Introduction: Why a Small Business CRM Demo Matters

So, you’re running a small business. Congratulations! You’re living the dream (most of the time, anyway). You’re juggling a million things – from making sure the coffee machine doesn’t explode to actually, you know, selling your product or service. And somewhere in the middle of all that, you’ve probably heard whispers about something called a CRM. Maybe you’ve even considered it. But what is a CRM, and more importantly, why should you care? This is where a small business CRM demo comes in.

A Customer Relationship Management (CRM) system is essentially a digital hub for all your customer interactions. It’s where you store contact information, track communications, manage sales pipelines, and get a bird’s-eye view of your entire customer journey. A CRM demo is a guided tour, a sneak peek, a chance to see all this in action. It’s your opportunity to witness firsthand how a CRM can streamline your operations, boost sales, and, ultimately, help your small business thrive.

This article isn’t just about defining CRM; it’s about walking you through the process of understanding a CRM demo, highlighting its benefits, and helping you choose the right CRM for your specific needs. We’ll explore what to look for in a demo, what questions to ask, and how to leverage the power of CRM to transform your business. Get ready to dive in and discover how a CRM demo can be your secret weapon for success.

What is a CRM, and Why Does Your Small Business Need One?

Before we jump into the demo, let’s get the basics down. A CRM, as we mentioned, stands for Customer Relationship Management. It’s more than just a contact list; it’s a comprehensive system designed to manage all aspects of your interactions with current and potential customers. Think of it as the central nervous system for your customer relationships.

Here’s why your small business desperately needs a CRM:

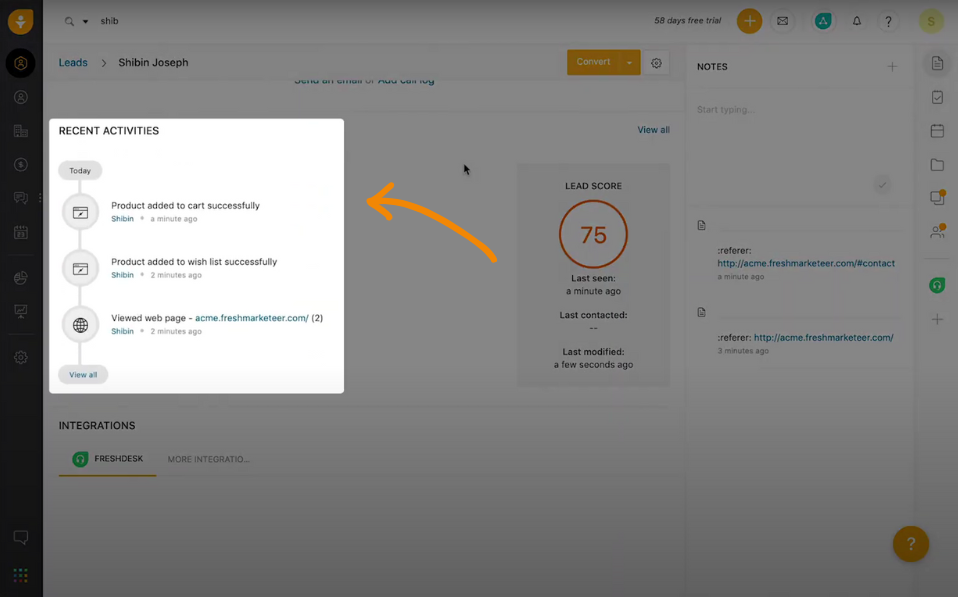

- Centralized Customer Data: Say goodbye to scattered spreadsheets and sticky notes. A CRM stores all your customer information in one easily accessible place. This includes contact details, purchase history, communication logs, and more.

- Improved Customer Service: With a complete view of each customer, your team can provide personalized and proactive support. This leads to happier customers and increased loyalty.

- Streamlined Sales Processes: A CRM helps you automate tasks, track leads, and manage your sales pipeline, ensuring that no opportunity falls through the cracks.

- Enhanced Marketing Efforts: Segment your audience, personalize your messaging, and track the performance of your campaigns. A CRM empowers you to run more effective marketing initiatives.

- Data-Driven Decision Making: CRM systems provide valuable insights into your customers and your business. You can use this data to make informed decisions about your sales, marketing, and customer service strategies.

- Increased Productivity: By automating tasks and streamlining workflows, a CRM frees up your team to focus on more important things, like closing deals and building relationships.

- Scalability: As your business grows, a CRM can scale with you. It can accommodate an increasing number of customers, employees, and data, ensuring that your system remains effective as your business expands.

In essence, a CRM is an investment in your business’s future. It’s about building stronger customer relationships, improving efficiency, and driving sustainable growth. Now, let’s see how it all works through a CRM demo.

What to Expect in a Small Business CRM Demo

So, you’ve decided to take the plunge and explore a CRM demo. Awesome! But what exactly should you expect? Here’s a breakdown of what typically happens during a demo:

- Introduction and Needs Assessment: The demo usually starts with an introduction to the CRM provider and a discussion about your specific business needs. The presenter will ask questions to understand your current processes, challenges, and goals. This is your chance to explain what you’re looking for in a CRM.

- Overview of Key Features: The presenter will walk you through the CRM’s core functionalities, such as contact management, sales pipeline management, marketing automation, and reporting. They’ll demonstrate how these features work and how they can benefit your business.

- Live Demonstration: This is where the magic happens! The presenter will show you the CRM in action, usually using a sample data set. They’ll demonstrate how to add contacts, track leads, create sales opportunities, send emails, and generate reports.

- Customization Options: Most CRM systems offer a range of customization options. The presenter will show you how you can tailor the system to fit your specific business needs, such as configuring workflows, adding custom fields, and integrating with other tools.

- Q&A Session: This is your chance to ask questions and get clarification on anything you don’t understand. Don’t be afraid to ask specific questions about your business needs.

- Pricing and Implementation: The demo will usually conclude with a discussion of pricing plans and implementation options. The presenter will explain the different pricing tiers and how the CRM can be implemented in your business.

The goal of the demo is to give you a clear understanding of the CRM’s capabilities and how it can help your business. It’s a chance to see the system in action and determine whether it’s the right fit for your needs.

Key Features to Look for in a Small Business CRM Demo

Not all CRM systems are created equal. During your demo, pay close attention to these key features that can significantly impact your small business:

- Contact Management: Can you easily store and manage customer contact information, including names, addresses, phone numbers, email addresses, and social media profiles? Look for features like duplicate contact detection and the ability to segment contacts.

- Sales Pipeline Management: Does the CRM offer a visual sales pipeline that allows you to track leads, opportunities, and deals? Can you customize the pipeline stages to match your sales process?

- Lead Management: How does the CRM capture and qualify leads? Does it integrate with lead generation tools and provide lead scoring capabilities?

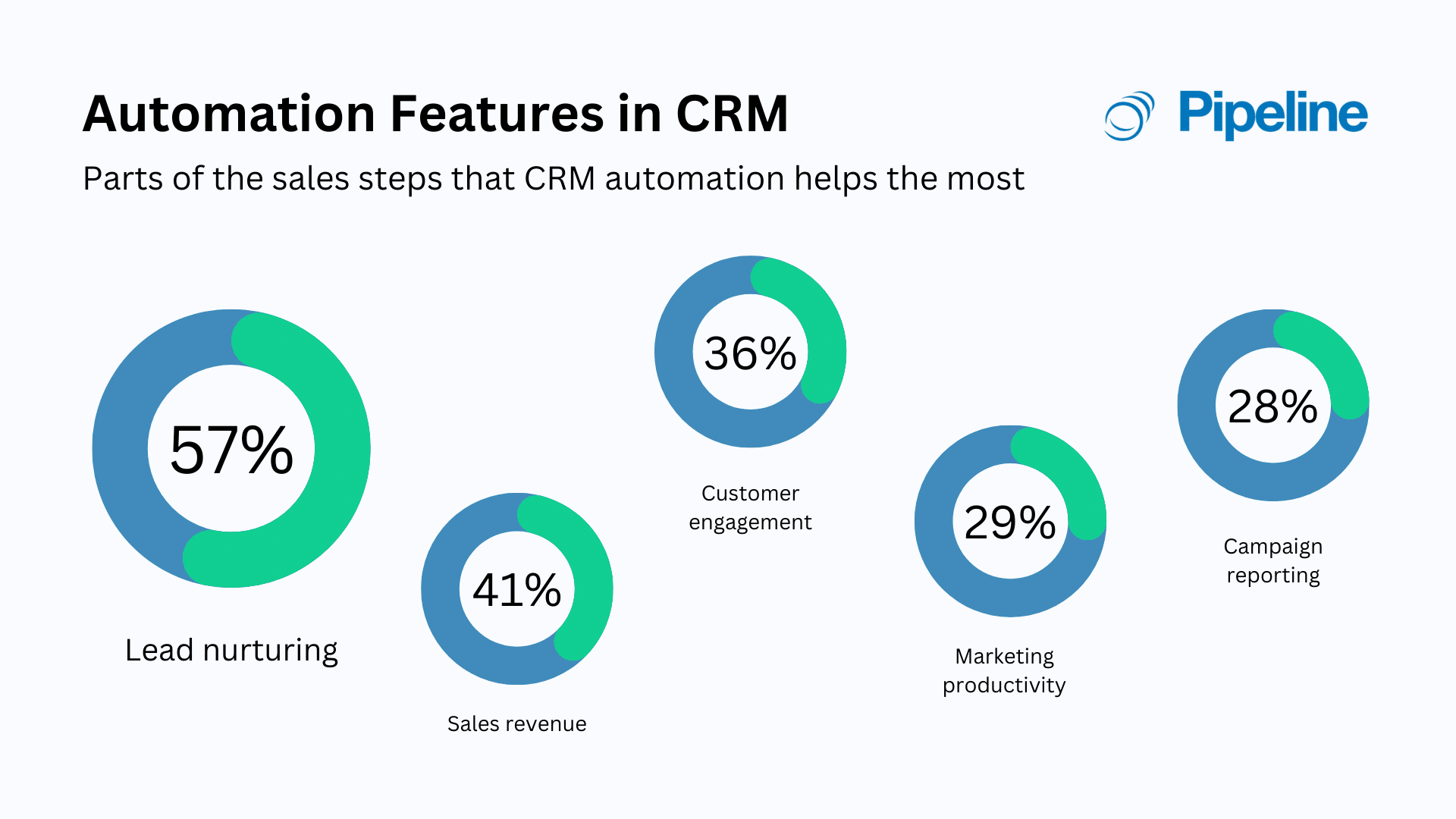

- Marketing Automation: Does the CRM offer marketing automation features, such as email marketing, drip campaigns, and lead nurturing? Can you personalize your marketing messages and track campaign performance?

- Reporting and Analytics: Does the CRM provide robust reporting and analytics capabilities? Can you generate custom reports to track key performance indicators (KPIs) and gain insights into your business?

- Integration with Other Tools: Does the CRM integrate with the other tools you use, such as email marketing platforms, accounting software, and social media channels?

- Mobile Accessibility: Does the CRM offer a mobile app or a mobile-friendly interface? This allows you to access your data and manage your customer relationships on the go.

- User-Friendliness: Is the CRM easy to use and navigate? A simple and intuitive interface will save you time and frustration.

- Customization Options: Can you customize the CRM to fit your specific business needs? Look for features like custom fields, workflow automation, and the ability to integrate with other applications.

- Scalability: As your business grows, will the CRM be able to scale with you? Make sure the system can handle an increasing number of customers, employees, and data.

By evaluating these features during your demo, you can determine whether a particular CRM is the right fit for your small business and its specific needs.

Asking the Right Questions During Your CRM Demo

A CRM demo is a two-way street. It’s not just about passively watching; it’s about actively engaging and asking the right questions. Here are some key questions to ask during your demo to ensure you make an informed decision:

- About Your Business Needs:

- How does your CRM system help businesses like mine, specifically [mention your industry or niche]?

- Can your CRM handle the specific challenges my business faces, such as [mention a particular challenge]?

- How does your CRM help me streamline my [sales/marketing/customer service] processes?

- About Features and Functionality:

- Can you show me how to [perform a specific task relevant to your business]?

- Does your CRM integrate with [specific tools you use, e.g., Mailchimp, QuickBooks]?

- How does your CRM handle [specific data management needs, e.g., data import, data security]?

- Can I customize the CRM to fit my specific workflows and business processes?

- What kind of reporting and analytics are available? Can I create custom reports?

- About Implementation and Support:

- What is the implementation process like? How long does it typically take?

- What kind of training and support do you offer?

- What are your pricing plans? Are there any hidden fees?

- Do you offer data migration services?

- About Security and Privacy:

- How does your CRM protect my customer data?

- What security measures are in place to prevent data breaches?

- Where is my data stored?

- Do you comply with data privacy regulations like GDPR and CCPA?

By asking these questions, you can gain a deeper understanding of the CRM’s capabilities and how it aligns with your business needs. It also gives you a chance to assess the provider’s expertise and support.

Benefits of Using a CRM for Your Small Business

The benefits of implementing a CRM for your small business are numerous and far-reaching. Here’s a closer look at some of the key advantages:

- Increased Sales:

- Improved Lead Management: CRM systems help you capture, qualify, and nurture leads more effectively, increasing your conversion rates.

- Faster Sales Cycles: By automating tasks and streamlining your sales pipeline, CRM can help you close deals faster.

- Better Sales Team Performance: CRM provides sales teams with the tools and insights they need to be more productive and successful.

- Enhanced Customer Service:

- Personalized Customer Interactions: CRM allows you to provide personalized service based on customer data and preferences.

- Faster Response Times: CRM systems enable your team to respond to customer inquiries and issues quickly and efficiently.

- Increased Customer Satisfaction: By providing excellent customer service, you can increase customer satisfaction and loyalty.

- Improved Marketing Effectiveness:

- Targeted Marketing Campaigns: CRM allows you to segment your audience and create targeted marketing campaigns that resonate with your customers.

- Increased ROI: By tracking the performance of your marketing campaigns, CRM can help you optimize your marketing spend and increase your ROI.

- Automated Marketing Processes: CRM can automate tasks like email marketing, lead nurturing, and social media posting, saving you time and effort.

- Better Data Management and Organization:

- Centralized Data Storage: CRM provides a central repository for all your customer data, making it easy to access and manage.

- Reduced Data Entry Errors: CRM systems automate data entry and reduce the risk of errors.

- Improved Data Accuracy: CRM helps you keep your data accurate and up-to-date.

- Improved Team Collaboration:

- Shared Customer Data: CRM allows your team members to share customer data and collaborate on sales, marketing, and customer service initiatives.

- Improved Communication: CRM facilitates communication between team members and customers.

- Increased Team Productivity: By streamlining workflows and improving communication, CRM can increase team productivity.

These benefits translate into a more efficient, productive, and customer-focused business, ultimately leading to increased revenue and sustainable growth. The CRM demo is your gateway to understanding these advantages.

Choosing the Right CRM for Your Small Business

Choosing the right CRM is a critical decision that can significantly impact your business’s success. Here’s a step-by-step guide to help you select the perfect CRM for your needs:

- Define Your Needs and Goals: Before you start evaluating CRM systems, take the time to define your specific needs and goals. What are you hoping to achieve with a CRM? What are your biggest challenges?

- Identify Your Must-Have Features: Based on your needs and goals, identify the must-have features that your CRM must have. Make a list of essential functionalities.

- Research CRM Providers: Research different CRM providers and compare their features, pricing, and reviews. Look for providers that offer solutions tailored to small businesses.

- Schedule Demos: Schedule demos with a few CRM providers that seem like a good fit. This is your opportunity to see the systems in action and ask questions.

- Evaluate User-Friendliness: Make sure the CRM is easy to use and navigate. The user interface should be intuitive and straightforward.

- Assess Integration Capabilities: Check whether the CRM integrates with the other tools you use, such as email marketing platforms, accounting software, and social media channels.

- Consider Customization Options: Look for a CRM that offers a range of customization options to fit your specific business needs.

- Evaluate Reporting and Analytics: Make sure the CRM provides robust reporting and analytics capabilities to track your KPIs and gain insights into your business.

- Check Pricing and Support: Compare the pricing plans of different CRM providers and assess the level of support they offer.

- Read Reviews and Get References: Read online reviews and get references from other small businesses to learn about their experiences with different CRM providers.

- Start with a Free Trial or Pilot Project: Many CRM providers offer free trials or pilot projects. This allows you to test the system before committing to a subscription.

By following these steps, you can make an informed decision and choose the right CRM that will help your small business thrive. Remember, the perfect CRM is the one that best meets your unique needs and helps you achieve your business goals.

Top CRM Systems for Small Businesses (and What to Look for in a Demo)

Now that you know what to look for, let’s look at some popular CRM systems and what you should be paying attention to during their demos:

- HubSpot CRM:

- What to look for in a demo: Ease of use, free version availability, marketing automation features, sales pipeline visualization, integration with HubSpot’s marketing tools.

- Why it’s good for small businesses: Free CRM option, user-friendly interface, strong marketing and sales features, excellent integration capabilities.

- Zoho CRM:

- What to look for in a demo: Customization options, workflow automation, sales force automation, integration with Zoho’s suite of business apps, pricing tiers.

- Why it’s good for small businesses: Affordable, comprehensive feature set, good for businesses looking for a full suite of integrated tools, strong customization.

- Salesforce Sales Cloud (Essentials):

- What to look for in a demo: Scalability, advanced reporting, sales automation, mobile app features, integration with other Salesforce products.

- Why it’s good for small businesses: Industry leader, robust features, scalability, strong customer support (though can be pricier).

- Pipedrive:

- What to look for in a demo: Intuitive sales pipeline management, visual interface, ease of use, sales automation features, integration with sales tools.

- Why it’s good for small businesses: Focus on sales pipeline management, user-friendly, easy to get started, designed for sales teams.

- Freshsales (by Freshworks):

- What to look for in a demo: Built-in phone and email integration, sales automation features, customizable sales stages, affordable pricing.

- Why it’s good for small businesses: Easy to set up and use, good for sales-focused teams, affordable pricing tiers.

When watching the demos for these systems, pay close attention to the features that align with your specific needs and business processes. Consider what’s most important for your team’s workflow, and don’t hesitate to ask questions.

Implementing Your New CRM: A Smooth Transition

So, you’ve chosen your CRM. Congratulations! The next step is implementing it. Proper implementation is crucial for a smooth transition and maximizing the benefits of your new system.

- Planning and Preparation:

- Define Your Goals: Clearly outline your objectives for implementing the CRM. What do you want to achieve?

- Assess Your Data: Audit your existing customer data and identify any issues, such as duplicates or inconsistencies.

- Choose a Project Team: Assemble a team of key stakeholders to manage the implementation process.

- Data Migration:

- Clean Your Data: Clean and organize your existing data before migrating it to the CRM.

- Choose a Migration Method: Decide whether you’ll migrate your data manually or use a data migration tool.

- Test Your Data: Test the data migration process to ensure that your data is transferred accurately.

- Customization and Configuration:

- Configure Workflows: Set up automated workflows to streamline your sales, marketing, and customer service processes.

- Customize Fields and Layouts: Customize the CRM to fit your specific business needs.

- Integrate with Other Tools: Integrate the CRM with the other tools you use, such as email marketing platforms and accounting software.

- Training and Adoption:

- Train Your Team: Provide comprehensive training to your team on how to use the CRM.

- Encourage Adoption: Encourage your team to use the CRM consistently.

- Provide Ongoing Support: Provide ongoing support to your team to address any questions or issues.

- Ongoing Optimization:

- Monitor Performance: Monitor the performance of your CRM and identify areas for improvement.

- Make Adjustments: Make adjustments to your workflows and configurations as needed.

- Stay Up-to-Date: Stay up-to-date with the latest features and updates to your CRM.

A well-planned implementation process ensures a smooth transition and sets you up for success with your new CRM. Don’t be afraid to seek help from the CRM provider or a third-party consultant if needed.

Conclusion: Embracing the Power of Small Business CRM

Choosing and implementing a CRM system is a significant step for any small business. It’s an investment in efficiency, customer satisfaction, and ultimately, your bottom line. A CRM demo is the perfect starting point, allowing you to witness the potential of these tools firsthand. By understanding what to expect in a demo, asking the right questions, and choosing the CRM that best fits your needs, you’re well on your way to building stronger customer relationships, streamlining your sales processes, and driving sustainable growth.

Don’t be intimidated by the technology. Embrace the potential. A well-chosen and implemented CRM can be the game-changer your small business needs to compete in today’s market. Take the leap, schedule those demos, and embark on the journey to a more successful future. Your customers – and your business – will thank you.