Seamless Symphony: Unlocking Business Growth with CRM Integration into QuickBooks

The Power of Two: Why CRM Integration with QuickBooks Matters

In the bustling world of business, efficiency and organization are the cornerstones of success. Entrepreneurs, small business owners, and even large corporations are constantly seeking ways to streamline their operations, reduce errors, and boost profitability. One powerful combination that’s been gaining significant traction is the integration of Customer Relationship Management (CRM) systems with QuickBooks, the widely-used accounting software.

This article delves deep into the benefits of this integration, exploring how it can transform your business, improve customer relationships, and ultimately, drive growth. We’ll cover everything from the basics of CRM and QuickBooks to the nitty-gritty details of how the integration works, the advantages it offers, and how to choose the right tools for your specific needs. Get ready to unlock a new level of business efficiency!

Understanding the Players: CRM and QuickBooks

What is a CRM?

CRM, or Customer Relationship Management, is more than just software; it’s a strategy. It’s a comprehensive approach to managing and analyzing customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships, assisting in customer retention, and driving sales growth. Think of it as the central hub for all things customer-related.

Key features of a CRM system include:

- Contact Management: Storing and organizing customer information, including contact details, communication history, and purchase records.

- Sales Automation: Automating sales processes, such as lead tracking, opportunity management, and proposal generation.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media engagement, and lead nurturing.

- Customer Service: Managing customer support requests, tracking issues, and providing timely resolutions.

- Analytics and Reporting: Providing insights into customer behavior, sales performance, and marketing effectiveness.

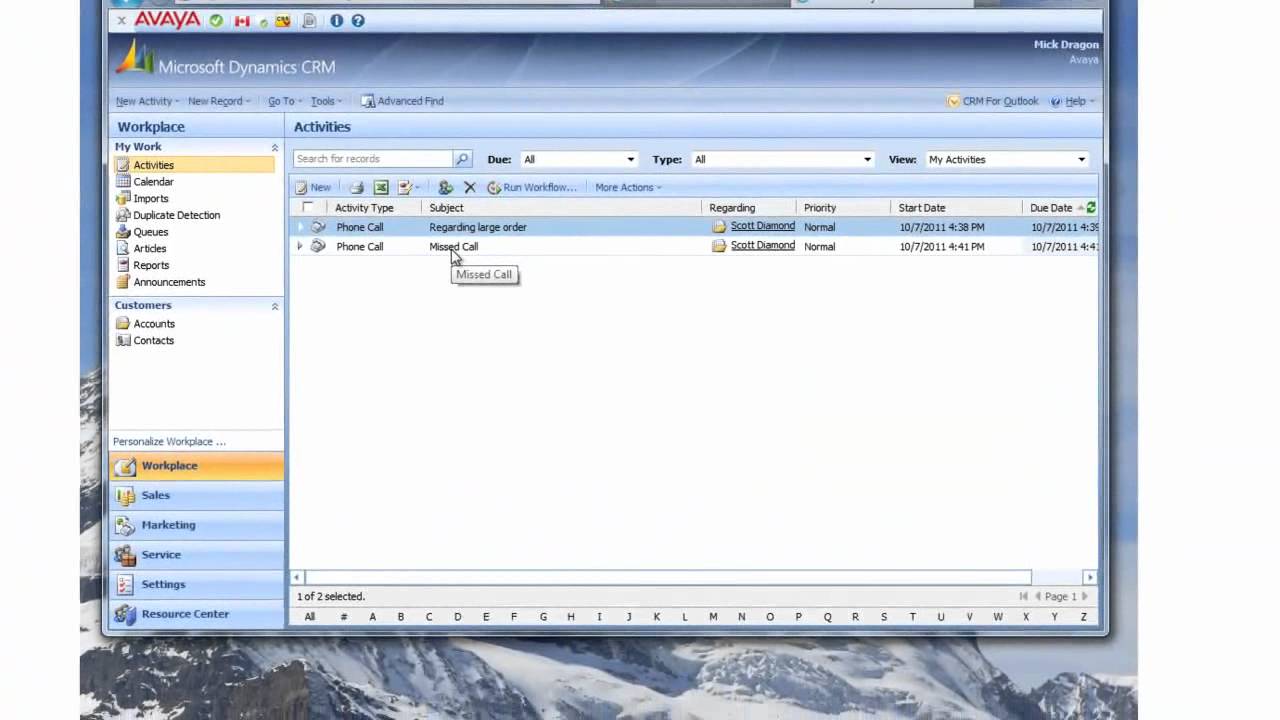

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

What is QuickBooks?

QuickBooks is a leading accounting software designed for small and medium-sized businesses. It simplifies financial management by providing tools for:

- Accounting: Managing income and expenses, tracking invoices, and reconciling bank accounts.

- Payroll: Processing employee salaries, managing taxes, and generating payroll reports.

- Reporting: Generating financial statements, such as profit and loss statements, balance sheets, and cash flow statements.

- Inventory Management: Tracking inventory levels, managing purchase orders, and calculating cost of goods sold.

- Accounts Receivable and Payable: Managing customer invoices and vendor bills.

QuickBooks is known for its user-friendly interface and comprehensive features, making it a popular choice for businesses of all sizes.

The Magic of Integration: How CRM and QuickBooks Work Together

The integration between CRM and QuickBooks creates a seamless flow of data between your sales and accounting departments. This eliminates the need for manual data entry, reduces errors, and saves valuable time. Here’s how it typically works:

- Data Synchronization: Key data, such as customer information, sales orders, invoices, and payments, is automatically synchronized between the CRM and QuickBooks.

- Contact and Account Mapping: Customer and vendor records in the CRM are linked to corresponding accounts in QuickBooks.

- Sales Order to Invoice Automation: When a sales order is created in the CRM, it can automatically generate an invoice in QuickBooks.

- Payment Tracking: Payments received in QuickBooks are automatically updated in the CRM, providing a complete view of the customer’s financial status.

The specifics of the integration will vary depending on the CRM and QuickBooks versions you are using, as well as the integration tools you choose. However, the fundamental principle remains the same: to create a unified view of your customer data and financial information.

The Benefits: Why Integrate CRM with QuickBooks?

The advantages of integrating CRM with QuickBooks are numerous and can significantly impact your business’s bottom line. Here are some of the most significant benefits:

1. Improved Efficiency and Reduced Errors

Manual data entry is a time-consuming and error-prone process. By integrating CRM with QuickBooks, you can eliminate the need to manually transfer data between the two systems. This not only saves time but also reduces the risk of errors, such as typos or incorrect data entry. This means your team can focus on more strategic tasks, like building relationships with customers and closing deals, instead of repetitive data entry.

2. Enhanced Data Accuracy

When data is entered manually, there’s always a chance for inaccuracies. Integrated systems synchronize data automatically, ensuring that information is consistent across both platforms. This leads to more reliable reporting and better decision-making. This consistency is especially important for financial data, where accuracy is paramount.

3. Streamlined Sales and Accounting Processes

Integration streamlines the entire sales cycle, from lead generation to payment collection. Sales reps can quickly access customer financial information in the CRM, while accounting staff can easily track sales and payments. This collaboration between departments leads to faster order processing, quicker invoicing, and improved cash flow. It’s like having a well-oiled machine where every part works in perfect harmony.

4. Better Customer Relationship Management

With a complete view of your customer data, including sales history, payment information, and communication history, you can provide better customer service and build stronger relationships. Sales teams can personalize their interactions and offer tailored solutions based on a customer’s specific needs and preferences. This improved customer experience leads to increased customer loyalty and repeat business. Understanding your customers is the key to success.

5. Improved Reporting and Analytics

Integrated systems provide a more comprehensive view of your business performance. You can generate reports that combine sales data from your CRM with financial data from QuickBooks, giving you a holistic view of your business’s performance. This enables you to identify trends, track key metrics, and make data-driven decisions. You’ll have a much clearer picture of what’s working and what’s not.

6. Increased Revenue and Profitability

By streamlining processes, reducing errors, and improving customer relationships, CRM integration with QuickBooks can ultimately lead to increased revenue and profitability. Improved efficiency allows you to focus on growing your business, while better customer service leads to increased sales and customer retention. It’s a win-win situation.

7. Time and Cost Savings

Automating tasks and eliminating manual data entry frees up your employees’ time, allowing them to focus on more productive activities. This can lead to significant cost savings in the long run. It reduces the need for extra staff and minimizes the potential for costly errors.

Choosing the Right Integration Tools

Several tools can help you integrate your CRM with QuickBooks. The best choice for you will depend on your specific needs and the CRM and QuickBooks versions you are using. Here are some of the most popular options:

1. Native Integrations

Some CRM systems, such as Salesforce and HubSpot, offer native integrations with QuickBooks. These integrations are usually easy to set up and offer a seamless experience. They often include pre-built features and functionalities that are specifically designed for the integration.

2. Third-Party Integration Platforms

Several third-party platforms, such as Zapier, Make (formerly Integromat), and PieSync (now part of HubSpot), provide integration services between various applications, including CRM and QuickBooks. These platforms offer a wide range of pre-built integrations and allow you to customize the integration to meet your specific needs. They’re a great option if you’re using a CRM that doesn’t have a native integration or if you need more flexibility in your integration setup.

3. Custom Integrations

If you have unique requirements or need a highly customized integration, you may consider developing a custom integration. This option offers the most flexibility but can also be the most time-consuming and expensive. You’ll need to hire a developer or team with experience in both CRM and QuickBooks integration.

4. Consider Your Needs

Before choosing an integration tool, consider the following factors:

- Your CRM and QuickBooks versions: Ensure the integration tool is compatible with the versions you are using.

- Your budget: Integration tools range in price, from free to expensive.

- Your technical expertise: Some tools are easier to set up and manage than others.

- The features you need: Make sure the tool offers the features you need, such as data synchronization, contact mapping, and sales order automation.

Step-by-Step Guide to Setting Up CRM and QuickBooks Integration (General Overview)

While the specific steps will vary depending on the integration tool you choose, here’s a general overview of the process:

- Choose an Integration Tool: Select the tool that best meets your needs and budget.

- Connect Your Accounts: Connect your CRM and QuickBooks accounts to the integration tool. This typically involves entering your login credentials.

- Configure Data Mapping: Map the fields in your CRM to the corresponding fields in QuickBooks. This ensures that data is synchronized correctly.

- Set Up Automation Rules: Configure automation rules to streamline your processes, such as automatically creating invoices in QuickBooks when a sales order is created in your CRM.

- Test the Integration: Test the integration to ensure that data is being synchronized correctly and that all features are working as expected.

- Monitor and Maintain: Regularly monitor the integration to ensure it’s running smoothly. Update the integration as needed to accommodate changes in your CRM or QuickBooks setup.

Remember to consult the documentation for your specific integration tool for detailed instructions.

Best Practices for Successful CRM and QuickBooks Integration

To ensure a successful integration, follow these best practices:

- Plan Ahead: Before you start, plan your integration carefully. Determine what data you want to synchronize, how you want to map the fields, and what automation rules you want to set up.

- Clean Up Your Data: Before you integrate, clean up your data in both your CRM and QuickBooks. This will help ensure that data is synchronized correctly and that you avoid errors.

- Start Small: Start by integrating a small amount of data and gradually increase the scope of the integration as you become more comfortable.

- Test Thoroughly: Test the integration thoroughly before you go live. This will help you identify and fix any issues before they impact your business.

- Train Your Team: Train your team on how to use the integrated systems and how to troubleshoot any issues that may arise.

- Monitor Regularly: Regularly monitor the integration to ensure it’s running smoothly and that data is being synchronized correctly.

- Keep Software Updated: Make sure your CRM and QuickBooks software are always up-to-date.

Troubleshooting Common Integration Issues

Even with careful planning and execution, you may encounter some issues during the integration process. Here are some common problems and how to troubleshoot them:

- Data Synchronization Errors: If data is not synchronizing correctly, check the data mapping to ensure that the fields are correctly mapped. Also, check your internet connection and ensure that both systems are accessible.

- Duplicate Records: If you are seeing duplicate records, check your data mapping and ensure that you have not mapped the same fields to multiple locations. Also, clean up your data in both systems to remove any duplicate records.

- Incorrect Data: If you are seeing incorrect data, check the data mapping and ensure that the fields are mapped correctly. Also, check the data in both systems to ensure that it is accurate.

- Slow Performance: If the integration is running slowly, check your internet connection and ensure that both systems are running optimally. You may also need to optimize your data mapping or automation rules.

- Integration Errors: If you encounter any integration errors, consult the documentation for your integration tool or contact their support team.

The Future of CRM and QuickBooks Integration

As technology continues to evolve, the integration between CRM and QuickBooks will become even more seamless and powerful. We can expect to see:

- More Advanced Automation: More sophisticated automation capabilities, allowing you to automate even more of your sales and accounting processes.

- Improved Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will be used to analyze data and provide insights, helping you make better decisions and improve your business performance.

- Enhanced Mobile Capabilities: Improved mobile access to both CRM and QuickBooks, allowing you to manage your business from anywhere.

- Greater Customization: More customization options, allowing you to tailor the integration to your specific needs.

- Real-Time Data Synchronization: Faster and more reliable data synchronization, providing you with up-to-the-minute information.

The future is bright for businesses that embrace CRM and QuickBooks integration.

Real-World Examples: How Businesses Are Benefiting

Let’s look at a couple of examples of how businesses are benefiting from integrating their CRM with QuickBooks:

Example 1: A Growing E-commerce Business

A fast-growing e-commerce business was struggling to keep up with its sales and accounting. They were spending hours manually entering sales data from their CRM into QuickBooks, which led to errors and delays. After integrating their CRM with QuickBooks, they were able to automate the process of creating invoices and tracking payments. This saved them time, reduced errors, and improved their cash flow. They could also see a complete view of their customer data, allowing them to personalize their marketing efforts and improve customer service. The result? Increased sales and a more efficient operation.

Example 2: A Professional Services Firm

A professional services firm was experiencing difficulties managing their client invoices and payments. They had to manually create invoices in QuickBooks after the CRM recorded the project details. The integration allowed them to sync client information, projects, and payment details. The integration automated invoicing, payment tracking, and reporting. The firm saved time on administrative tasks and had a better understanding of its financial performance, leading to more informed decision-making. Their project managers could easily track project profitability, and the accounting team had a more accurate view of accounts receivable. The result: improved cash flow and enhanced client relationships.

Conclusion: Embrace the Power of Integration

Integrating your CRM with QuickBooks is a smart move for any business looking to streamline operations, improve customer relationships, and drive growth. By automating data synchronization, streamlining processes, and gaining a holistic view of your business performance, you can unlock a new level of efficiency and profitability. The key is to choose the right integration tools, plan carefully, and follow best practices. Don’t delay; start exploring the possibilities of CRM and QuickBooks integration today. Your business will thank you!