Unlocking Growth: How a CRM Can Supercharge Lead Management for Your Small Business

Unlocking Growth: How a CRM Can Supercharge Lead Management for Your Small Business

Starting and running a small business is an adventure. It’s a rollercoaster of highs and lows, filled with moments of sheer exhilaration and challenges that test your resolve. One of the biggest hurdles, and the key to unlocking sustained growth, is effectively managing your leads. Think of leads as the lifeblood of your business; they’re the potential customers who could transform your vision into reality. But, without a system to nurture and convert them, these precious leads can quickly slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes into play. This article delves deep into how a CRM can revolutionize lead management for small businesses, helping you capture, cultivate, and convert leads into loyal customers.

The Lead Management Dilemma: Why Small Businesses Struggle

Before diving into the solutions, let’s acknowledge the struggles. Many small businesses, particularly those in their early stages, face a common set of challenges when it comes to lead management. These challenges often stem from a lack of dedicated resources, limited budgets, and the sheer volume of tasks that demand attention. Here are some of the most prevalent issues:

- Disorganized Data: Leads are often tracked using spreadsheets, email inboxes, or even sticky notes. This fragmented approach makes it incredibly difficult to get a complete view of your leads, their interactions with your business, and their progress through the sales funnel.

- Inefficient Communication: Without a centralized system, communication with leads can become chaotic. Emails get missed, follow-ups are forgotten, and valuable information gets lost in the shuffle. This leads to a poor customer experience and lost opportunities.

- Lack of Segmentation: Not all leads are created equal. Without proper segmentation, you’re likely treating every lead the same, which is a recipe for inefficiency. You might be wasting time and resources on leads who aren’t a good fit for your business.

- Missed Opportunities: When leads aren’t nurtured effectively, they often go cold. Without timely follow-ups, personalized communication, and targeted content, you risk losing potential customers to your competitors.

- Time-Consuming Manual Tasks: Small business owners wear many hats, and manual lead management tasks like data entry, scheduling appointments, and sending follow-up emails can consume a significant amount of valuable time that could be spent on core business activities.

These challenges can lead to lost sales, decreased productivity, and ultimately, stunted growth. But there’s a better way.

Enter the CRM: Your Secret Weapon for Lead Management

A CRM system is more than just a contact database; it’s a comprehensive platform designed to manage all aspects of your customer interactions, from initial contact to post-sale support. For small businesses, a CRM can be a game-changer, providing the tools and insights needed to streamline lead management and drive revenue growth. Here’s how a CRM can transform your approach to lead management:

Centralized Database

A CRM provides a centralized repository for all your lead data. This means you can store and access all relevant information in one place, including contact details, communication history, purchase history, and notes. This 360-degree view of your leads allows you to understand their needs and preferences, enabling you to tailor your interactions and provide a more personalized experience. Imagine having all the information about a lead at your fingertips, allowing you to make informed decisions and build stronger relationships.

Automated Workflows

One of the most significant benefits of a CRM is its ability to automate repetitive tasks. You can set up automated workflows to:

- Send automated email sequences: Nurture leads with targeted content based on their stage in the sales funnel.

- Schedule follow-up calls and meetings: Ensure timely communication and prevent leads from slipping through the cracks.

- Assign tasks to team members: Distribute leads and responsibilities efficiently.

- Update lead statuses: Track progress through the sales process automatically.

Automation frees up your time and allows you to focus on more strategic activities, such as building relationships and closing deals.

Lead Scoring and Segmentation

Not all leads are equally valuable. A CRM allows you to score leads based on their behavior, demographics, and engagement with your business. This scoring system helps you prioritize your efforts and focus on the leads that are most likely to convert. Furthermore, you can segment your leads based on various criteria, such as industry, company size, or interests. This segmentation allows you to tailor your messaging and offers to specific groups, increasing the likelihood of conversion.

Improved Communication

A CRM provides a central hub for all communication with your leads. You can track emails, phone calls, and other interactions, ensuring that everyone on your team has access to the same information. This improved communication leads to a more consistent and personalized experience for your leads, building trust and fostering stronger relationships. Some CRMs even integrate with communication platforms, allowing you to make calls and send SMS messages directly from the CRM.

Sales Forecasting and Reporting

A CRM provides valuable insights into your sales pipeline, allowing you to forecast future revenue and track key performance indicators (KPIs). You can generate reports on lead conversion rates, sales cycle length, and other metrics to identify areas for improvement. This data-driven approach enables you to make informed decisions and optimize your sales strategy for maximum impact.

Choosing the Right CRM for Your Small Business

Selecting the right CRM is crucial for its successful implementation and adoption. With a plethora of options available, it’s essential to choose a system that aligns with your specific business needs and budget. Here are some key factors to consider:

- Ease of Use: The CRM should be user-friendly and intuitive, with a clean interface and easy navigation. If it’s too complex, your team won’t use it, and you won’t reap the benefits.

- Scalability: Choose a CRM that can grow with your business. As your lead volume increases and your team expands, the CRM should be able to accommodate your needs without performance issues.

- Integrations: The CRM should integrate with other tools you use, such as email marketing platforms, accounting software, and social media channels. This will streamline your workflows and eliminate the need for manual data entry.

- Features: Consider the features that are most important to your business, such as lead scoring, automation, sales forecasting, and reporting. Choose a CRM that offers the features you need without overwhelming you with unnecessary functionality.

- Pricing: CRM pricing varies widely, from free options to enterprise-level solutions. Evaluate your budget and choose a CRM that provides the best value for your money. Consider both the initial cost and the ongoing subscription fees.

- Customer Support: Ensure the CRM provider offers excellent customer support, including documentation, tutorials, and responsive technical assistance.

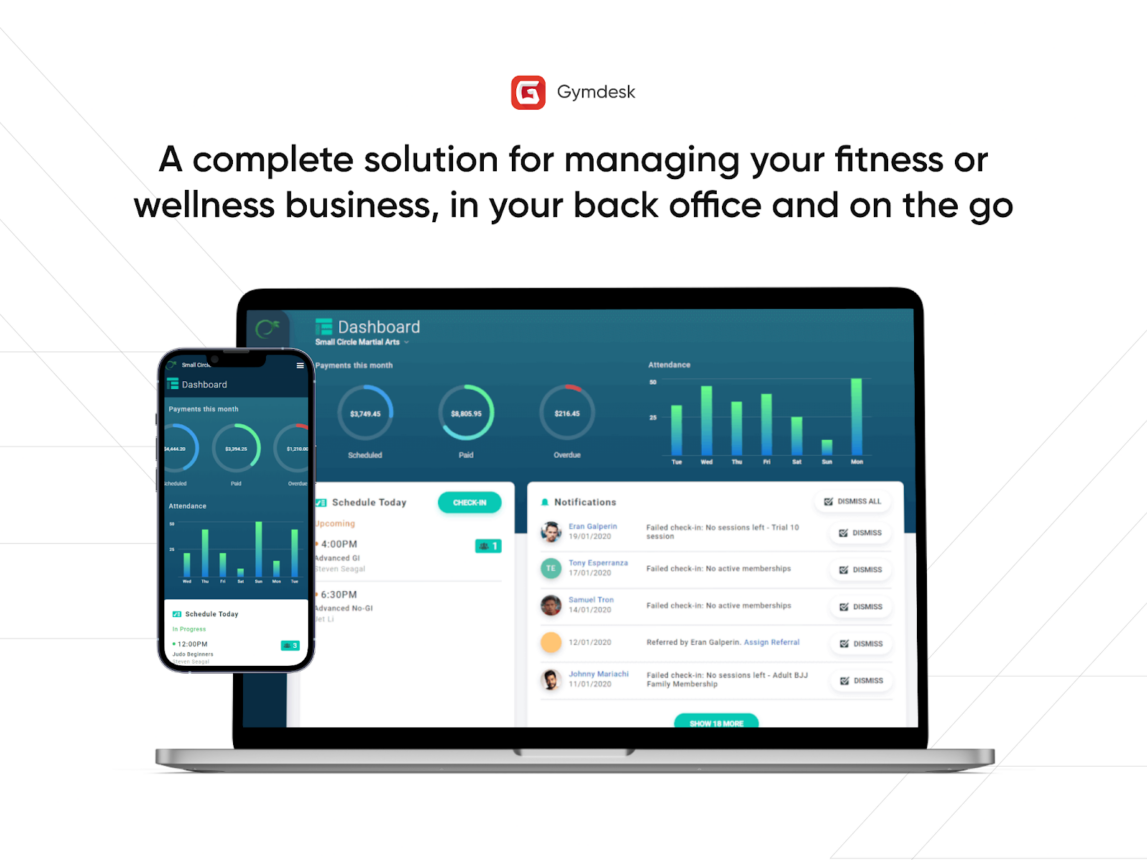

Here are a few popular CRM options tailored for small businesses:

- HubSpot CRM: HubSpot offers a free CRM with powerful features, making it an excellent choice for startups and small businesses. It’s known for its ease of use and comprehensive marketing and sales tools.

- Zoho CRM: Zoho CRM provides a range of features, from basic contact management to advanced sales automation. It offers a variety of pricing plans to suit different budgets.

- Salesforce Essentials: Salesforce Essentials is a streamlined version of the Salesforce platform, designed for small businesses. It offers a robust set of features, including sales automation, lead management, and reporting.

- Pipedrive: Pipedrive is a sales-focused CRM that’s known for its visual pipeline management and ease of use. It’s ideal for businesses that want to focus on closing deals.

Implementing Your CRM: A Step-by-Step Guide

Once you’ve selected a CRM, the next step is to implement it effectively. Here’s a step-by-step guide to help you get started:

- Define Your Goals: Before you start, clearly define your goals for using the CRM. What do you want to achieve? Increase sales? Improve customer satisfaction? Define your key performance indicators (KPIs) to measure your success.

- Clean Your Data: Before importing your data into the CRM, clean it up. Remove duplicates, correct errors, and standardize your data format. This will ensure that your CRM data is accurate and reliable.

- Import Your Data: Import your existing lead data into the CRM. Most CRMs offer data import tools that allow you to upload data from spreadsheets or other sources.

- Customize Your CRM: Customize the CRM to fit your specific business needs. Add custom fields, create workflows, and configure integrations.

- Train Your Team: Provide training to your team on how to use the CRM. Make sure everyone understands how to enter data, manage leads, and use the various features.

- Start Using the CRM: Start using the CRM for all your lead management activities. Encourage your team to adopt the CRM and make it an integral part of their daily workflow.

- Monitor and Optimize: Regularly monitor your CRM usage and track your KPIs. Identify areas for improvement and optimize your CRM configuration to maximize its effectiveness.

Best Practices for CRM Success

Implementing a CRM is just the first step; to truly maximize its benefits, you need to follow best practices. Here are some tips to ensure your CRM implementation is successful:

- Get Buy-In from Your Team: Involve your team in the CRM selection and implementation process. Get their feedback and address their concerns. This will increase their buy-in and encourage them to use the CRM effectively.

- Establish Clear Processes: Define clear processes for lead management, sales, and customer service. Document these processes and make them accessible to your team.

- Use the CRM Consistently: Encourage your team to use the CRM consistently. Make it a habit to enter data, update lead statuses, and communicate through the CRM.

- Integrate with Other Tools: Integrate your CRM with other tools you use, such as email marketing platforms and social media channels. This will streamline your workflows and provide a more holistic view of your leads.

- Analyze Your Data: Regularly analyze your CRM data to identify trends, track your progress, and make data-driven decisions.

- Provide Ongoing Training: Provide ongoing training to your team on how to use the CRM effectively. As your business evolves, so will your CRM needs.

- Stay Flexible and Adaptable: Be prepared to adapt your CRM configuration as your business needs change. Regularly review your CRM setup and make adjustments as needed.

The Benefits of CRM: A Summary

In essence, a CRM is an investment in the future of your small business. By centralizing your lead data, automating your workflows, and providing valuable insights, a CRM empowers you to:

- Increase Sales: By nurturing leads more effectively, you can close more deals and increase your revenue.

- Improve Customer Satisfaction: By providing a more personalized and responsive customer experience, you can build stronger relationships and increase customer loyalty.

- Boost Productivity: By automating manual tasks, you can free up your time and allow your team to focus on more strategic activities.

- Gain Valuable Insights: By tracking key performance indicators (KPIs), you can gain valuable insights into your sales pipeline and make data-driven decisions.

- Improve Collaboration: By centralizing your lead data and communication, you can improve collaboration within your team.

In today’s competitive landscape, a CRM is no longer a luxury; it’s a necessity. By embracing a CRM, you can transform your lead management process, unlock new growth opportunities, and build a thriving small business. It’s about working smarter, not harder, and equipping yourself with the tools you need to succeed. Don’t let your leads slip through the cracks; invest in a CRM and watch your business flourish.

Conclusion: Taking the Leap

Investing in a CRM for your small business is a significant step towards sustainable growth and enhanced customer relationships. It’s about taking control of your lead management, streamlining your processes, and empowering your team to achieve their full potential. While the initial setup and implementation might seem daunting, the long-term benefits – from increased sales and improved customer satisfaction to enhanced productivity and data-driven decision-making – are well worth the effort. Take the leap, explore the various CRM options available, and find the one that best aligns with your specific needs and budget. Your future success depends on it.