The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

Running a small accounting practice can be incredibly rewarding. You’re helping businesses thrive, providing essential financial guidance, and building lasting relationships with your clients. But let’s be honest, it can also be a whirlwind of spreadsheets, emails, and endless to-do lists. That’s where a Customer Relationship Management (CRM) system comes in – it’s your secret weapon for organization, efficiency, and ultimately, profitability. This comprehensive guide dives deep into the best CRM options specifically tailored for small accountants, helping you choose the perfect tool to transform your practice.

Why Your Small Accounting Practice Needs a CRM

Before we get into the specifics, let’s address the elephant in the room: Why do you, as a small accountant, even *need* a CRM? The truth is, a robust CRM system offers a multitude of benefits that directly impact your bottom line and overall success.

- Centralized Client Data: Say goodbye to scattered information. A CRM consolidates all your client details – contact information, communication history, financial data (with integrations), and more – into one easily accessible location.

- Improved Client Relationships: Knowing your clients is key to providing excellent service. A CRM helps you track interactions, personalize communications, and anticipate their needs, fostering stronger relationships and loyalty.

- Enhanced Efficiency: Automate repetitive tasks, such as scheduling appointments, sending follow-up emails, and generating reports. This frees up your time to focus on higher-value activities like strategic planning and client consultations.

- Streamlined Lead Management: Track potential clients, nurture leads, and convert them into paying customers. A CRM helps you manage your sales pipeline and close deals more effectively.

- Increased Profitability: By improving efficiency, strengthening client relationships, and optimizing your sales process, a CRM ultimately contributes to increased revenue and profitability.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal, and what works for a large corporation might not be ideal for a small accounting practice. When evaluating CRM options, prioritize these essential features:

1. Contact Management

This is the foundation of any good CRM. Look for features like:

- Detailed client profiles with customizable fields.

- Easy import and export of contact data.

- Segmentation capabilities to group clients based on criteria like industry, revenue, or service type.

2. Communication Tracking

Keeping track of all your client interactions is crucial. The CRM should allow you to:

- Record emails, phone calls, and meetings.

- Integrate with your email provider (e.g., Gmail, Outlook).

- Automate email marketing campaigns.

3. Task and Workflow Automation

Automate repetitive tasks to save time and reduce errors. Look for features like:

- Appointment scheduling.

- Automated email follow-ups.

- Workflow automation for tasks like onboarding new clients or sending invoices.

4. Reporting and Analytics

Gain insights into your business performance with comprehensive reporting tools. The CRM should provide:

- Customizable dashboards to track key metrics.

- Reports on client activity, sales performance, and revenue.

- Data visualization tools to easily understand trends.

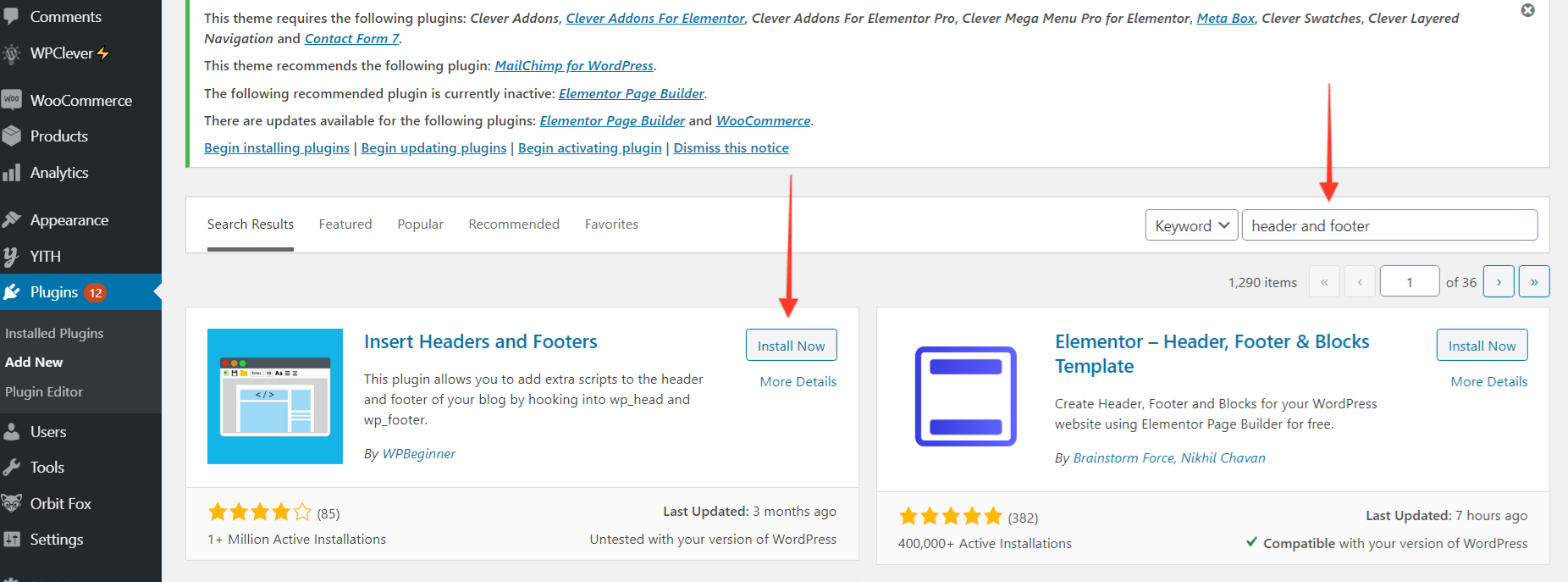

5. Integration Capabilities

The CRM should seamlessly integrate with other tools you use, such as:

- Accounting software (e.g., QuickBooks, Xero).

- Email marketing platforms.

- Project management software.

6. Security and Compliance

Data security is paramount, especially when dealing with sensitive financial information. Ensure the CRM offers:

- Secure data storage and encryption.

- Compliance with relevant regulations (e.g., GDPR, CCPA).

- User access controls to protect sensitive data.

7. Mobile Accessibility

Being able to access your client information on the go is a major advantage. Choose a CRM with:

- A mobile app or a mobile-friendly interface.

- The ability to update client information and manage tasks from your smartphone or tablet.

Top CRM Systems for Small Accountants: A Detailed Comparison

Now, let’s dive into some of the best CRM options specifically designed or well-suited for small accounting practices. We’ll look at their key features, pricing, and what makes them stand out.

1. HubSpot CRM

Overview: HubSpot is a popular and powerful CRM platform known for its user-friendliness and comprehensive features. It offers a free version that’s perfect for getting started, with paid plans that scale as your needs grow. HubSpot’s focus on marketing and sales makes it a strong choice for accountants looking to grow their client base.

Key Features for Accountants:

- Free CRM with core features.

- Contact management and segmentation.

- Email marketing and automation.

- Sales pipeline management.

- Reporting and analytics.

- Integration with various tools, including accounting software through the HubSpot App Marketplace (though direct integrations with accounting software are limited in the free tier).

Pros:

- Free version is incredibly generous.

- User-friendly interface.

- Excellent marketing and sales tools.

- Scalable pricing plans.

Cons:

- Limited direct integrations with accounting software in the free version.

- Can be overwhelming with all its features.

Pricing: Free plan available. Paid plans start at a reasonable price point, depending on the modules and features you need.

2. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s known for its visual pipeline management and ease of use. It’s a great choice for accountants who want a straightforward CRM to manage their leads and clients.

Key Features for Accountants:

- Visual sales pipeline management.

- Contact management.

- Email integration and tracking.

- Workflow automation.

- Reporting and analytics.

- Integrations with various tools, including accounting software via Zapier.

Pros:

- Intuitive and easy to use.

- Excellent sales pipeline management.

- Affordable pricing.

Cons:

- Less focus on marketing features compared to HubSpot.

- May require Zapier for some accounting software integrations.

Pricing: Offers various pricing tiers, with affordable starting prices.

3. Zoho CRM

Overview: Zoho CRM is a comprehensive CRM platform that offers a wide range of features, including sales, marketing, and customer service tools. It’s a good option for accountants who need a CRM that can handle various aspects of their business.

Key Features for Accountants:

- Contact management.

- Sales pipeline management.

- Email marketing and automation.

- Workflow automation.

- Reporting and analytics.

- Integration with Zoho Books (Zoho’s accounting software) and other third-party apps.

Pros:

- Feature-rich platform.

- Strong integration with Zoho’s suite of apps.

- Scalable pricing plans.

Cons:

- Can be complex to set up and configure.

- Interface may feel overwhelming for some users.

Pricing: Offers a free plan for a limited number of users and features. Paid plans are competitively priced.

4. Capsule CRM

Overview: Capsule CRM is a simple, user-friendly CRM that’s ideal for small businesses. It focuses on contact management and sales pipeline management, making it a great choice for accountants who prioritize ease of use.

Key Features for Accountants:

- Contact management.

- Sales pipeline management.

- Task management.

- Reporting and analytics.

- Integrations with various tools via Zapier.

Pros:

- Simple and easy to use.

- Affordable pricing.

- Good customer support.

Cons:

- Fewer features compared to other CRMs.

- May require Zapier for some accounting software integrations.

Pricing: Offers a free plan for basic use. Paid plans are competitively priced.

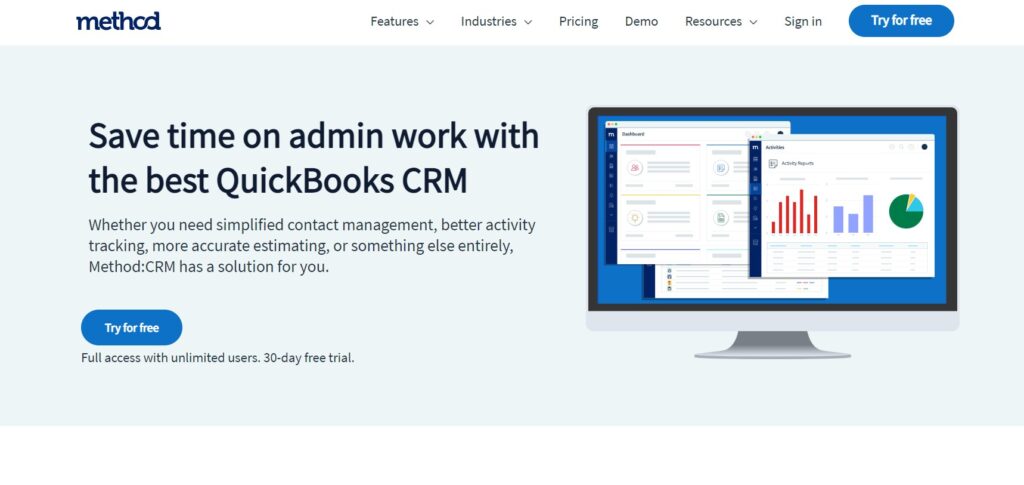

5. Method:CRM

Overview: Method:CRM is a CRM specifically designed to integrate seamlessly with QuickBooks. This makes it a strong contender for accountants already using QuickBooks for their accounting needs.

Key Features for Accountants:

- Deep integration with QuickBooks.

- Contact management.

- Sales pipeline management.

- Workflow automation.

- Customizable dashboards and reports.

Pros:

- Excellent integration with QuickBooks.

- Designed specifically for small businesses.

- Good customer support.

Cons:

- Limited integrations with other accounting software.

- Pricing may be higher than some other options.

Pricing: Pricing is based on the number of users and features required. Contact Method:CRM for specific pricing details.

6. Insightly

Overview: Insightly is a CRM platform that is well-suited for businesses of all sizes, offering a balance of features and ease of use. It’s known for its project management capabilities, which can be a plus for accountants who manage multiple client projects.

Key Features for Accountants:

- Contact management.

- Sales pipeline management.

- Project management.

- Email integration and automation.

- Reporting and analytics.

- Integrations with various tools.

Pros:

- Good balance of features and ease of use.

- Project management capabilities.

- Competitive pricing.

Cons:

- The user interface may not be as intuitive as some other options.

- Limited free plan.

Pricing: Offers a free plan for a limited number of users and features. Paid plans are competitively priced.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the best CRM for your small accounting practice requires careful consideration. Follow these steps to make an informed decision:

1. Assess Your Needs

Before you start comparing CRMs, take the time to identify your specific needs and pain points. Consider these questions:

- What are your primary goals for implementing a CRM? (e.g., improve client relationships, increase sales, automate tasks)

- What are the biggest challenges you face in managing your client data and workflow?

- What features are essential for your practice? (e.g., contact management, email integration, reporting)

- What other software do you currently use (e.g., accounting software, email marketing platforms)?

2. Define Your Budget

CRM pricing varies widely, from free plans to enterprise-level solutions. Determine how much you’re willing to spend on a CRM, considering factors like:

- The number of users you need to support.

- The features you require.

- The potential return on investment (ROI) of a CRM.

3. Research and Compare Options

Based on your needs and budget, research different CRM options. Compare their features, pricing, and reviews. Consider the following:

- Features: Does the CRM offer the features you need?

- Ease of Use: Is the CRM user-friendly and easy to learn?

- Integrations: Does the CRM integrate with your existing software?

- Pricing: Is the pricing affordable and scalable?

- Customer Support: Does the CRM provider offer good customer support?

- Reviews: Read online reviews to get feedback from other users.

4. Take Advantage of Free Trials and Demos

Most CRM providers offer free trials or demos. This is an excellent opportunity to test the software and see if it’s a good fit for your practice. During the trial, try out different features, explore the interface, and see how the CRM integrates with your existing systems.

5. Consider the Long Term

Choose a CRM that can grow with your business. As your practice expands, you’ll need a CRM that can accommodate more users, more data, and more complex workflows. Consider the scalability of the CRM and whether it offers the features you’ll need in the future.

6. Implement and Train Your Team

Once you’ve chosen a CRM, it’s time to implement it. Import your client data, configure the settings, and train your team on how to use the software. Provide ongoing support and training to ensure your team is using the CRM effectively.

Maximizing Your CRM Investment: Best Practices

Implementing a CRM is just the first step. To get the most out of your investment, follow these best practices:

- Clean and Organize Your Data: Ensure your client data is accurate, complete, and up-to-date. This will improve the accuracy of your reporting and the effectiveness of your communication.

- Customize Your CRM: Tailor the CRM to your specific needs and workflows. Customize fields, create custom reports, and automate tasks to streamline your processes.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM effectively. Encourage them to embrace the CRM and use it consistently.

- Use the CRM Consistently: Make the CRM an integral part of your daily workflow. Encourage your team to use it for all client interactions, communication, and task management.

- Monitor and Analyze Your Results: Track key metrics, such as client acquisition cost, client retention rate, and revenue. Use the data to identify areas for improvement and optimize your CRM usage.

- Integrate with Other Tools: Integrate your CRM with other tools, such as your accounting software, email marketing platform, and project management software, to streamline your workflow and improve efficiency.

- Regularly Review and Update: Regularly review your CRM usage and make adjustments as needed. Update your client data, customize your workflows, and add new features as your business evolves.

Conclusion: Embrace the Power of CRM for Accounting Success

In the fast-paced world of accounting, a CRM is no longer a luxury – it’s a necessity. By choosing the right CRM for your small accounting practice and implementing it effectively, you can streamline your operations, strengthen client relationships, and ultimately, boost your profitability. Take the time to research your options, assess your needs, and choose the CRM that’s the perfect fit for your business. The investment will pay off in increased efficiency, a more organized practice, and happier clients. Embrace the power of CRM, and watch your accounting practice thrive!