Level Up Your Fitness Business: The Ultimate Guide to the Best CRM for Small Fitness Trainers

Level Up Your Fitness Business: The Ultimate Guide to the Best CRM for Small Fitness Trainers

So, you’re a fitness trainer, pouring your heart and soul into helping clients achieve their goals. You’re passionate about fitness, dedicated to your craft, and probably juggling a million things at once. Booking appointments, tracking progress, managing payments, and keeping up with client communication – it’s a lot, right? That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your digital personal assistant, helping you streamline your operations and focus on what you love: training.

This comprehensive guide dives deep into the world of CRMs, specifically tailored for small fitness trainers like you. We’ll explore the benefits, the key features to look for, and, most importantly, the top CRM platforms that can revolutionize your business. Get ready to transform your workflow, boost client engagement, and watch your business thrive.

Why Do Small Fitness Trainers Need a CRM? The Game-Changing Benefits

You might be thinking, “I’m a small operation; do I really need a CRM?” The answer, more often than not, is a resounding YES! While it might seem like an added expense, a CRM is actually an investment that pays dividends in the long run. Here’s why:

- Centralized Client Data: No more scattered spreadsheets, sticky notes, or emails. A CRM centralizes all your client information – contact details, fitness goals, progress reports, payment history, and communication logs – in one accessible place. This 360-degree view of your clients allows you to personalize your interactions and provide exceptional service.

- Improved Organization and Efficiency: A CRM automates many of the tedious tasks that eat up your time. Think automated appointment reminders, follow-up emails, and payment processing. This frees you up to focus on what matters most: training your clients and growing your business.

- Enhanced Client Communication: Stay connected with your clients effortlessly. A CRM allows you to send targeted messages, newsletters, and updates, keeping them engaged and informed. You can also easily track communication history and ensure no client slips through the cracks.

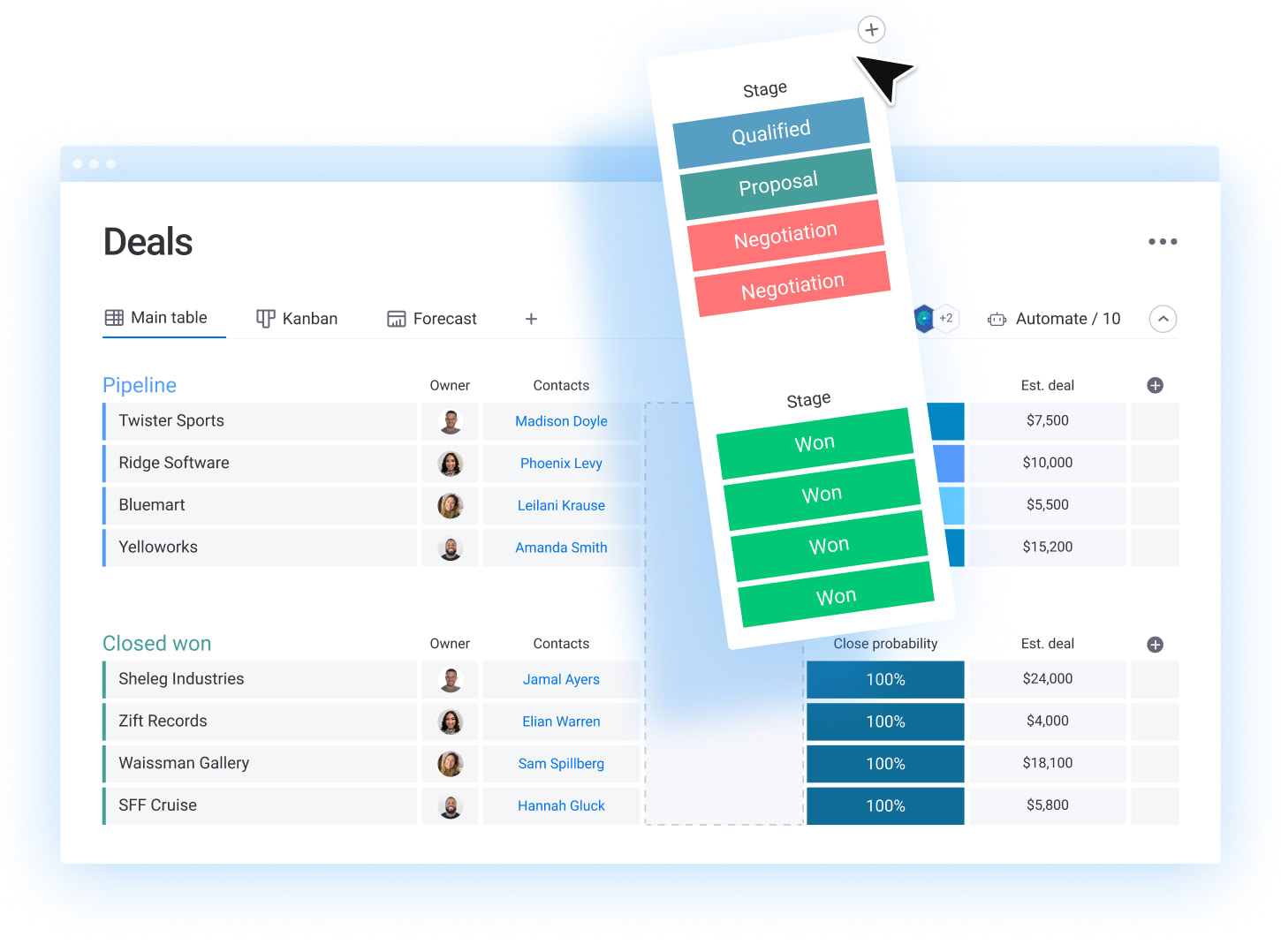

- Streamlined Scheduling and Booking: Say goodbye to the back-and-forth emails and phone calls. Many CRMs offer integrated scheduling tools that allow clients to book appointments online, view your availability, and manage their sessions with ease.

- Better Client Retention: By providing personalized service, staying in regular contact, and tracking client progress, a CRM helps you build stronger relationships and increase client retention rates. Happy clients are loyal clients!

- Data-Driven Insights: A CRM provides valuable data and analytics on your business performance. You can track client acquisition costs, revenue, popular services, and much more. This data empowers you to make informed decisions and optimize your business strategies.

- Professional Image: Using a CRM projects a professional image to your clients, showcasing that you are organized, efficient, and committed to providing the best possible experience.

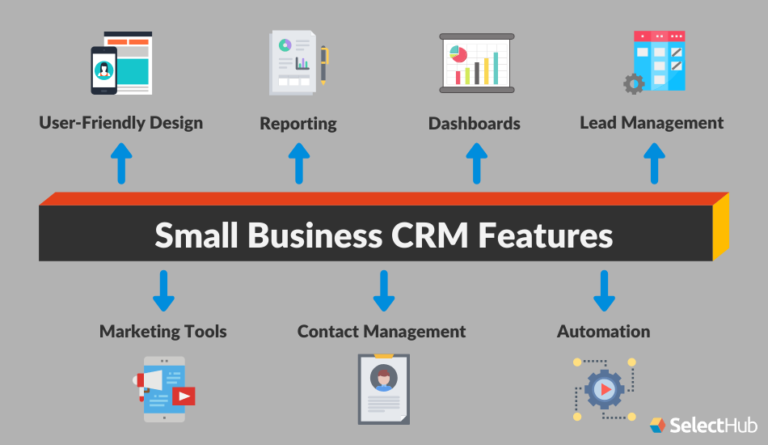

Essential Features to Look for in a CRM for Fitness Trainers

Not all CRMs are created equal. When choosing a CRM for your fitness business, consider these essential features:

- Client Management: This is the core of any CRM. Look for features like contact management, detailed client profiles, progress tracking, goal setting, and the ability to upload documents and photos.

- Appointment Scheduling: An integrated calendar and online booking system are crucial for streamlining your scheduling process. Make sure the system allows clients to book, reschedule, and cancel appointments with ease.

- Communication Tools: Look for features like email marketing, SMS messaging, and the ability to send automated reminders and follow-up messages.

- Payment Processing: Integrating with payment gateways like Stripe or PayPal simplifies billing and payment collection. Look for features like recurring billing, invoicing, and payment tracking.

- Progress Tracking: The ability to track client progress is essential for fitness trainers. Look for features like progress charts, body composition analysis, and the ability to upload workout logs and measurements.

- Reporting and Analytics: Gain insights into your business performance with reporting and analytics tools. Track key metrics like client acquisition cost, revenue, and client retention rates.

- Integrations: Consider which other tools you use in your business, such as email marketing platforms, social media, or other software. Choose a CRM that integrates seamlessly with these tools.

- Mobile Accessibility: The ability to access your CRM on the go is essential for fitness trainers who are often on the move. Look for a CRM with a mobile app or a mobile-friendly interface.

- Ease of Use: Choose a CRM that is user-friendly and easy to navigate. The learning curve should be minimal, allowing you to get up and running quickly.

- Customer Support: Look for a CRM provider that offers excellent customer support. This is crucial if you encounter any issues or have questions.

Top CRM Platforms for Small Fitness Trainers: A Deep Dive

Now, let’s explore some of the best CRM platforms specifically designed for fitness trainers. We’ll examine their key features, pricing, and pros and cons to help you find the perfect fit for your business.

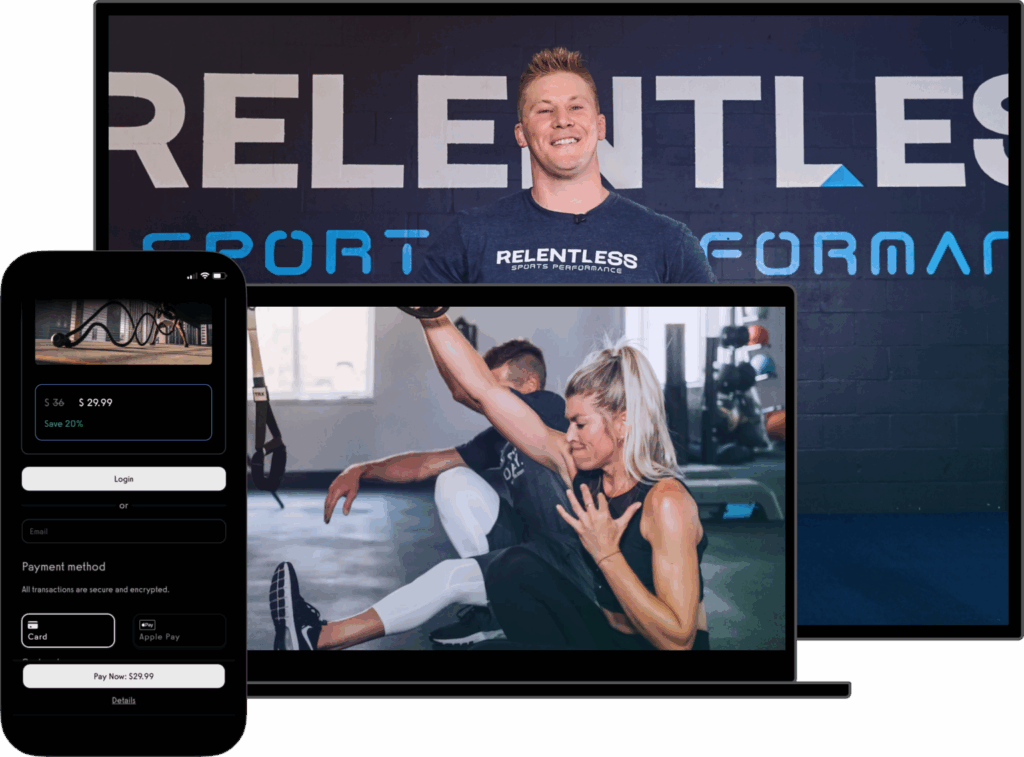

1. Trainerize

Overview: Trainerize is a comprehensive fitness business platform that goes beyond just CRM functionality. It offers a suite of tools for online training, client management, and program design.

Key Features:

- Client management with detailed profiles

- Customizable workout programs and meal plans

- Online training and video integration

- Progress tracking with charts and measurements

- Appointment scheduling and online booking

- Payment processing and invoicing

- Integration with wearable devices

- Mobile app for both trainers and clients

Pros:

- Feature-rich platform with a wide range of tools

- Excellent for online training

- User-friendly mobile app

- Strong community and support

Cons:

- Can be more expensive than other options

- Interface can feel overwhelming for some users

Pricing: Trainerize offers various pricing plans based on the number of clients and features. They typically have a free trial available.

Who it’s best for: Fitness trainers who offer online training, want comprehensive program design tools, and are looking for a platform that can scale with their business.

2. TrueCoach

Overview: TrueCoach is a popular platform focused on coaching and client management. It’s known for its user-friendly interface and robust communication features.

Key Features:

- Client management with detailed profiles

- Custom workout program creation

- Progress tracking with measurements and photos

- Messaging and communication tools

- Integration with training apps like MyFitnessPal

- Workout logging and performance tracking

Pros:

- User-friendly interface

- Excellent communication features

- Focus on coaching and client engagement

- Affordable pricing plans

Cons:

- Lacks advanced features compared to Trainerize

- Limited payment processing options

Pricing: TrueCoach offers different pricing tiers based on the number of clients. They also offer a free trial.

Who it’s best for: Fitness trainers who prioritize coaching and client communication, and are looking for a user-friendly and affordable platform.

3. WellnessLiving

Overview: WellnessLiving is a comprehensive business management software that caters to various wellness businesses, including fitness studios and personal trainers. It offers a wide range of features, including CRM, scheduling, and marketing tools.

Key Features:

- Client management with detailed profiles

- Appointment scheduling and online booking

- Automated marketing and email campaigns

- Payment processing and invoicing

- Membership management

- Class scheduling and registration

- Reporting and analytics

- Mobile app for clients and staff

Pros:

- All-in-one platform with a wide range of features

- Strong marketing and automation capabilities

- Excellent for managing fitness studios and multiple trainers

Cons:

- Can be more complex and overwhelming for solo trainers

- Pricing can be higher than other options

Pricing: WellnessLiving offers various pricing plans based on the number of staff and features. They often have custom pricing options available.

Who it’s best for: Fitness studios, personal training businesses with multiple trainers, and businesses that need a comprehensive solution with marketing and automation features.

4. Pike13

Overview: Pike13 is a popular platform designed for fitness studios and businesses that offer classes and appointments. It focuses on scheduling, client management, and payment processing.

Key Features:

- Client management with detailed profiles

- Appointment and class scheduling

- Online booking and payment processing

- Membership management

- Automated email and SMS communication

- Reporting and analytics

Pros:

- User-friendly interface

- Excellent for managing classes and appointments

- Strong scheduling and payment processing features

Cons:

- Limited progress tracking features

- Can be less focused on individual client coaching

Pricing: Pike13 offers different pricing plans based on the number of clients and locations. They typically have a free trial available.

Who it’s best for: Fitness studios, trainers who offer classes, and businesses that prioritize scheduling and payment processing.

5. Glofox

Overview: Glofox is another platform geared towards fitness studios and gyms, focusing on online booking, membership management, and client engagement.

Key Features:

- Client management with detailed profiles

- Online booking and class scheduling

- Membership management and payments

- Automated marketing and communication tools

- Mobile app for clients

- Reporting and analytics

Pros:

- Strong booking and scheduling features

- Focus on client engagement and retention

- User-friendly mobile app

Cons:

- Can be more expensive than other options

- Limited program design features

Pricing: Glofox offers various pricing plans based on the number of clients and features. They usually have a free trial or demo available.

Who it’s best for: Fitness studios and gyms that want a platform focused on online booking, membership management, and client engagement.

Choosing the Right CRM: A Step-by-Step Guide

Choosing the right CRM can feel overwhelming, but breaking it down into manageable steps can help you make the best decision for your business:

- Assess Your Needs: Before you start researching, take some time to evaluate your current workflow and identify your pain points. What tasks are you spending the most time on? What areas of your business could be improved? Make a list of your must-have features and nice-to-have features.

- Set Your Budget: Determine how much you’re willing to spend on a CRM. Pricing plans vary widely, so having a budget will help you narrow down your options. Consider the ongoing monthly costs, as well as any setup fees or additional expenses.

- Research Your Options: Explore the CRM platforms mentioned above and others that you come across. Read reviews, compare features, and check out their websites.

- Take Advantage of Free Trials: Most CRM platforms offer free trials. This is the best way to test the software and see if it’s a good fit for your business. Spend some time playing around with the features, importing sample data, and seeing how it integrates with your existing workflow.

- Consider Integrations: Think about the other tools you use in your business. Does the CRM integrate with your email marketing platform, social media, or other essential software? This is an important factor to consider.

- Prioritize User-Friendliness: The CRM you choose should be easy to use and navigate. Look for a platform with a clean interface and a minimal learning curve. If you’re not tech-savvy, this is especially important.

- Evaluate Customer Support: Read reviews about the CRM’s customer support. Do they offer helpful and responsive assistance? This is crucial if you encounter any issues or have questions.

- Start Small and Scale Up: Don’t try to implement every feature at once. Start with the core features that address your biggest pain points. As you become more comfortable with the platform, you can gradually add more features and integrations.

Maximizing Your CRM Investment: Tips for Success

Once you’ve chosen a CRM, here are some tips to help you get the most out of your investment:

- Import Your Data: Take the time to import all your client data into the CRM. This includes contact information, fitness goals, progress reports, and payment history. The more data you have, the more effective the CRM will be.

- Customize Your Settings: Tailor the CRM to your specific needs. Set up your branding, customize your email templates, and configure your payment settings.

- Train Your Team: If you have a team, make sure everyone is trained on how to use the CRM. Provide them with clear instructions and ongoing support.

- Use the Automation Features: Take advantage of the CRM’s automation features, such as automated appointment reminders, follow-up emails, and payment processing. This will save you time and improve your efficiency.

- Track Your Results: Regularly review your CRM data and analytics. Track key metrics like client acquisition cost, revenue, and client retention rates. This will help you identify areas for improvement and optimize your business strategies.

- Stay Organized: Make it a habit to keep your CRM up-to-date. Regularly update client profiles, track progress, and log communication.

- Provide Excellent Customer Service: Use the CRM to provide personalized service and build strong relationships with your clients. Respond promptly to their inquiries, track their progress, and celebrate their successes.

- Seek Ongoing Support: Don’t hesitate to reach out to the CRM provider’s customer support team if you have any questions or encounter any issues.

The Future of Fitness Training and CRM

The fitness industry is constantly evolving, and so are CRM platforms. Here are some trends to watch out for:

- Artificial Intelligence (AI): AI is being integrated into CRMs to automate tasks, provide personalized recommendations, and analyze client data.

- Mobile-First Design: With more and more trainers and clients using mobile devices, CRM platforms are focusing on mobile-friendly interfaces and mobile apps.

- Integration with Wearable Devices: CRMs are increasingly integrating with wearable devices to track client activity, heart rate, and other fitness metrics.

- Focus on Client Engagement: CRM platforms are placing a greater emphasis on client engagement and retention, with features like gamification, challenges, and social sharing.

- Data Security and Privacy: As data privacy becomes increasingly important, CRM platforms are prioritizing data security and compliance with regulations like GDPR.

Conclusion: Embrace the Power of CRM

In today’s competitive fitness landscape, a CRM is no longer a luxury, but a necessity. By choosing the right CRM and implementing it effectively, you can streamline your operations, enhance client communication, and grow your business. Take the time to research your options, assess your needs, and choose a platform that aligns with your goals. Embrace the power of CRM and watch your fitness business thrive!

Investing in a CRM is an investment in your future. It’s about working smarter, not harder. It’s about building stronger relationships with your clients and providing them with the best possible experience. It’s about achieving your business goals and living your passion. So, take the leap, explore the options, and find the perfect CRM to help you level up your fitness business. Your clients, and your business, will thank you for it.