Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

Seamless Synergy: Mastering CRM Integration with QuickBooks for Business Growth

In the dynamic world of business, efficiency and organization are paramount. The ability to streamline processes, manage customer relationships effectively, and maintain accurate financial records is crucial for sustainable growth. This is where the powerful combination of Customer Relationship Management (CRM) software and QuickBooks accounting software comes into play. This article delves into the intricacies of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and the tools that can help you unlock its full potential.

Understanding the Power of CRM and QuickBooks

Before we dive into the integration aspect, let’s briefly understand the roles each software plays in a business ecosystem.

What is CRM?

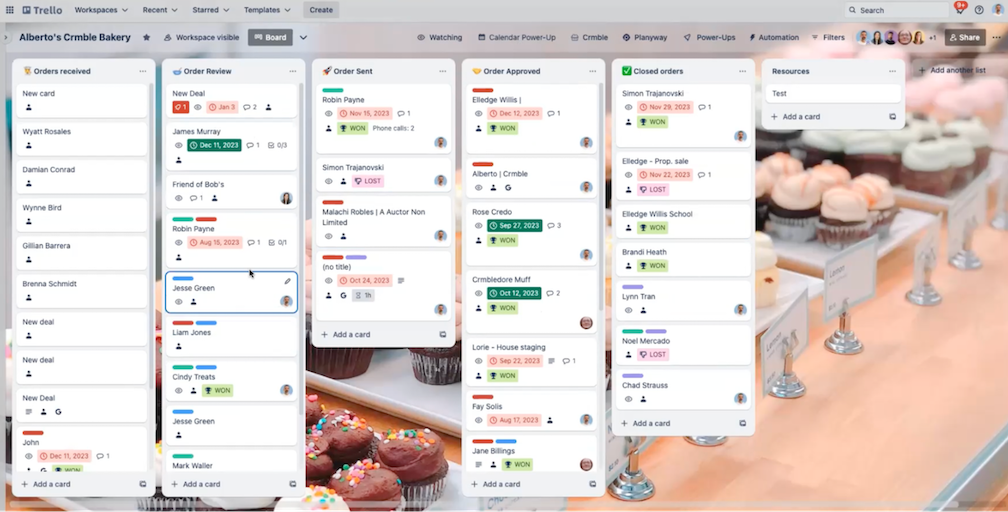

CRM, or Customer Relationship Management, is a technology that helps businesses manage their interactions with current and potential customers. It’s more than just a contact list; it’s a comprehensive system designed to improve customer relationships, drive sales, and boost profitability. Key features of CRM software include:

- Contact Management: Centralized storage of customer information, including contact details, interactions, and purchase history.

- Sales Automation: Automating repetitive sales tasks, such as lead scoring, follow-up emails, and opportunity management.

- Marketing Automation: Automating marketing campaigns, segmenting audiences, and tracking campaign performance.

- Customer Service: Managing customer inquiries, resolving issues, and providing excellent customer support.

- Reporting and Analytics: Providing insights into sales performance, customer behavior, and marketing effectiveness.

What is QuickBooks?

QuickBooks is a widely used accounting software designed to help businesses manage their finances. It simplifies accounting tasks, provides financial insights, and helps businesses stay compliant with tax regulations. Key features of QuickBooks include:

- Accounts Payable: Managing vendor invoices, tracking payments, and managing cash flow.

- Accounts Receivable: Creating and sending invoices, tracking payments, and managing outstanding balances.

- General Ledger: Recording all financial transactions and generating financial statements.

- Payroll: Processing employee salaries, managing payroll taxes, and generating payroll reports.

- Reporting and Analytics: Providing financial insights, such as profit and loss statements, balance sheets, and cash flow statements.

The Benefits of CRM Integration with QuickBooks

Integrating CRM and QuickBooks offers a multitude of advantages that can significantly improve business operations. Here are some key benefits:

1. Enhanced Data Accuracy and Consistency

One of the most significant benefits of integration is the elimination of manual data entry. When data is manually entered into multiple systems, there’s a high risk of errors and inconsistencies. Integration ensures that data flows seamlessly between CRM and QuickBooks, minimizing the chance of errors and providing a single source of truth for customer and financial information. For instance, when a new customer is created in the CRM, their information can automatically sync to QuickBooks, eliminating the need to manually enter the data again.

2. Improved Efficiency and Productivity

Integration automates several tasks, saving valuable time and effort. Sales teams no longer need to manually enter sales data into QuickBooks, and accounting teams don’t have to manually enter customer information. This frees up employees to focus on more strategic tasks, such as building customer relationships, closing deals, and analyzing financial data. This automation also accelerates key processes, like invoicing and payment tracking, leading to faster cash flow.

3. Streamlined Sales and Accounting Processes

Integration streamlines the entire sales and accounting lifecycle. Sales teams can access customer financial information directly from their CRM, allowing them to make informed decisions and provide better service. Accounting teams can easily track sales data and generate financial reports. This seamless flow of information improves collaboration between sales and accounting departments, leading to better overall business performance.

4. Better Customer Relationship Management

By integrating CRM with QuickBooks, you gain a 360-degree view of your customers. Sales teams can see a customer’s purchase history, outstanding invoices, and payment status directly from their CRM. This allows them to personalize interactions, provide better customer service, and identify upselling and cross-selling opportunities. This enhanced understanding of customer behavior can lead to increased customer satisfaction and loyalty.

5. Improved Financial Reporting and Insights

Integration allows you to generate more comprehensive and accurate financial reports. Sales data from the CRM can be combined with financial data from QuickBooks to provide a holistic view of business performance. You can track sales by customer, product, and sales representative, and gain valuable insights into profitability, cash flow, and customer lifetime value. This data-driven approach enables better decision-making and strategic planning.

6. Reduced Data Entry Errors

Manual data entry is prone to errors, which can lead to inaccurate financial records and poor decision-making. Integration eliminates the need for manual data entry, reducing the risk of errors and ensuring the accuracy of your financial data. This leads to more reliable financial reporting and better insights into your business performance.

7. Faster Invoicing and Payment Processing

With integration, you can automatically generate invoices in QuickBooks directly from your CRM. This eliminates the need to manually create invoices, saving time and reducing the risk of errors. You can also track payments and send automated payment reminders, leading to faster payment processing and improved cash flow. This streamlined process contributes to a more efficient and productive accounts receivable cycle.

How to Integrate CRM with QuickBooks

There are several ways to integrate CRM with QuickBooks, each with its own advantages and disadvantages. Here are the most common methods:

1. Native Integrations

Some CRM and QuickBooks vendors offer native integrations, which are pre-built integrations that connect the two systems seamlessly. These integrations are typically easy to set up and use, and they often provide a wide range of features, such as two-way data sync, automated invoice generation, and real-time data updates. Examples of CRM systems that offer native integrations with QuickBooks include Salesforce, HubSpot, and Zoho CRM. This is often the easiest and most reliable method, as the integration is designed specifically to work with both platforms.

2. Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, Make (formerly Integromat), and PieSync (now part of HubSpot), allow you to connect a wide range of applications, including CRM and QuickBooks. These platforms provide a user-friendly interface for creating integrations, and they offer a variety of pre-built connectors and automation tools. While third-party platforms offer a flexible and cost-effective solution, they may require more technical expertise to set up and maintain. They also sometimes lack the depth of features found in native integrations.

3. Custom Integrations

For businesses with complex integration requirements, custom integrations may be the best option. Custom integrations are built specifically to meet your unique needs and can provide a high level of customization and control. However, they require technical expertise and can be more expensive and time-consuming to develop and maintain. This approach is suitable for businesses with unique processes or specific data mapping needs that are not addressed by native or third-party solutions.

Step-by-Step Guide to Setting Up CRM Integration with QuickBooks (Example using Zapier)

Let’s walk through a general example of integrating CRM with QuickBooks using Zapier, a popular integration platform. Keep in mind that the specific steps may vary depending on the CRM and QuickBooks versions you are using.

1. Choose Your CRM and QuickBooks

Select the CRM and QuickBooks accounts you want to integrate. Make sure you have the necessary login credentials for both systems.

2. Create a Zapier Account

If you don’t already have one, create a Zapier account. You may need a paid plan depending on the number of tasks (automated actions) you intend to perform.

3. Connect Your CRM and QuickBooks to Zapier

In Zapier, connect your CRM and QuickBooks accounts. You’ll typically need to authorize Zapier to access your accounts. This involves logging into your CRM and QuickBooks accounts within Zapier and granting permission for Zapier to access and modify your data.

4. Define Triggers and Actions

A Zap consists of a trigger and one or more actions. The trigger is the event that starts the automation, such as creating a new contact in your CRM. The action is what happens in QuickBooks when the trigger occurs, such as creating a new customer. For example, your trigger might be “New Contact in HubSpot” and your action might be “Create Customer in QuickBooks.”

5. Map Data Fields

When setting up your actions, you’ll need to map the data fields from your CRM to the corresponding fields in QuickBooks. For example, you’ll map the “First Name” field from your CRM to the “First Name” field in QuickBooks. This ensures that the data is transferred correctly between the two systems. Careful mapping is crucial for data accuracy.

6. Test Your Zap

Before activating your Zap, test it to make sure it’s working correctly. Create a test contact in your CRM and verify that it’s automatically created as a customer in QuickBooks. This helps identify and resolve any issues before the integration goes live. Test thoroughly to ensure all data fields are correctly mapped and the automated process functions as intended.

7. Activate Your Zap

Once you’ve tested your Zap and confirmed that it’s working correctly, activate it. Your integration is now live, and any new contacts created in your CRM will automatically be created as customers in QuickBooks.

8. Monitor and Maintain

Regularly monitor your Zaps to ensure they’re working as expected. Check for any errors or issues and make adjustments as needed. Keep your CRM and QuickBooks software up to date to ensure compatibility with Zapier.

Choosing the Right CRM for QuickBooks Integration

The best CRM for QuickBooks integration depends on your specific business needs and requirements. Here are some popular CRM options that offer seamless integration with QuickBooks:

1. Salesforce

Salesforce is a leading CRM platform that offers robust features and extensive customization options. It provides a native integration with QuickBooks, allowing you to sync customer data, sales data, and invoices. Salesforce is a powerful, scalable platform suitable for businesses of all sizes, especially those with complex sales processes. It can be a significant investment, but the features often justify the cost for larger organizations.

2. HubSpot CRM

HubSpot CRM is a free, user-friendly CRM that offers a range of features, including contact management, sales automation, and marketing automation. It integrates seamlessly with QuickBooks through a native integration, allowing you to sync customer data and financial information. HubSpot CRM is an excellent choice for small and medium-sized businesses looking for an easy-to-use and affordable CRM solution. It is particularly well-suited for businesses focused on inbound marketing and sales.

3. Zoho CRM

Zoho CRM is a versatile CRM platform that offers a wide range of features, including sales automation, marketing automation, and customer service. It offers a native integration with QuickBooks, allowing you to sync customer data, sales data, and invoices. Zoho CRM is a cost-effective option suitable for businesses of all sizes. It provides a good balance of features and affordability, making it a popular choice for many businesses.

4. Pipedrive

Pipedrive is a sales-focused CRM designed to help sales teams manage their deals and close more sales. It integrates with QuickBooks through third-party platforms like Zapier. Pipedrive is known for its intuitive interface and ease of use, making it ideal for sales teams that prioritize deal management and pipeline visibility. This is a great solution for businesses looking for a simple, effective CRM focused on sales performance.

5. Insightly

Insightly is a CRM and project management platform that focuses on building strong customer relationships. It offers integrations with QuickBooks through third-party platforms. Insightly is a good option for businesses that need both CRM and project management capabilities. It provides a comprehensive platform for managing customer interactions and project workflows.

Best Practices for CRM Integration with QuickBooks

To maximize the benefits of CRM integration with QuickBooks, follow these best practices:

1. Plan Your Integration Strategy

Before you start integrating, define your goals and objectives. Identify the specific data you want to sync between CRM and QuickBooks, and map out your integration strategy. Consider the workflows you want to automate and the reports you want to generate. A well-defined plan will ensure a successful integration.

2. Clean and Organize Your Data

Before integrating, clean and organize your data in both CRM and QuickBooks. Remove duplicate records, correct any errors, and ensure that your data is consistent and accurate. Clean data will prevent errors during the integration process and ensure that your reports are accurate. This step is crucial for a smooth transition and accurate data flow.

3. Test the Integration Thoroughly

Before going live, test the integration thoroughly. Create test records in your CRM and verify that they are correctly synced to QuickBooks. This will help you identify and resolve any issues before they impact your business operations. Thorough testing is essential to ensure data accuracy and system functionality.

4. Train Your Team

Provide training to your team on how to use the integrated systems. Explain the workflows, data entry procedures, and reporting capabilities. Ensure that everyone understands how to use the new systems effectively. Proper training will maximize the benefits of the integration and improve team productivity.

5. Monitor and Maintain the Integration

After the integration is live, monitor it regularly to ensure that it’s working correctly. Check for any errors or issues and make adjustments as needed. Keep your CRM and QuickBooks software up to date to ensure compatibility. Regular maintenance will ensure the long-term success of the integration.

6. Choose the Right Integration Method

Select the integration method that best suits your needs. Consider your budget, technical expertise, and integration requirements. Native integrations are often the easiest to set up and maintain, while third-party platforms offer more flexibility. Custom integrations are suitable for businesses with complex needs. Choosing the right method is crucial for a successful integration.

7. Start Small and Scale Up

If you’re new to CRM integration, start small and gradually scale up. Begin by integrating a few key features, such as contact syncing, and then add more features as you become more comfortable with the system. This phased approach reduces the risk of disruption and allows you to learn and adapt as you go. It helps you avoid overwhelming your team and ensures a smoother transition.

Troubleshooting Common Issues

Even with careful planning, you may encounter some issues during the integration process. Here are some common problems and how to resolve them:

1. Data Synchronization Errors

Data synchronization errors can occur if there are inconsistencies in your data or if the integration settings are incorrect. To resolve these errors, review your data in both CRM and QuickBooks, and ensure that the data fields are correctly mapped. Check the integration settings and make sure that the synchronization rules are properly configured. If necessary, contact the support team for your CRM or QuickBooks or the integration platform you are using.

2. Duplicate Records

Duplicate records can occur if the integration is not set up to prevent them. To prevent duplicate records, configure the integration to check for existing records before creating new ones. You can also set up rules to merge duplicate records or flag them for review. Regularly review your CRM and QuickBooks data to identify and merge any duplicate records that may have been created. This ensures data integrity and prevents confusion.

3. Data Mapping Issues

Data mapping issues can occur if the data fields in your CRM and QuickBooks are not correctly mapped. This can lead to data being transferred incorrectly or not at all. To resolve data mapping issues, carefully review the data field mappings and ensure that they are accurate. Test the integration thoroughly to verify that the data is being transferred correctly. If necessary, adjust the data field mappings to ensure that the data flows seamlessly between the two systems. Pay close attention to data types (e.g., text, numbers, dates) to avoid errors.

4. Performance Issues

Performance issues can occur if the integration is not optimized. This can lead to slow synchronization times or other performance problems. To improve performance, optimize the integration settings and avoid syncing unnecessary data. Consider using a more efficient integration platform or upgrading your CRM or QuickBooks software. Monitor the performance of the integration and make adjustments as needed. This ensures that the integration does not negatively impact your business operations.

5. Security Concerns

Security concerns can arise if the integration is not properly secured. To address security concerns, use a secure integration platform and protect your login credentials. Regularly review the security settings and ensure that they are up to date. Consider using two-factor authentication to enhance security. Prioritize the security of your data and protect it from unauthorized access.

The Future of CRM and QuickBooks Integration

The integration between CRM and QuickBooks is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are being used to automate tasks, provide insights, and improve the accuracy of data synchronization. AI-powered integrations can automatically identify and resolve data inconsistencies, predict customer behavior, and provide personalized recommendations. Expect to see more AI-driven features that streamline processes and enhance decision-making. These technologies will continue to improve the efficiency and effectiveness of integration efforts.

2. Enhanced Automation

Automation is becoming more sophisticated, with the ability to automate more complex workflows and processes. Integrations are now able to handle more data and perform more actions automatically. This will allow businesses to streamline their operations and free up employees to focus on more strategic tasks. With enhanced automation, businesses can improve efficiency and reduce the risk of errors.

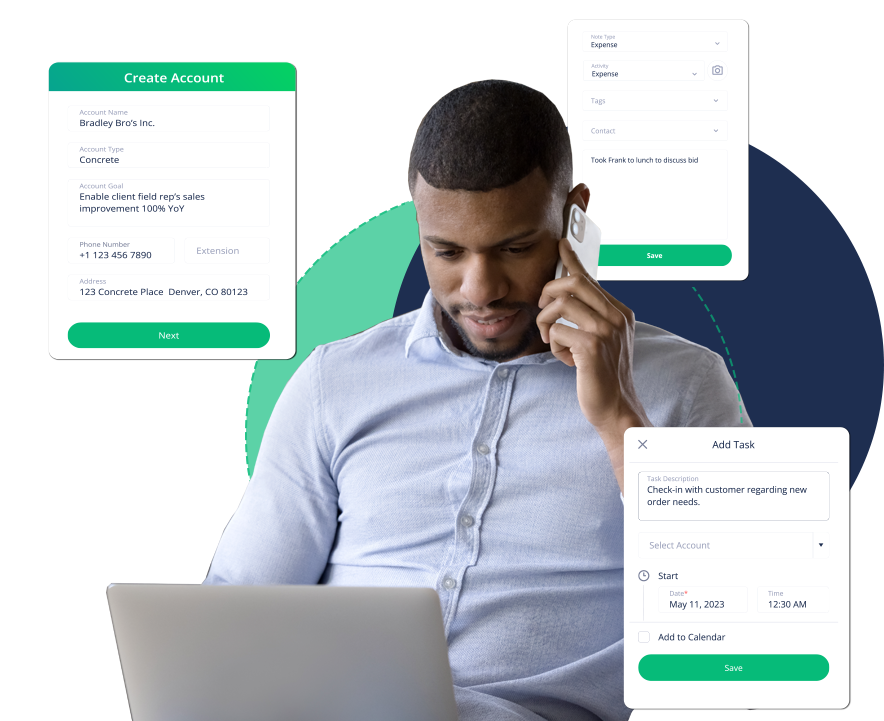

3. Increased Mobile Capabilities

Mobile access is becoming increasingly important, with the ability to access CRM and QuickBooks data from anywhere at any time. Mobile integrations will allow sales teams and other employees to access the data they need on the go. This will improve productivity and enable businesses to respond to customer needs more quickly. The ability to manage customer relationships and financial data from mobile devices will become increasingly essential.

4. Deeper Integration with Other Business Systems

Integrations are expanding beyond CRM and QuickBooks to include other business systems, such as e-commerce platforms, marketing automation tools, and project management software. This will create a more integrated ecosystem that allows businesses to streamline all aspects of their operations. This will provide a more holistic view of business performance and enable businesses to make better decisions. This broader integration will improve overall efficiency and data flow.

5. Focus on User Experience

User experience is becoming a key focus, with integrations designed to be more user-friendly and intuitive. This will make it easier for businesses to set up and manage their integrations. The goal is to make the integration process as seamless as possible. This improved user experience will encourage wider adoption and improve user satisfaction.

Conclusion

CRM integration with QuickBooks is a powerful tool that can transform your business operations. By streamlining processes, improving data accuracy, and enhancing customer relationships, you can boost efficiency, productivity, and profitability. Whether you choose a native integration, a third-party platform, or a custom solution, the key is to plan carefully, choose the right tools, and implement the integration effectively. By embracing the synergy between CRM and QuickBooks, you can set your business on the path to sustainable growth and success. The continuous advancement of integration technologies ensures that businesses can continually improve their operations and stay ahead of the competition. Investing in CRM integration with QuickBooks is a strategic move that can yield significant returns for your business.