Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms in 2024

Running a small accounting firm is like juggling chainsaws while riding a unicycle. You’re constantly balancing client needs, deadlines, compliance, and the never-ending quest for new business. In the midst of this whirlwind, one tool can make a world of difference: a Customer Relationship Management (CRM) system. But with so many options available, choosing the right one can feel overwhelming. This article delves into the best CRM systems tailored specifically for small accounting firms in 2024, helping you streamline operations, boost client satisfaction, and ultimately, grow your practice.

Why Your Accounting Firm Needs a CRM

Before we dive into specific CRM solutions, let’s address the elephant in the room: Why does your accounting firm even need a CRM? The answer is multifaceted, but it boils down to this: a CRM is the central nervous system of your client relationships.

- Centralized Client Data: A CRM consolidates all client information – contact details, communication history, financial data (with proper integrations), and more – in one easily accessible location. No more scattered spreadsheets or lost emails!

- Improved Communication: CRM systems often include features like email integration, task management, and automated reminders, ensuring you stay on top of client communication and never miss a deadline.

- Enhanced Client Satisfaction: By understanding your clients’ needs and preferences, you can provide more personalized service, leading to increased satisfaction and loyalty.

- Streamlined Workflow: CRM systems automate repetitive tasks, freeing up your time to focus on higher-value activities like financial analysis and strategic planning.

- Better Lead Management: CRM tools help you track leads, nurture prospects, and convert them into paying clients more efficiently.

- Data-Driven Decision Making: By analyzing CRM data, you can gain insights into client behavior, identify areas for improvement, and make data-driven decisions to grow your business.

In essence, a CRM empowers you to work smarter, not harder, ultimately leading to a more profitable and sustainable accounting firm.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider these essential features:

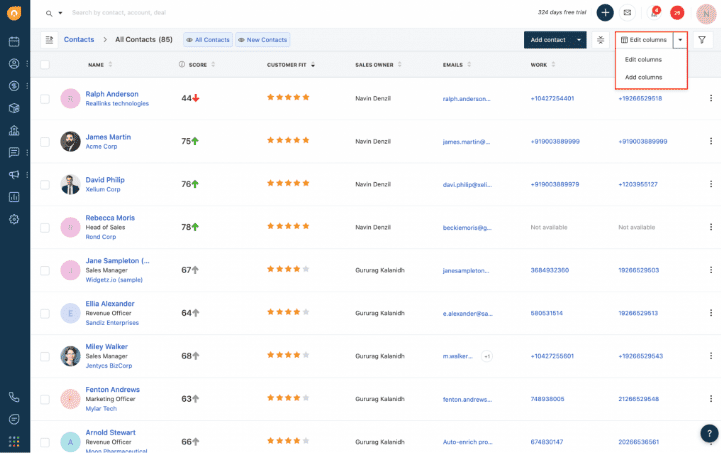

- Contact Management: This is the foundation of any CRM. Look for features like detailed contact profiles, segmentation capabilities, and the ability to track interactions.

- Lead Management: The ability to capture, track, and nurture leads is crucial for business growth. Ensure the CRM offers lead scoring, lead assignment, and pipeline management.

- Task Management: Stay organized with built-in task management features, including task assignments, deadlines, and reminders.

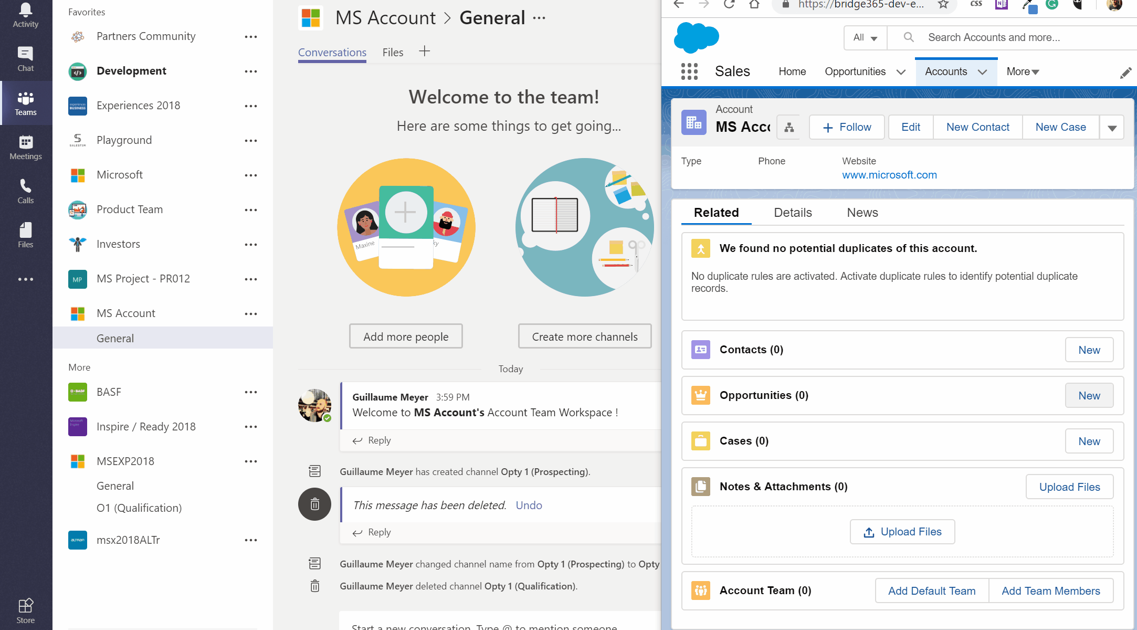

- Email Integration: Seamless integration with your email provider (e.g., Gmail, Outlook) is essential for efficient communication.

- Reporting and Analytics: Gain valuable insights into your business performance with customizable reports and dashboards.

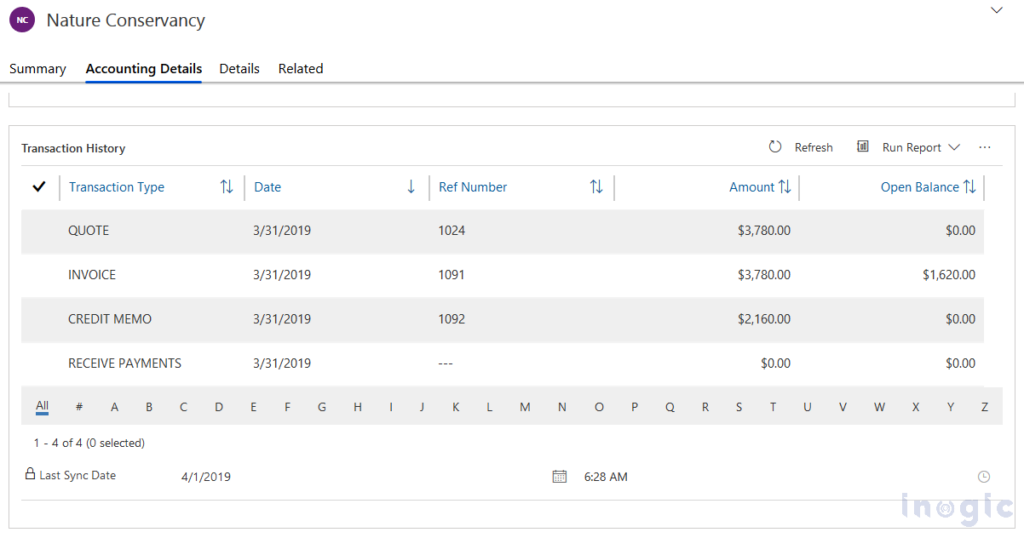

- Integration with Accounting Software: This is arguably the most critical feature for accountants. The CRM should integrate seamlessly with your existing accounting software (e.g., QuickBooks, Xero) to streamline data flow and eliminate manual data entry.

- Security and Compliance: Choose a CRM that prioritizes data security and complies with relevant regulations, such as GDPR and CCPA.

- Mobile Accessibility: Access your client data and manage your tasks on the go with a mobile-friendly CRM.

- Customization: The ability to customize the CRM to fit your specific needs and workflows is crucial for maximizing its value.

- User-Friendly Interface: A clean and intuitive interface will make it easier for your team to adopt and use the CRM.

Top CRM Systems for Small Accounting Firms in 2024

Now, let’s explore some of the best CRM systems for small accounting firms, keeping in mind the features discussed above:

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses, and for good reason. Its free version offers a robust set of features, including contact management, deal tracking, and email marketing tools. While the free version may be sufficient for very small firms, HubSpot’s paid plans offer more advanced features, such as:

- Marketing Automation: Automate your marketing efforts with email sequences, workflows, and lead nurturing campaigns.

- Sales Automation: Automate repetitive sales tasks, such as follow-up emails and task creation.

- Advanced Reporting: Gain deeper insights into your sales and marketing performance with customizable reports.

- Integration: HubSpot integrates with a wide range of other tools, including accounting software like Xero and QuickBooks through third-party apps.

Pros:

- Free version is powerful and feature-rich.

- User-friendly interface.

- Excellent customer support.

- Integrates with many other tools.

- Scalable – grows with your business.

Cons:

- The free version has limitations on the number of contacts and features.

- Some integrations with accounting software require third-party apps.

- Can become expensive as your business grows and you require more features.

Ideal for: Startups and small accounting firms looking for a free or affordable CRM with robust features and a user-friendly interface.

2. Zoho CRM

Zoho CRM is another strong contender, offering a comprehensive suite of features at a competitive price. It’s known for its customizability and its ability to integrate with other Zoho apps, such as Zoho Books (accounting software), Zoho Campaigns (email marketing), and Zoho Projects (project management). Key features for accountants include:

- Contact Management: Manage client data, including contact details, communication history, and financial information.

- Lead Management: Track leads, nurture prospects, and convert them into paying clients.

- Workflow Automation: Automate repetitive tasks, such as follow-up emails and task assignments.

- Sales Automation: Automate your sales process, from lead generation to deal closing.

- Reporting and Analytics: Generate customizable reports to track your sales performance and identify areas for improvement.

- Integration with Accounting Software: Zoho CRM integrates directly with Zoho Books and also integrates with other accounting software platforms.

Pros:

- Highly customizable.

- Competitive pricing.

- Excellent integration with other Zoho apps.

- Robust feature set.

- Good customer support.

Cons:

- The interface can be overwhelming for some users.

- Learning curve can be steeper than some other options.

- Some integrations with third-party apps may require additional fees.

Ideal for: Small to medium-sized accounting firms looking for a customizable and affordable CRM with robust features and strong integration capabilities.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its intuitive interface and visual pipeline management. While it may not have all the bells and whistles of some other CRMs, it excels at helping sales teams manage their leads and close deals. Features particularly relevant for accountants include:

- Visual Pipeline Management: Easily track leads through your sales pipeline with a drag-and-drop interface.

- Deal Tracking: Monitor the progress of your deals and identify potential roadblocks.

- Contact Management: Manage client contact information and communication history.

- Email Integration: Integrate with your email provider to track email communication and automate follow-up emails.

- Workflow Automation: Automate repetitive tasks, such as sending emails and creating tasks.

- Reporting and Analytics: Generate reports to track your sales performance and identify areas for improvement.

- Integration with Accounting Software: Pipedrive integrates with popular accounting software platforms through third-party apps, such as Zapier.

Pros:

- Intuitive and user-friendly interface.

- Visual pipeline management.

- Focus on sales and deal closing.

- Easy to set up and use.

Cons:

- Not as feature-rich as some other CRMs.

- May not be ideal for firms that need extensive marketing automation capabilities.

- Integration with accounting software relies on third-party apps.

Ideal for: Accounting firms with a strong sales focus that want a simple and intuitive CRM to manage their leads and close deals.

4. Keap (formerly Infusionsoft)

Keap is a CRM designed specifically for small businesses, offering a powerful combination of CRM, sales automation, and marketing automation features. It’s a great option for accounting firms looking to streamline their sales and marketing efforts. Key features include:

- Contact Management: Manage client data, including contact details, communication history, and custom fields.

- Lead Management: Track leads, nurture prospects, and convert them into paying clients.

- Sales Automation: Automate your sales process, from lead generation to deal closing.

- Marketing Automation: Create automated email sequences, landing pages, and lead nurturing campaigns.

- E-commerce Integration: Integrate with your e-commerce platform to sell your services online.

- Reporting and Analytics: Generate reports to track your sales and marketing performance.

- Integration with Accounting Software: Keap integrates with popular accounting software platforms through third-party apps.

Pros:

- Powerful sales and marketing automation features.

- Designed specifically for small businesses.

- User-friendly interface.

- Good customer support.

Cons:

- Can be more expensive than some other options.

- Learning curve can be steeper due to the complexity of the features.

- Some users find the interface a bit cluttered.

Ideal for: Small accounting firms that want a powerful CRM with robust sales and marketing automation capabilities and are willing to invest in training and setup.

5. Monday.com

While not solely a CRM, Monday.com is a versatile work management platform that can be customized to function as a CRM. It’s known for its visual interface and its ability to streamline workflows. For accounting firms, Monday.com can be used to manage client relationships, track projects, and automate tasks. Key features include:

- Contact Management: Manage client contact information and communication history.

- Lead Management: Track leads, nurture prospects, and convert them into paying clients.

- Project Management: Manage client projects and track progress.

- Workflow Automation: Automate repetitive tasks, such as sending emails and creating tasks.

- Reporting and Analytics: Generate reports to track your sales and project performance.

- Integration: Monday.com integrates with a variety of other tools, including accounting software through third-party apps.

Pros:

- Highly visual and intuitive interface.

- Customizable to fit your specific needs.

- Excellent for project management.

- Integrates with many other tools.

Cons:

- May not be as feature-rich as dedicated CRM systems.

- Requires some setup and customization.

- Integration with accounting software may require third-party apps.

Ideal for: Accounting firms that need a versatile work management platform that can also function as a CRM and want a highly visual and customizable interface.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the best CRM for your small accounting firm is a crucial decision. Here’s a step-by-step guide to help you navigate the process:

- Assess Your Needs: Before you start researching CRMs, take the time to identify your specific needs and requirements. What are your pain points? What features are essential? What are your goals for implementing a CRM?

- Define Your Budget: Determine how much you’re willing to spend on a CRM. Consider the cost of the software itself, as well as the cost of implementation, training, and ongoing support.

- Research CRM Options: Research the different CRM systems available, paying close attention to their features, pricing, and reviews. The options listed above are a good starting point.

- Create a Shortlist: Narrow down your options to a shortlist of two or three CRMs that seem to be a good fit for your needs.

- Request Demos and Free Trials: Request demos or sign up for free trials of your shortlisted CRMs. This will allow you to test the software and see how it works in practice.

- Evaluate the User Experience: Consider the user interface, ease of use, and overall user experience. Is the CRM intuitive and easy to navigate? Will your team be able to adopt it quickly?

- Assess Integration Capabilities: Ensure the CRM integrates with your existing accounting software and other tools.

- Consider Scalability: Choose a CRM that can grow with your business. Make sure it can accommodate your future needs as your firm expands.

- Evaluate Customer Support: Research the CRM provider’s customer support options. Do they offer phone, email, and live chat support? Are they responsive and helpful?

- Make Your Decision: Based on your research and evaluation, choose the CRM that best meets your needs and budget.

- Implement and Train: Once you’ve selected a CRM, implement it and train your team on how to use it effectively.

- Continuously Evaluate and Optimize: Regularly evaluate your CRM usage and make adjustments as needed. Strive to optimize your CRM workflows to maximize its value.

Tips for Successful CRM Implementation

Implementing a CRM is a significant undertaking. Here are some tips to ensure a successful implementation:

- Get Buy-In from Your Team: Involve your team in the selection process and get their buy-in. This will increase the likelihood of adoption.

- Clean Up Your Data: Before importing your data into the CRM, clean it up to ensure accuracy and consistency.

- Customize the CRM: Tailor the CRM to your specific needs and workflows.

- Provide Training: Provide comprehensive training to your team on how to use the CRM.

- Set Clear Expectations: Set clear expectations for CRM usage and track your progress.

- Monitor and Evaluate: Regularly monitor your CRM usage and make adjustments as needed.

- Celebrate Successes: Acknowledge and celebrate your team’s successes in using the CRM.

The Benefits of a Well-Implemented CRM

The right CRM, implemented effectively, can transform your accounting firm. You can expect to see:

- Increased Efficiency: Automate tasks, streamline workflows, and save valuable time.

- Improved Client Satisfaction: Provide personalized service, respond to client inquiries quickly, and build stronger relationships.

- Enhanced Lead Generation: Track leads effectively, nurture prospects, and convert them into paying clients.

- Better Data Analysis: Gain insights into your business performance and make data-driven decisions.

- Increased Revenue: Close more deals, retain more clients, and grow your practice.

By embracing a CRM, your accounting firm can position itself for sustained success in today’s competitive landscape.

Final Thoughts

Choosing the right CRM is a crucial investment for your small accounting firm. Consider your specific needs, research the options, and choose a system that aligns with your goals and budget. With the right CRM in place, you can streamline your operations, improve client relationships, and drive growth for your business. Don’t be afraid to take the plunge – the benefits are well worth the effort. The future of accounting is intertwined with the power of data and client relationships, and a well-chosen CRM is your key to unlocking that future.