.

By integrating Zoho CRM with QuickBooks using a third-party integration platform like Zapier, they automated the data transfer process. Customer information, order details, and payment information were automatically synced between the two systems. This eliminated manual data entry, reduced errors, and saved the business several hours per week.

The business owner could then focus on marketing and customer service, while the accounting team could generate accurate financial reports and manage invoices efficiently. They also gained a better understanding of their customers, allowing them to personalize their marketing efforts and improve customer satisfaction.

Example 2: Mid-Sized Consulting Firm

A mid-sized consulting firm was using Salesforce for CRM and QuickBooks for accounting. They were struggling to manage their project finances effectively because they had to manually enter project data, time entries, and expenses into both systems. This led to delays in invoicing, inaccurate financial reporting, and difficulty tracking project profitability.

By implementing native integration between Salesforce and QuickBooks, they automated the data transfer process. Project data, time entries, and expenses were automatically synced between the two systems. This streamlined their project accounting, allowing them to generate invoices quickly, track project costs accurately, and gain a better understanding of project profitability.

The integration also improved collaboration between the sales and accounting teams. Sales teams could access project financial data from Salesforce, and accounting teams could see project details and customer information from QuickBooks. This fostered better communication and improved decision-making.

Example 3: Manufacturing Company

A manufacturing company was struggling with inefficiencies in its sales and accounting processes. Their sales team was using a custom CRM, and their accounting team was using QuickBooks. The lack of integration meant that sales orders had to be manually entered into QuickBooks, leading to delays and errors.

The company chose to develop a custom integration using APIs. This provided them with the flexibility to tailor the integration to their specific needs. They automated the transfer of sales orders, inventory data, and payment information between the CRM and QuickBooks. This eliminated manual data entry, reduced errors, and improved the accuracy of their financial reporting.

The integration also improved their inventory management. Sales orders automatically reduced inventory levels in QuickBooks, and the accounting team could easily track inventory costs. This led to better inventory control and reduced the risk of stockouts.

Addressing Common Challenges in CRM and QuickBooks Integration

While CRM integration with QuickBooks offers numerous benefits, it’s important to be aware of potential challenges and how to overcome them:

1. Data Mapping Complexity

Mapping data fields between the CRM and QuickBooks can be complex, especially if the systems have different data structures. To address this, carefully plan your data mapping, ensuring that data fields are mapped correctly and that data is consistent across both systems. Consider using a third-party integration platform that simplifies the data mapping process.

2. Data Synchronization Issues

Data synchronization issues, such as slow sync times or data conflicts, can disrupt the integration. To mitigate these issues, monitor the data synchronization logs regularly, identify and resolve any errors promptly, and configure the sync settings to optimize performance. Consider using a two-way sync to ensure data is updated across both systems.

3. Security Concerns

Integrating sensitive customer and financial data can raise security concerns. To address these concerns, choose a reputable integration platform that offers robust security features, such as data encryption and secure data transmission. Implement strong password policies and regularly review access permissions.

4. Training and Adoption Challenges

Successfully integrating CRM and QuickBooks requires proper training and user adoption. To overcome these challenges, provide comprehensive training to your team, clearly communicate the benefits of the integration, and offer ongoing support. Encourage user feedback and address any concerns promptly.

5. Cost Considerations

The cost of CRM and QuickBooks integration can vary depending on the chosen method, the complexity of the integration, and the size of your business. To manage costs effectively, carefully evaluate your integration needs, compare different integration options, and choose the solution that best fits your budget. Consider the long-term cost savings and ROI of the integration.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving, with new technologies and features emerging to enhance efficiency and improve business operations. Here are some trends to watch:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being integrated into CRM and QuickBooks to automate tasks, provide insights, and improve decision-making. For example, AI-powered CRM systems can analyze customer data to predict sales opportunities and personalize customer interactions. ML can be used to automate invoice processing and fraud detection in QuickBooks.

2. Enhanced Automation

Automation is becoming more sophisticated, with the ability to automate complex workflows and processes. This includes automating tasks such as lead nurturing, sales order processing, and invoice generation. Automation will continue to streamline operations and reduce manual effort.

3. Mobile Integration

Mobile integration is becoming increasingly important, allowing users to access CRM and QuickBooks data from anywhere at any time. This includes mobile apps that provide real-time access to customer information, sales data, and financial reports. Mobile integration will empower remote workers and improve productivity.

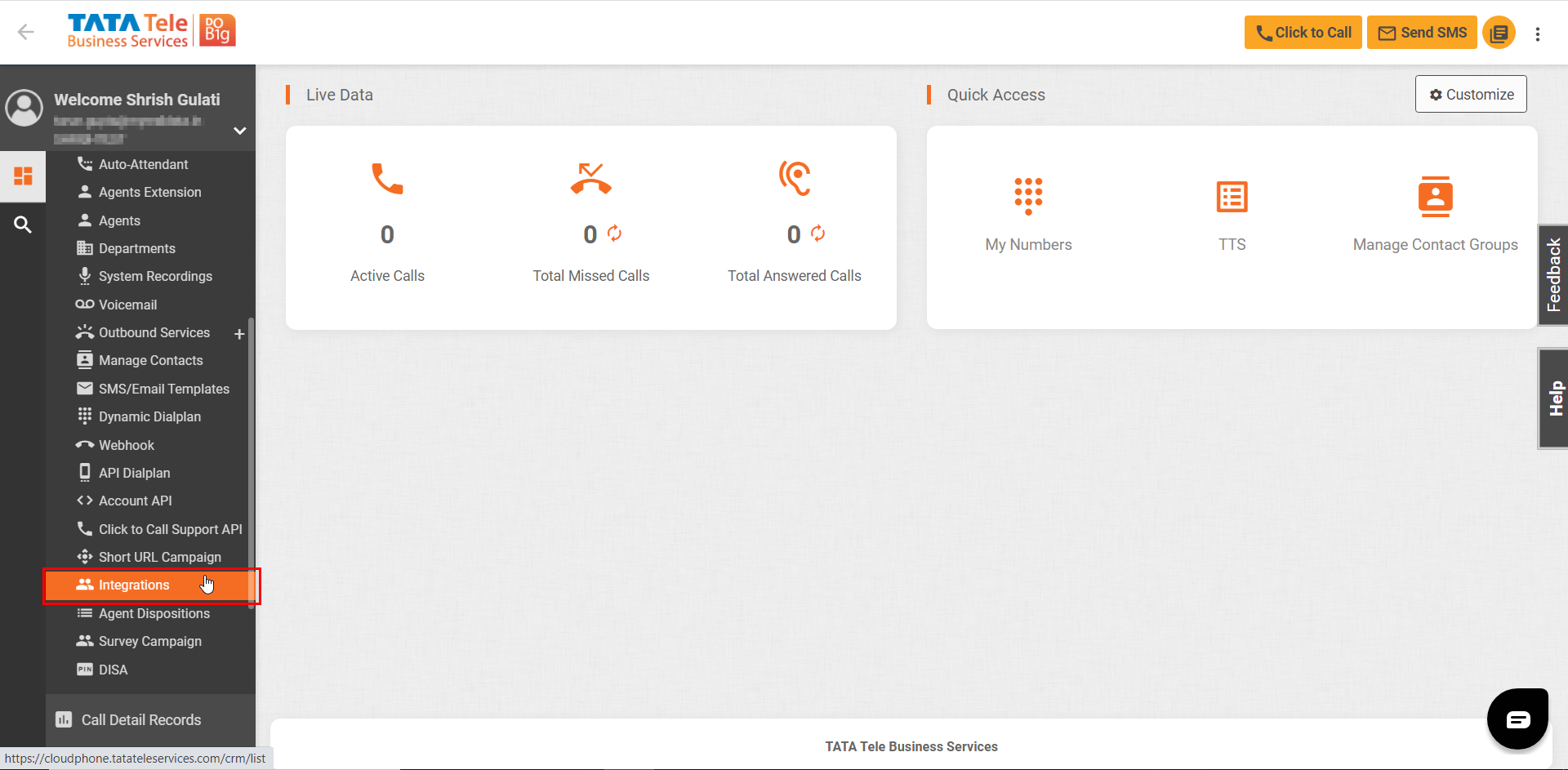

4. Integration with Other Business Systems

CRM and QuickBooks are increasingly being integrated with other business systems, such as e-commerce platforms, marketing automation tools, and project management software. This integration creates a more connected ecosystem, allowing businesses to manage all aspects of their operations from a single platform.

5. Focus on User Experience

User experience is becoming a key focus, with CRM and QuickBooks developers focusing on creating more intuitive and user-friendly interfaces. This includes simplifying workflows, providing personalized dashboards, and offering real-time insights. A better user experience will improve user adoption and boost productivity.

Conclusion: Embrace the Synergy for Business Success

CRM integration with QuickBooks is a powerful strategy for businesses seeking to improve efficiency, enhance customer relationships, and drive growth. By automating data transfer, streamlining processes, and providing a 360-degree view of the customer, integration unlocks a wealth of benefits, from enhanced data accuracy and improved financial reporting to reduced costs and increased collaboration.

While the implementation process may seem complex, the long-term rewards are well worth the effort. By carefully planning, choosing the right integration method, and following best practices, businesses can successfully integrate their CRM and QuickBooks systems and reap the benefits of a more unified, efficient, and data-driven operation.

As technology continues to evolve, the future of CRM and QuickBooks integration looks bright. With the rise of AI, enhanced automation, mobile integration, and integration with other business systems, businesses can expect even greater efficiency, insights, and control over their operations. Embrace the synergy of CRM and QuickBooks integration and position your business for success in today’s competitive landscape.