Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

In the dynamic world of business, efficiency and organization are paramount. As companies grow, managing customer relationships and financial data separately can lead to wasted time, errors, and missed opportunities. This is where the powerful combination of Customer Relationship Management (CRM) software and QuickBooks accounting software comes into play. This article delves into the intricacies of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and real-world applications. We’ll uncover how this integration can streamline your operations, boost productivity, and ultimately drive business growth.

Understanding the Power of CRM and QuickBooks

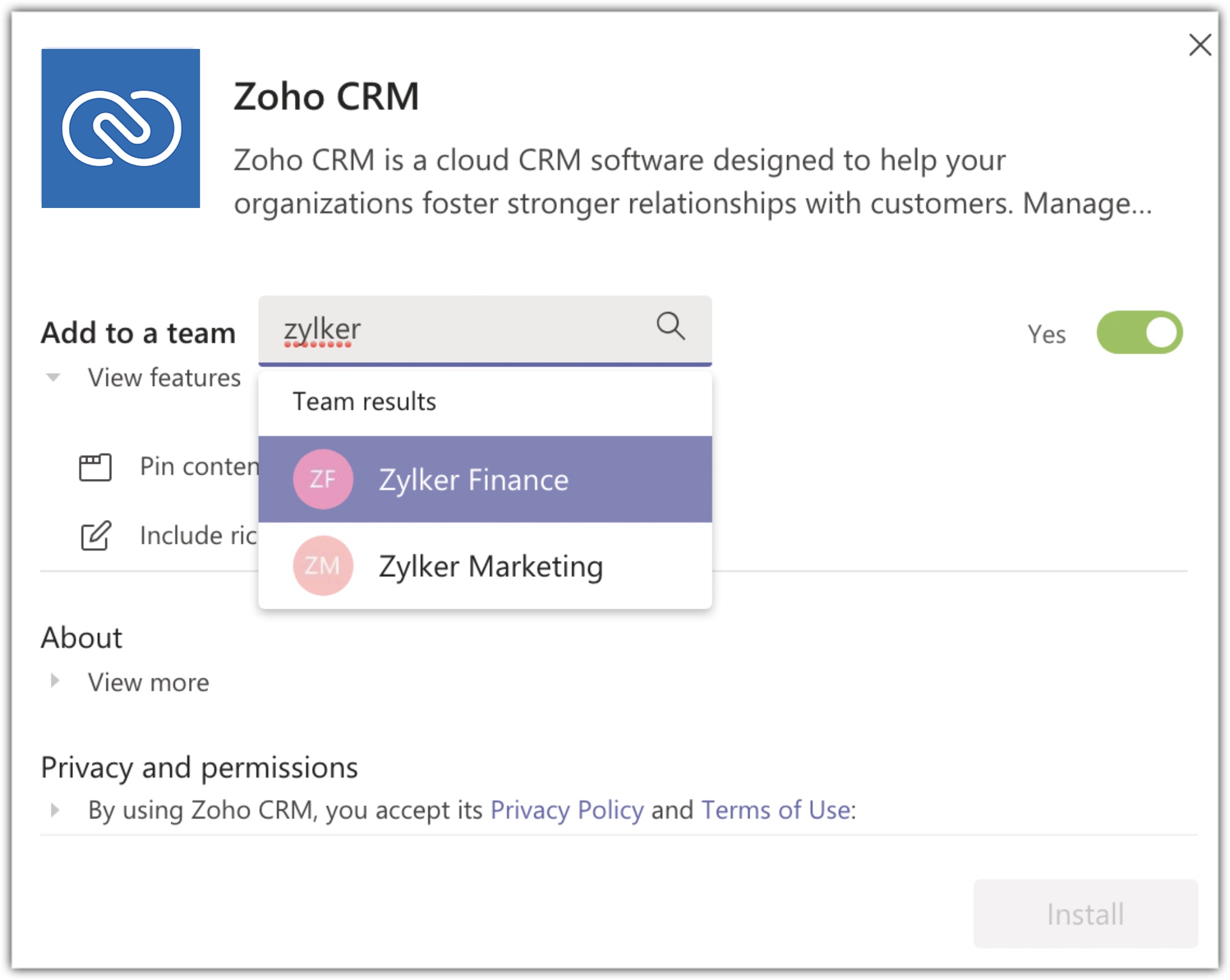

Before diving into integration, it’s crucial to understand the individual strengths of CRM and QuickBooks. CRM software, such as Salesforce, HubSpot, or Zoho CRM, is designed to manage all aspects of customer interactions. It helps businesses track leads, manage sales pipelines, provide customer service, and analyze customer data. QuickBooks, on the other hand, is a leading accounting software that handles financial tasks like invoicing, expense tracking, and financial reporting.

The core function of CRM is to centralize customer information. Think of it as the nerve center for all things customer-related. It allows you to:

- Track Interactions: Log calls, emails, and meetings to understand customer history.

- Manage Leads: Qualify leads and move them through the sales pipeline.

- Automate Tasks: Automate repetitive tasks like sending follow-up emails.

- Analyze Data: Gain insights into customer behavior and sales performance.

QuickBooks, in its essence, is the financial backbone of a business. It provides tools for:

- Invoicing: Create and send professional invoices.

- Expense Tracking: Monitor and categorize business expenses.

- Financial Reporting: Generate reports on revenue, expenses, and profitability.

- Bank Reconciliation: Reconcile bank statements with your financial records.

The Benefits of CRM Integration with QuickBooks

Integrating CRM with QuickBooks is more than just connecting two software programs; it’s about creating a unified system that enhances business operations. The benefits are numerous and can significantly impact various aspects of your business.

Enhanced Data Accuracy and Reduced Errors

One of the most significant advantages is the elimination of manual data entry. When customer and financial data are manually entered into separate systems, there’s a high risk of errors and inconsistencies. Integration automates the transfer of data, reducing the likelihood of mistakes. For example, when a sales order is created in your CRM, the relevant customer information and order details are automatically synced with QuickBooks, eliminating the need to re-enter the data.

Improved Efficiency and Productivity

Integration streamlines workflows, saving time and effort. Sales teams no longer need to manually input customer information into QuickBooks for invoicing, and accounting teams don’t have to manually enter sales data from the CRM. This time saved can be redirected to more strategic tasks, such as focusing on customer relationships, sales generation, and financial analysis.

Better Customer Relationship Management

Integration provides a more holistic view of the customer. Sales, accounting, and customer service teams can access a single source of truth for customer data. This enables a better understanding of customer behavior, purchase history, and financial interactions. As a result, you can personalize interactions, provide better customer service, and build stronger customer relationships.

Streamlined Sales Process

The sales process becomes smoother and more efficient. When a deal is closed in the CRM, the necessary information is automatically transferred to QuickBooks for invoicing. This reduces the time it takes to invoice customers and receive payments. Sales reps can also track the financial status of their deals, such as payments received and outstanding balances, directly within the CRM.

Faster Payments and Improved Cash Flow

Automated invoicing and payment tracking can expedite the payment process. By syncing customer data and invoice information, you can send invoices quickly and track payments more efficiently. This can lead to faster payments and improved cash flow, which is crucial for the financial health of any business.

Better Financial Reporting

With integrated data, you can generate more accurate and comprehensive financial reports. Sales data from the CRM can be combined with financial data from QuickBooks to provide a complete picture of your business performance. This allows for better decision-making based on real-time insights.

Choosing the Right CRM and QuickBooks Integration Method

The method of integration depends on your specific needs, budget, and the CRM and QuickBooks versions you use. There are several options to consider:

Native Integrations

Some CRM and QuickBooks solutions offer native integrations, which means they are built-in and designed to work seamlessly together. These integrations are often the easiest to set up and maintain. They usually provide a straightforward process for syncing data between the two systems. Check if your CRM and QuickBooks versions offer this type of integration.

Third-Party Integration Platforms

If native integrations are not available or do not meet your specific needs, third-party integration platforms can provide more flexibility. These platforms, such as Zapier, PieSync, or Automate.io, act as intermediaries between your CRM and QuickBooks. They allow you to connect various apps and automate workflows. They often offer a wide range of pre-built integrations and customization options.

Custom Integrations

For complex integration needs or unique business requirements, custom integrations may be necessary. This involves developing a customized solution using APIs (Application Programming Interfaces) and developer resources. Custom integrations provide the most flexibility but require more technical expertise and investment.

Evaluating Integration Options

When choosing an integration method, consider the following factors:

- Ease of Use: How easy is it to set up and maintain the integration?

- Features: Does the integration support the data synchronization and workflows you need?

- Cost: What are the costs associated with the integration, including setup, ongoing fees, and maintenance?

- Scalability: Can the integration handle your current and future business needs?

- Support: What level of support is available if you encounter issues?

Step-by-Step Guide to Integrating CRM with QuickBooks

The specific steps for integrating your CRM with QuickBooks will vary depending on the method you choose. However, here’s a general guide to help you get started:

1. Assess Your Needs

Before you begin, identify your integration goals. What data do you want to sync between your CRM and QuickBooks? What workflows do you want to automate? Understanding your needs will help you choose the right integration method and configure it effectively.

2. Choose Your Integration Method

Based on your needs, select the appropriate integration method (native, third-party, or custom). Research the available options and compare their features, pricing, and ease of use.

3. Set Up Your Accounts

Ensure you have active accounts with both your CRM and QuickBooks. You may need to create user accounts and assign appropriate permissions for the integration to function correctly.

4. Connect Your Systems

Follow the instructions provided by your chosen integration method to connect your CRM and QuickBooks accounts. This may involve entering API keys, authorizing access, and configuring settings.

5. Configure Data Mapping

Data mapping is the process of matching fields in your CRM with corresponding fields in QuickBooks. For example, you’ll need to map customer name, address, and contact information. Carefully configure the data mapping to ensure accurate data synchronization.

6. Test the Integration

Before going live, test the integration to verify that data is syncing correctly. Create test records in your CRM and QuickBooks and check if the data is transferred as expected. Review the integration logs for any errors or issues.

7. Go Live and Monitor

Once you’re confident that the integration is working correctly, you can go live. Monitor the integration regularly to ensure it continues to function smoothly. Review the data syncing and address any issues that arise.

Real-World Examples of CRM Integration with QuickBooks

Let’s explore some practical examples of how businesses are leveraging CRM integration with QuickBooks:

Example 1: Sales Team Efficiency

A sales team using Salesforce as their CRM can integrate it with QuickBooks. When a sales rep closes a deal in Salesforce, the customer information and sales details are automatically transferred to QuickBooks. This triggers the creation of an invoice, which is sent to the customer automatically. This eliminates manual data entry, saves the sales team valuable time, and ensures invoices are generated promptly.

Example 2: Improved Customer Service

A customer service team using HubSpot can integrate it with QuickBooks. When a customer calls with an invoice-related question, the customer service representative can quickly access the customer’s financial history, including invoices and payments, directly within HubSpot. This allows the representative to provide faster and more informed customer service.

Example 3: Streamlined Operations for E-commerce Businesses

An e-commerce business using Shopify can integrate it with QuickBooks. When an order is placed on Shopify, the customer information, order details, and payment information are automatically synced with QuickBooks. This automates the invoicing process, tracks revenue, and ensures that the accounting records are up-to-date. This helps the business manage its finances effectively and gain insights into its e-commerce sales performance.

Example 4: Enhanced Reporting for Marketing and Sales

A marketing team using Zoho CRM can integrate it with QuickBooks. They can track the revenue generated from specific marketing campaigns by linking sales data from QuickBooks to the leads and opportunities managed in Zoho CRM. This provides a comprehensive view of the return on investment (ROI) of their marketing efforts.

Troubleshooting Common CRM and QuickBooks Integration Issues

Even with careful planning, you may encounter issues during the integration process. Here are some common problems and how to address them:

Data Synchronization Errors

Data synchronization errors can occur due to incorrect data mapping, mismatched field types, or API limitations. To troubleshoot these issues, review the integration logs to identify the specific errors. Check the data mapping configuration and make sure that the fields are correctly matched. If necessary, contact the support team of your CRM, QuickBooks, or the integration platform for assistance.

Duplicate Data

Duplicate data can occur if the integration is not configured to prevent duplicate entries. Review the integration settings to ensure that it identifies and handles duplicate records appropriately. You may need to set up rules for merging or overwriting duplicate data.

Slow Syncing

Slow syncing can be caused by a large volume of data or API limitations. Consider optimizing the data synchronization frequency and limiting the amount of data being synced. You may also need to contact the support team of your CRM, QuickBooks, or the integration platform to address performance issues.

Security Concerns

Security is a crucial consideration when integrating CRM and QuickBooks. Ensure that the integration platform uses secure protocols, such as SSL/TLS encryption, to protect sensitive data. Review the data access permissions and limit access to only authorized users. Regularly update your software and monitor the integration for any security vulnerabilities.

Best Practices for Successful Integration

To maximize the benefits of CRM integration with QuickBooks, follow these best practices:

- Plan Thoroughly: Define your integration goals, choose the right integration method, and plan the data mapping carefully.

- Test Rigorously: Test the integration thoroughly before going live to ensure that data is syncing correctly.

- Monitor Regularly: Monitor the integration regularly to identify and address any issues promptly.

- Provide Training: Train your team on how to use the integrated system effectively.

- Keep Software Updated: Keep your CRM, QuickBooks, and integration platform updated to ensure compatibility and security.

- Document Everything: Document the integration process, including the configuration settings, data mapping, and troubleshooting steps.

- Seek Expert Assistance: If you’re unsure about any aspect of the integration, seek assistance from a qualified professional or the support team of your CRM, QuickBooks, or integration platform.

The Future of CRM and QuickBooks Integration

The integration between CRM and QuickBooks is constantly evolving. As technology advances, we can expect to see even more sophisticated integrations with enhanced features and capabilities. Some potential trends include:

- AI-Powered Automation: AI and machine learning will further automate data synchronization and workflow processes.

- Enhanced Data Analytics: More advanced data analytics capabilities will provide deeper insights into customer behavior and financial performance.

- Integration with Other Business Systems: Integrations will expand to encompass other business systems, such as marketing automation platforms and e-commerce platforms.

- Increased Mobile Accessibility: Mobile apps and integrations will provide access to customer and financial data on the go.

The future of CRM and QuickBooks integration promises to further streamline business operations, improve efficiency, and drive growth. By embracing these advancements, businesses can stay ahead of the curve and gain a competitive advantage.

Conclusion: Unlocking Business Potential with CRM and QuickBooks Integration

CRM integration with QuickBooks is a powerful strategy for businesses of all sizes. By seamlessly connecting these two essential systems, you can eliminate manual data entry, improve efficiency, enhance customer relationships, and gain better financial insights. From sales and marketing to customer service and accounting, the benefits are widespread. By following the best practices outlined in this article, you can implement a successful integration and unlock the full potential of your business. Embrace the synergy, and watch your business thrive.