Seamless Harmony: Mastering CRM Integration with QuickBooks for Business Growth

Introduction: Bridging the Gap for Business Success

In today’s dynamic business landscape, efficiency and streamlined operations are paramount. Businesses are constantly seeking ways to optimize their workflows, enhance customer relationships, and boost profitability. A powerful solution that addresses these needs is the integration of Customer Relationship Management (CRM) systems with accounting software like QuickBooks. This article delves deep into the intricacies of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and the transformative impact it can have on your business. We’ll navigate the landscape together, ensuring you understand the ‘how’ and the ‘why’ behind this crucial integration.

Understanding the Power of CRM and QuickBooks

Before we dive into integration, let’s clarify what CRM and QuickBooks are and why they are essential tools for businesses.

What is CRM?

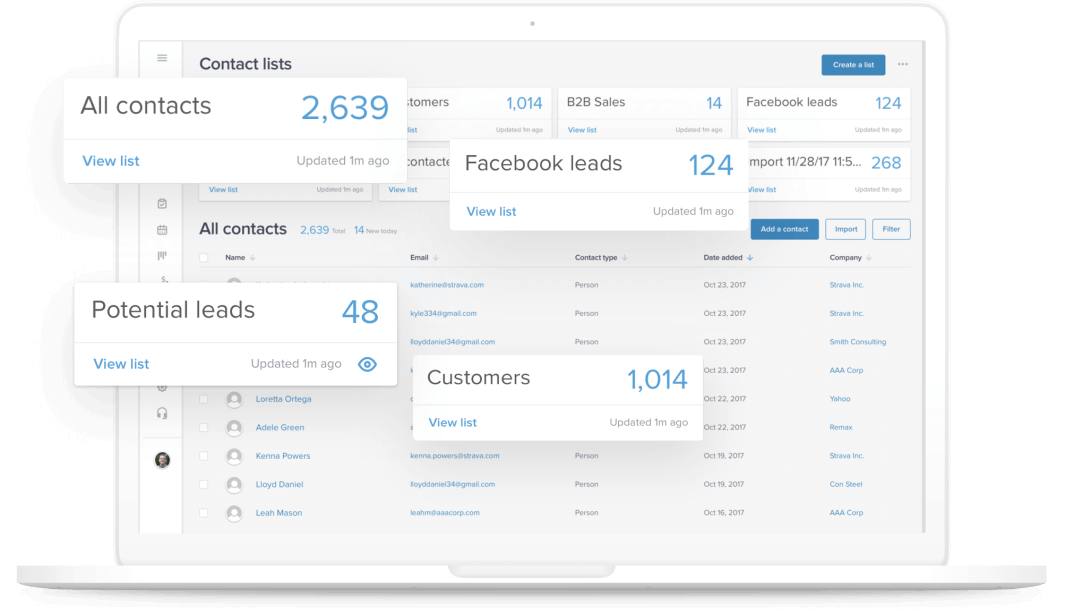

CRM, or Customer Relationship Management, is a technology and strategy designed to manage and analyze customer interactions and data throughout the customer lifecycle. It’s about building and nurturing relationships, understanding customer needs, and providing exceptional service. A robust CRM system helps businesses:

- Organize and manage customer data.

- Automate sales and marketing processes.

- Improve customer service and support.

- Analyze customer behavior and preferences.

- Increase sales and revenue.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, each with its strengths and suitability for various business sizes and industries.

What is QuickBooks?

QuickBooks is a widely used accounting software designed to help businesses manage their finances. It simplifies accounting tasks, such as:

- Tracking income and expenses.

- Generating invoices and managing payments.

- Reconciling bank accounts.

- Creating financial reports.

- Managing payroll (depending on the version).

QuickBooks comes in various versions, including QuickBooks Online and QuickBooks Desktop, offering different features and pricing models to cater to diverse business needs. It’s the go-to choice for many small and medium-sized businesses.

The Benefits of Integrating CRM with QuickBooks

Integrating your CRM with QuickBooks creates a powerful synergy, allowing data to flow seamlessly between sales, marketing, and finance. The benefits are numerous and can significantly impact your bottom line.

Enhanced Data Accuracy and Efficiency

One of the primary advantages is the elimination of manual data entry. With integration, customer information, sales transactions, and financial data are automatically synchronized between the two systems. This reduces the risk of errors associated with manual input and saves valuable time. Your teams will spend less time on administrative tasks and more time on strategic initiatives.

Improved Sales and Revenue

A well-integrated system provides sales teams with a complete view of customer interactions, purchase history, and financial information. This enables them to:

- Identify cross-selling and upselling opportunities.

- Personalize sales pitches.

- Close deals faster.

- Track sales performance more effectively.

Ultimately, this leads to increased sales and revenue.

Streamlined Financial Management

Integration streamlines financial processes by automatically syncing sales data from the CRM to QuickBooks. This simplifies tasks such as:

- Generating invoices.

- Tracking payments.

- Managing accounts receivable.

- Generating financial reports.

This streamlined approach improves cash flow management and provides a clearer picture of your financial health.

Better Customer Service

With integrated systems, customer service representatives have access to comprehensive customer information, including purchase history, support tickets, and payment details. This allows them to provide faster, more personalized, and more effective support, leading to increased customer satisfaction and loyalty.

Improved Reporting and Analytics

Integration allows you to generate comprehensive reports that combine sales, marketing, and financial data. This provides valuable insights into:

- Customer behavior.

- Sales performance.

- Marketing campaign effectiveness.

- Overall business performance.

These insights enable data-driven decision-making and help you identify areas for improvement.

How to Integrate CRM with QuickBooks: A Step-by-Step Guide

Integrating your CRM with QuickBooks may seem daunting, but the process is generally straightforward. Here’s a step-by-step guide to help you through the process:

1. Choose the Right Integration Method

There are several methods for integrating CRM with QuickBooks. The best method depends on your CRM and QuickBooks versions, budget, and technical expertise.

- Native Integrations: Some CRM systems, such as Salesforce and HubSpot, offer native integrations with QuickBooks. These integrations are often the easiest to set up and maintain.

- Third-Party Integration Platforms: Platforms like Zapier, PieSync (now part of HubSpot), and Workato provide pre-built integrations or allow you to create custom integrations between various apps, including CRM and QuickBooks.

- Custom Integrations: For more complex needs, you may need to develop a custom integration using APIs (Application Programming Interfaces). This option requires technical expertise.

2. Assess Your Needs and Requirements

Before you begin, identify your specific integration needs. Consider:

- Which data needs to be synchronized: Customer information, sales transactions, invoices, payments, etc.

- The direction of data flow: Do you need data to flow from CRM to QuickBooks, QuickBooks to CRM, or both?

- Frequency of synchronization: Real-time, daily, or weekly?

- Any specific customizations or workflows you need.

Documenting these requirements will help you choose the right integration method and ensure a successful implementation.

3. Select an Integration Tool

Based on your needs assessment, choose the appropriate integration tool. If your CRM offers a native integration with QuickBooks, that’s often the easiest option. Otherwise, explore third-party integration platforms or consider custom development.

4. Set Up the Integration

The setup process varies depending on the integration method you choose. Generally, you’ll need to:

- Connect your CRM and QuickBooks accounts.

- Map the fields (e.g., customer name, address, email) between the two systems.

- Configure the data synchronization settings, including the direction of data flow and the frequency of synchronization.

- Test the integration to ensure data is flowing correctly.

Follow the instructions provided by your chosen integration tool.

5. Test and Monitor the Integration

After setting up the integration, thoroughly test it to ensure data is synchronized correctly. Create test records, generate invoices, and verify that the data appears accurately in both systems. Regularly monitor the integration to identify and resolve any issues promptly. Most integration platforms offer monitoring tools and alerts to notify you of any errors.

6. Provide Training and Support

Train your employees on how to use the integrated system. Provide clear documentation and ongoing support to ensure they can effectively utilize the new workflows and processes. This will maximize the benefits of the integration and minimize any disruption.

Choosing the Right CRM for QuickBooks Integration

The choice of CRM software is crucial for successful integration with QuickBooks. Consider these factors when selecting a CRM:

Integration Capabilities

Ensure the CRM you choose has a robust integration with QuickBooks. Check for native integrations, third-party integration compatibility, and the ability to customize the integration to meet your specific needs. Look for systems that offer two-way sync to avoid data silos.

Features and Functionality

Choose a CRM that provides the features and functionality your business needs, such as sales automation, marketing automation, customer service, and reporting. Align the CRM’s features with your business goals to maximize its value.

Scalability

Select a CRM that can scale with your business. Consider the CRM’s ability to handle increasing data volumes, user numbers, and evolving business needs. Make sure it can grow alongside your company.

Ease of Use

Opt for a CRM that is user-friendly and easy to learn. A complex CRM can be difficult to adopt, hindering employee productivity. Prioritize a CRM that offers an intuitive interface and comprehensive training resources.

Pricing and Budget

Evaluate the CRM’s pricing model and ensure it aligns with your budget. Consider the total cost of ownership, including subscription fees, implementation costs, and ongoing maintenance. Compare different CRM options to find the best value for your investment.

Popular CRM Options for QuickBooks Integration

Here are some popular CRM options that integrate well with QuickBooks:

- Salesforce: A leading CRM with robust features and a well-established QuickBooks integration.

- HubSpot: A popular CRM with a user-friendly interface and a seamless QuickBooks integration.

- Zoho CRM: A versatile CRM that offers a variety of features and a reliable QuickBooks integration.

- Microsoft Dynamics 365: A comprehensive CRM with strong integration capabilities and a focus on business intelligence.

Common Challenges and How to Overcome Them

While CRM integration with QuickBooks offers numerous benefits, you may encounter some challenges during implementation. Here’s how to address them:

Data Mapping Complexity

Challenge: Mapping fields between the CRM and QuickBooks can be complex, especially if the systems have different data structures or naming conventions.

Solution: Carefully plan your data mapping process. Identify the essential fields to synchronize and ensure the data types and formats are compatible. Use the integration platform’s mapping tools to streamline the process. Test the mapping thoroughly to verify that data is flowing correctly.

Data Synchronization Errors

Challenge: Data synchronization errors can occur due to various reasons, such as network issues, software bugs, or data conflicts.

Solution: Regularly monitor the integration for errors. Set up alerts to notify you of any issues. Review the error logs to identify the root cause of the problem and take corrective action. Ensure your systems are up-to-date and running smoothly.

Security Concerns

Challenge: Integrating sensitive financial and customer data raises security concerns.

Solution: Choose a reputable integration platform that uses secure data transmission protocols (e.g., HTTPS) and encryption. Implement strong passwords and access controls to protect your data. Regularly review your security settings and update them as needed.

User Adoption Issues

Challenge: Employees may resist using the integrated system or fail to adopt the new workflows.

Solution: Provide comprehensive training and support to your employees. Explain the benefits of the integrated system and how it will improve their work. Encourage user feedback and address any concerns promptly. Celebrate successes and provide ongoing coaching to promote adoption.

Cost and Budget Overruns

Challenge: Integration projects can sometimes exceed the initial budget due to unforeseen complexities or scope changes.

Solution: Carefully plan your budget and include a contingency fund for unexpected costs. Clearly define the scope of the project and stick to it as much as possible. Regularly monitor your spending and make adjustments as needed.

Real-World Examples: Success Stories

Let’s look at some real-world examples of businesses that have successfully integrated their CRM with QuickBooks.

Example 1: Small Retail Business

A small retail business implemented a CRM and integrated it with QuickBooks. They used the CRM to manage customer contacts, track sales leads, and process orders. The integration automatically synced sales data to QuickBooks, generating invoices and tracking payments. As a result, they reduced data entry errors, improved cash flow, and gained a better understanding of their customer behavior.

Example 2: Manufacturing Company

A manufacturing company integrated their CRM with QuickBooks to streamline their quoting and invoicing processes. They used the CRM to generate quotes and track customer orders. The integration automatically created invoices in QuickBooks and updated inventory levels. This reduced the time it took to process orders, improved accuracy, and provided better visibility into their financial performance.

Example 3: Service-Based Business

A service-based business integrated its CRM with QuickBooks to manage customer projects and track billable hours. The CRM tracked project details, customer communication, and time spent on each project. The integration synced this data to QuickBooks, generating invoices and tracking project costs. This improved project profitability, enhanced customer communication, and streamlined their billing process.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is continually evolving. As technology advances, we can expect to see even more sophisticated and seamless integrations. Here are some trends to watch:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will be used to automate more tasks, such as data entry, reporting, and predictive analytics.

- Enhanced Automation: Integration platforms will offer more advanced automation features, such as automated workflows and personalized customer experiences.

- Greater Integration with Other Systems: CRM and QuickBooks will integrate with other business systems, such as e-commerce platforms and marketing automation tools.

- Improved User Experience: Integration tools will become more user-friendly and intuitive, making it easier for businesses to set up and manage integrations.

Staying informed about these trends will help you leverage the latest innovations to optimize your business processes and gain a competitive advantage.

Conclusion: Embracing Integration for Business Growth

Integrating CRM with QuickBooks is a strategic move that can significantly benefit your business. By streamlining data flow, improving efficiency, and enhancing customer relationships, you can drive sales, improve financial management, and achieve sustainable growth. By following the steps outlined in this guide, you can successfully implement CRM integration with QuickBooks and unlock its full potential. Embrace the power of integration and position your business for success in today’s competitive market. Now is the time to bridge the gap between your customer relationships and your financial management. Start today and watch your business thrive.