Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Unlocking Business Potential: The Power of CRM and PayPal Integration

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost profitability. One of the most effective strategies for achieving these goals is through the seamless integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This article delves into the intricacies of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help businesses of all sizes harness its full potential.

Imagine a world where your sales team can effortlessly track customer interactions, manage payment history, and personalize marketing campaigns, all within a single, unified platform. This is the reality that CRM and PayPal integration offers. By connecting these two powerful tools, businesses can gain a 360-degree view of their customers, automate critical processes, and make data-driven decisions that drive growth. Let’s explore the advantages, the ‘how-to’, and the ‘why’ behind this transformative integration.

Understanding the Fundamentals: CRM and PayPal

What is a CRM System?

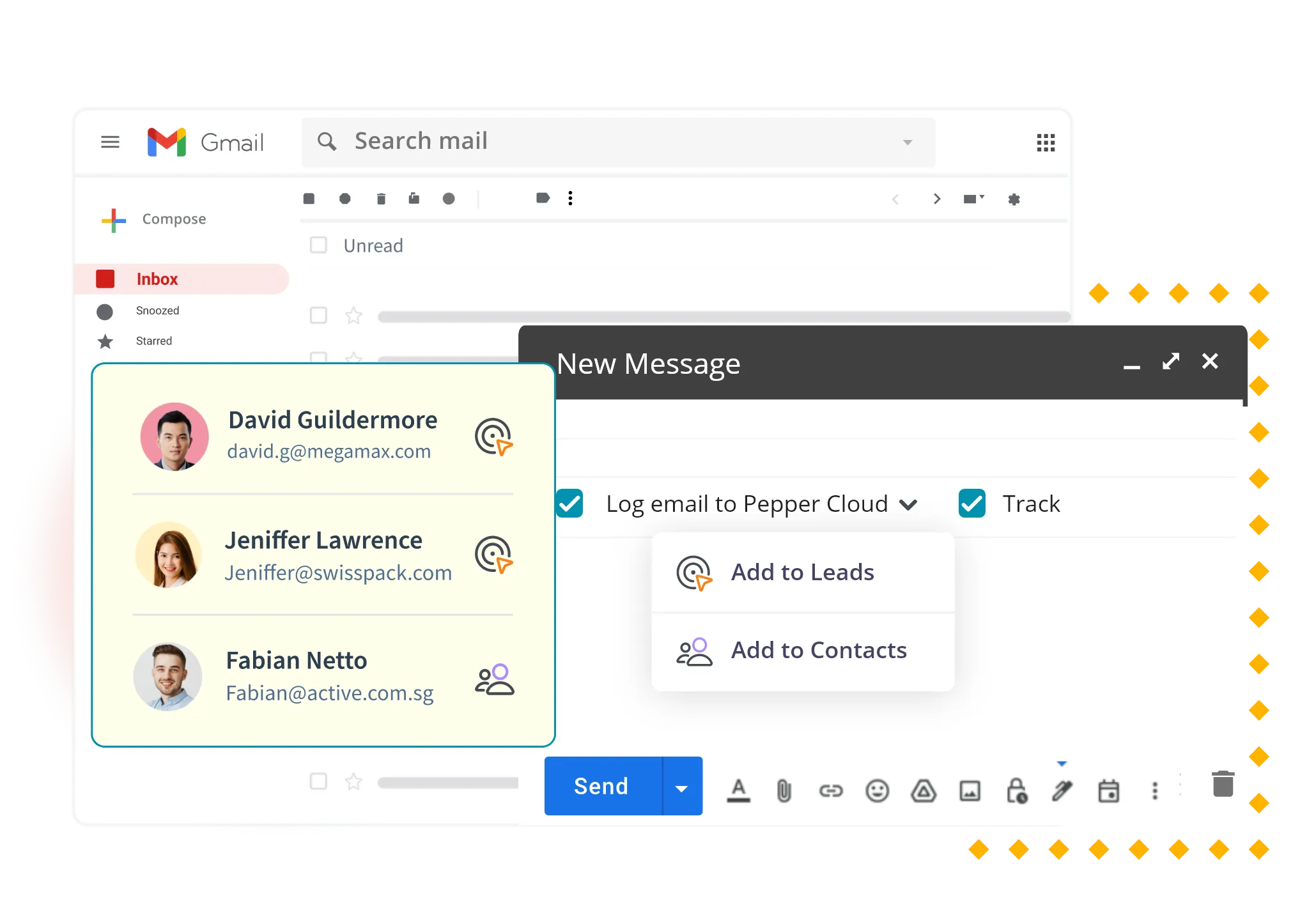

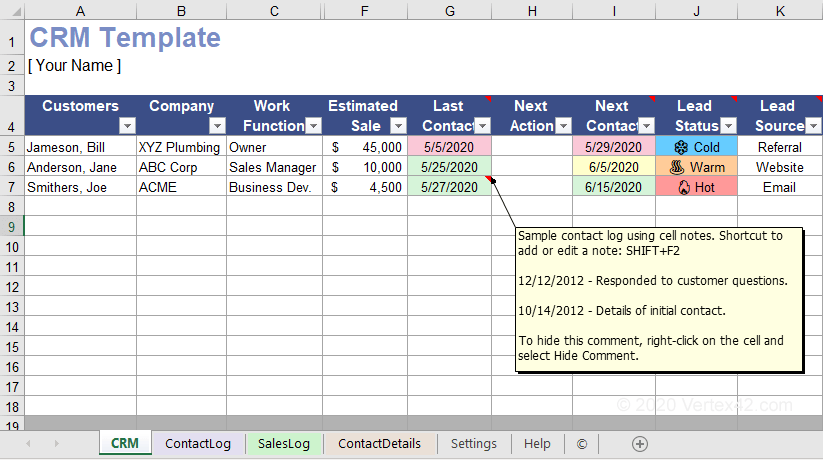

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps businesses build stronger customer relationships, improve customer retention, and ultimately, increase sales. Key features of a CRM system typically include:

- Contact Management: Storing and organizing customer information, such as contact details, purchase history, and communication logs.

- Sales Automation: Automating repetitive sales tasks, such as lead qualification, follow-ups, and proposal generation.

- Marketing Automation: Automating marketing campaigns, such as email marketing, social media posting, and lead nurturing.

- Customer Service: Managing customer inquiries, resolving issues, and providing support.

- Reporting and Analytics: Tracking key performance indicators (KPIs) and generating reports to measure sales performance and customer satisfaction.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, Microsoft Dynamics 365, and Pipedrive, among others. The choice of CRM depends on a business’s specific needs, budget, and technical expertise.

What is PayPal?

PayPal is a widely used online payment platform that enables businesses and individuals to send and receive money securely over the internet. It acts as an intermediary between the buyer and the seller, handling payment processing and protecting sensitive financial information. Key features of PayPal include:

- Secure Payment Processing: PayPal uses advanced security measures, such as encryption and fraud detection, to protect financial transactions.

- Global Reach: PayPal supports transactions in multiple currencies and is available in numerous countries, making it ideal for businesses with international customers.

- Ease of Use: PayPal offers a user-friendly interface and a simple checkout process, allowing customers to make payments quickly and easily.

- Payment Options: PayPal supports a variety of payment methods, including credit cards, debit cards, and bank transfers.

- Integration Capabilities: PayPal integrates with a wide range of e-commerce platforms, CRM systems, and other business applications.

PayPal’s popularity stems from its ease of use, security, and global reach. It’s a trusted name in online payments, making it an attractive option for both businesses and customers.

The Synergy: Benefits of Integrating CRM with PayPal

The integration of CRM with PayPal creates a powerful synergy that can significantly benefit businesses. Here are some of the key advantages:

Enhanced Customer Insights

By connecting CRM with PayPal, businesses can gain a more comprehensive understanding of their customers. This integration allows you to:

- Track Payment History: Automatically record payment transactions within the CRM system, providing a complete view of each customer’s purchase history.

- Identify Customer Preferences: Analyze payment data to identify customer preferences, such as preferred products, spending habits, and purchase frequency.

- Segment Customers: Segment customers based on their payment behavior, allowing for more targeted marketing campaigns and personalized customer experiences.

This deeper understanding of your customers empowers you to tailor your offerings, improve customer service, and increase sales.

Streamlined Sales and Payment Processes

Integration streamlines sales and payment processes, saving time and reducing manual effort. Specifically, you can:

- Automate Payment Collection: Automate the collection of payments for invoices and subscriptions directly through the CRM system.

- Reduce Manual Data Entry: Eliminate the need to manually enter payment information into the CRM system, reducing the risk of errors and saving valuable time.

- Simplify Order Management: Automate order processing and fulfillment by linking payment information to customer orders within the CRM.

Automation frees up your sales team to focus on more strategic activities, such as building relationships and closing deals.

Improved Customer Experience

Integration enhances the customer experience by providing a more seamless and personalized interaction. For example:

- Personalized Communication: Use customer payment data to personalize marketing messages and offers, increasing engagement and conversions.

- Faster Checkout: Provide a faster and more convenient checkout experience by integrating PayPal directly into your CRM system.

- Improved Customer Service: Access payment history and transaction details within the CRM system, enabling customer service representatives to quickly resolve payment-related issues.

A better customer experience leads to increased customer satisfaction, loyalty, and positive word-of-mouth referrals.

Increased Revenue and Profitability

Ultimately, the integration of CRM with PayPal can lead to increased revenue and profitability. This is achieved through:

- Increased Sales: By streamlining sales processes, personalizing marketing campaigns, and improving customer experiences, businesses can increase sales and revenue.

- Reduced Costs: Automation reduces manual effort and minimizes errors, leading to lower operational costs.

- Improved Customer Retention: By providing a better customer experience and building stronger customer relationships, businesses can improve customer retention rates.

The combination of these factors contributes to improved financial performance and long-term business success.

Implementing the Integration: A Step-by-Step Guide

Integrating CRM with PayPal can seem daunting, but with the right approach, it can be a smooth and rewarding process. Here’s a step-by-step guide to help you through the implementation:

1. Choose the Right CRM and PayPal Plan

The first step is to ensure you have the appropriate accounts and plans. Consider the following:

- CRM System: Select a CRM system that meets your business needs and offers integration capabilities with PayPal. Research different CRM providers and compare their features, pricing, and integration options.

- PayPal Account: Ensure you have a PayPal Business account. If you don’t have one, create an account and complete the necessary verification steps.

- Compatibility: Verify that the CRM system and PayPal are compatible. Check the CRM provider’s documentation or support resources to confirm compatibility and identify any specific integration requirements.

Selecting the right tools is crucial for a successful integration. Consider your budget, business size, and specific needs when making your choices.

2. Assess Your Integration Needs

Before you begin the integration, carefully assess your specific needs and goals. Consider the following:

- Data Mapping: Identify the data fields you want to synchronize between the CRM and PayPal. This might include customer contact information, transaction details, and payment status.

- Automation Requirements: Determine which processes you want to automate, such as payment collection, order processing, and customer notifications.

- Reporting and Analytics: Decide which reports and analytics you want to generate to track the performance of your sales and marketing efforts.

A clear understanding of your needs will help you choose the right integration method and configure the system effectively.

3. Choose an Integration Method

There are several methods for integrating CRM with PayPal. The best approach depends on your technical expertise, budget, and the capabilities of your CRM system.

- Native Integration: Some CRM systems offer native integration with PayPal. This means that the integration is built directly into the CRM system, making it easy to set up and manage.

- Third-Party Apps: Many third-party apps and plugins are available that facilitate CRM and PayPal integration. These apps often offer pre-built integrations and customization options.

- API Integration: For more advanced users, API (Application Programming Interface) integration provides the most flexibility and control. This method involves using the PayPal and CRM APIs to create a custom integration.

Consider the pros and cons of each method and choose the one that best suits your needs.

4. Set Up the Integration

Follow these steps to set up the integration, depending on the method you’ve chosen:

- Native Integration: Follow the instructions provided by your CRM system to connect to your PayPal account. This typically involves entering your PayPal API credentials and configuring the data mapping.

- Third-Party Apps: Install the third-party app or plugin and follow its instructions to connect your CRM and PayPal accounts. This may involve configuring the app’s settings and mapping data fields.

- API Integration: Consult the PayPal and CRM API documentation to create a custom integration. This requires technical expertise and may involve coding and testing.

Carefully follow the instructions and test the integration to ensure it works correctly.

5. Test and Refine the Integration

After setting up the integration, thoroughly test it to ensure that data is being synchronized correctly and that all processes are working as expected. Conduct the following tests:

- Data Synchronization: Verify that customer information, transaction details, and payment status are being synchronized between the CRM and PayPal.

- Automation Processes: Test automated processes, such as payment collection and order processing, to ensure they are functioning correctly.

- Reporting and Analytics: Review reports and analytics to confirm that they are providing accurate and relevant insights.

Make any necessary adjustments to the integration configuration based on the test results. This may involve modifying data mappings, adjusting automation settings, or refining reports.

6. Train Your Team

Once the integration is set up and tested, train your team on how to use the integrated system. Provide training on the following:

- Accessing and Using the Integrated System: Show your team how to access and use the CRM system and PayPal integration.

- Entering and Managing Data: Train your team on how to enter and manage customer information, transaction details, and payment status within the system.

- Using Automation Features: Explain how to use the automated features, such as payment collection and order processing.

Effective training ensures that your team can use the integrated system effectively and take full advantage of its benefits.

Best Practices for CRM and PayPal Integration

To maximize the benefits of CRM and PayPal integration, consider these best practices:

Data Integrity and Security

Maintaining data integrity and security is paramount. Implement the following measures:

- Regular Data Backups: Regularly back up your CRM data and PayPal transaction data to protect against data loss.

- Data Encryption: Use encryption to protect sensitive data during transmission and storage.

- Access Control: Implement access control measures to restrict access to sensitive data to authorized users only.

- Compliance: Ensure compliance with data privacy regulations, such as GDPR and CCPA.

Protecting your data is crucial for maintaining customer trust and avoiding legal issues.

Automation and Efficiency

Leverage automation to streamline processes and improve efficiency:

- Automate Payment Reminders: Set up automated payment reminders to reduce late payments.

- Automate Order Processing: Automate order processing to speed up fulfillment.

- Automate Customer Notifications: Send automated customer notifications about payment confirmations, order updates, and shipping information.

Automation frees up your team to focus on more strategic activities.

Personalization and Customer Experience

Use the integrated data to personalize the customer experience:

- Personalize Marketing Campaigns: Use customer payment data to personalize marketing messages and offers.

- Segment Customers: Segment customers based on their payment behavior to create targeted marketing campaigns.

- Offer Personalized Support: Provide personalized customer support based on customer purchase history and preferences.

Personalization leads to increased customer engagement and loyalty.

Monitoring and Optimization

Continuously monitor and optimize the integration to ensure it is performing effectively:

- Monitor Key Metrics: Track key metrics, such as sales, revenue, customer satisfaction, and payment processing efficiency.

- Analyze Data: Analyze data to identify areas for improvement.

- Make Adjustments: Make adjustments to the integration configuration based on your analysis.

Continuous monitoring and optimization are essential for maximizing the benefits of the integration.

Choosing the Right CRM for PayPal Integration

The choice of CRM system is critical for seamless PayPal integration. Several CRM systems offer robust integration capabilities. Here are some popular options:

Salesforce

Salesforce is a leading CRM platform that offers powerful integration options with PayPal. It provides a comprehensive suite of features for sales, marketing, and customer service. Salesforce’s integration with PayPal allows businesses to:

- Track Payment History: Automatically record payment transactions within Salesforce.

- Automate Payment Collection: Automate the collection of payments for invoices and subscriptions.

- Generate Reports: Generate reports on sales, revenue, and customer payment behavior.

Salesforce is a good choice for businesses that need a comprehensive CRM solution with advanced integration capabilities.

HubSpot

HubSpot is a popular CRM platform that offers a user-friendly interface and strong integration capabilities. Its integration with PayPal allows businesses to:

- Track Customer Payments: Track customer payments and payment history.

- Automate Payment Notifications: Send automated payment notifications to customers.

- Manage Sales Pipeline: Integrate payment data with the sales pipeline to improve sales forecasting.

HubSpot is a good choice for businesses that want an easy-to-use CRM with robust integration capabilities.

Zoho CRM

Zoho CRM is a versatile CRM platform that offers a range of features for sales, marketing, and customer service. Its integration with PayPal allows businesses to:

- Manage Payments: Manage payments and track transaction details.

- Automate Payment-Related Tasks: Automate payment-related tasks, such as invoice generation and payment reminders.

- Analyze Sales Data: Analyze sales data and payment information to gain insights into customer behavior.

Zoho CRM is a good choice for businesses that need a cost-effective CRM with comprehensive integration capabilities.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a comprehensive CRM platform that offers a suite of applications for sales, marketing, and customer service. Its integration with PayPal allows businesses to:

- Manage Customer Payments: Manage customer payments and track transaction details.

- Automate Payment Processing: Automate payment processing and reconciliation.

- Gain Insights: Gain insights into customer behavior and payment patterns.

Microsoft Dynamics 365 is a good choice for businesses that want a robust CRM solution with advanced integration capabilities.

When choosing a CRM, consider your business needs, budget, and the specific features you require for PayPal integration. Research different CRM providers and compare their integration options to find the best fit for your business.

Troubleshooting Common Integration Issues

Even with careful planning, you may encounter some common integration issues. Here are some troubleshooting tips:

Connection Errors

Connection errors can occur for various reasons. To resolve them:

- Verify API Credentials: Double-check your PayPal API credentials to ensure they are correct.

- Check Network Connectivity: Ensure that your CRM system has a stable internet connection.

- Review Firewall Settings: Check your firewall settings to ensure they are not blocking the connection.

If connection errors persist, consult the CRM provider’s documentation or contact their support team.

Data Synchronization Issues

Data synchronization issues can occur if data fields are not mapped correctly or if there are errors in the data. To resolve them:

- Verify Data Mapping: Double-check the data mappings between the CRM and PayPal to ensure that data fields are mapped correctly.

- Check Data Formatting: Ensure that data is formatted correctly and that there are no errors.

- Review Error Logs: Review error logs to identify and resolve data synchronization issues.

If data synchronization issues persist, consult the CRM provider’s documentation or contact their support team.

Payment Processing Errors

Payment processing errors can occur due to various reasons, such as incorrect payment information or insufficient funds. To resolve them:

- Verify Payment Information: Double-check the payment information entered by the customer to ensure it is correct.

- Check Account Balance: Ensure that the customer’s PayPal account has sufficient funds.

- Review Transaction Logs: Review transaction logs to identify and resolve payment processing errors.

If payment processing errors persist, consult the PayPal documentation or contact their support team.

The Future of CRM and PayPal Integration

The integration of CRM with PayPal is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch for:

AI-Powered Insights

AI-powered insights will become increasingly important, allowing businesses to gain deeper insights into customer behavior and payment patterns. This will enable businesses to:

- Predict Customer Behavior: Predict customer behavior based on payment data and other customer information.

- Personalize Marketing Campaigns: Personalize marketing campaigns based on customer payment behavior and preferences.

- Optimize Sales Processes: Optimize sales processes based on insights from payment data.

AI-powered insights will empower businesses to make data-driven decisions that drive growth.

Enhanced Automation

Automation will continue to evolve, with new features and capabilities being added to streamline processes and improve efficiency. This will include:

- Automated Payment Reminders: Automated payment reminders will become more sophisticated, with the ability to personalize reminders based on customer behavior.

- Automated Order Processing: Automated order processing will become even more efficient, with the ability to integrate with other business systems.

- Automated Customer Service: Automated customer service will become more prevalent, with the ability to resolve common payment-related issues automatically.

Enhanced automation will free up your team to focus on more strategic activities.

Seamless Mobile Experience

Mobile integration will become increasingly important, allowing businesses to manage their CRM and PayPal integration from anywhere. This will include:

- Mobile CRM Apps: Mobile CRM apps will provide access to customer information and payment data on the go.

- Mobile Payment Processing: Mobile payment processing will enable businesses to accept payments from anywhere.

- Real-Time Notifications: Real-time notifications will keep businesses informed about payment activity and customer interactions.

A seamless mobile experience will improve productivity and customer satisfaction.

Conclusion: Embracing the Power of Integration

CRM integration with PayPal is a powerful strategy for businesses looking to streamline operations, enhance customer experiences, and drive growth. By connecting these two essential tools, businesses can gain valuable insights, automate critical processes, and improve their bottom line. From enhanced customer insights to streamlined sales and payment processes, the benefits are clear.

By following the steps outlined in this guide, businesses can successfully implement CRM and PayPal integration and unlock its full potential. Remember to choose the right CRM and PayPal plan, assess your integration needs, choose an appropriate integration method, and test and refine the integration. Embrace best practices, such as data integrity, automation, personalization, and continuous monitoring, to maximize the benefits of the integration.

As the digital landscape continues to evolve, the integration of CRM with PayPal will become even more important. Stay informed about the latest trends and technologies to ensure that your business remains competitive and successful. By embracing the power of integration, businesses can build stronger customer relationships, improve operational efficiency, and achieve sustainable growth. Start today and experience the transformative benefits of CRM and PayPal integration.