Seamlessly Sync: Mastering CRM Integration with QuickBooks for Business Growth

Introduction: Bridging the Gap Between Sales and Finances

In the bustling world of business, efficiency is the name of the game. Streamlining operations, reducing errors, and making data-driven decisions are crucial for staying ahead. One of the most impactful ways to achieve this is through the seamless integration of your Customer Relationship Management (CRM) system with your accounting software, particularly QuickBooks. This article delves into the transformative power of CRM integration with QuickBooks, exploring its benefits, implementation strategies, and how it can propel your business towards greater success.

Imagine a world where your sales team and your finance department are on the same page, always. No more manual data entry, no more discrepancies, and no more wasted time. This is the reality that CRM integration with QuickBooks can create. By connecting these two vital components of your business, you can unlock a treasure trove of benefits, from improved accuracy and reduced costs to enhanced customer relationships and better decision-making.

Understanding the Power of CRM and QuickBooks

What is CRM?

Customer Relationship Management (CRM) is more than just a software; it’s a strategy. It’s a system that helps businesses manage and analyze customer interactions and data throughout the customer lifecycle. A robust CRM system centralizes customer information, tracks interactions, automates tasks, and provides valuable insights into customer behavior, preferences, and needs. This empowers businesses to build stronger relationships with customers, personalize their experiences, and drive sales growth.

Key features of a CRM system typically include:

- Contact Management: Storing and organizing customer contact information, including names, addresses, phone numbers, and email addresses.

- Lead Management: Tracking and nurturing leads through the sales pipeline, from initial contact to conversion.

- Sales Automation: Automating repetitive sales tasks, such as email follow-ups, appointment scheduling, and proposal generation.

- Marketing Automation: Automating marketing campaigns, such as email blasts, social media posts, and targeted advertising.

- Reporting and Analytics: Providing insights into sales performance, customer behavior, and marketing effectiveness.

What is QuickBooks?

QuickBooks is a leading accounting software solution designed to help small and medium-sized businesses manage their finances. It simplifies accounting tasks, such as invoicing, expense tracking, payroll, and financial reporting. QuickBooks provides a clear picture of your financial health, allowing you to make informed decisions about your business’s future.

Core functionalities of QuickBooks include:

- Invoicing: Creating and sending professional invoices to customers.

- Expense Tracking: Recording and categorizing business expenses.

- Accounts Payable: Managing vendor bills and payments.

- Accounts Receivable: Tracking customer payments and outstanding invoices.

- Financial Reporting: Generating reports on income, expenses, and profitability.

- Payroll: Processing employee salaries and taxes.

The Benefits of CRM Integration with QuickBooks

The magic truly happens when you connect your CRM system with QuickBooks. The integration creates a powerful synergy that streamlines operations, reduces errors, and enhances decision-making. Here are some of the key benefits:

1. Enhanced Data Accuracy and Reduced Errors

Manual data entry is a recipe for errors. When your sales team enters customer information in the CRM and your finance team manually inputs the same data into QuickBooks, there’s a high chance of discrepancies. CRM integration automates the transfer of data between the two systems, eliminating the need for manual entry and significantly reducing the risk of errors. This ensures that your financial records are accurate and reliable.

2. Time Savings and Increased Efficiency

Imagine the time your team spends manually transferring data between systems. CRM integration automates this process, freeing up valuable time for your employees to focus on more strategic tasks, such as building customer relationships and driving sales. This increased efficiency can lead to significant cost savings and improved productivity.

3. Streamlined Sales and Accounting Processes

CRM integration streamlines the entire sales-to-cash cycle. When a deal closes in your CRM, the relevant information, such as customer details, product/service details, and pricing, is automatically transferred to QuickBooks, generating invoices and updating your accounts receivable. This eliminates the need for manual invoice creation and payment tracking, making the entire process more efficient.

4. Improved Customer Relationship Management

By integrating your CRM with QuickBooks, you gain a 360-degree view of your customers. You can see not only their sales history and interactions with your sales team but also their payment history and outstanding invoices. This comprehensive view enables you to provide better customer service, personalize your interactions, and build stronger relationships.

5. Better Financial Reporting and Insights

CRM integration allows you to generate more accurate and insightful financial reports. You can track sales performance by customer, product, or sales representative, and analyze the profitability of different customer segments. This data-driven approach empowers you to make informed decisions about your business’s future.

6. Reduced Costs

By automating tasks, reducing errors, and improving efficiency, CRM integration can lead to significant cost savings. You can reduce the time spent on manual data entry, minimize the risk of errors that lead to costly mistakes, and optimize your sales and accounting processes.

Choosing the Right CRM and QuickBooks Integration Method

Selecting the right integration method is crucial for a successful implementation. Several options are available, each with its own pros and cons. Here’s a breakdown of the most common methods:

1. Native Integrations

Many CRM systems and QuickBooks offer native integrations, meaning they are built-in and designed to work seamlessly together. These integrations are often the easiest to set up and maintain, as they are usually pre-configured and require minimal technical expertise. Native integrations typically offer a wide range of features and functionalities, such as automatic data synchronization, invoice creation, and payment tracking.

Pros: Easy to set up, often the most cost-effective option, provides a wide range of features.

Cons: May not offer the same level of customization as other integration methods, may be limited in terms of the CRM systems it supports.

2. Third-Party Integration Platforms

Third-party integration platforms, such as Zapier, Integromat, or PieSync, act as intermediaries between your CRM and QuickBooks. These platforms allow you to connect different applications and automate workflows without writing any code. They offer a wide range of pre-built integrations and can be customized to meet your specific needs.

Pros: Offers a high degree of flexibility and customization, supports a wide range of CRM systems and QuickBooks versions, allows you to connect multiple applications.

Cons: May require more technical expertise to set up and maintain, can be more expensive than native integrations.

3. Custom Integrations

If your business has unique requirements or needs a highly customized integration, you may need to develop a custom integration. This involves writing code to connect your CRM and QuickBooks. Custom integrations offer the greatest flexibility and control but require significant technical expertise and can be more time-consuming and expensive to develop and maintain.

Pros: Offers the greatest flexibility and control, allows you to tailor the integration to your specific needs.

Cons: Requires significant technical expertise, can be time-consuming and expensive to develop and maintain.

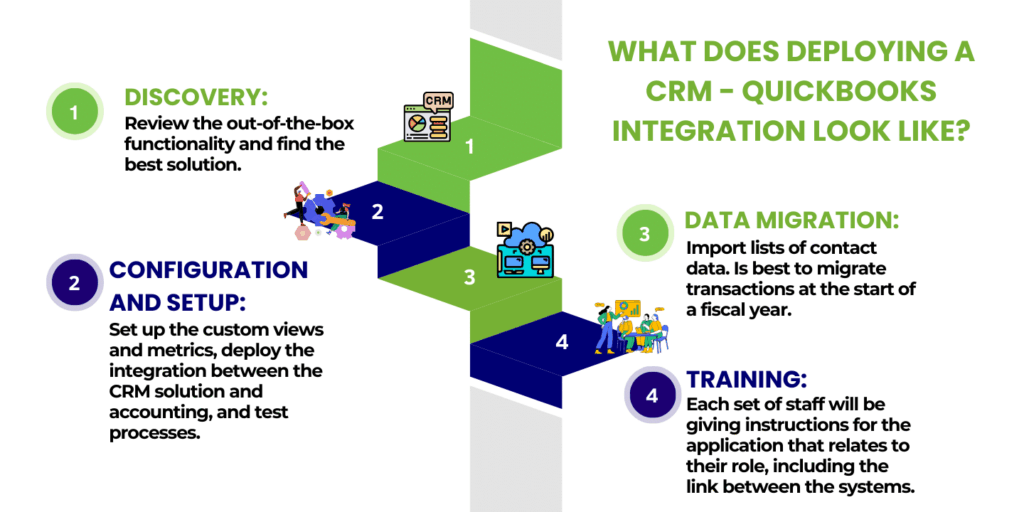

Step-by-Step Guide to CRM Integration with QuickBooks

Here’s a general guide to help you through the integration process, although the specific steps may vary depending on your chosen CRM and integration method.

1. Planning and Preparation

Before you dive into the technical aspects, take time to plan your integration. Define your goals, identify the data you want to synchronize, and determine the workflows you want to automate. This will help you choose the right integration method and ensure a smooth implementation.

Key steps in the planning phase:

- Define your objectives: What do you want to achieve with the integration? (e.g., reduce manual data entry, improve reporting).

- Map your data: Identify the data fields you want to synchronize between your CRM and QuickBooks.

- Choose your integration method: Select the method that best suits your needs and budget (native, third-party, or custom).

- Assess your technical capabilities: Determine if you have the in-house expertise to handle the integration or if you need to hire a consultant.

2. Selecting Your CRM and Integration Method

Choose a CRM system that meets your business needs and offers integration capabilities with QuickBooks. Research different CRM systems and compare their features, pricing, and integration options. Once you’ve chosen your CRM, select the appropriate integration method based on your technical expertise and the complexity of your needs.

3. Setting Up the Integration

Follow the instructions provided by your CRM and QuickBooks, or your chosen integration platform. This may involve connecting your accounts, mapping data fields, and configuring automated workflows. Be sure to test the integration thoroughly to ensure that data is synchronizing correctly.

Common setup tasks include:

- Connecting your accounts: Authorize the integration platform to access your CRM and QuickBooks accounts.

- Mapping data fields: Match the corresponding fields in your CRM and QuickBooks to ensure data is synchronized accurately.

- Configuring workflows: Set up automated workflows to trigger actions, such as creating invoices or updating customer records.

- Testing the integration: Perform test transactions to verify that data is synchronizing correctly.

4. Data Mapping and Synchronization

Data mapping is a crucial step in the integration process. It involves specifying how data fields in your CRM system correspond to data fields in QuickBooks. For example, you’ll need to map the “customer name” field in your CRM to the “customer name” field in QuickBooks. Accurate data mapping ensures that information is transferred correctly between the two systems.

Data synchronization can be real-time or scheduled. Real-time synchronization means that data is updated instantly as changes are made in either system. Scheduled synchronization means that data is updated periodically, such as every hour or every day. Choose the synchronization method that best suits your business needs.

5. Testing and Troubleshooting

Thoroughly test your integration to ensure that data is synchronizing correctly and that all workflows are functioning as expected. Create test records, generate invoices, and track payments to verify that data is flowing seamlessly between your CRM and QuickBooks. If you encounter any issues, consult the documentation for your CRM, QuickBooks, or integration platform, or seek help from a technical expert.

Common troubleshooting steps include:

- Checking connection settings: Verify that your CRM and QuickBooks accounts are connected correctly.

- Reviewing data mappings: Ensure that data fields are mapped accurately.

- Examining error logs: Identify any errors or warnings in the integration logs.

- Consulting support documentation: Refer to the documentation for your CRM, QuickBooks, or integration platform.

- Contacting technical support: Seek help from a technical expert if you are unable to resolve the issue.

6. Training and Adoption

Once the integration is set up and tested, it’s essential to train your team on how to use the integrated systems. Provide clear instructions, user guides, and ongoing support to ensure that your team can effectively leverage the benefits of the integration. Encourage user adoption by highlighting the time-saving and efficiency gains that the integration provides.

7. Ongoing Monitoring and Maintenance

After the integration is live, it’s important to monitor its performance and make adjustments as needed. Regularly review the data synchronization logs for any errors or warnings. Keep your CRM and QuickBooks software up to date to ensure compatibility and security. As your business grows and your needs evolve, you may need to modify your integration to accommodate new features or workflows.

Choosing the Right CRM for QuickBooks Integration

The choice of CRM is crucial for a successful integration with QuickBooks. Several CRM systems are designed to integrate seamlessly with QuickBooks, offering a range of features and functionalities.

Here are some popular CRM systems that offer robust QuickBooks integration:

1. Salesforce

Salesforce is a leading CRM platform that offers a wide range of features and integrations, including a powerful integration with QuickBooks. Salesforce’s integration with QuickBooks allows you to synchronize customer data, create invoices, track payments, and generate financial reports. Its robust features and scalability make it a great choice for businesses of all sizes.

2. HubSpot CRM

HubSpot CRM is a popular CRM platform that offers a free version with basic features and paid versions with more advanced functionalities. HubSpot CRM integrates seamlessly with QuickBooks, allowing you to synchronize customer data, track deals, and manage invoices. It’s user-friendly and ideal for small and medium-sized businesses.

3. Zoho CRM

Zoho CRM is a comprehensive CRM platform that offers a wide range of features and integrations, including a robust integration with QuickBooks. Zoho CRM’s integration with QuickBooks allows you to synchronize customer data, create invoices, track payments, and manage inventory. It’s a cost-effective option for businesses of all sizes.

4. Pipedrive

Pipedrive is a sales-focused CRM platform that offers a user-friendly interface and a strong integration with QuickBooks. Pipedrive’s integration with QuickBooks allows you to synchronize customer data, create invoices, and track deals. It’s an excellent choice for sales teams looking to streamline their processes.

5. Insightly

Insightly is a CRM platform that focuses on project management and sales. Insightly’s integration with QuickBooks allows you to synchronize customer data, create invoices, and track projects. It’s a great choice for businesses that need to manage both sales and projects.

When selecting a CRM for QuickBooks integration, consider the following factors:

- Features: Choose a CRM that offers the features you need, such as contact management, lead management, sales automation, and reporting.

- Ease of use: Select a CRM that is user-friendly and easy to learn.

- Integration capabilities: Ensure that the CRM integrates seamlessly with QuickBooks and other applications you use.

- Scalability: Choose a CRM that can grow with your business.

- Pricing: Consider the cost of the CRM and its integration options.

Best Practices for Successful CRM and QuickBooks Integration

To maximize the benefits of your CRM and QuickBooks integration, follow these best practices:

1. Define Clear Objectives

Before you start the integration process, clearly define your goals. What do you want to achieve with the integration? Are you looking to reduce manual data entry, improve reporting, or streamline your sales and accounting processes? Having clear objectives will help you choose the right integration method and ensure a successful implementation.

2. Clean Up Your Data

Before you start the integration, take the time to clean up your data in both your CRM and QuickBooks. This includes removing duplicate records, correcting errors, and standardizing data formats. Clean data will ensure that your integration runs smoothly and that you get accurate results.

3. Map Your Data Carefully

Data mapping is a crucial step in the integration process. Carefully map the data fields in your CRM to the corresponding fields in QuickBooks. Ensure that the data types are compatible and that the data is synchronized accurately. Incorrect data mapping can lead to errors and inconsistencies.

4. Test Thoroughly

Before you go live with the integration, thoroughly test it. Create test records, generate invoices, and track payments to verify that data is flowing seamlessly between your CRM and QuickBooks. Test all the workflows you’ve set up to ensure they’re functioning correctly. Testing will help you identify and fix any issues before they impact your business operations.

5. Train Your Team

Once the integration is set up and tested, train your team on how to use the integrated systems. Provide clear instructions, user guides, and ongoing support. Ensure that your team understands how to enter data, track transactions, and generate reports. Proper training will help your team adopt the new system and maximize its benefits.

6. Monitor and Maintain

After the integration is live, monitor its performance and make adjustments as needed. Regularly review the data synchronization logs for any errors or warnings. Keep your CRM and QuickBooks software up to date to ensure compatibility and security. As your business grows and your needs evolve, you may need to modify your integration to accommodate new features or workflows.

7. Seek Expert Help if Needed

If you’re not confident in your ability to set up and maintain the integration, don’t hesitate to seek help from a technical expert. A consultant can guide you through the process, troubleshoot any issues, and ensure that the integration is successful. Investing in expert help can save you time, money, and frustration.

The Future of CRM and QuickBooks Integration

The integration of CRM and QuickBooks is constantly evolving. As technology advances, we can expect to see even more sophisticated integrations that offer greater automation, insights, and efficiency.

Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered integrations can automate more tasks, such as lead scoring, sales forecasting, and customer segmentation.

- Advanced Analytics: Integrations will provide more in-depth analytics, allowing businesses to gain a deeper understanding of their customers and sales performance.

- Mobile Integration: Mobile access to CRM and QuickBooks data will become even more important, allowing businesses to manage their operations from anywhere.

- Integration with Other Applications: Integrations will expand to include more applications, such as e-commerce platforms, marketing automation tools, and project management software.

Conclusion: Unleashing the Power of Integration

CRM integration with QuickBooks is a game-changer for businesses seeking to streamline operations, reduce errors, and improve decision-making. By connecting these two powerful tools, you can unlock a wealth of benefits, from enhanced data accuracy and increased efficiency to improved customer relationships and better financial insights. Choosing the right integration method, following best practices, and staying informed about the latest trends will empower you to harness the full potential of this powerful combination and drive your business towards sustainable growth.

Embrace the power of integration and watch your business thrive!