Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Introduction: The Power of Integration in Today’s Business Landscape

In the fast-paced world of business, efficiency and customer satisfaction are paramount. Companies are constantly seeking ways to streamline their operations, improve customer experiences, and boost their bottom lines. One of the most effective strategies for achieving these goals is through seamless integration. And when it comes to handling online payments and managing customer relationships, the combination of CRM (Customer Relationship Management) systems and PayPal is a powerful one.

This article delves deep into the world of CRM integration with PayPal. We’ll explore the benefits, the how-tos, and the best practices for leveraging this dynamic duo to transform your business. Whether you’re a small startup or a large enterprise, understanding and implementing this integration can significantly impact your sales, customer service, and overall business performance.

Understanding the Building Blocks: CRM and PayPal

What is CRM?

CRM, or Customer Relationship Management, is more than just a software; it’s a philosophy of putting the customer at the center of your business. A CRM system is designed to help you manage and analyze customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships, assisting in customer retention, and driving sales growth. Key features of a CRM system include:

- Contact Management: Storing and organizing customer information, including contact details, communication history, and purchase history.

- Sales Automation: Automating sales processes, such as lead management, opportunity tracking, and quote generation.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media marketing, and lead nurturing.

- Customer Service: Managing customer inquiries, resolving issues, and providing support.

- Reporting and Analytics: Tracking key performance indicators (KPIs), analyzing customer data, and generating reports to make data-driven decisions.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

What is PayPal?

PayPal is a global online payment system that facilitates secure and convenient money transfers. It allows businesses to accept payments online, in person, and through mobile devices. PayPal offers a variety of features, including:

- Payment Processing: Accepting payments from credit cards, debit cards, and bank accounts.

- Secure Transactions: Providing secure payment processing with encryption and fraud protection.

- International Payments: Supporting payments in multiple currencies and from various countries.

- Easy Integration: Offering easy integration with websites, e-commerce platforms, and mobile apps.

- Payment Options: Offering various payment options, such as PayPal Checkout, PayPal Payments Pro, and PayPal Express Checkout.

PayPal is a widely recognized and trusted payment gateway, making it a preferred choice for both businesses and customers.

The Synergy: Benefits of CRM Integration with PayPal

Integrating your CRM system with PayPal is like combining two powerful engines into one supercharged machine. The benefits are numerous and can significantly impact various aspects of your business. Here are some of the key advantages:

1. Enhanced Customer Experience

By integrating CRM with PayPal, you create a more seamless and user-friendly experience for your customers. Customers can easily make payments directly from their CRM records, eliminating the need to switch between different platforms. This streamlined process reduces friction and improves customer satisfaction.

2. Streamlined Sales Processes

Integration automates many sales-related tasks, saving your sales team valuable time and effort. For example, you can automatically generate invoices and send payment reminders directly from your CRM system. This automation frees up your sales team to focus on building relationships and closing deals.

3. Improved Payment Tracking and Reconciliation

With CRM integration, you can track all payment-related activities within your CRM system. This includes payment status, transaction history, and payment amounts. This centralized view makes it easier to reconcile payments, identify discrepancies, and manage your finances.

4. Reduced Manual Data Entry

Manual data entry is time-consuming and prone to errors. CRM integration with PayPal automates the transfer of payment data, eliminating the need for manual data entry. This saves time, reduces errors, and improves data accuracy.

5. Better Customer Insights

By combining customer data from your CRM system with payment data from PayPal, you gain valuable insights into customer behavior and purchasing patterns. You can use this information to personalize your marketing efforts, improve your sales strategies, and provide better customer service.

6. Increased Efficiency and Productivity

Automation and streamlined processes lead to increased efficiency and productivity across your organization. Your teams can work more effectively, reduce wasted time, and focus on higher-value tasks.

7. Reduced Risk of Fraud

PayPal provides secure payment processing with fraud protection. Integrating PayPal with your CRM system helps protect your business from fraudulent transactions and reduces the risk of financial loss.

8. Improved Reporting and Analytics

CRM integration allows you to track and analyze payment data alongside other customer data. This provides a more complete picture of your business performance and helps you make data-driven decisions.

How to Integrate CRM with PayPal: A Step-by-Step Guide

The integration process can vary depending on your specific CRM system and the features you need. However, the general steps involved are similar. Here’s a comprehensive guide:

1. Choose the Right CRM and PayPal Integration Method

There are several ways to integrate your CRM system with PayPal:

- Native Integrations: Some CRM systems offer native integrations with PayPal. These integrations are typically pre-built and easy to set up.

- Third-Party Apps and Plugins: Many third-party apps and plugins are available that provide integration between CRM systems and PayPal. These options often offer more advanced features and customization options.

- Custom Development: If your CRM system doesn’t offer a native integration or a suitable third-party app, you may need to develop a custom integration using APIs (Application Programming Interfaces). This option requires technical expertise and can be more time-consuming.

Consider your specific needs and technical skills when choosing the integration method.

2. Set Up Your PayPal Account

If you don’t already have one, you’ll need to create a PayPal business account. You’ll need to provide business information, link your bank account, and configure your payment preferences.

3. Connect Your CRM System to PayPal

The specific steps for connecting your CRM system to PayPal will vary depending on the integration method you choose. Here’s a general overview:

- Native Integrations: Within your CRM system, look for the PayPal integration settings. You’ll typically need to enter your PayPal API credentials (API username, password, and signature) to connect your accounts.

- Third-Party Apps and Plugins: Install the app or plugin within your CRM system. Follow the installation instructions and enter your PayPal API credentials.

- Custom Development: Use the PayPal APIs to build a custom integration. This will require coding and technical expertise.

4. Configure Payment Settings

Once your accounts are connected, you’ll need to configure your payment settings. This includes:

- Payment Methods: Specify which payment methods you want to accept (e.g., credit cards, debit cards, PayPal).

- Currency: Set your preferred currency.

- Payment Notifications: Configure payment notifications to receive alerts when payments are made.

- Invoice Settings: Customize your invoices with your branding and payment information.

5. Test the Integration

Before going live, thoroughly test the integration to ensure that payments are processed correctly and that data is transferred accurately between your CRM system and PayPal. Make a test transaction to verify that everything works as expected.

6. Train Your Team

Train your team on how to use the integrated system. Provide instructions on how to create invoices, process payments, and manage customer data.

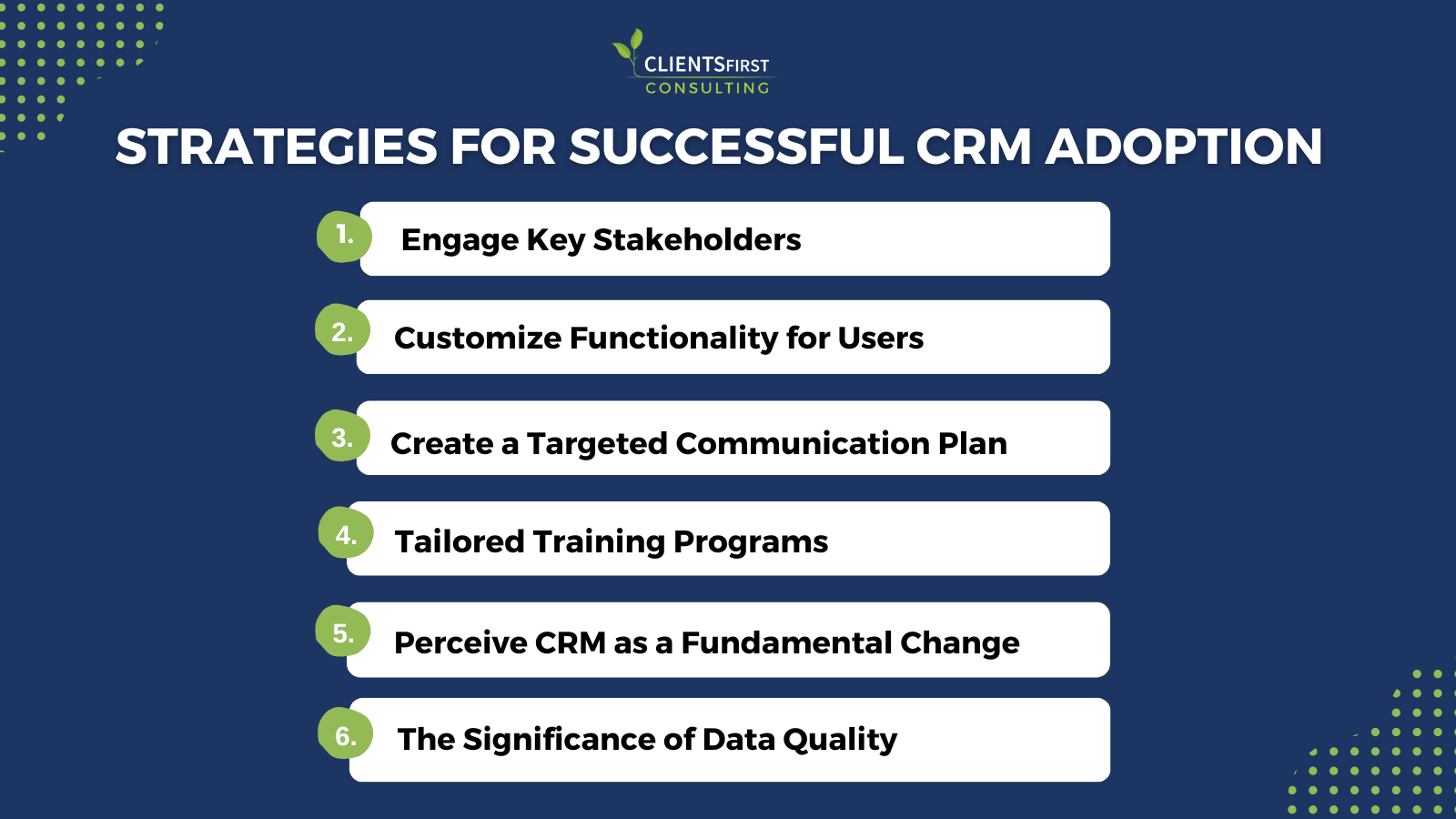

Best Practices for Successful CRM and PayPal Integration

Successfully integrating CRM with PayPal requires careful planning and execution. Here are some best practices to ensure a smooth and effective integration:

1. Plan Your Integration Strategy

Before you start integrating, take the time to plan your strategy. Define your goals, identify the specific features you need, and choose the right integration method. Consider your team’s technical skills and resources.

2. Choose the Right CRM System

Select a CRM system that meets your business needs and offers robust integration capabilities with PayPal. Consider factors such as ease of use, features, scalability, and pricing.

3. Secure Your Data

Data security is critical. Use strong passwords, enable two-factor authentication, and regularly review your security settings. Ensure that your integration method complies with PCI DSS (Payment Card Industry Data Security Standard) requirements.

4. Customize the Integration

Customize the integration to meet your specific business needs. Tailor the integration to match your branding, workflow, and reporting requirements.

5. Regularly Monitor and Update the Integration

Monitor the integration regularly to ensure that it’s working correctly. Update the integration when necessary to take advantage of new features and security enhancements. Keep your CRM and PayPal accounts updated.

6. Provide Excellent Customer Support

Provide excellent customer support to address any issues or questions that your customers may have. Make sure your team is well-trained and equipped to handle payment-related inquiries.

7. Automate Whenever Possible

Leverage automation features to streamline your processes and save time. Automate tasks such as invoice generation, payment reminders, and data entry.

8. Analyze and Optimize Your Processes

Analyze your payment data and customer data to identify areas for improvement. Optimize your processes to increase efficiency and improve customer satisfaction. Track key performance indicators (KPIs) such as sales, customer retention, and payment processing times.

Advanced Features and Considerations

Beyond the basic integration, there are several advanced features and considerations that can further enhance your CRM and PayPal integration.

1. Recurring Payments

If your business offers subscription services or recurring billing, consider using PayPal’s recurring payments feature. This allows you to automatically bill your customers on a regular schedule, streamlining the payment process and improving cash flow.

2. Refunds and Disputes

Understand how to handle refunds and disputes within your CRM system. Ensure that your CRM system can track and manage refunds and disputes effectively.

3. Reporting and Analytics

Use the reporting and analytics features of your CRM system and PayPal to gain insights into your payment data and customer behavior. This data can help you make informed decisions about your business.

4. Mobile Payments

If you conduct business on the go, consider integrating PayPal with your mobile CRM app. This allows you to accept payments from customers directly from your mobile device.

5. Compliance and Security

Ensure that your integration complies with all relevant regulations and security standards. This includes PCI DSS compliance, GDPR compliance, and other data privacy regulations.

6. Multi-Currency Support

If you do business internationally, ensure that your CRM and PayPal integration supports multiple currencies. This allows you to accept payments from customers in their local currencies.

Case Studies: Real-World Examples of Successful CRM and PayPal Integration

Let’s look at some real-world examples of how businesses have successfully integrated CRM with PayPal:

1. E-commerce Businesses

Many e-commerce businesses use CRM and PayPal integration to manage customer orders, track payments, and provide customer support. They can easily track order status, send payment confirmations, and process refunds directly from their CRM system.

2. Subscription-Based Businesses

Subscription-based businesses use CRM and PayPal integration to automate recurring billing, manage customer subscriptions, and track payment history. This streamlines the subscription management process and reduces manual effort.

3. Service-Based Businesses

Service-based businesses, such as consultants and freelancers, use CRM and PayPal integration to generate invoices, accept payments, and track project costs. They can easily manage client payments and track their financial performance.

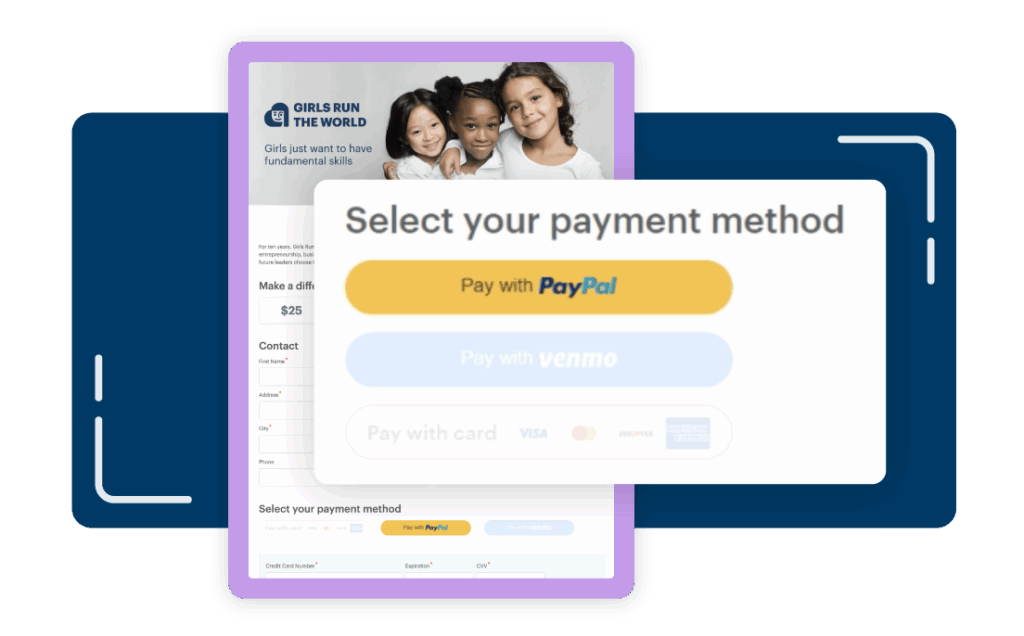

4. Non-Profit Organizations

Non-profit organizations use CRM and PayPal integration to manage donations, track donor information, and send donation receipts. They can easily manage fundraising campaigns and track their fundraising goals.

Troubleshooting Common Issues

Even with careful planning, you may encounter some issues during the integration process. Here are some common problems and how to resolve them:

1. Connection Errors

If you encounter connection errors, double-check your API credentials, ensure that your PayPal account is active, and verify that your internet connection is stable.

2. Payment Processing Errors

If payments are not processing correctly, check your payment settings, ensure that your account is verified, and verify that the customer’s payment information is correct. If the problem persists, contact PayPal support or your CRM provider for assistance.

3. Data Synchronization Issues

If data is not synchronizing correctly between your CRM system and PayPal, check your integration settings, verify that the data mapping is correct, and ensure that the integration is running properly. If the problem persists, contact your CRM provider or the third-party integration provider.

4. Reporting Issues

If you are having trouble generating reports, check your reporting settings, verify that the data is being tracked correctly, and ensure that you have the necessary permissions. If the problem persists, contact your CRM provider for assistance.

5. Security Concerns

If you have security concerns, review your security settings, enable two-factor authentication, and regularly monitor your account for suspicious activity. Contact PayPal support or your CRM provider immediately if you suspect any security breaches.

Conclusion: Embracing the Future of Payments and Customer Relationships

Integrating CRM with PayPal is a strategic move that can revolutionize your business operations. By streamlining your payment processes, enhancing customer experiences, and gaining valuable insights, you can unlock significant growth potential. The benefits of this integration extend beyond mere convenience; they provide a foundation for building stronger customer relationships, improving efficiency, and driving revenue.

As technology continues to evolve, the integration of CRM and payment systems will become even more crucial. By embracing this technology, you can stay ahead of the competition and position your business for long-term success. Take the time to plan your integration strategy, choose the right tools, and implement best practices. The rewards – increased sales, improved customer satisfaction, and a more efficient business – are well worth the effort.

So, take the leap and integrate your CRM with PayPal today. Your business, and your customers, will thank you for it.