Seamlessly Connecting Your Business: A Comprehensive Guide to CRM Integration with QuickBooks

Seamlessly Connecting Your Business: A Comprehensive Guide to CRM Integration with QuickBooks

In today’s fast-paced business environment, efficiency and organization are paramount. Businesses are constantly seeking ways to streamline their operations, improve customer relationships, and boost their bottom line. One of the most effective strategies for achieving these goals is integrating Customer Relationship Management (CRM) software with accounting software like QuickBooks. This article delves deep into the benefits, processes, and best practices of CRM integration with QuickBooks, providing a comprehensive guide to help you unlock the full potential of this powerful combination.

Understanding the Power of CRM and QuickBooks

Before we dive into the integration process, let’s establish a clear understanding of what CRM and QuickBooks are and why they’re essential tools for modern businesses.

What is CRM?

CRM, or Customer Relationship Management, is a system designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps businesses build stronger relationships with their customers, improve customer service, and drive sales growth. CRM software typically includes features for:

- Contact management: Storing and organizing customer information (names, contact details, interactions, etc.).

- Sales automation: Automating sales processes, such as lead tracking, opportunity management, and quote generation.

- Marketing automation: Automating marketing campaigns, such as email marketing, social media posting, and lead nurturing.

- Customer service: Managing customer support tickets, providing self-service portals, and tracking customer satisfaction.

- Analytics and reporting: Providing insights into customer behavior, sales performance, and marketing effectiveness.

What is QuickBooks?

QuickBooks is a widely used accounting software solution designed to help small and medium-sized businesses manage their finances. It simplifies accounting tasks, such as:

- Invoicing and billing: Creating and sending invoices, tracking payments, and managing accounts receivable.

- Expense tracking: Recording and categorizing expenses, tracking vendor payments, and managing accounts payable.

- Financial reporting: Generating financial statements, such as profit and loss statements, balance sheets, and cash flow statements.

- Payroll: Processing payroll, calculating taxes, and managing employee compensation.

- Inventory management: Tracking inventory levels, managing stock, and generating inventory reports.

By integrating CRM with QuickBooks, businesses can create a unified system that streamlines operations, eliminates data silos, and provides a 360-degree view of their customers and finances.

The Benefits of CRM Integration with QuickBooks

Integrating CRM with QuickBooks offers a multitude of benefits that can significantly impact a business’s efficiency, profitability, and customer satisfaction. Let’s explore some of the key advantages:

Improved Data Accuracy and Consistency

One of the biggest challenges for businesses is maintaining accurate and consistent data across different systems. CRM integration with QuickBooks eliminates the need for manual data entry, reducing the risk of errors and ensuring that all customer and financial information is synchronized. For example, when a new customer is created in the CRM, their information can automatically be synced to QuickBooks, and vice versa. This ensures that both systems have the latest, most accurate information.

Streamlined Sales and Accounting Processes

Integration automates many time-consuming tasks, such as creating invoices, tracking payments, and reconciling accounts. Sales reps can easily create invoices directly from the CRM, and the invoice data is automatically synced to QuickBooks. This eliminates the need for manual data entry, saving time and reducing the risk of errors. Accounting teams can also benefit from automated processes, such as automated payment reconciliation. This streamlined workflow improves efficiency and allows employees to focus on more strategic tasks.

Enhanced Customer Relationship Management

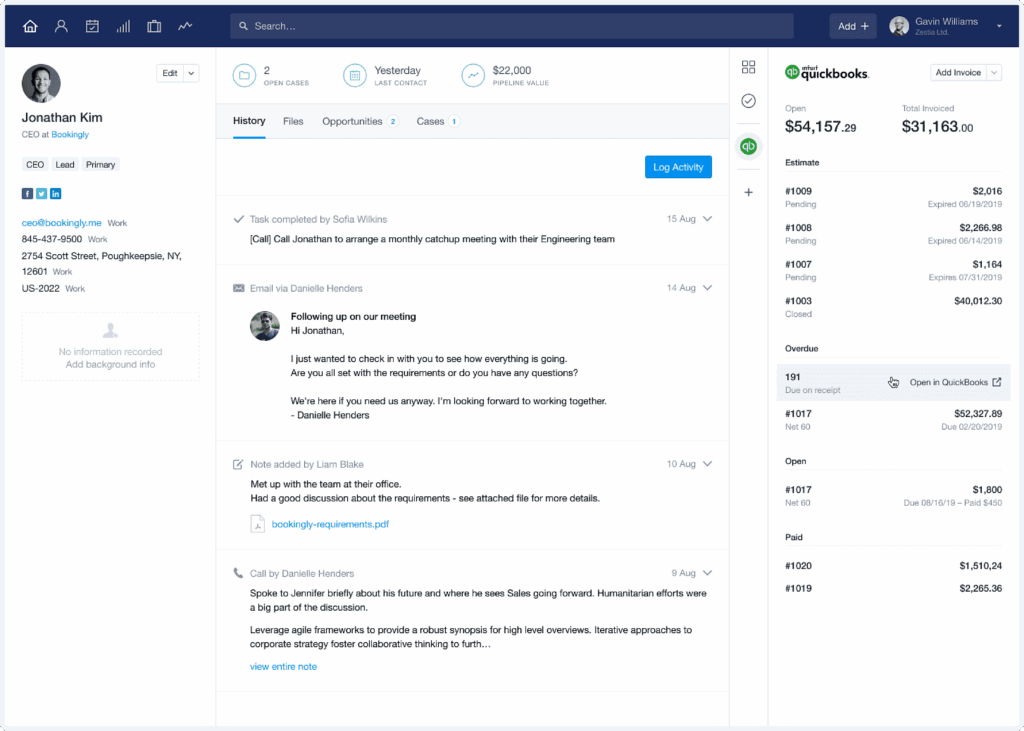

By integrating CRM with QuickBooks, businesses gain a 360-degree view of their customers. Sales reps can see a customer’s entire history, including their purchase history, invoices, payments, and any interactions they’ve had with customer service. This comprehensive view allows sales reps to provide better service, identify upselling and cross-selling opportunities, and build stronger customer relationships. For instance, a sales rep can see a customer’s invoice history in the CRM and proactively offer a new product or service that aligns with their past purchases.

Better Financial Visibility and Reporting

Integration provides a consolidated view of both customer data and financial data. Businesses can generate more comprehensive reports that provide valuable insights into their sales performance, customer profitability, and overall financial health. For example, you can easily generate reports that show the revenue generated by each customer, the cost of acquiring each customer, and the overall profitability of your customer base. This information can be used to make data-driven decisions and improve business performance.

Reduced Costs and Increased Efficiency

By automating manual tasks, reducing errors, and improving data accuracy, CRM integration with QuickBooks can significantly reduce costs and increase efficiency. This can lead to reduced labor costs, improved cash flow, and increased profitability. Automation also frees up employees to focus on more strategic tasks, such as building customer relationships, developing new products, and expanding into new markets.

Choosing the Right CRM and QuickBooks Integration Method

There are several ways to integrate CRM with QuickBooks. The best method depends on the specific CRM and QuickBooks versions you are using, your budget, and your technical expertise. Here are the most common integration methods:

Native Integrations

Some CRM systems, such as Salesforce, HubSpot, and Zoho CRM, offer native integrations with QuickBooks. These integrations are typically easy to set up and use, and they provide a seamless connection between the two systems. Native integrations often include features like automatic data synchronization, invoice creation, and payment tracking.

Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, PieSync (now part of HubSpot), and Workato, provide a more flexible and customizable approach to integration. These platforms allow you to connect a wide range of apps, including CRM and QuickBooks, using pre-built connectors and workflow automation tools. They are often a good option if your CRM or QuickBooks doesn’t have a native integration or if you need more advanced integration features.

Custom Integrations

For businesses with unique requirements, custom integrations may be the best option. This involves developing a custom integration solution using APIs (Application Programming Interfaces) provided by the CRM and QuickBooks. Custom integrations offer the greatest flexibility and control, but they also require more technical expertise and resources.

Step-by-Step Guide to CRM Integration with QuickBooks

The specific steps for integrating CRM with QuickBooks will vary depending on the integration method you choose. However, here’s a general overview of the process:

1. Assess Your Needs and Goals

Before you start the integration process, it’s important to assess your needs and goals. What data do you want to sync between CRM and QuickBooks? What processes do you want to automate? What are your budget and technical resources? Answering these questions will help you choose the right integration method and define the scope of the integration.

2. Choose an Integration Method

Based on your needs and goals, choose the integration method that best fits your requirements. Consider factors such as the availability of native integrations, the features offered by third-party platforms, and your technical expertise.

3. Set up the Integration

Follow the instructions provided by your chosen integration method to set up the connection between CRM and QuickBooks. This may involve connecting your accounts, mapping fields, and configuring data synchronization settings.

4. Test the Integration

Before going live, test the integration to ensure that data is syncing correctly and that the automated processes are working as expected. Create test records in both systems and verify that they are being synchronized correctly.

5. Train Your Team

Provide training to your team on how to use the integrated systems. Explain the new workflows and processes, and answer any questions they may have. Clear training ensures that your team can effectively utilize the integrated systems and maximize their benefits.

6. Monitor and Optimize

After the integration is live, monitor its performance and make adjustments as needed. Review the data synchronization logs, identify any errors, and optimize the integration settings to improve its performance. Continuous monitoring and optimization ensure that the integration continues to meet your business needs.

Best Practices for Successful CRM and QuickBooks Integration

To ensure a successful CRM and QuickBooks integration, follow these best practices:

Plan Carefully

Thorough planning is crucial. Define your goals, identify the data you need to sync, and choose the right integration method. A well-defined plan will streamline the integration process and minimize the risk of errors.

Map Fields Accurately

Carefully map the fields between CRM and QuickBooks to ensure that data is synchronized correctly. Pay close attention to data types and formats to avoid errors. Incorrect field mapping can lead to inaccurate data and reporting.

Test Thoroughly

Test the integration thoroughly before going live. Create test records in both systems and verify that data is syncing correctly. Testing helps identify and resolve any issues before they impact your business operations.

Provide Training

Train your team on how to use the integrated systems. Explain the new workflows and processes, and answer any questions they may have. Proper training ensures that your team can effectively utilize the integrated systems and maximize their benefits.

Monitor and Maintain

Monitor the integration’s performance and make adjustments as needed. Review the data synchronization logs, identify any errors, and optimize the integration settings. Regular maintenance ensures that the integration continues to meet your business needs.

Keep Software Updated

Ensure that both your CRM and QuickBooks software are up-to-date. Software updates often include bug fixes, performance improvements, and new features that can enhance the integration’s functionality. Keeping your software updated also helps maintain security and protects your data.

Prioritize Data Security

Implement security measures to protect your data. Use strong passwords, enable two-factor authentication, and regularly back up your data. Data security is paramount, especially when integrating sensitive financial and customer information.

Real-World Examples of CRM and QuickBooks Integration

Let’s look at some real-world examples of how businesses are leveraging CRM and QuickBooks integration:

Example 1: A Growing E-commerce Business

An e-commerce business uses a CRM to manage customer relationships and track sales leads. They integrate their CRM with QuickBooks to automatically sync customer data, create invoices, and track payments. This eliminates the need for manual data entry, reduces errors, and allows them to generate accurate financial reports in real-time. As a result, they can better manage their cash flow, identify top-performing products, and make data-driven decisions about their marketing and sales strategies.

Example 2: A Professional Services Firm

A professional services firm uses a CRM to manage their client projects and track billable hours. They integrate their CRM with QuickBooks to automatically generate invoices based on the hours logged by their employees. This streamlines their billing process, ensures accurate invoicing, and reduces the time it takes to get paid. The integration also allows them to track project profitability and identify areas where they can improve their efficiency and profitability.

Example 3: A Manufacturing Company

A manufacturing company uses a CRM to manage their sales pipeline and track customer orders. They integrate their CRM with QuickBooks to automatically sync order information, create invoices, and track payments. This ensures that their accounting system is always up-to-date with the latest sales data. The integration also allows them to track their inventory levels, manage their production costs, and generate accurate financial reports. This provides them with a clear picture of their profitability and enables them to make informed decisions about their operations and investments.

Troubleshooting Common Integration Issues

Even with careful planning and execution, you may encounter some issues during the CRM and QuickBooks integration process. Here are some common problems and how to troubleshoot them:

Data Synchronization Errors

Data synchronization errors can occur due to various reasons, such as incorrect field mapping, data format inconsistencies, or network connectivity issues. To troubleshoot these errors, review the integration logs, identify the specific errors, and correct the underlying issues. Ensure that your field mapping is accurate and that the data formats are consistent between CRM and QuickBooks. Check your network connectivity and ensure that both systems can communicate with each other.

Invoice Creation Errors

Invoice creation errors can occur if the necessary customer information is missing or if there are issues with the product or service information. To troubleshoot these errors, verify that all required customer information is available in the CRM and that the product or service information is accurately synced to QuickBooks. Review the integration settings and ensure that the invoice creation process is correctly configured. If you’re using custom fields, make sure they are correctly mapped.

Payment Tracking Issues

Payment tracking issues can occur if the payment information is not syncing correctly between CRM and QuickBooks. To troubleshoot these issues, verify that the payment information is being captured correctly in the CRM and that the payment tracking process is correctly configured in QuickBooks. Review the integration logs and check for any errors related to payment synchronization. Ensure that your payment gateway settings are correctly configured and that the payments are being processed correctly.

Connectivity Issues

Connectivity issues can occur if there are problems with your network connection or if the CRM and QuickBooks systems are not able to communicate with each other. To troubleshoot these issues, check your network connection and ensure that both systems are able to access the internet. Verify that the CRM and QuickBooks systems are correctly configured to communicate with each other. You may need to contact your CRM provider or QuickBooks support for assistance.

The Future of CRM and QuickBooks Integration

The integration between CRM and QuickBooks is constantly evolving. As technology advances, we can expect to see even more seamless and sophisticated integrations in the future. Here are some trends to watch:

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML technologies are being used to automate more complex tasks, such as data analysis, lead scoring, and predictive analytics. In the future, we can expect to see CRM and QuickBooks integrations that leverage AI and ML to provide even deeper insights into customer behavior and financial performance.

Enhanced Automation

Automation will continue to play a key role in CRM and QuickBooks integration. We can expect to see more sophisticated automation features that streamline processes, reduce errors, and improve efficiency. This includes automated invoice creation, payment reconciliation, and data synchronization.

Increased Customization

Integration platforms will offer more customization options, allowing businesses to tailor the integration to their specific needs. This includes the ability to create custom workflows, map custom fields, and integrate with other third-party applications. Customization will empower businesses to create a truly integrated system that meets their unique requirements.

Mobile Integration

Mobile integration will become increasingly important. Businesses will be able to access their CRM and QuickBooks data from anywhere, at any time, using their mobile devices. This will enable them to make data-driven decisions on the go and stay connected to their customers and finances.

Conclusion: Unleash the Power of Integration

CRM integration with QuickBooks is a powerful strategy for businesses seeking to streamline their operations, improve customer relationships, and boost their bottom line. By carefully planning your integration, choosing the right method, and following best practices, you can unlock the full potential of this powerful combination. From improved data accuracy and streamlined processes to enhanced customer relationships and better financial visibility, the benefits of CRM and QuickBooks integration are undeniable. Embrace the power of integration and take your business to the next level!