In the dynamic world of small business, data is the new gold. But unlike gold, data isn’t inherently valuable; it’s what you do with it that counts. This is where Customer Relationship Management (CRM) systems, coupled with robust analytics, step in. They’re not just tools; they’re your secret weapon for understanding your customers, streamlining operations, and ultimately, driving growth. This article dives deep into the transformative power of CRM for small business analytics, exploring its benefits, implementation strategies, and how it can propel your venture to new heights. Think of it as your comprehensive guide to turning raw data into actionable insights.

Why CRM and Analytics are a Match Made in Business Heaven

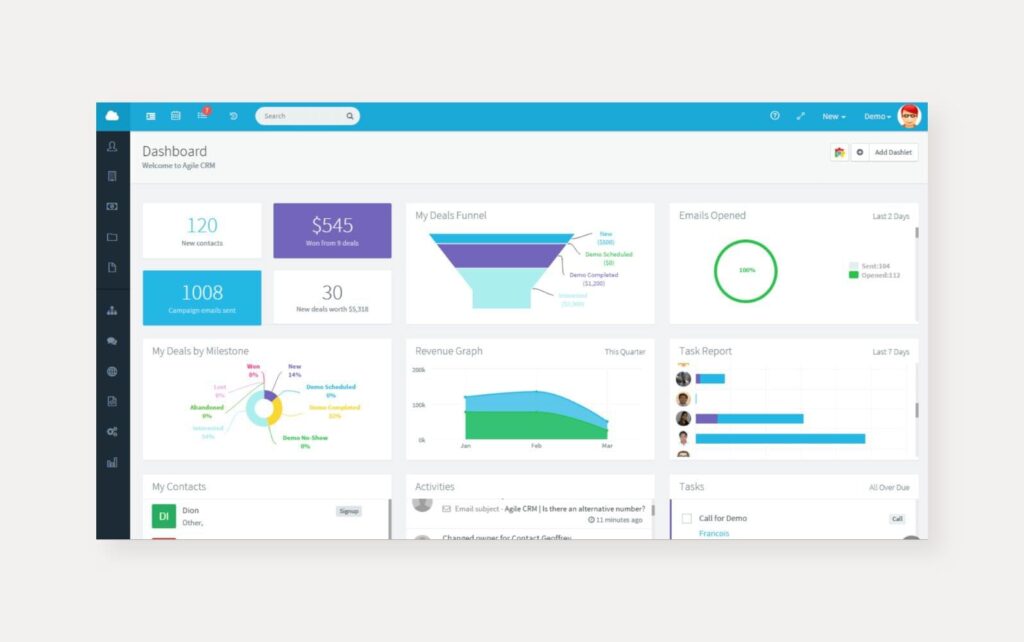

At its core, a CRM system is designed to manage and analyze customer interactions and data throughout the customer lifecycle. This includes everything from initial contact and lead generation to sales, customer service, and retention. When integrated with analytics, this system becomes exponentially more powerful. It shifts from simply storing data to actively providing insights that inform decision-making. This synergy is crucial for small businesses that often operate with limited resources and need to maximize every opportunity.

Here’s why this combination is so potent:

- Improved Customer Understanding: Analytics provides a deep dive into customer behavior, preferences, and needs. You’ll know what your customers want, when they want it, and how they prefer to receive it.

- Enhanced Sales Performance: By identifying high-potential leads, optimizing sales processes, and predicting future sales trends, CRM analytics empowers your sales team to close more deals, faster.

- Streamlined Marketing Campaigns: Target the right customers with the right messages at the right time. CRM analytics helps you segment your audience, personalize your marketing efforts, and measure the ROI of your campaigns.

- Superior Customer Service: Anticipate customer needs, resolve issues efficiently, and build stronger customer relationships by understanding their interactions and feedback.

- Data-Driven Decision Making: Instead of relying on gut feelings, you can make informed decisions based on concrete data, minimizing risks and maximizing opportunities.

The Core Benefits of CRM for Small Business Analytics

The advantages of implementing a CRM system integrated with analytics are numerous. Let’s break down some of the key benefits in more detail:

1. Boosted Sales and Revenue

One of the most immediate impacts of CRM analytics is its ability to boost sales and revenue. By analyzing sales data, you can identify patterns, track sales performance, and pinpoint areas for improvement. This leads to:

- Lead Qualification: Identify and prioritize the most promising leads, ensuring your sales team focuses on prospects with the highest likelihood of conversion.

- Sales Forecasting: Accurately predict future sales trends, allowing you to better manage inventory, staffing, and resources.

- Sales Process Optimization: Identify bottlenecks in your sales process and streamline your approach for greater efficiency.

- Personalized Sales Strategies: Tailor your sales approach to individual customer needs and preferences, increasing the chances of closing deals.

2. Enhanced Marketing ROI

CRM analytics empowers your marketing team to make data-driven decisions, leading to more effective campaigns and a higher return on investment (ROI). Key advantages include:

- Customer Segmentation: Divide your audience into specific groups based on demographics, behavior, and preferences, allowing for targeted marketing messages.

- Campaign Performance Tracking: Monitor the performance of your marketing campaigns in real-time, identifying what’s working and what’s not.

- Personalized Marketing: Deliver personalized content and offers to individual customers, increasing engagement and conversion rates.

- Lead Nurturing: Guide potential customers through the sales funnel with automated email sequences and targeted content.

3. Improved Customer Retention and Loyalty

Retaining existing customers is often more cost-effective than acquiring new ones. CRM analytics helps you understand customer behavior and preferences, allowing you to build stronger relationships and increase customer loyalty. This translates to:

- Identifying At-Risk Customers: Proactively identify customers who may be at risk of churning and take steps to retain them.

- Personalized Customer Service: Provide tailored support and assistance based on individual customer needs and past interactions.

- Loyalty Program Optimization: Analyze the effectiveness of your loyalty programs and make adjustments to maximize customer engagement.

- Proactive Customer Engagement: Reach out to customers with relevant offers and information, keeping them engaged and satisfied.

4. Increased Operational Efficiency

CRM analytics can streamline your business operations, freeing up your team to focus on more strategic initiatives. Key benefits include:

- Process Automation: Automate repetitive tasks, such as data entry and follow-up emails, to save time and reduce errors.

- Improved Collaboration: Facilitate communication and collaboration between different departments, ensuring everyone is on the same page.

- Resource Optimization: Allocate resources more effectively based on data-driven insights.

- Reduced Costs: Identify areas where you can reduce costs and improve profitability.

Choosing the Right CRM for Your Small Business

Selecting the right CRM system is a crucial decision. The best choice depends on your specific business needs, budget, and technical capabilities. Here are some factors to consider:

1. Features and Functionality

Assess your needs. What features are essential for your business? Consider the following:

- Contact Management: Does the system allow you to easily store and manage customer contact information?

- Sales Automation: Does it automate sales tasks like lead tracking and follow-ups?

- Marketing Automation: Can you create and manage email campaigns, track website activity, and segment your audience?

- Customer Service: Does it offer support ticketing, live chat, and knowledge base features?

- Reporting and Analytics: Does it provide comprehensive reporting and analytics capabilities?

- Integration: Does it integrate with other tools you use, such as your website, email marketing platform, and accounting software?

2. Ease of Use

A user-friendly CRM system will save your team time and frustration. Look for a system with an intuitive interface, easy navigation, and clear instructions.

3. Scalability

Choose a CRM that can grow with your business. Consider whether the system can handle increasing data volumes and user numbers as your company expands.

4. Pricing

CRM systems come in various pricing models, from free versions to enterprise-level solutions. Consider your budget and choose a system that offers the features you need at a price you can afford. Factor in the cost of implementation, training, and ongoing support.

5. Integration Capabilities

Ensure the CRM system integrates with the other tools you use, such as your website, email marketing platform, accounting software, and social media channels. This will streamline your workflows and eliminate the need for manual data entry.

6. Customer Support

Look for a CRM provider that offers excellent customer support. This will be essential if you encounter any issues or have questions. Check the provider’s website for support resources, such as FAQs, tutorials, and documentation. Consider whether they offer phone, email, or chat support.

Implementing CRM Analytics: A Step-by-Step Guide

Once you’ve chosen your CRM system, the next step is implementation. Here’s a step-by-step guide to help you get started:

1. Define Your Goals and Objectives

Before you start implementing your CRM system, define your goals and objectives. What do you hope to achieve with your CRM? Are you looking to increase sales, improve customer satisfaction, or streamline your marketing efforts? Having clear goals will help you choose the right features, configure the system, and measure your success.

2. Clean and Migrate Your Data

Data quality is crucial for accurate analytics. Clean and organize your existing customer data before migrating it to your CRM system. This may involve removing duplicates, correcting errors, and standardizing formats. Consider using data cleansing tools or services to help with this process.

3. Customize Your CRM System

Customize your CRM system to meet your specific business needs. This may involve creating custom fields, defining workflows, and configuring reports. Make sure the system is set up to track the data that is most important to your business.

4. Train Your Team

Provide comprehensive training to your team on how to use the CRM system. This will ensure that everyone understands how to enter data, use the features, and interpret the reports. Offer different training sessions for different roles within your company to ensure everyone is equipped with the knowledge they need.

5. Integrate with Other Systems

Integrate your CRM system with other tools and systems you use, such as your website, email marketing platform, and accounting software. This will streamline your workflows and eliminate the need for manual data entry.

6. Start Tracking Key Metrics

Identify the key metrics that are most important to your business. These might include sales revenue, customer acquisition cost, customer lifetime value, and customer satisfaction scores. Track these metrics regularly to measure your progress and identify areas for improvement.

7. Analyze Your Data and Generate Reports

Use the CRM system’s reporting and analytics features to analyze your data and generate reports. This will help you identify trends, patterns, and insights that can inform your decision-making. Regularly review your reports and make adjustments to your strategies as needed.

8. Continuously Improve Your CRM Usage

CRM implementation is not a one-time process; it’s an ongoing journey. Regularly review your CRM usage, identify areas for improvement, and make adjustments as needed. Stay up-to-date on the latest CRM features and best practices to maximize the value of your investment.

Key Metrics to Track with CRM Analytics

To get the most out of your CRM analytics, it’s essential to track the right metrics. Here are some of the most important ones:

Sales Metrics:

- Conversion Rate: The percentage of leads that convert into customers.

- Sales Cycle Length: The average time it takes to close a deal.

- Average Deal Size: The average value of your sales deals.

- Revenue per Sales Rep: The revenue generated by each member of your sales team.

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer.

Marketing Metrics:

- Website Traffic: The number of visitors to your website.

- Lead Generation: The number of leads generated through your marketing efforts.

- Marketing ROI: The return on investment of your marketing campaigns.

- Click-Through Rate (CTR): The percentage of people who click on your ads or links.

- Conversion Rate: The percentage of people who take a desired action, such as filling out a form or making a purchase.

Customer Service Metrics:

- Customer Satisfaction Score (CSAT): A measure of customer satisfaction.

- Net Promoter Score (NPS): A measure of customer loyalty.

- First Call Resolution Rate: The percentage of customer issues resolved on the first call.

- Average Resolution Time: The average time it takes to resolve a customer issue.

- Customer Churn Rate: The percentage of customers who stop doing business with you.

Real-World Examples: CRM Analytics in Action

Let’s explore some real-world examples of how small businesses are leveraging CRM analytics to achieve remarkable results:

Example 1: Retail Business

A small clothing boutique uses CRM analytics to analyze customer purchase history and preferences. They discover that customers who buy dresses also tend to purchase specific accessories. Armed with this insight, they create targeted email campaigns offering discounts on these accessories to customers who have recently bought dresses. This results in a 15% increase in accessory sales and a boost in overall revenue.

Example 2: Service-Based Business

A local landscaping company uses CRM analytics to track customer interactions and feedback. They notice a pattern of negative reviews related to missed appointments. They implement a new automated scheduling system and send appointment reminders via SMS. This leads to a significant reduction in missed appointments, a 20% improvement in customer satisfaction scores, and an increase in positive online reviews.

Example 3: E-commerce Startup

An e-commerce startup uses CRM analytics to analyze website visitor behavior and identify areas for improvement. They discover that a significant number of customers abandon their shopping carts at the checkout stage. They implement a retargeting campaign, offering a discount to customers who abandoned their carts. This campaign results in a 25% increase in completed purchases and a boost in overall sales.

Common Pitfalls to Avoid

While CRM analytics offers immense potential, there are common pitfalls that small businesses should avoid:

- Lack of Clear Goals: Without clear goals, you won’t know what data to track or how to measure your success.

- Poor Data Quality: Inaccurate or incomplete data will lead to flawed insights and poor decision-making.

- Insufficient Training: If your team isn’t properly trained, they won’t be able to use the CRM system effectively.

- Ignoring Customer Feedback: Customer feedback is invaluable for improving your products, services, and customer experience.

- Not Adapting to Change: The business landscape is constantly evolving. Be prepared to adapt your strategies based on the insights you gain from your CRM analytics.

The Future of CRM Analytics for Small Businesses

The future of CRM analytics for small businesses is bright, with exciting developments on the horizon. Here are some key trends to watch:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are already transforming CRM analytics, enabling businesses to automate tasks, personalize customer experiences, and gain deeper insights.

- Predictive Analytics: CRM systems will increasingly use predictive analytics to forecast customer behavior, predict sales trends, and identify potential risks.

- Personalized Customer Journeys: Businesses will be able to create highly personalized customer journeys, delivering the right content and offers at the right time.

- Integration with IoT: The Internet of Things (IoT) will provide new sources of data, allowing businesses to gain a more comprehensive understanding of their customers.

By embracing these trends, small businesses can stay ahead of the curve and unlock even greater value from their CRM systems.

Conclusion: Embrace the Power of CRM and Analytics

In conclusion, CRM for small business analytics is no longer a luxury; it’s a necessity. By implementing a well-chosen CRM system and leveraging its analytics capabilities, small businesses can gain a competitive edge, drive growth, and achieve sustainable success. From boosting sales and enhancing marketing ROI to improving customer retention and streamlining operations, the benefits are undeniable. By avoiding common pitfalls, staying informed about emerging trends, and continuously refining your approach, you can transform your data into a powerful engine for growth. So, take the leap, embrace the power of CRM and analytics, and watch your small business thrive.