Unlocking Innovation: How CRM Powers Small Business Growth and Future-Proofs Your Company

The Power of CRM for Small Businesses: More Than Just Contact Management

In the dynamic world of small business, the ability to adapt, innovate, and stay ahead of the curve is crucial. As an SEO expert, I understand the importance of not just having a presence, but thriving in the digital landscape. This is where Customer Relationship Management (CRM) systems come into play, especially for small businesses. Forget the image of complex, enterprise-level software; modern CRM is designed to be accessible, affordable, and a powerful engine for innovation.

At its core, CRM is about understanding and nurturing your relationships with customers. It’s about knowing their needs, preferences, and purchase history. But it’s much more than just storing contact information. A well-implemented CRM system can be the cornerstone of your small business’s innovation strategy, fueling growth and helping you future-proof your company in an ever-changing market.

Why Small Businesses Need CRM

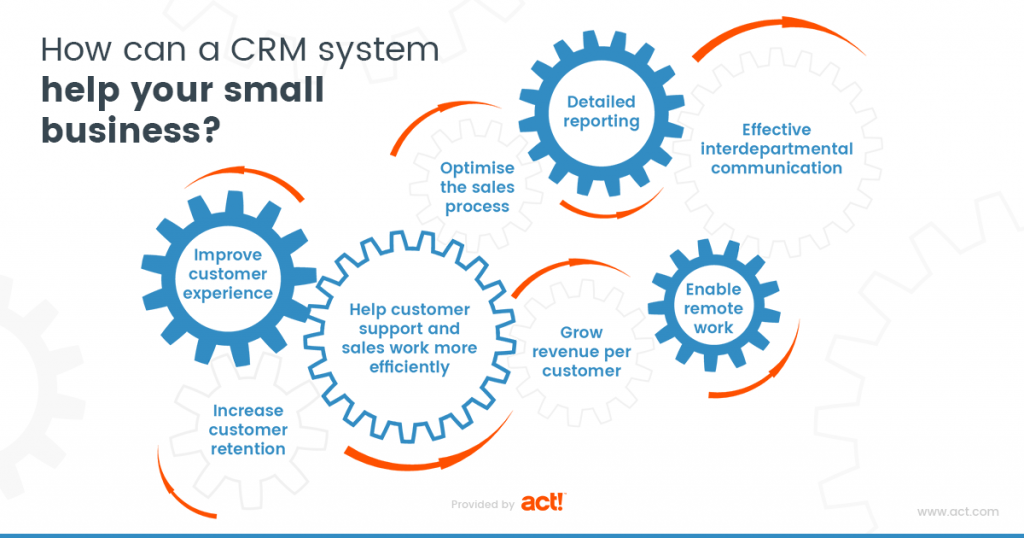

For many entrepreneurs, the initial thought about CRM might be, “I don’t need that yet.” They might believe it’s a luxury for larger companies with dedicated sales teams. However, this is a misconception. In fact, small businesses stand to gain the most from CRM because it helps them:

- Improve Customer Relationships: Build stronger connections by remembering personal details, preferences, and past interactions.

- Boost Sales: Identify and nurture leads, close deals faster, and increase revenue.

- Enhance Efficiency: Automate repetitive tasks, saving time and resources.

- Gain Actionable Insights: Analyze customer data to understand trends and make data-driven decisions.

- Foster Innovation: Identify new product or service opportunities based on customer feedback and behavior.

The benefits are clear: CRM empowers small businesses to work smarter, not harder, and to create a customer-centric culture that drives innovation.

CRM Features That Fuel Innovation

The beauty of modern CRM systems lies in their versatility. They offer a range of features that can be tailored to the specific needs of your small business, each contributing to a culture of innovation. Let’s delve into some key features and how they can be leveraged:

1. Contact Management and Segmentation

This is the foundation of any CRM system. It allows you to store and organize customer data, including contact information, purchase history, communication logs, and more. But it goes beyond just storing data. Effective contact management enables you to segment your customer base based on various criteria, such as demographics, purchasing behavior, and engagement level. This segmentation is critical for:

- Personalized Marketing: Tailor your marketing messages to specific customer segments, increasing engagement and conversion rates.

- Targeted Product Development: Identify customer needs and preferences within specific segments to inform new product or service development.

- Improved Customer Service: Provide more relevant and personalized support based on individual customer profiles.

By segmenting your audience, you can understand your customers better and create more effective strategies, which is a key driver of innovation.

2. Sales Automation

Sales automation streamlines the sales process, freeing up your team to focus on more strategic tasks. This includes automating tasks such as lead qualification, email marketing, and follow-up reminders. Sales automation not only improves efficiency but also:

- Accelerates the Sales Cycle: Automated workflows can move leads through the sales funnel faster, increasing the speed at which you close deals.

- Improves Lead Nurturing: Automated email sequences and personalized content can nurture leads, keeping your business top-of-mind and building relationships.

- Enhances Sales Team Productivity: By automating mundane tasks, sales reps can spend more time on high-value activities like building relationships and closing deals.

This increased efficiency allows your team to focus on more strategic initiatives, such as identifying new market opportunities and refining your sales approach, which directly contributes to innovation.

3. Marketing Automation

Marketing automation takes the power of CRM to the next level. It allows you to automate marketing campaigns, personalize content, and track customer engagement. Key benefits include:

- Lead Generation: Automate lead capture and qualification processes, ensuring that your sales team is focused on the most promising prospects.

- Personalized Communication: Deliver personalized email campaigns, website content, and social media messages based on customer behavior and preferences.

- Improved ROI: Track the performance of your marketing campaigns and optimize them for maximum impact, leading to a higher return on investment.

Marketing automation provides the data and insights needed to understand customer behavior, identify trends, and make data-driven decisions about your marketing strategy, supporting innovation in your approach to reaching and engaging your target audience.

4. Customer Service and Support

CRM empowers you to provide exceptional customer service. Features such as help desk integration, ticketing systems, and self-service portals ensure that customer issues are resolved quickly and efficiently. This leads to:

- Increased Customer Satisfaction: Happy customers are more likely to remain loyal and recommend your business to others.

- Improved Brand Reputation: Positive customer experiences build a strong brand reputation and attract new customers.

- Valuable Customer Feedback: Customer interactions and feedback can provide valuable insights for product development and service improvements, which is critical for innovation.

By providing excellent customer service, you not only retain customers but also gather valuable insights that drive innovation.

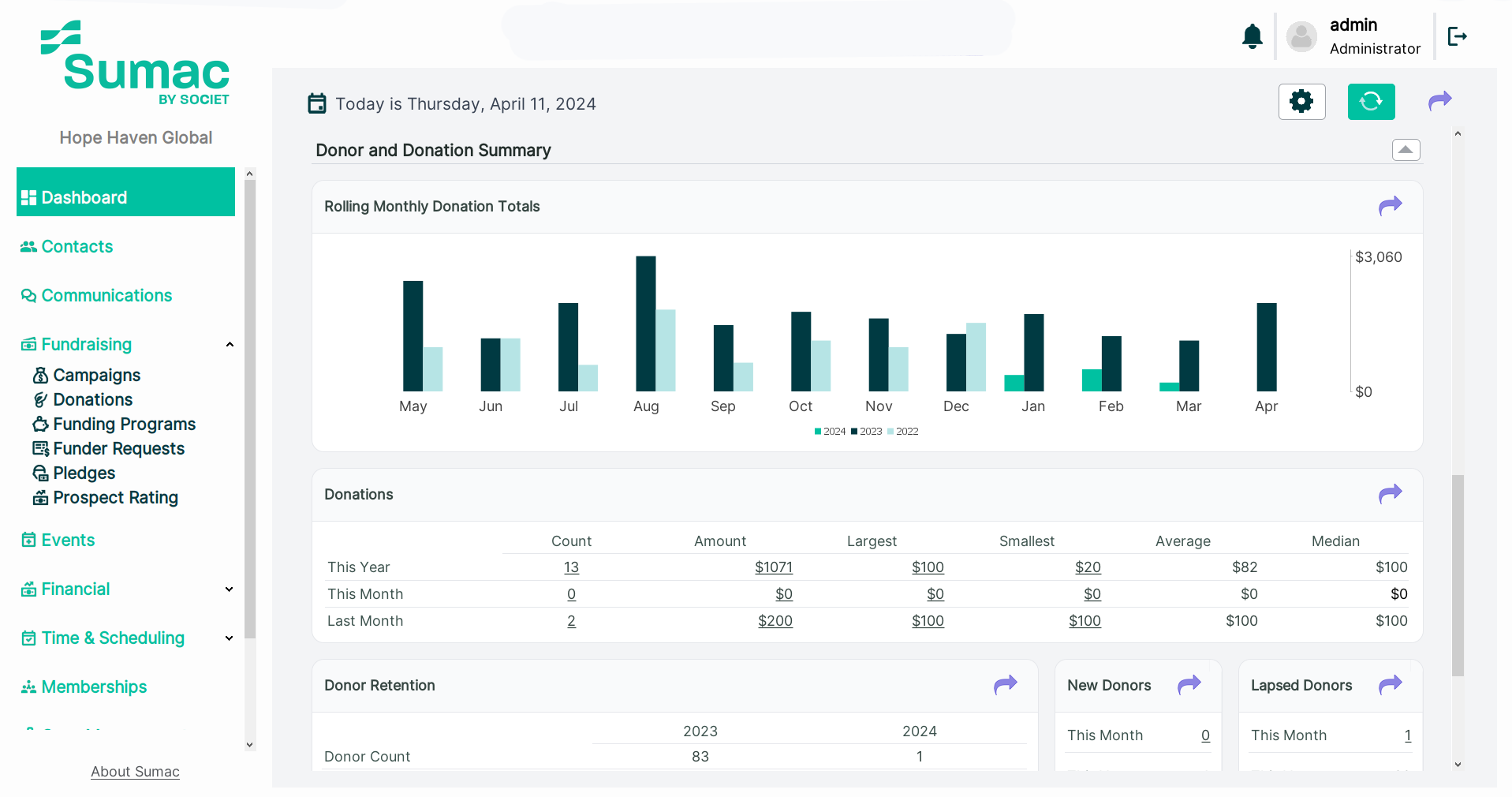

5. Reporting and Analytics

CRM systems provide powerful reporting and analytics tools that help you track key performance indicators (KPIs), analyze customer data, and identify trends. This data-driven approach is essential for:

- Making Data-Driven Decisions: Use real-time data to inform your business decisions, from sales and marketing strategies to product development.

- Identifying Opportunities: Analyze customer behavior and market trends to identify new opportunities for growth and innovation.

- Measuring Success: Track the performance of your campaigns and initiatives to ensure that you are achieving your goals.

Reporting and analytics are the engine of innovation, providing the insights you need to understand your business, your customers, and the market, enabling you to make informed decisions and drive growth.

Integrating CRM into Your Innovation Strategy: A Step-by-Step Guide

Implementing a CRM system is not just about choosing the right software; it’s about integrating it into your overall business strategy, particularly your innovation initiatives. Here’s a step-by-step guide to help you do just that:

1. Define Your Innovation Goals

Before you implement a CRM system, define your innovation goals. What do you want to achieve? Are you looking to develop new products, improve customer service, or enter new markets? Having clear goals will help you select the right CRM features and tailor your implementation to your specific needs.

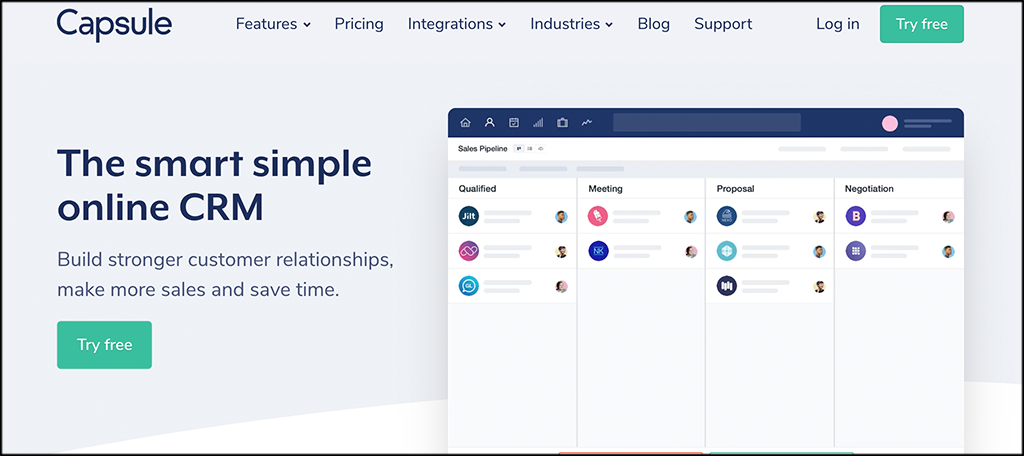

2. Choose the Right CRM System

There are many CRM systems available, each with its own strengths and weaknesses. When choosing a system, consider the following:

- Ease of Use: Choose a system that is easy to use and intuitive, especially for non-technical users.

- Scalability: Select a system that can grow with your business.

- Integration: Make sure the system integrates with your existing tools, such as your website, email marketing platform, and accounting software.

- Features: Choose a system that offers the features you need to achieve your innovation goals.

- Pricing: Consider your budget and choose a system that offers a pricing plan that fits your needs.

Popular options include Salesforce, HubSpot CRM, Zoho CRM, and Pipedrive, but the best choice depends on your unique requirements.

3. Implement Your CRM System

Once you’ve chosen a CRM system, it’s time to implement it. This process typically involves:

- Data Migration: Import your existing customer data into the CRM system.

- Customization: Customize the system to fit your specific needs, such as creating custom fields and workflows.

- Training: Train your team on how to use the system effectively.

- Testing: Test the system to ensure that it is working correctly.

Consider seeking professional help during implementation to ensure a smooth transition.

4. Train Your Team

Even the best CRM system is useless if your team doesn’t know how to use it. Provide comprehensive training to all team members who will be using the system, covering all aspects of the platform, from data entry to reporting. This training should be ongoing, with refresher courses and updates as the system evolves.

5. Integrate CRM with Your Innovation Process

This is where the magic happens. Integrate your CRM system with your innovation processes by:

- Collecting Customer Feedback: Use your CRM to collect customer feedback through surveys, feedback forms, and social media monitoring.

- Analyzing Customer Data: Use your CRM’s reporting and analytics tools to analyze customer data and identify trends.

- Generating Ideas: Use customer insights to generate new product ideas, improve existing products, and identify new market opportunities.

- Testing and Iterating: Use your CRM to track the performance of your new products and services and make adjustments as needed.

By integrating CRM into your innovation process, you can create a feedback loop that drives continuous improvement and helps you stay ahead of the competition.

6. Measure and Refine

Regularly measure the impact of your CRM system on your innovation efforts. Track KPIs such as customer satisfaction, sales growth, and new product development. Use these metrics to refine your CRM strategy and make adjustments as needed. This iterative process ensures that your CRM system continues to support your innovation goals.

Real-World Examples: CRM in Action for Innovation

Let’s look at some real-world examples of how small businesses are using CRM to drive innovation:

Example 1: A Local Bakery

A local bakery uses CRM to track customer preferences, birthdays, and special occasions. They segment their customers based on these criteria and send personalized email promotions for custom cakes and other treats. They also use customer feedback from their CRM to develop new flavors and products, like gluten-free options, which cater to customer demand. This customer-centric approach has led to increased customer loyalty and a significant boost in sales.

Example 2: A Software Development Company

A software development company uses CRM to manage leads, track customer interactions, and provide customer support. They use CRM data to identify common customer pain points and develop new software features that address these issues. By analyzing customer feedback and usage data, they can quickly identify areas for improvement and innovate on their existing products and services. This data-driven approach enables them to stay ahead of their competitors and deliver solutions that meet the evolving needs of their customers.

Example 3: An E-commerce Retailer

An e-commerce retailer uses CRM to track customer purchase history, browsing behavior, and abandoned carts. They use this information to personalize product recommendations, offer targeted discounts, and improve their website user experience. By analyzing customer data, they can identify new product trends and develop new product lines that meet the evolving needs of their customers. This data-driven approach has resulted in increased sales, higher customer retention rates, and a stronger brand reputation.

Overcoming Challenges and Maximizing CRM Success

While CRM offers immense potential, there are challenges to overcome. Here’s how to maximize your chances of success:

1. Data Quality and Accuracy

The effectiveness of your CRM system depends on the quality and accuracy of your data. Regularly clean and update your data to ensure that it is accurate and reliable. This includes verifying contact information, removing duplicate entries, and correcting any errors.

2. User Adoption

Get buy-in from your team. Ensure that your team understands the value of CRM and is committed to using it consistently. Provide adequate training and ongoing support to encourage adoption.

3. Integration with Other Systems

Ensure that your CRM system integrates with your other business systems, such as your website, email marketing platform, and accounting software. This will streamline your workflows and improve data accuracy.

4. Continuous Improvement

CRM is not a set-it-and-forget-it solution. Regularly review your CRM strategy and make adjustments as needed to ensure that it continues to meet your needs. This includes updating your processes, customizing your system, and training your team on new features.

The Future of CRM and Innovation

The future of CRM is bright, especially for small businesses looking to innovate. Emerging technologies are transforming the way businesses interact with their customers and drive innovation. Here are some trends to watch:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are already being used to automate tasks, personalize customer experiences, and provide insights that drive innovation. Expect to see more AI-powered features in CRM systems, such as predictive analytics, chatbots, and intelligent automation.

2. Mobile CRM

Mobile CRM allows you to access your CRM data on the go, empowering your team to stay connected with customers and close deals from anywhere. The rise of mobile technology will continue to drive the adoption of mobile CRM solutions.

3. Social CRM

Social CRM integrates social media data with your CRM system, providing a more comprehensive view of your customers. This allows you to track customer conversations, monitor brand mentions, and engage with customers on social media platforms.

4. Increased Personalization

Customers expect personalized experiences. CRM systems will continue to evolve to provide more sophisticated personalization capabilities, allowing businesses to tailor their interactions to individual customer preferences.

Conclusion: Embrace CRM for a Future-Forward Small Business

In conclusion, CRM is not just a tool for managing customer relationships; it’s a powerful engine for innovation. By embracing CRM and integrating it into your business strategy, you can:

- Gain a Deeper Understanding of Your Customers: Know their needs, preferences, and behaviors.

- Improve Customer Engagement: Build stronger relationships and increase customer loyalty.

- Drive Sales Growth: Close more deals and increase revenue.

- Enhance Efficiency: Automate tasks and streamline your workflows.

- Foster Innovation: Identify new opportunities and stay ahead of the competition.

For small businesses seeking to thrive in today’s competitive market, CRM is no longer optional—it’s essential. By implementing a well-chosen CRM system and integrating it into your innovation process, you can future-proof your business, drive sustainable growth, and create a customer-centric culture that fuels success. As an SEO expert, I encourage you to take the leap. Embrace the power of CRM, and unlock the potential for innovation within your small business.