Boost Conversions: How CRM, Marketing, and Social Proof Work Together

Boost Conversions: How CRM, Marketing, and Social Proof Work Together

In the ever-evolving world of marketing, staying ahead of the curve is crucial. Businesses are constantly seeking innovative strategies to attract, engage, and convert potential customers. Three powerful elements often work in synergy to achieve these goals: Customer Relationship Management (CRM), marketing automation, and social proof. When strategically integrated, these components can create a potent force, driving conversions and fostering lasting customer relationships. This article delves deep into the intricacies of how these three pillars function together, offering insights and actionable strategies to elevate your marketing efforts.

Understanding the Core Components

Customer Relationship Management (CRM)

At its core, CRM is more than just a software; it’s a comprehensive strategy designed to manage and analyze customer interactions and data throughout the customer lifecycle. A robust CRM system acts as a centralized hub, housing valuable information about each customer, including their contact details, purchase history, communication logs, and preferences. This data-driven approach allows businesses to personalize their interactions, tailor their marketing messages, and provide exceptional customer service.

The benefits of CRM are manifold. It enables businesses to:

- Improve Customer Segmentation: Group customers based on shared characteristics, behaviors, and needs.

- Enhance Customer Service: Provide faster, more efficient support by having instant access to customer information.

- Increase Sales: Identify and nurture leads, track sales progress, and close deals more effectively.

- Boost Customer Retention: Foster loyalty by providing personalized experiences and proactive support.

Popular CRM systems include Salesforce, HubSpot CRM, and Zoho CRM, each offering a range of features and integrations to suit different business needs.

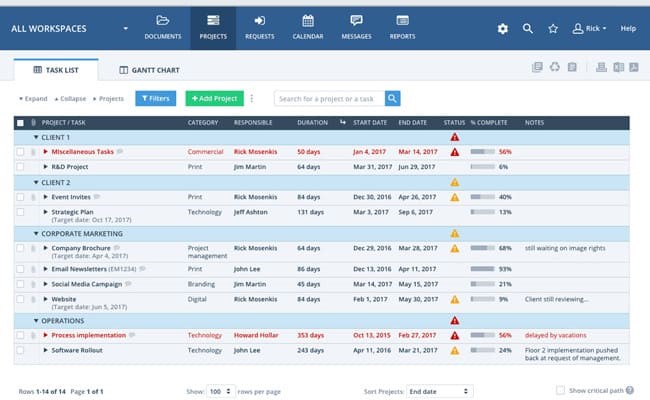

Marketing Automation

Marketing automation involves using software to automate repetitive marketing tasks, such as email campaigns, social media posting, and lead nurturing. This frees up marketers to focus on more strategic initiatives, like content creation and campaign optimization. Automation tools streamline the marketing process, ensuring consistent messaging and timely communication with potential customers.

Key aspects of marketing automation include:

- Email Marketing: Automated email sequences based on customer behavior or demographics.

- Lead Nurturing: Guiding leads through the sales funnel with targeted content and offers.

- Social Media Management: Scheduling posts, monitoring engagement, and analyzing performance.

- Personalization: Tailoring content and offers to individual customer preferences.

Tools like Marketo, Pardot, and Mailchimp provide robust marketing automation capabilities, enabling businesses to scale their marketing efforts effectively.

Social Proof

Social proof is a psychological phenomenon where people look to the actions of others to guide their own behavior. In marketing, social proof leverages the influence of others to build trust, credibility, and encourage conversions. This can take many forms, including customer reviews, testimonials, case studies, social media mentions, and influencer endorsements.

Types of social proof:

- Customer Reviews: Feedback from existing customers about their experiences with a product or service.

- Testimonials: Quotes or statements from satisfied customers highlighting the benefits they’ve received.

- Case Studies: In-depth analyses of successful customer implementations.

- Social Media Mentions: Positive comments, shares, and engagement on social media platforms.

- Influencer Endorsements: Recommendations from respected individuals or experts in the industry.

By incorporating social proof strategically, businesses can build trust, overcome objections, and drive conversions.

The Synergy: How They Work Together

The true power lies in how these three components – CRM, marketing automation, and social proof – work together. When integrated effectively, they create a powerful engine for driving conversions and fostering customer loyalty. Here’s how they synergize:

1. Data-Driven Personalization

CRM provides the data, marketing automation delivers the personalization. CRM systems collect and store valuable customer data, including demographics, purchase history, and preferences. Marketing automation tools leverage this data to personalize marketing messages and offers. For instance, if a customer has previously purchased a specific product, marketing automation can automatically send them targeted emails promoting related products or services. This level of personalization enhances the customer experience, making them feel valued and understood.

2. Targeted Lead Nurturing

CRM and marketing automation work hand-in-hand to nurture leads through the sales funnel. CRM systems track lead interactions and behaviors, such as website visits, content downloads, and email opens. Marketing automation tools then use this information to create targeted lead nurturing campaigns. These campaigns deliver relevant content and offers based on the lead’s stage in the buying process, guiding them towards a purchase decision. For example, a lead who downloads a whitepaper on a specific topic might receive a series of emails showcasing related products or services.

3. Leveraging Social Proof for Trust and Conversion

Social proof adds a crucial layer of credibility and trust to the marketing efforts. CRM and marketing automation can be used to strategically incorporate social proof into customer interactions. For example, after a customer makes a purchase, an automated email sequence can be triggered, requesting a review or testimonial. These reviews and testimonials can then be displayed on the company’s website, product pages, and marketing materials, providing social proof that encourages other potential customers to make a purchase. Similarly, marketing automation can be used to share positive social media mentions or influencer endorsements, further reinforcing the brand’s credibility.

4. Measuring and Optimizing Performance

CRM and marketing automation provide valuable data on campaign performance. CRM systems track sales and customer interactions, while marketing automation tools provide insights into email open rates, click-through rates, and conversion rates. By analyzing this data, businesses can identify what’s working and what’s not, allowing them to optimize their marketing strategies for maximum impact. For example, if a particular email campaign isn’t generating the desired results, the marketing team can adjust the messaging, targeting, or call to action based on the data. This iterative approach ensures that marketing efforts are constantly improving and driving better results.

Implementing the Strategy: Practical Steps

Integrating CRM, marketing automation, and social proof requires a strategic and well-planned approach. Here are some practical steps to guide you:

1. Choose the Right Tools

Selecting the right CRM and marketing automation tools is crucial. Consider your business’s specific needs, budget, and technical capabilities when making your selection. Research different platforms, compare features, and read reviews to find the best fit. Ensure that the chosen tools can integrate seamlessly with each other and with other relevant systems, such as your website and e-commerce platform.

2. Integrate Your Systems

Once you’ve chosen your tools, it’s time to integrate them. This involves connecting your CRM, marketing automation platform, and other relevant systems, so that data can flow seamlessly between them. This integration allows you to automate tasks, personalize communications, and track customer interactions effectively. Most CRM and marketing automation platforms offer built-in integrations with popular tools, making the process relatively straightforward.

3. Segment Your Audience

Effective audience segmentation is essential for personalized marketing. Use your CRM data to segment your audience based on demographics, behaviors, purchase history, and other relevant factors. This allows you to tailor your marketing messages and offers to specific customer groups, increasing their relevance and impact. For example, you might segment your audience into different buyer personas, such as new customers, repeat customers, and high-value customers.

4. Create Targeted Content and Offers

Develop targeted content and offers for each segment of your audience. This includes creating personalized email campaigns, landing pages, and social media posts. Your content should address the specific needs and interests of each segment, providing value and encouraging them to take action. For example, you might create a series of welcome emails for new customers, highlighting the benefits of your products or services. For repeat customers, you might offer exclusive discounts or early access to new products.

5. Automate Your Workflows

Leverage marketing automation to streamline your workflows. Automate repetitive tasks, such as sending welcome emails, nurturing leads, and following up with customers. This frees up your marketing team to focus on more strategic initiatives. Use automation to trigger specific actions based on customer behavior, such as sending a personalized email when a customer abandons their shopping cart or downloading a specific piece of content.

6. Gather and Showcase Social Proof

Actively gather and showcase social proof. Encourage customers to leave reviews, testimonials, and ratings. Display these reviews and testimonials prominently on your website, product pages, and marketing materials. Share positive social media mentions and influencer endorsements. Social proof helps build trust and credibility, influencing potential customers to make a purchase.

7. Track, Analyze, and Optimize

Continuously track and analyze your marketing performance. Use your CRM and marketing automation tools to monitor key metrics, such as email open rates, click-through rates, conversion rates, and customer lifetime value. Identify what’s working and what’s not, and make adjustments to your strategies accordingly. This iterative approach ensures that your marketing efforts are constantly improving and driving better results. Regularly review your customer data, analyze your segmentation strategy, and refine your content and offers to maximize their impact.

Real-World Examples

To further illustrate the power of integrating CRM, marketing automation, and social proof, let’s examine a few real-world examples:

Example 1: E-commerce Retailer

An e-commerce retailer uses CRM to track customer purchase history and preferences. When a customer purchases a particular product category, the CRM triggers an automated email sequence promoting related products. The retailer also integrates social proof by showcasing customer reviews and ratings on product pages, encouraging conversions. Furthermore, they utilize marketing automation to re-engage customers who abandon their shopping carts, offering a discount to incentivize the purchase. The combined effect is a significant increase in sales and customer loyalty.

Example 2: SaaS Company

A SaaS company uses CRM to manage leads and track their interactions with the sales team. They leverage marketing automation to nurture leads with targeted content, such as case studies and product demos. They integrate social proof by featuring customer testimonials and showcasing their client logos on their website. The result is a higher conversion rate and a shorter sales cycle. They also implement a customer referral program, further amplifying the impact of social proof.

Example 3: Local Service Business

A local service business uses CRM to manage customer appointments and track their service history. They use marketing automation to send appointment reminders and follow-up emails. They gather social proof by encouraging customers to leave reviews on Google My Business and other review platforms. These reviews are then displayed on their website and social media pages, building trust and attracting new customers. The result is increased brand awareness and a steady stream of new business.

Common Pitfalls to Avoid

While integrating CRM, marketing automation, and social proof can be highly effective, there are some common pitfalls to avoid:

- Lack of Data Quality: If your CRM data is inaccurate or incomplete, your marketing efforts will suffer. Ensure that your CRM data is clean, organized, and up-to-date.

- Poor Segmentation: If your audience segmentation is too broad, your marketing messages won’t be relevant. Take the time to segment your audience carefully based on their characteristics and behaviors.

- Irrelevant Content: If your content isn’t relevant to your audience’s needs and interests, they won’t engage with it. Create high-quality, targeted content that provides value.

- Over-Automation: Don’t rely solely on automation. Personalize your communications and provide human touchpoints when necessary.

- Ignoring Social Proof: Failing to gather and showcase social proof is a missed opportunity. Actively encourage customers to leave reviews and testimonials.

- Lack of Measurement: Without measuring your results, you won’t know what’s working and what’s not. Track your key metrics and make adjustments to your strategies accordingly.

Conclusion: Embracing the Power of Integration

In conclusion, the synergy between CRM, marketing automation, and social proof represents a powerful approach to modern marketing. By strategically integrating these components, businesses can personalize customer experiences, nurture leads effectively, build trust and credibility, and drive conversions. The key is to choose the right tools, integrate them seamlessly, and continuously track and optimize your marketing efforts. By embracing this integrated approach, businesses can build stronger customer relationships and achieve sustainable growth in today’s competitive market.

Remember to focus on providing value to your customers, building trust, and continuously improving your marketing strategies. By staying agile and adaptable, you can navigate the ever-changing landscape of marketing and achieve lasting success.

The future of marketing lies in the ability to create personalized, data-driven experiences that resonate with customers. By mastering the art of integrating CRM, marketing automation, and social proof, you can unlock the full potential of your marketing efforts and drive significant results.