Seamless Symphony: Mastering CRM Integration with QuickBooks for Business Bliss

Unveiling the Power of CRM Integration with QuickBooks

In the dynamic world of business, efficiency and organization are paramount. Imagine a scenario where your customer relationship management (CRM) system and your accounting software, QuickBooks, work in perfect harmony. This isn’t a utopian dream; it’s the reality achievable through seamless integration. This comprehensive guide delves into the intricacies of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and the transformative impact it can have on your business.

We’ll explore the ‘why’ and the ‘how’ of this powerful combination, providing insights, tips, and actionable advice to help you unlock the full potential of your business operations. Prepare to revolutionize how you manage your customer relationships and financial data.

Understanding the Core Concepts: CRM and QuickBooks

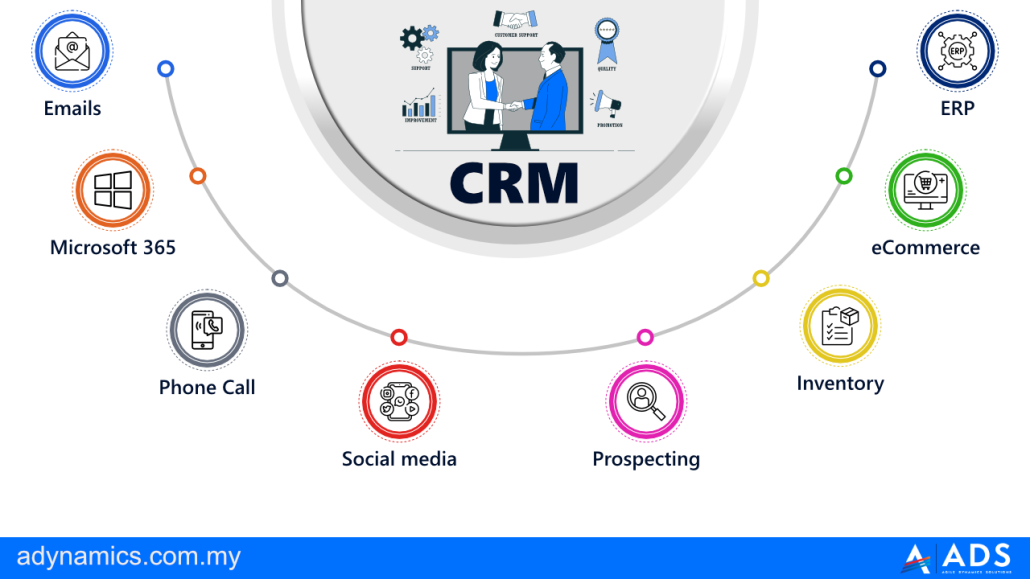

What is CRM?

CRM, or Customer Relationship Management, is a strategy and a set of technologies used to manage and analyze customer interactions and data throughout the customer lifecycle. It aims to improve business relationships with customers, retain customers, and drive sales growth. A robust CRM system typically includes functionalities such as:

- Contact Management: Storing and organizing customer information, including contact details, communication history, and purchase records.

- Sales Automation: Streamlining the sales process, from lead generation to closing deals, by automating tasks and providing sales teams with the tools they need.

- Marketing Automation: Automating marketing campaigns, such as email marketing and social media management, to nurture leads and engage customers.

- Customer Service: Providing a platform for managing customer inquiries, resolving issues, and providing excellent customer support.

- Analytics and Reporting: Providing insights into customer behavior, sales performance, and marketing effectiveness through data analysis and reporting tools.

The ultimate goal of a CRM system is to provide a 360-degree view of the customer, enabling businesses to understand their needs, personalize their interactions, and build lasting relationships.

What is QuickBooks?

QuickBooks is a widely used accounting software designed to help small and medium-sized businesses manage their finances. It provides a comprehensive suite of features, including:

- Accounting: Managing financial transactions, such as income and expenses, and generating financial statements.

- Invoicing: Creating and sending invoices, tracking payments, and managing accounts receivable.

- Expense Tracking: Tracking and categorizing business expenses, including mileage, travel, and supplies.

- Payroll: Processing employee salaries, calculating taxes, and managing payroll-related tasks.

- Reporting: Generating financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

QuickBooks is known for its user-friendly interface, robust features, and affordability, making it a popular choice for businesses of all sizes.

The Synergy: Why Integrate CRM with QuickBooks?

The integration of CRM with QuickBooks creates a powerful synergy, streamlining operations and providing numerous benefits. Here are some key advantages:

Enhanced Data Accuracy and Consistency

One of the most significant benefits is the elimination of manual data entry and the reduction of errors. When data is entered manually, there’s always a risk of typos, omissions, or inconsistencies. Integration automates the transfer of data between the CRM and QuickBooks, ensuring that information is accurate and consistent across both systems. This includes customer information, sales transactions, invoices, and payments.

Improved Efficiency and Productivity

Integration automates various tasks, freeing up valuable time for employees. For example, sales reps no longer need to manually enter sales data into QuickBooks, and accounting staff don’t need to re-enter customer information from the CRM. This increased efficiency allows employees to focus on more strategic tasks, such as building customer relationships and analyzing financial data.

Streamlined Sales and Accounting Processes

Integration streamlines the entire sales-to-cash cycle. When a sale is closed in the CRM, the relevant information (customer details, product/service details, pricing) can be automatically transferred to QuickBooks, generating an invoice. Once the payment is received, it’s automatically recorded in QuickBooks, updating the accounts receivable. This seamless process reduces the time and effort required to manage sales and accounting tasks.

Better Customer Relationship Management

Integrating CRM with QuickBooks provides a more comprehensive view of the customer. Sales teams can access financial information, such as payment history and outstanding invoices, directly from the CRM. This allows them to better understand the customer’s needs, personalize their interactions, and provide excellent customer service. Moreover, customer service representatives can easily access invoice and payment information to answer customer queries effectively.

Enhanced Financial Reporting and Analysis

Integration allows for more accurate and timely financial reporting. By having sales data and financial information in one place, businesses can generate more comprehensive reports, such as sales performance by customer, product, or region. This information can be used to make informed business decisions, identify trends, and optimize sales strategies.

Reduced Costs

By automating tasks, reducing errors, and improving efficiency, CRM integration with QuickBooks can significantly reduce operational costs. This includes reduced labor costs, lower data entry errors, and improved cash flow management.

Choosing the Right Integration Method

There are several ways to integrate CRM with QuickBooks, each with its own advantages and disadvantages. The best approach depends on your specific business needs, technical expertise, and budget. Here are some common integration methods:

Native Integrations

Some CRM systems and QuickBooks offer native integrations, meaning they are built-in and designed to work seamlessly together. These integrations are typically the easiest to set up and maintain. They offer a user-friendly interface and often provide a wide range of features, such as automatic data synchronization, invoice creation, and payment tracking. However, native integrations may be limited in terms of customization and features compared to third-party integrations.

Third-Party Integrations

Third-party integrations are provided by software vendors specializing in connecting different applications. These integrations often offer a wider range of features and customization options compared to native integrations. They can support more complex data mapping and workflows. However, they may require more technical expertise to set up and maintain. Popular third-party integration platforms include:

- Zapier: A popular automation platform that connects thousands of apps, including CRM systems and QuickBooks.

- PieSync: A two-way contact sync platform that keeps contact data synchronized between different apps.

- Workato: An enterprise-grade integration platform that offers advanced features and customization options.

API Integration

API (Application Programming Interface) integration involves using the APIs of the CRM and QuickBooks to build a custom integration. This approach offers the most flexibility and control but requires significant technical expertise and resources. It’s typically used by businesses with complex integration needs or those who require a highly customized solution.

Manual Data Entry (Not Recommended)

While not a true integration, some businesses choose to manually enter data from their CRM into QuickBooks. This is the least efficient and most error-prone method. It’s highly discouraged due to the time-consuming nature, the risk of errors, and the lack of real-time data synchronization.

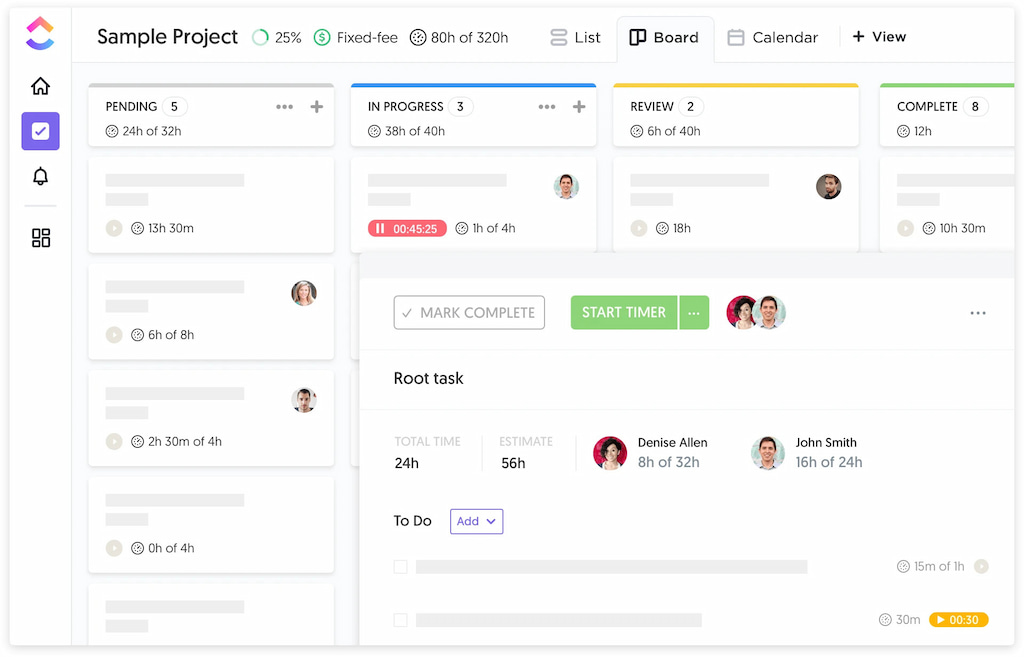

Step-by-Step Guide to CRM Integration with QuickBooks

Implementing CRM integration with QuickBooks can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a step-by-step guide to help you get started:

Step 1: Assess Your Needs and Goals

Before you begin, it’s essential to define your goals and requirements. What do you hope to achieve with the integration? What data needs to be synchronized between the CRM and QuickBooks? Identify the specific workflows you want to automate. This will help you choose the right integration method and ensure the solution meets your needs.

Step 2: Choose Your CRM and QuickBooks

If you haven’t already, select your CRM system and QuickBooks. Consider your business size, industry, and budget when making your choices. Ensure that the CRM and QuickBooks you choose are compatible with each other and offer integration options.

Step 3: Evaluate Integration Options

Research and compare the different integration methods available. Consider the features, pricing, ease of use, and technical requirements of each option. Read reviews and testimonials from other businesses to get an idea of their experiences.

Step 4: Plan Your Data Mapping

Data mapping involves defining how data will be transferred between the CRM and QuickBooks. Determine which fields from the CRM will map to which fields in QuickBooks. This process requires careful planning to ensure data accuracy and consistency. Consider the following:

- Customer Data: Map customer names, addresses, contact information, and other relevant details.

- Products and Services: Map product and service names, descriptions, and pricing.

- Sales Data: Map sales transactions, including invoice numbers, dates, amounts, and payment terms.

Step 5: Set Up the Integration

Follow the instructions provided by the integration provider to set up the connection between your CRM and QuickBooks. This may involve creating accounts, entering API keys, and configuring data mapping settings. Test the integration thoroughly to ensure that data is being synchronized correctly. If you encounter any issues, consult the documentation or contact the support team.

Step 6: Test and Refine

After setting up the integration, conduct thorough testing to ensure that data is flowing correctly between the two systems. Create test records in your CRM and QuickBooks and verify that the data is synchronized as expected. Make any necessary adjustments to the data mapping or settings. Monitor the integration regularly to identify and address any issues that may arise.

Step 7: Train Your Team

Provide training to your employees on how to use the integrated systems. Explain the new workflows and processes, and provide guidance on how to access and use the synchronized data. Ensure that your team understands the benefits of the integration and how it can improve their productivity.

Step 8: Monitor and Maintain

Once the integration is live, monitor it regularly to ensure that it continues to function correctly. Check for any errors or data synchronization issues. Update the integration as needed to accommodate any changes in your business processes or the functionality of the CRM and QuickBooks.

Common Challenges and How to Overcome Them

While CRM integration with QuickBooks offers significant benefits, it can also present some challenges. Here are some common issues and how to overcome them:

Data Synchronization Errors

Data synchronization errors can occur due to various reasons, such as incorrect data mapping, formatting issues, or connection problems. To address these errors, carefully review your data mapping settings and ensure that the fields are correctly aligned. Check for any formatting inconsistencies or invalid characters in the data. Monitor the integration regularly and troubleshoot any connection issues.

Data Duplication

Data duplication can occur if the integration is not configured correctly or if there are inconsistencies in the data between the two systems. To avoid data duplication, implement data deduplication rules in your CRM and QuickBooks. Regularly review your data and merge any duplicate records. Ensure that the integration is configured to handle duplicate data correctly.

Security Concerns

When integrating CRM and QuickBooks, it’s essential to address security concerns. Protect your data by using secure connections, encrypting sensitive information, and implementing access controls. Choose integration providers that prioritize security and comply with industry standards. Regularly review your security settings and update them as needed.

Complexity and Technical Expertise

Setting up and maintaining CRM integration with QuickBooks can be complex and require technical expertise. If you lack the necessary skills, consider seeking assistance from an experienced consultant or integration provider. They can help you with the implementation, configuration, and troubleshooting of the integration.

Cost Considerations

The cost of CRM integration with QuickBooks can vary depending on the integration method, the complexity of the solution, and the size of your business. Factor in the costs of software licenses, integration tools, and professional services. Evaluate the return on investment (ROI) of the integration to ensure that it aligns with your budget and business goals.

Maximizing the Benefits: Best Practices for CRM Integration with QuickBooks

To get the most out of your CRM integration with QuickBooks, consider these best practices:

Start Small and Scale Up

If you’re new to CRM integration, start with a simple integration and gradually add more features and functionality. This approach allows you to test the integration thoroughly and identify any issues before implementing a complex solution.

Prioritize Data Quality

Ensure that your data is accurate, complete, and consistent. Cleanse your data regularly and implement data validation rules to prevent errors. High-quality data is crucial for effective CRM integration.

Automate as Much as Possible

Identify tasks that can be automated and automate them. This includes data synchronization, invoice creation, and payment tracking. Automation will save you time and effort and reduce the risk of errors.

Train Your Team Effectively

Provide comprehensive training to your employees on how to use the integrated systems. Ensure that they understand the new workflows and processes. Ongoing training and support are essential for maximizing the benefits of the integration.

Monitor Performance Regularly

Monitor the performance of the integration regularly. Track key metrics, such as data synchronization success rates, time savings, and cost reductions. Use this information to optimize the integration and identify any areas for improvement.

Choose the Right Integration Partner

If you’re using a third-party integration, choose a reputable provider with a proven track record. Read reviews and testimonials from other businesses. Ensure that the provider offers excellent customer support and ongoing maintenance.

Regularly Review and Update

Your business processes and systems will evolve over time. Regularly review your CRM integration with QuickBooks to ensure that it continues to meet your needs. Update the integration as needed to accommodate any changes in your business processes or the functionality of the CRM and QuickBooks.

Real-World Examples: Success Stories of CRM and QuickBooks Integration

To illustrate the power of CRM integration with QuickBooks, let’s look at some real-world examples:

Example 1: A Growing E-commerce Business

An e-commerce business was struggling to manage its sales and accounting data. They were using a CRM to manage customer relationships and a separate accounting system for financial management. Data entry was manual, time-consuming, and prone to errors. After integrating their CRM with QuickBooks, they automated the transfer of sales data, invoices, and payments. This resulted in a significant reduction in data entry errors, improved cash flow management, and increased efficiency. They now have a more comprehensive view of their customers and can make more informed business decisions.

Example 2: A Consulting Firm

A consulting firm was facing challenges in tracking client projects and managing invoices. They integrated their CRM with QuickBooks to automate the creation of invoices and track project expenses. This streamlined their billing process, improved their cash flow, and provided them with a better understanding of project profitability. They also gained a more accurate view of their clients’ payment history and were able to provide better customer service.

Example 3: A Manufacturing Company

A manufacturing company implemented CRM integration with QuickBooks to streamline its sales and accounting processes. This enabled them to automate the creation of invoices, track sales performance, and manage inventory more effectively. The integration also provided them with real-time insights into their financial performance, allowing them to make data-driven decisions and improve their bottom line.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving, with new technologies and innovations emerging. Here are some trends to watch:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being used to automate more tasks, such as data entry, invoice creation, and payment tracking. These technologies can also provide valuable insights into customer behavior and financial performance.

Enhanced Data Analytics

Integration is enabling businesses to analyze data more effectively, providing them with a deeper understanding of their customers and financial performance. More sophisticated reporting and analytics tools are emerging.

Mobile Integration

With the increasing use of mobile devices, CRM and QuickBooks integration is becoming more mobile-friendly. This allows businesses to access their data and manage their operations from anywhere, anytime.

Increased Automation

Automation is becoming more sophisticated, with the ability to automate more complex tasks and workflows. This is leading to greater efficiency and productivity.

The future of CRM and QuickBooks integration is bright. As technology continues to advance, businesses can expect to see even more powerful and integrated solutions that will help them streamline their operations, improve their customer relationships, and drive growth.

Conclusion: Embrace the Synergy

CRM integration with QuickBooks is a game-changer for businesses of all sizes. By streamlining operations, improving data accuracy, and enhancing customer relationships, integration can help you achieve greater efficiency, productivity, and profitability. By following the steps outlined in this guide, choosing the right integration method, and implementing best practices, you can harness the power of this synergy and take your business to the next level. Embrace the transformative power of CRM integration with QuickBooks and unlock your business’s full potential.