Unlocking Success: How Small Business CRM Accessibility Will Transform Your Operations in 2025

Unlocking Success: How Small Business CRM Accessibility Will Transform Your Operations in 2025

In the dynamic world of small business, staying ahead of the curve is crucial. As we look towards 2025, the accessibility of Customer Relationship Management (CRM) systems isn’t just a trend; it’s becoming the cornerstone of operational efficiency, customer satisfaction, and sustainable growth. This article delves into the transformative power of accessible CRM solutions, exploring how they can revolutionize your small business and prepare you for the future.

The Evolution of CRM and its Importance for Small Businesses

CRM has evolved significantly since its inception. Initially, it was primarily used by large corporations. However, with the advent of cloud-based solutions and user-friendly interfaces, CRM has become increasingly accessible to small businesses. It’s no longer a luxury; it’s a necessity. In 2025, the businesses that thrive will be those that fully leverage the power of CRM.

Why CRM Matters

- Improved Customer Relationships: At its core, CRM is about building and maintaining strong customer relationships. It helps you understand your customers better, anticipate their needs, and provide personalized service.

- Increased Efficiency: CRM automates many repetitive tasks, freeing up your team to focus on more strategic initiatives.

- Enhanced Sales Performance: CRM provides valuable insights into your sales pipeline, helping you identify opportunities, track progress, and close deals more effectively.

- Data-Driven Decision Making: CRM collects and analyzes vast amounts of data, providing you with the insights you need to make informed decisions.

What is CRM Accessibility? Understanding the Core Principles

CRM accessibility goes beyond just having a CRM system. It means ensuring that your CRM is usable by everyone, regardless of their abilities or disabilities. This includes people with visual, auditory, motor, and cognitive impairments. In 2025, legal and ethical considerations will make accessibility a non-negotiable aspect of CRM implementation.

Key Principles of CRM Accessibility

- Perceivability: Information and user interface components must be presentable to users in ways they can perceive. This includes providing text alternatives for non-text content (images, videos), providing captions and other alternatives for multimedia, and making content distinguishable.

- Operability: User interface components and navigation must be operable. This encompasses making all functionality available from a keyboard (keyboard accessibility), providing users with enough time to read and use content, and avoiding content that could cause seizures.

- Understandability: Information and the operation of the user interface must be understandable. This involves making text readable and understandable, making content appear and operate in predictable ways, and helping users avoid and correct mistakes.

- Robustness: Content must be robust enough that it can be interpreted reliably by a wide variety of user agents, including assistive technologies. This means maximizing compatibility with current and future user agents.

The Benefits of Accessible CRM for Small Businesses in 2025

Investing in an accessible CRM system offers a multitude of benefits for small businesses, extending far beyond mere compliance. It’s about creating a more inclusive and efficient work environment, broadening your customer base, and ultimately, boosting your bottom line.

Expanded Customer Reach

By making your CRM accessible, you’re opening your doors to a wider customer base. Individuals with disabilities represent a significant market segment, and catering to their needs can lead to increased sales and brand loyalty. This includes those who may use screen readers, have limited mobility, or experience cognitive difficulties. This also means being more inclusive of employees with disabilities.

Improved Employee Productivity

Accessible CRM systems are often designed with intuitive interfaces and streamlined workflows. This can benefit all employees, not just those with disabilities. The result is increased productivity, reduced errors, and a more efficient operation. Think about the time saved when your employees can easily find the information they need, manage tasks, and collaborate with colleagues.

Enhanced Data Accuracy

Accessibility features often include improved data validation and error prevention. This leads to more accurate data, which in turn leads to better decision-making and improved customer service. This is particularly important in sales and marketing, where data accuracy is critical for targeting the right customers and measuring the effectiveness of your campaigns.

Stronger Brand Reputation

Demonstrating a commitment to accessibility enhances your brand reputation. It shows that you care about all your customers and employees, and it positions your business as a leader in inclusivity. This can lead to increased customer loyalty, positive word-of-mouth marketing, and a stronger competitive advantage.

Compliance with Regulations

As accessibility regulations become more prevalent, investing in an accessible CRM system helps you avoid costly lawsuits and penalties. Ensuring your CRM is compliant with standards like WCAG (Web Content Accessibility Guidelines) is essential for legal and ethical reasons.

Key Features of Accessible CRM Systems in 2025

The best CRM systems in 2025 will incorporate a range of features designed to enhance accessibility. These features are not just add-ons; they are integral to the design and functionality of the system.

Screen Reader Compatibility

Screen readers are essential for users with visual impairments. An accessible CRM system must be fully compatible with screen readers, ensuring that all information and functionality can be accessed and understood. This involves using semantic HTML, providing alt text for images, and ensuring proper keyboard navigation.

Keyboard Navigation

Users with motor impairments often rely on keyboard navigation. An accessible CRM system must allow users to navigate the entire interface using only a keyboard. This includes the ability to access all features, forms, and controls.

Customizable Interface

The ability to customize the interface is crucial for users with various needs. This includes the ability to adjust font sizes, color contrast, and other visual elements. Some systems will also offer options for voice control and other assistive technologies.

Alternative Text for Images and Multimedia

All images and multimedia content must have alternative text (alt text) that describes the content. This allows screen reader users to understand the information conveyed by the images. Captions and transcripts are also essential for video and audio content.

Clear and Concise Language

Using clear and concise language is important for all users, but especially for those with cognitive impairments. Avoid jargon, complex sentence structures, and ambiguous language. The goal is to make the information as easy to understand as possible.

Color Contrast

Adequate color contrast is essential for users with visual impairments. Ensure that there is sufficient contrast between text and background colors to make the content readable. Avoid using color alone to convey information.

Selecting the Right Accessible CRM for Your Small Business

Choosing the right CRM system is a critical decision. When considering accessibility, you need to go beyond just looking at features. You need to evaluate the system’s overall design, usability, and commitment to accessibility standards.

Conduct a Needs Assessment

Before you start evaluating CRM systems, conduct a thorough needs assessment. Identify the specific accessibility needs of your employees and customers. This will help you prioritize the features and functionalities that are most important.

Evaluate Accessibility Features

Look for CRM systems that offer a comprehensive range of accessibility features, such as screen reader compatibility, keyboard navigation, and customizable interfaces. Check the system’s documentation and user reviews to learn more about its accessibility features.

Test the System

If possible, test the CRM system with users who have disabilities. This will give you valuable insights into its usability and identify any potential accessibility issues. Ask for feedback and be prepared to make adjustments based on the results.

Review Accessibility Statements

Many CRM vendors provide accessibility statements, which outline their commitment to accessibility and the features they offer. Review these statements to gain a better understanding of the vendor’s approach to accessibility. This will help ensure the vendor is proactively thinking about the needs of everyone.

Consider Integration with Assistive Technologies

Ensure that the CRM system integrates seamlessly with assistive technologies, such as screen readers, voice recognition software, and alternative input devices. This will help users with disabilities access and use the system effectively.

Prioritize Vendor Support

Choose a CRM vendor that offers excellent support and training. This is especially important if you have limited experience with accessibility. The vendor should be responsive to your needs and provide assistance when needed.

Implementing Accessible CRM: A Step-by-Step Guide

Implementing an accessible CRM system requires a strategic approach. It’s not just about choosing the right software; it’s about integrating accessibility into your business processes and culture.

Step 1: Plan and Prepare

Define your goals and objectives for implementing an accessible CRM system. Identify the key stakeholders and involve them in the planning process. Conduct a needs assessment to determine the specific accessibility needs of your employees and customers.

Step 2: Select and Configure the CRM System

Choose a CRM system that meets your accessibility requirements. Configure the system to meet your specific needs, including customizing the interface, setting up user roles and permissions, and integrating with other systems. Make sure to take advantage of all the accessibility features offered by the platform.

Step 3: Train Your Team

Provide comprehensive training to your team on how to use the CRM system effectively. This training should include information on accessibility features and best practices. Encourage your team to embrace the new system and provide feedback.

Step 4: Integrate Accessibility into Your Processes

Integrate accessibility into your business processes. This includes creating accessible documents, using alt text for images, and ensuring that all content is easy to understand. Develop a culture of accessibility within your organization.

Step 5: Monitor and Evaluate

Regularly monitor and evaluate the performance of your CRM system. Collect feedback from users and identify any areas for improvement. Make adjustments as needed to ensure that the system remains accessible and effective.

Common Challenges and Solutions for CRM Accessibility

Implementing an accessible CRM system can present challenges. However, with careful planning and execution, these challenges can be overcome.

Challenge: Lack of Awareness

Many businesses lack awareness of the importance of CRM accessibility. This can lead to a lack of resources and support for accessibility initiatives. Educate your team on the benefits of accessibility and the legal requirements.

Solution: Education and Training

Provide education and training on CRM accessibility to all employees. This will help raise awareness and build support for accessibility initiatives.

Challenge: Limited Budget

Implementing an accessible CRM system can require an investment of resources. Some businesses may have limited budgets for accessibility initiatives. Prioritize the most critical accessibility features and functionalities.

Solution: Prioritize and Phase Implementation

Prioritize the most critical accessibility features and functionalities. Implement the system in phases, focusing on the most important features first. Look for cost-effective solutions, such as cloud-based CRM systems.

Challenge: Technical Difficulties

Implementing an accessible CRM system can involve technical difficulties. This can include compatibility issues, integration problems, and lack of technical expertise. Work with a qualified IT provider or CRM vendor to address technical challenges.

Solution: Seek Expert Advice

Seek expert advice from accessibility consultants or CRM vendors. They can provide guidance on how to address technical challenges and ensure that the system is implemented correctly.

Challenge: Resistance to Change

Some employees may resist adopting a new CRM system or using accessibility features. This can hinder the implementation process. Communicate the benefits of the new system and address any concerns raised by employees.

Solution: Communication and Collaboration

Communicate the benefits of the new system to all employees. Encourage collaboration and provide support for employees who are struggling to adapt.

The Future of CRM Accessibility: Trends to Watch in 2025 and Beyond

The landscape of CRM accessibility is constantly evolving. Staying informed about emerging trends is crucial for ensuring that your business remains competitive and accessible in the years to come.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are playing an increasingly important role in CRM accessibility. AI-powered tools can automate tasks, personalize user experiences, and provide real-time support. ML algorithms can be used to analyze data and identify accessibility issues. Watch for AI-powered chatbots that can provide personalized assistance to users with disabilities.

Voice Control and Natural Language Processing (NLP)

Voice control and NLP are making CRM systems more accessible to users with motor impairments. Voice-activated interfaces allow users to control the system using their voice, eliminating the need for a keyboard or mouse. NLP enables users to interact with the system using natural language, making it easier to understand and use.

Augmented Reality (AR) and Virtual Reality (VR)

AR and VR are being used to create immersive and accessible CRM experiences. AR can be used to overlay information onto the real world, making it easier for users to visualize data and interact with the system. VR can be used to create virtual training environments for employees.

Increased Focus on User Experience (UX)

User experience (UX) is becoming increasingly important in CRM design. Businesses are focusing on creating user-friendly interfaces that are intuitive and easy to use. This includes designing interfaces that are accessible to users with disabilities. This is a trend that is likely to become more prevalent in the coming years.

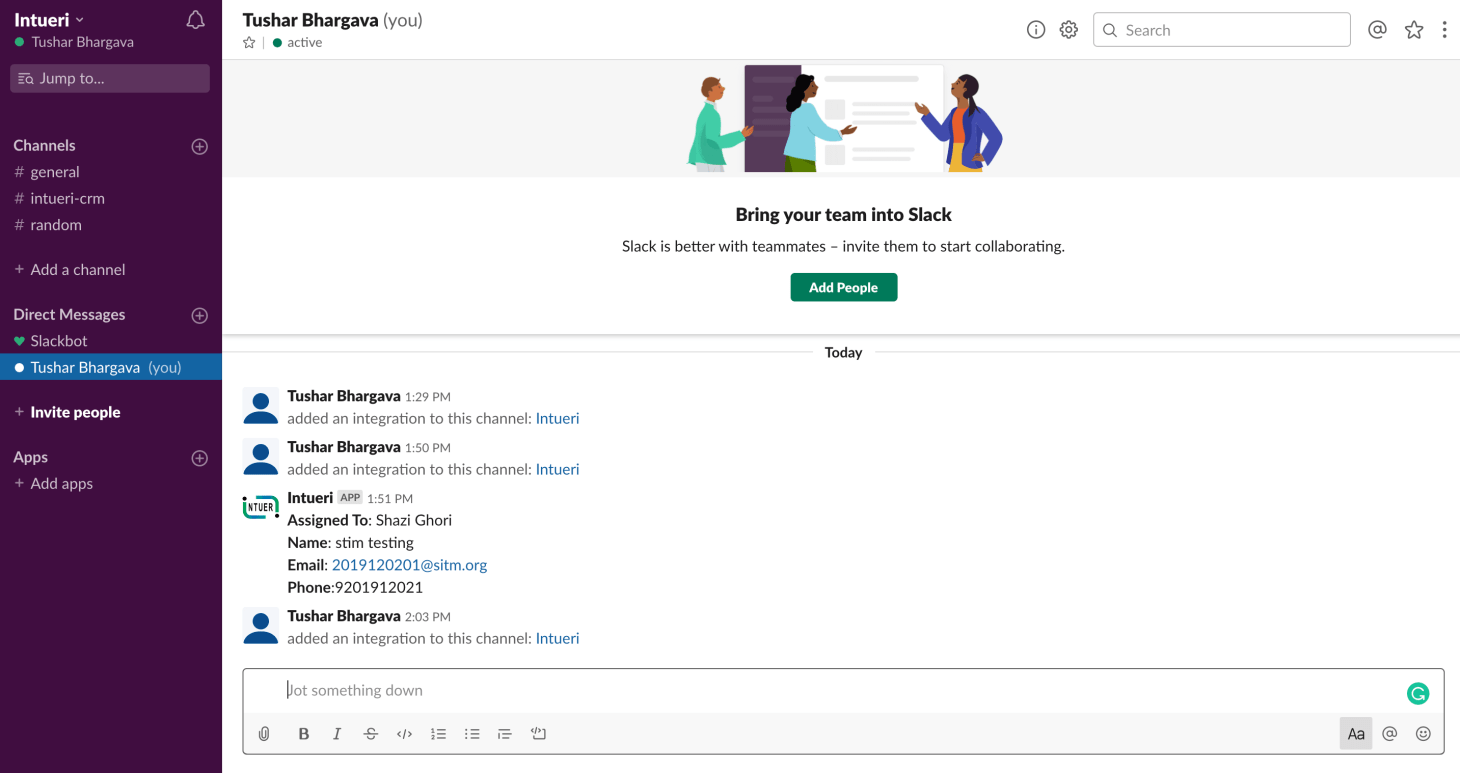

Integration with Wearable Devices

CRM systems are being integrated with wearable devices, such as smartwatches and fitness trackers. This allows users to access CRM data and functionality on the go. This can be particularly useful for sales teams and other employees who are constantly on the move.

Accessibility as a Service (AaaS)

AaaS offers businesses a way to outsource their accessibility needs to a third-party provider. This can be a cost-effective way to ensure that your CRM system is accessible and compliant with accessibility standards. AaaS providers offer a range of services, including accessibility testing, remediation, and training.

Conclusion: Embrace Accessibility for a Successful Future

As we move towards 2025, the accessibility of your CRM system is no longer optional; it is essential for the success of your small business. By embracing accessibility, you can unlock a wealth of opportunities, from expanding your customer base to improving employee productivity and strengthening your brand reputation. The time to act is now. By prioritizing accessibility, you’re not just complying with regulations; you’re investing in a more inclusive, efficient, and successful future for your business. The future of CRM is accessible, and the future is now.