In the ever-evolving landscape of business, the ability to cultivate strong customer relationships is no longer a luxury; it’s a necessity. This is where Customer Relationship Management (CRM) systems come into play, acting as the backbone of effective customer engagement. But simply implementing a CRM isn’t enough. To truly leverage its power, you need to understand the intricacies of CRM marketing ROI – the return on investment you can expect from your CRM marketing efforts.

This comprehensive guide delves deep into the world of CRM marketing ROI, providing you with the knowledge and strategies needed to optimize your CRM investment and achieve tangible results. We’ll explore what CRM marketing ROI is, why it’s crucial, how to measure it, and most importantly, how to boost it. Get ready to transform your CRM from a mere data repository into a powerful engine for growth and profitability.

What is CRM Marketing ROI?

At its core, CRM marketing ROI is a metric that quantifies the financial return generated from your CRM marketing initiatives. It’s a measure of how effectively your CRM system is contributing to your bottom line. This includes the costs associated with implementing, maintaining, and utilizing your CRM system, weighed against the revenue generated and other benefits derived from its use.

Calculating CRM marketing ROI involves comparing the benefits of your CRM marketing efforts to the costs. This can be a complex process, as benefits can be both tangible (like increased sales) and intangible (like improved customer satisfaction). However, by understanding the key components of ROI, you can gain valuable insights into the performance of your CRM and make informed decisions to improve its effectiveness.

Why is CRM Marketing ROI Important?

In today’s competitive business environment, every dollar counts. Understanding your CRM marketing ROI is paramount for several reasons:

- Justifying Investment: CRM systems can be a significant investment. Demonstrating a positive ROI justifies the initial expenditure and ongoing costs, ensuring that your organization is getting the most value from its CRM.

- Strategic Decision-Making: ROI data provides critical insights into the effectiveness of your CRM marketing strategies. This allows you to make data-driven decisions about which campaigns to prioritize, which features to leverage, and where to allocate resources.

- Optimizing Performance: By tracking ROI, you can identify areas where your CRM marketing efforts are excelling and areas that need improvement. This enables you to continuously refine your strategies and maximize your returns.

- Securing Budget: A strong ROI demonstrates the value of your CRM to stakeholders, making it easier to secure budget for future enhancements and expansions.

- Competitive Advantage: Companies that effectively leverage their CRM systems to drive ROI often gain a significant competitive advantage by providing superior customer experiences, increasing sales, and reducing costs.

How to Measure CRM Marketing ROI

Measuring CRM marketing ROI requires a systematic approach that involves identifying key metrics, tracking data, and performing calculations. Here’s a breakdown of the essential steps:

1. Identify Key Metrics

The first step is to determine the specific metrics that will be used to measure your CRM marketing ROI. These metrics should align with your business goals and the objectives of your CRM initiatives. Common metrics include:

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

- Customer Lifetime Value (CLTV): The predicted revenue a customer will generate over their relationship with your business.

- Conversion Rates: The percentage of leads that convert into customers.

- Sales Revenue: The total revenue generated from sales.

- Lead Generation: The number of leads generated through CRM-driven campaigns.

- Customer Retention Rate: The percentage of customers who remain customers over a specific period.

- Customer Satisfaction: Measured through surveys or other feedback mechanisms.

- Marketing Campaign Performance: Track key metrics such as click-through rates, open rates, and conversion rates for each campaign.

- Cost of CRM Implementation and Maintenance: This includes the software costs, implementation costs, training expenses, and ongoing maintenance fees.

2. Track Data Accurately

Accurate data is the foundation of any reliable ROI calculation. Implement robust data tracking mechanisms to ensure that you capture the necessary information. This may involve:

- Integrating Your CRM with other systems: Connect your CRM to your marketing automation platform, sales tools, and other relevant systems to create a unified view of your customer data.

- Using unique tracking codes: Use unique tracking codes (e.g., UTM parameters) to track the source of leads and attribute conversions to specific marketing campaigns.

- Regular data audits: Conduct regular data audits to identify and correct any inaccuracies or inconsistencies in your data.

- Establishing clear data entry protocols: Implement clear guidelines and training to ensure that your team consistently enters data accurately into the CRM.

3. Calculate the ROI

Once you’ve gathered the necessary data, you can calculate your CRM marketing ROI using the following formula:

ROI = ((Revenue Generated – Cost of CRM) / Cost of CRM) * 100

Let’s break down the components:

- Revenue Generated: This is the total revenue directly attributable to your CRM marketing efforts. This can be calculated by identifying the sales generated by leads nurtured through the CRM, the increase in sales from existing customers due to targeted campaigns, or the revenue generated from improved customer retention.

- Cost of CRM: This encompasses all the costs associated with your CRM system, including the initial implementation costs, software licensing fees, ongoing maintenance expenses, and the cost of any training or consulting services.

- Example: If your CRM marketing efforts generated $100,000 in revenue and the total cost of your CRM was $20,000, your ROI would be ((100,000 – 20,000) / 20,000) * 100 = 400%. This means that for every dollar invested in your CRM, you generated $4 in return.

Important Considerations:

- Attribution Modeling: Determining which marketing efforts contributed to a sale can be complex. Consider implementing an attribution model to accurately assign credit to your CRM-driven activities.

- Time Horizon: The time frame for calculating ROI should align with your business cycle. For example, you might calculate ROI quarterly or annually.

- Intangible Benefits: While the ROI formula focuses on financial returns, don’t overlook the intangible benefits of your CRM, such as improved customer satisfaction, increased employee productivity, and better decision-making.

Strategies to Boost CRM Marketing ROI

Calculating your CRM marketing ROI is just the first step. The real value lies in using the insights gained to optimize your strategies and maximize your returns. Here are some proven strategies to boost your CRM marketing ROI:

1. Data Quality and Management

The quality of your data is paramount. A CRM is only as good as the information it contains. Poor data quality leads to inaccurate insights, wasted resources, and ultimately, a lower ROI. To improve data quality:

- Cleanse and De-duplicate Data: Regularly clean your database by removing duplicate records, correcting errors, and standardizing data formats.

- Verify Data Accuracy: Implement data validation rules to ensure the accuracy of new data entries. This can include using address verification tools and email validation services.

- Segment Your Data: Segment your customer data based on demographics, behavior, purchase history, and other relevant criteria. This allows you to tailor your marketing campaigns to specific customer groups, increasing their relevance and effectiveness.

- Automate Data Entry: Automate data entry wherever possible to reduce manual errors and improve efficiency. This can involve integrating your CRM with other systems, such as your website or e-commerce platform.

- Regularly Update Data: Keep your data up-to-date by regularly reviewing and updating customer information. Encourage your sales and marketing teams to update contact information whenever they interact with a customer.

2. Targeted Marketing Campaigns

One of the primary benefits of a CRM is the ability to create targeted marketing campaigns. By segmenting your audience and personalizing your messaging, you can significantly improve your ROI. Consider these tactics:

- Personalized Email Marketing: Use your CRM to send personalized emails to your customers based on their interests, purchase history, and behavior.

- Behavioral Targeting: Trigger automated emails or website messages based on customer behavior, such as browsing specific products, abandoning a shopping cart, or visiting a specific page on your website.

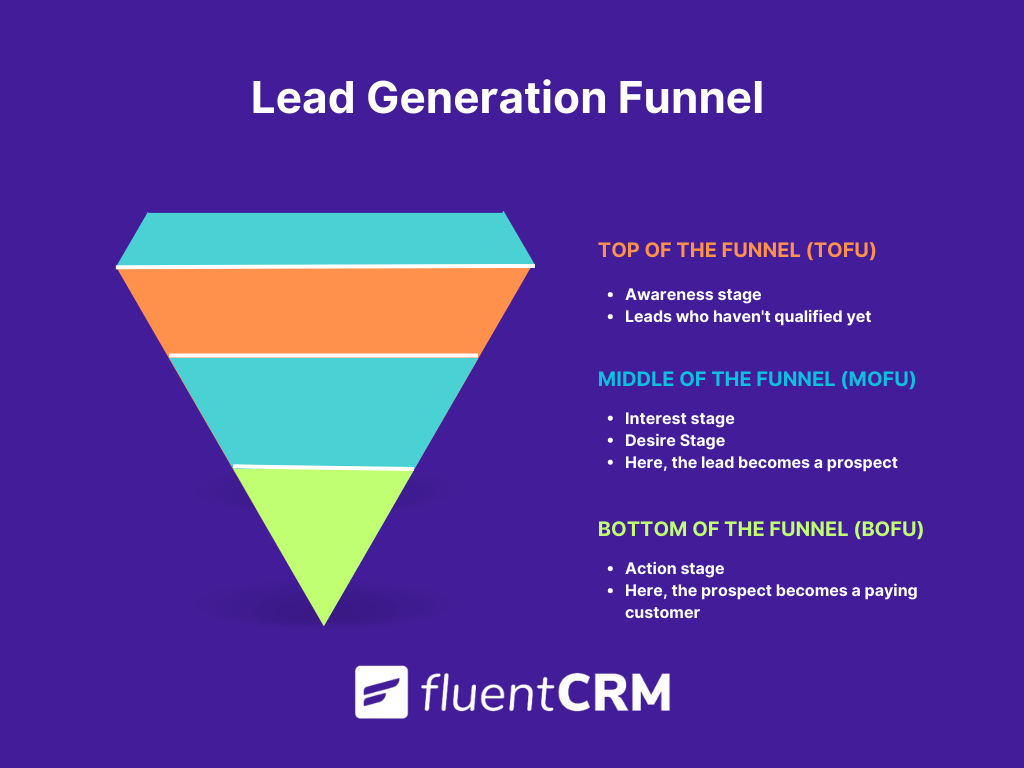

- Lead Nurturing: Nurture leads through the sales funnel with targeted content and automated workflows. This helps to move leads closer to a purchase decision.

- Customer Segmentation: Divide your customer base into segments based on demographics, behavior, and purchase history. Tailor your marketing messages to each segment to increase relevance and engagement.

- Lifecycle Marketing: Implement lifecycle marketing campaigns that target customers at different stages of their relationship with your brand. This includes welcome emails, onboarding sequences, and win-back campaigns.

3. Sales and Marketing Alignment

A strong alignment between your sales and marketing teams is crucial for maximizing your CRM marketing ROI. When these two teams work together seamlessly, they can create a consistent customer experience and drive more revenue. Strategies for aligning sales and marketing include:

- Shared Goals and Metrics: Establish shared goals and metrics for sales and marketing, such as lead generation, conversion rates, and revenue. This helps to align their efforts and ensure that they are working towards the same objectives.

- Service Level Agreements (SLAs): Develop SLAs that define the roles and responsibilities of each team, as well as the processes for lead handoff, follow-up, and reporting.

- Regular Communication: Encourage regular communication between sales and marketing teams. This can include weekly meetings, shared dashboards, and collaborative projects.

- Lead Scoring: Implement a lead scoring system to prioritize leads and ensure that sales representatives focus their efforts on the most qualified prospects.

- Feedback Loops: Create feedback loops to ensure that sales and marketing teams are continuously learning from each other. This can include sharing insights about customer interactions, campaign performance, and market trends.

4. Automation and Efficiency

Automation is a key component of maximizing your CRM marketing ROI. By automating repetitive tasks, you can free up your team’s time and resources, allowing them to focus on higher-value activities. Consider these automation tactics:

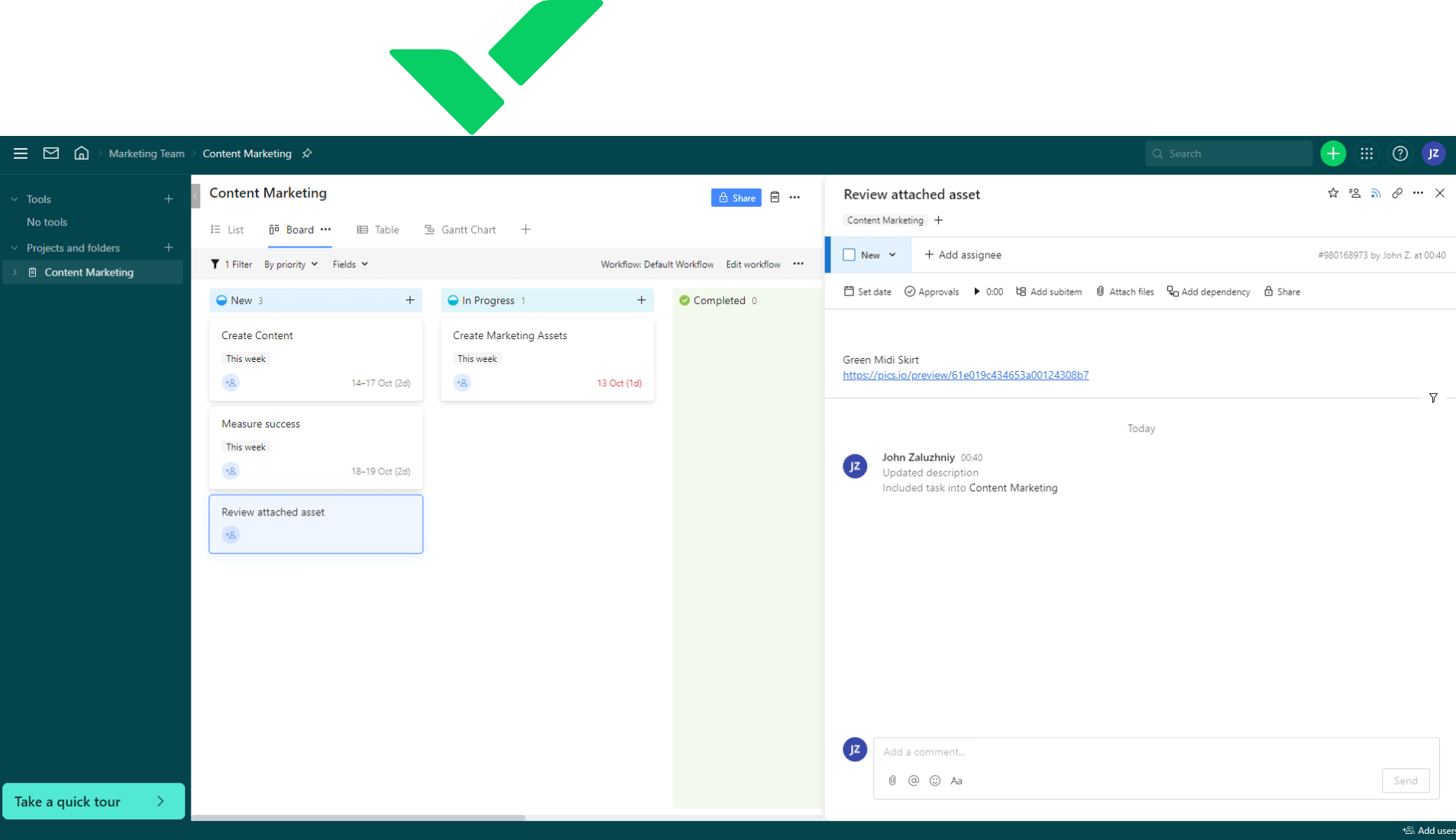

- Automated Workflows: Create automated workflows for tasks such as lead nurturing, email marketing, and customer service.

- Task Automation: Automate tasks such as data entry, report generation, and follow-up emails.

- Personalized Communication: Use personalization tokens to automatically insert customer information into emails and other communications.

- Chatbots: Implement chatbots to provide instant customer support and answer frequently asked questions.

- Marketing Automation Platforms: Integrate your CRM with a marketing automation platform to streamline your marketing efforts and automate complex workflows.

5. Customer Experience Optimization

A positive customer experience is essential for driving customer loyalty and repeat business. Your CRM can play a vital role in optimizing the customer experience. Here’s how:

- Personalized Customer Service: Use your CRM to provide personalized customer service. Access customer data to understand their needs and preferences, and tailor your interactions accordingly.

- Proactive Communication: Proactively communicate with your customers about product updates, special offers, and other relevant information.

- Feedback Collection: Collect customer feedback through surveys, reviews, and other channels. Use this feedback to improve your products, services, and customer experience.

- Self-Service Portals: Offer self-service portals where customers can access information, manage their accounts, and resolve issues on their own.

- Omni-Channel Integration: Integrate your CRM with all your customer touchpoints, including your website, email, social media, and phone, to provide a seamless customer experience across all channels.

6. Continuous Monitoring and Optimization

CRM marketing ROI is not a one-time calculation; it’s an ongoing process. Continuously monitor your performance, analyze your results, and make adjustments as needed. This includes:

- Regular Reporting: Generate regular reports to track your key metrics and identify trends.

- A/B Testing: Conduct A/B tests to optimize your marketing campaigns and website content.

- Analyze Campaign Performance: Analyze the performance of your marketing campaigns to identify what’s working and what’s not.

- Gather Customer Feedback: Regularly gather customer feedback to understand their needs and preferences.

- Stay Up-to-Date: Stay up-to-date on the latest CRM marketing trends and best practices.

Common Challenges and How to Overcome Them

While CRM systems offer tremendous potential, businesses often encounter challenges that can hinder their ability to achieve a positive ROI. Here’s how to navigate these hurdles:

1. Poor Data Quality

Challenge: Inaccurate, incomplete, or outdated data. This can lead to incorrect insights, ineffective marketing campaigns, and a poor customer experience.

Solution: Implement rigorous data cleansing and validation processes. Establish clear data entry protocols, integrate your CRM with other systems to automate data updates, and regularly audit your data for accuracy.

2. Low User Adoption

Challenge: Employees not using the CRM system consistently or effectively. This can be due to lack of training, a complex interface, or a perception that the CRM is not valuable.

Solution: Provide comprehensive training, simplify the user interface, and demonstrate the value of the CRM to employees. Highlight how it can improve their productivity and make their jobs easier. Consider providing incentives for CRM usage and fostering a culture of data-driven decision-making.

3. Lack of Integration

Challenge: The CRM system not integrated with other business systems, such as marketing automation platforms, sales tools, and e-commerce platforms. This can lead to data silos and a fragmented customer view.

Solution: Integrate your CRM with other relevant systems to create a unified view of customer data. This will enable you to personalize your marketing efforts, improve sales efficiency, and provide a seamless customer experience.

4. Poor Campaign Design

Challenge: Marketing campaigns that are not targeted, personalized, or relevant to the customer. This can lead to low engagement, poor conversion rates, and a negative impact on ROI.

Solution: Segment your audience and tailor your marketing messages to specific customer groups. Use personalization to make your communications more relevant and engaging. Test different campaign elements, such as subject lines, calls to action, and content, to optimize your results.

5. Inadequate Reporting and Analytics

Challenge: Lack of data-driven insights and the inability to track key metrics. This makes it difficult to measure ROI and make informed decisions about your marketing strategies.

Solution: Implement robust reporting and analytics capabilities. Track key metrics such as customer acquisition cost, customer lifetime value, and conversion rates. Use these insights to optimize your marketing campaigns and improve your ROI.

6. Unrealistic Expectations

Challenge: Setting unrealistic expectations for the CRM implementation and expecting immediate results. This can lead to disappointment and a lack of commitment to the CRM strategy.

Solution: Set realistic goals and expectations for your CRM implementation. Focus on incremental improvements and celebrate small wins along the way. Recognize that it takes time and effort to fully realize the benefits of your CRM system.

The Future of CRM Marketing ROI

The landscape of CRM marketing is constantly evolving, driven by technological advancements and changing customer expectations. Staying ahead of the curve requires a forward-thinking approach. Here’s a glimpse into the future of CRM marketing ROI:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are poised to revolutionize CRM marketing by automating tasks, personalizing customer experiences, and providing deeper insights into customer behavior. Expect to see more AI-powered chatbots, predictive analytics, and personalized recommendations.

- Hyper-Personalization: As technology advances, businesses will be able to deliver even more personalized experiences to their customers. This will involve using data to create highly targeted marketing campaigns and provide tailored recommendations.

- Omni-Channel Integration: The ability to provide a seamless customer experience across all channels will become increasingly important. Businesses will need to integrate their CRM systems with all their customer touchpoints, including their website, email, social media, and phone.

- Data Privacy and Security: Data privacy and security will become increasingly important as businesses collect and use more customer data. Businesses will need to comply with data privacy regulations and implement robust security measures to protect customer data.

- Focus on Customer Experience (CX): Customer experience will continue to be a key differentiator. Businesses will need to focus on providing exceptional customer experiences to build brand loyalty and drive revenue.

Conclusion

Unlocking the full potential of CRM marketing ROI requires a strategic and data-driven approach. By understanding the key metrics, implementing effective strategies, and continuously optimizing your efforts, you can transform your CRM into a powerful engine for growth. Remember that data quality, targeted campaigns, sales and marketing alignment, automation, and customer experience are all critical components of a successful CRM marketing strategy. Embrace the future of CRM marketing and position your business for long-term success by prioritizing data-driven decision-making, personalized customer experiences, and continuous optimization.

By following the guidelines outlined in this comprehensive guide, you’ll be well-equipped to measure, analyze, and ultimately, maximize your CRM marketing ROI, paving the way for sustainable growth and a thriving business.