Unlocking Growth: How CRM Empowers Small Businesses to Expand

The landscape of business is constantly evolving. What worked yesterday might not work tomorrow. In this dynamic environment, small businesses face a unique set of challenges and opportunities. One of the most critical factors in navigating this terrain and achieving sustainable growth is a well-defined customer relationship management (CRM) strategy. And at the heart of that strategy lies a robust CRM system. This article delves into the intricacies of CRM, specifically how it can be a game-changer for small businesses looking to expand their horizons. We’ll explore the core functionalities, benefits, and implementation strategies, ensuring that even the smallest of ventures can leverage the power of CRM to achieve remarkable growth.

Understanding the Core of CRM: More Than Just a Database

Many people mistakenly equate CRM with simply a database for storing customer information. While data storage is a fundamental component, CRM is so much more. It’s a comprehensive approach to managing all interactions and relationships a business has with its current and potential customers. Think of it as the central nervous system of your customer-facing operations. It’s about understanding your customers, anticipating their needs, and tailoring your interactions to foster loyalty and drive sales. This holistic view is what sets CRM apart and makes it so valuable.

Key Components of a CRM System:

- Contact Management: This is the foundation. It involves storing and organizing customer data, including contact details, communication history, and purchase information.

- Sales Automation: Automating repetitive sales tasks, such as lead tracking, email follow-ups, and proposal generation, frees up your sales team to focus on closing deals.

- Marketing Automation: CRM systems often integrate with marketing tools to automate email campaigns, social media management, and lead nurturing.

- Customer Service and Support: Managing customer inquiries, resolving issues, and providing excellent support are crucial for customer satisfaction and retention.

- Analytics and Reporting: CRM systems provide valuable insights into customer behavior, sales performance, and marketing effectiveness through comprehensive reporting and dashboards.

Why CRM is Crucial for Small Business Expansion

Small businesses often operate with limited resources, making efficiency and effectiveness paramount. CRM provides a powerful solution by streamlining processes, improving customer relationships, and ultimately driving revenue growth. Let’s break down the key reasons why CRM is a non-negotiable tool for small business expansion.

Enhanced Customer Relationships: The Cornerstone of Growth

In the hyper-competitive world of business, building strong customer relationships is a key differentiator. CRM empowers you to do just that. By centralizing customer data and providing a 360-degree view of each customer, you can personalize interactions, anticipate needs, and provide exceptional service. This fosters customer loyalty and turns them into advocates for your brand.

Improved Sales Performance: Closing More Deals

CRM streamlines the sales process, making it easier for your sales team to manage leads, track progress, and close deals. Features like sales automation, lead scoring, and pipeline management provide a clear overview of the sales pipeline and help identify potential roadblocks. This leads to increased sales efficiency and a higher conversion rate.

Increased Efficiency and Productivity: Doing More with Less

CRM automates repetitive tasks, freeing up your team to focus on more strategic initiatives. This can significantly improve productivity and efficiency, allowing you to do more with the same resources. Automating tasks like email follow-ups, appointment scheduling, and report generation saves valuable time and reduces the risk of errors.

Data-Driven Decision Making: Making Smarter Choices

CRM systems provide valuable data and insights into customer behavior, sales performance, and marketing effectiveness. This data allows you to make informed decisions about your business strategies, marketing campaigns, and sales efforts. Analyzing this data can help you identify areas for improvement and optimize your operations for maximum impact.

Scalability and Adaptability: Growing with Your Business

A good CRM system is designed to scale with your business. As your business grows, the CRM system can accommodate your increasing needs, such as adding more users, expanding data storage, and integrating with other business applications. This ensures that your CRM system remains a valuable asset as your business evolves.

Choosing the Right CRM for Your Small Business: A Step-by-Step Guide

Selecting the right CRM system can feel overwhelming, especially with so many options available. However, by following a structured approach, you can find the perfect fit for your small business. Here’s a step-by-step guide to help you navigate the selection process.

1. Define Your Needs and Objectives: Laying the Groundwork

Before you start evaluating CRM systems, take the time to clearly define your needs and objectives. What are you hoping to achieve with CRM? What are your pain points? What specific features are essential for your business? Consider the following questions:

- What are your key business goals?

- What are your current challenges in managing customer relationships and sales?

- What specific features do you need to streamline your processes?

- Who will be using the CRM system, and what are their roles and responsibilities?

Answering these questions will help you create a clear picture of your CRM requirements.

2. Research and Evaluate Potential CRM Systems: Weighing Your Options

Once you have a clear understanding of your needs, it’s time to research and evaluate potential CRM systems. There are numerous options available, ranging from simple, free systems to complex, enterprise-level solutions. Consider the following factors:

- Features: Does the system offer the features you need, such as contact management, sales automation, marketing automation, and customer support?

- Ease of Use: Is the system user-friendly and easy to navigate?

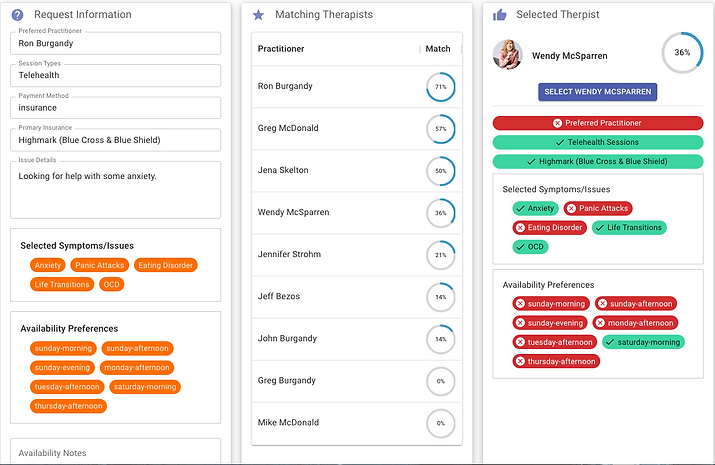

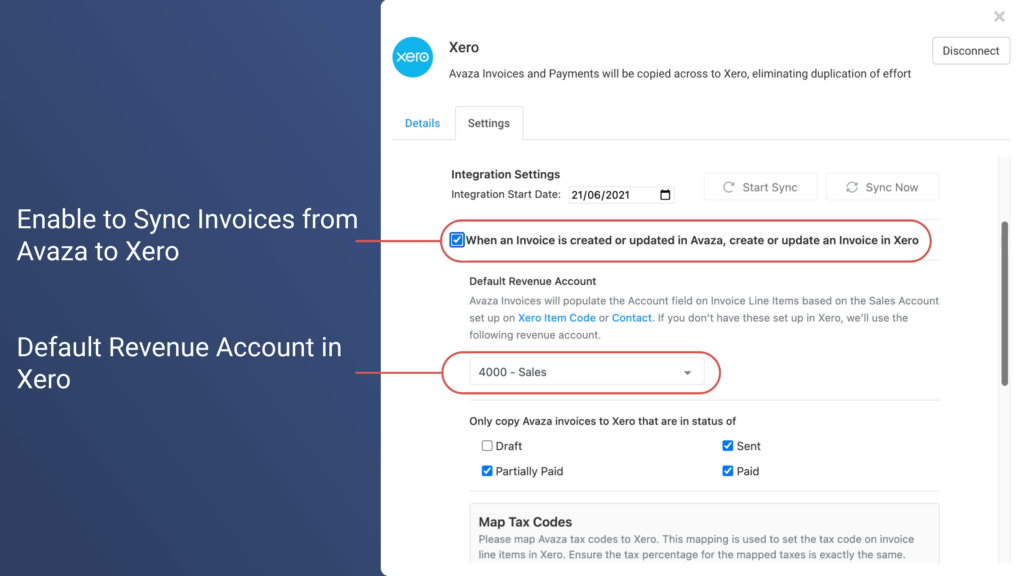

- Integration: Does the system integrate with other tools you use, such as email marketing platforms, accounting software, and social media platforms?

- Scalability: Can the system scale with your business as it grows?

- Cost: What is the pricing model, and does it fit within your budget?

- Support: Does the vendor offer adequate support and training?

- Reviews: Read reviews from other small businesses to get insights into their experiences.

3. Consider Cloud-Based vs. On-Premise CRM: The Deployment Decision

One of the first decisions you’ll need to make is whether to opt for a cloud-based or on-premise CRM system. Cloud-based (also known as Software-as-a-Service or SaaS) CRM systems are hosted on the vendor’s servers and accessed via the internet. On-premise CRM systems are installed on your own servers. Here’s a comparison:

- Cloud-Based CRM:

- Pros: Lower upfront costs, easier to implement and maintain, accessible from anywhere with an internet connection, automatic updates, and scalability.

- Cons: Requires a reliable internet connection, potential security concerns (though vendors typically have robust security measures), and less control over data.

- On-Premise CRM:

- Pros: Greater control over data, potential for customization, and no reliance on an internet connection.

- Cons: Higher upfront costs, requires IT expertise for implementation and maintenance, and limited accessibility.

For most small businesses, cloud-based CRM is the more practical and cost-effective option.

4. Conduct a Pilot Test: Testing the Waters

Before committing to a CRM system, it’s highly recommended to conduct a pilot test. This involves implementing the system with a small group of users or in a specific department. This allows you to test the system’s functionality, identify any issues, and get feedback from your team. During the pilot test, pay attention to:

- Ease of use: Is the system intuitive and easy to learn?

- Functionality: Does the system meet your needs?

- Integration: Does the system integrate seamlessly with your existing tools?

- Performance: Is the system reliable and responsive?

- User feedback: Gather feedback from your team on their experience with the system.

5. Implement and Train Your Team: Putting it into Action

Once you’ve chosen a CRM system, it’s time to implement it and train your team. This process involves importing your data, configuring the system to meet your specific needs, and providing training to your team members. Ensure that everyone understands how to use the system and its benefits. Consider the following:

- Data migration: Plan how you will import your existing data into the new CRM system.

- Customization: Configure the system to meet your specific needs.

- Training: Provide comprehensive training to your team members.

- Ongoing support: Offer ongoing support and resources to help your team use the system effectively.

6. Monitor and Optimize: Continuous Improvement

Implementing a CRM system is not a one-time event. It’s an ongoing process that requires continuous monitoring and optimization. Regularly review your CRM data, track your key metrics, and identify areas for improvement. Make adjustments to your processes and workflows as needed to maximize the value of your CRM system. Consider the following:

- Track key metrics: Monitor your sales performance, customer satisfaction, and marketing effectiveness.

- Analyze data: Identify trends and insights from your CRM data.

- Make adjustments: Optimize your processes and workflows based on your findings.

- Seek feedback: Gather feedback from your team on their experience with the system.

CRM Implementation Strategies for Small Business Success

Implementing a CRM system is a significant undertaking. To ensure a successful implementation, consider these strategies:

1. Start Small and Scale Gradually: Avoid Overwhelm

Don’t try to implement everything at once. Start with the core features that are most important to your business. Focus on getting those features up and running smoothly, and then gradually add more features as needed. This approach minimizes disruption and allows your team to adapt to the new system more easily.

2. Involve Your Team: Foster Buy-In

Involve your team in the CRM selection and implementation process from the beginning. Get their input on their needs and preferences. This will help ensure that the CRM system meets their requirements and that they are invested in using it. Provide them with adequate training and support, and encourage them to provide feedback.

3. Clean and Organize Your Data: The Foundation of Success

Before importing your data into the CRM system, take the time to clean and organize it. Remove duplicate entries, correct errors, and standardize your data format. This will ensure that your data is accurate and reliable, which is crucial for making informed decisions. A clean database ensures that your reports and analytics are accurate and that your sales and marketing efforts are targeted effectively.

4. Integrate with Other Tools: Streamline Your Workflow

Integrate your CRM system with other tools you use, such as email marketing platforms, accounting software, and social media platforms. This will streamline your workflow and eliminate the need to manually enter data into multiple systems. Integration can also provide a more holistic view of your customer data.

5. Set Clear Goals and Track Progress: Measuring Success

Establish clear goals for your CRM implementation, such as increasing sales, improving customer satisfaction, or reducing costs. Track your progress regularly and measure your results against your goals. This will help you identify areas for improvement and ensure that your CRM system is delivering the desired results. Use the CRM’s reporting features to generate reports on key metrics, such as sales conversion rates, customer retention rates, and marketing ROI.

6. Provide Ongoing Training and Support: Ensuring Adoption

Provide ongoing training and support to your team to ensure that they are using the CRM system effectively. Offer regular training sessions, create user manuals, and provide access to online resources. Encourage your team to ask questions and provide feedback. This will help ensure that your team is comfortable using the system and that they are getting the most out of it. Regularly review your team’s usage of the CRM system and identify areas where they may need additional support.

Real-World Examples: CRM in Action for Small Businesses

Let’s look at some examples of how small businesses are using CRM to achieve remarkable results:

Example 1: Retail Business

A small boutique retail store uses CRM to track customer purchase history, preferences, and contact information. They use this data to personalize email marketing campaigns, offer exclusive discounts to loyal customers, and provide tailored recommendations. This has resulted in increased customer loyalty, higher sales, and improved customer satisfaction.

Example 2: Service-Based Business

A small consulting firm uses CRM to manage leads, track project progress, and provide excellent customer service. They use the CRM to automate email follow-ups, schedule appointments, and track project milestones. This has streamlined their operations, improved their project management, and increased their client satisfaction.

Example 3: E-commerce Business

An e-commerce business uses CRM to track customer website activity, purchase history, and customer service interactions. They use this data to personalize product recommendations, offer targeted promotions, and provide prompt customer support. This has led to increased sales, improved customer retention, and a better online shopping experience.

Overcoming Challenges: Common Pitfalls and Solutions

While CRM offers tremendous benefits, there are also potential challenges to be aware of. Here are some common pitfalls and how to overcome them:

1. Lack of User Adoption: Ensuring Everyone Uses the System

One of the most common challenges is a lack of user adoption. If your team doesn’t use the CRM system, it won’t be effective. To overcome this challenge, involve your team in the selection and implementation process, provide adequate training, and demonstrate the benefits of using the system. Make sure the system is user-friendly and easy to navigate. Provide ongoing support and encourage your team to provide feedback.

2. Poor Data Quality: Keeping Your Data Accurate

Poor data quality can undermine the effectiveness of your CRM system. Ensure that your data is accurate, complete, and up-to-date. Clean your data before importing it into the system. Implement data validation rules to prevent errors. Provide ongoing training on data entry best practices. Regularly review your data and make corrections as needed.

3. Choosing the Wrong CRM System: Finding the Right Fit

Choosing the wrong CRM system can be a costly mistake. Take the time to carefully research and evaluate different CRM systems. Define your needs and objectives clearly. Conduct a pilot test before committing to a system. Get feedback from your team. Ensure that the system integrates with your existing tools. Choose a system that is scalable and can grow with your business.

4. Ignoring Integration Needs: Connecting the Dots

Failing to integrate your CRM system with other tools can limit its effectiveness. Integrate your CRM system with your email marketing platform, accounting software, and social media platforms. This will streamline your workflow and eliminate the need to manually enter data into multiple systems. Integration can also provide a more holistic view of your customer data.

5. Lack of Ongoing Optimization: Continuous Improvement

Failing to monitor and optimize your CRM system can limit its effectiveness. Regularly review your CRM data, track your key metrics, and identify areas for improvement. Make adjustments to your processes and workflows as needed to maximize the value of your CRM system. Seek feedback from your team and make changes based on their input.

The Future of CRM for Small Businesses

The future of CRM for small businesses is bright. As technology continues to evolve, CRM systems will become even more powerful and accessible. Here are some trends to watch:

Artificial Intelligence (AI): Personalized Experiences

AI is already transforming CRM. AI-powered CRM systems can analyze customer data to provide personalized recommendations, predict customer behavior, and automate tasks. AI can help you identify sales opportunities, personalize marketing campaigns, and improve customer service. Expect to see even more AI-powered features in the future.

Mobile CRM: Always Connected

Mobile CRM allows you to access your CRM data and tools from anywhere, at any time. This is especially important for small businesses with remote teams or field sales representatives. Mobile CRM allows you to stay connected with your customers and manage your sales and marketing efforts on the go.

Integration with Social Media: Social CRM

Social media is an important channel for customer engagement. CRM systems are increasingly integrating with social media platforms. This allows you to track customer interactions on social media, monitor your brand reputation, and engage with your customers in real-time. Social CRM helps you build stronger relationships with your customers and improve your brand image.

Focus on Customer Experience: Putting the Customer First

The focus on customer experience is becoming increasingly important. CRM systems are designed to help you provide exceptional customer service and build strong customer relationships. The future of CRM will be centered on providing a seamless and personalized customer experience.

Conclusion: Embracing CRM for Sustainable Growth

In conclusion, CRM is not just a software solution; it’s a strategic approach to managing customer relationships and driving business growth. For small businesses seeking to expand, implementing a well-chosen and effectively utilized CRM system is no longer an option—it’s a necessity. By centralizing customer data, streamlining processes, and providing valuable insights, CRM empowers small businesses to build stronger customer relationships, improve sales performance, and achieve sustainable growth. The journey of implementing CRM may involve challenges, but the rewards are well worth the effort. By embracing CRM, small businesses can position themselves for success in today’s competitive marketplace, fostering customer loyalty, driving revenue, and unlocking their full potential for expansion. Now is the time to harness the power of CRM and embark on a journey of growth and prosperity.