Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost profitability. A powerful combination that can help achieve these goals is the integration of a Customer Relationship Management (CRM) system with a popular payment gateway like PayPal. This article delves deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help businesses of all sizes thrive.

Understanding the Power of CRM and PayPal

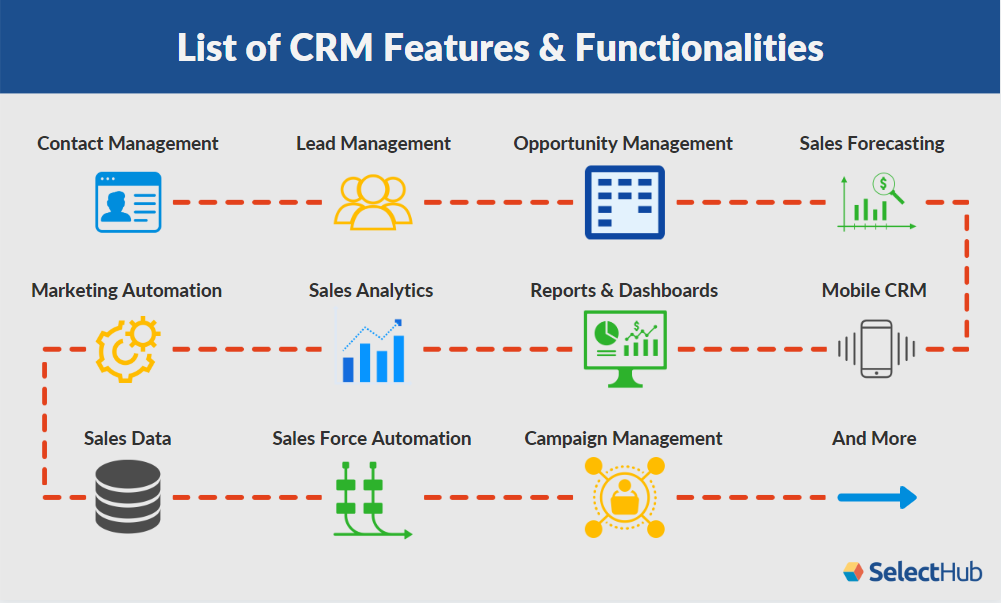

Before diving into the specifics of integration, it’s crucial to understand the individual strengths of CRM and PayPal. CRM systems are the backbone of customer relationship management, providing a centralized hub for storing, managing, and analyzing customer data. They empower businesses to:

- Centralize Customer Data: Consolidate all customer interactions, purchase history, and preferences in one place.

- Improve Customer Service: Provide personalized support and resolve issues efficiently.

- Automate Sales Processes: Streamline lead management, sales tracking, and deal closure.

- Enhance Marketing Campaigns: Target specific customer segments with tailored messaging.

- Gain Actionable Insights: Analyze customer behavior and identify opportunities for growth.

PayPal, on the other hand, is a globally recognized online payment platform that simplifies transactions for both businesses and customers. Its key advantages include:

- Ease of Use: Offers a user-friendly interface for sending and receiving payments.

- Security: Provides robust security measures to protect financial information.

- Global Reach: Supports transactions in multiple currencies and countries.

- Payment Flexibility: Accepts various payment methods, including credit cards, debit cards, and bank transfers.

- Brand Recognition: Builds trust and credibility with customers.

By integrating CRM with PayPal, businesses can leverage the strengths of both platforms to create a powerful synergy that drives efficiency, improves customer satisfaction, and ultimately, fuels business growth.

The Benefits of CRM Integration with PayPal

The integration of CRM with PayPal unlocks a wealth of benefits that can transform the way businesses operate. Here are some of the key advantages:

1. Streamlined Payment Processing

One of the most significant benefits is the ability to streamline payment processing. When integrated, your CRM can automatically trigger payment requests through PayPal when a deal is closed or an invoice is generated. This eliminates the need for manual data entry and reduces the risk of errors, saving valuable time and resources. Customers can conveniently pay invoices directly from their CRM portal, improving the overall payment experience.

2. Automated Invoice Management

Managing invoices manually can be a tedious and time-consuming task. CRM integration with PayPal automates the entire invoicing process. You can generate invoices, send them to customers, and track their payment status all within your CRM. Automated reminders can be set up to follow up on overdue invoices, improving cash flow and reducing the need for manual follow-ups.

3. Enhanced Customer Relationship Management

Integrating PayPal with your CRM provides a 360-degree view of your customer’s financial interactions. You can track payment history, see what products or services they’ve purchased, and understand their spending patterns. This information allows you to personalize your interactions, offer tailored recommendations, and build stronger customer relationships. By understanding customer behavior, you can anticipate needs and proactively offer solutions.

4. Improved Sales Efficiency

The integration streamlines the sales process by automating payment requests and tracking payment status. Sales representatives can quickly see which deals have been paid and which are still pending, allowing them to focus their efforts on closing deals and nurturing leads. This enhanced visibility improves sales efficiency and helps drive revenue growth.

5. Reduced Manual Data Entry

Manual data entry is prone to errors and can be a significant drain on resources. CRM integration with PayPal eliminates the need for manual data entry by automatically syncing payment information with your CRM. This reduces the risk of errors, saves time, and allows your team to focus on more strategic tasks.

6. Better Reporting and Analytics

Integrated systems provide a more comprehensive view of your business performance. You can generate detailed reports on sales, revenue, and customer behavior, all in one place. This data-driven approach allows you to make informed decisions, identify areas for improvement, and optimize your business strategies. You can track key performance indicators (KPIs) such as conversion rates, customer lifetime value, and average order value.

7. Faster Payments and Improved Cash Flow

By streamlining the payment process, CRM integration with PayPal enables faster payments. Customers can pay invoices more quickly and easily, improving your cash flow. Automated reminders for overdue invoices further accelerate payment collection, ensuring a healthy financial cycle for your business.

8. Increased Customer Satisfaction

Providing a seamless and convenient payment experience enhances customer satisfaction. Customers appreciate the ease of paying invoices directly from your CRM, the ability to track their payment history, and the convenience of automated reminders. This positive experience fosters loyalty and encourages repeat business.

How to Integrate CRM with PayPal: A Step-by-Step Guide

The process of integrating CRM with PayPal can vary depending on the CRM system you use. However, the general steps involved are typically similar. Here’s a step-by-step guide to help you navigate the integration process:

1. Choose a CRM System

If you don’t already have a CRM system, research and select one that meets your business needs. Consider factors such as features, scalability, pricing, and ease of use. Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

2. Create a PayPal Business Account

If you don’t already have one, sign up for a PayPal Business account. This account is specifically designed for businesses and offers features such as invoicing, payment processing, and reporting.

3. Check for Native Integrations

Many CRM systems offer native integrations with PayPal. This means that the integration is built directly into the CRM platform, making the setup process relatively simple. Check your CRM’s documentation or support resources to see if a native integration is available.

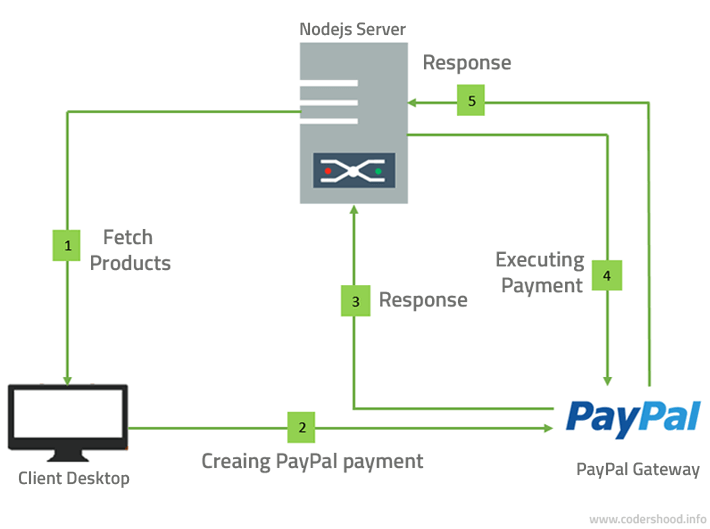

4. Use Third-Party Integration Tools (if needed)

If your CRM doesn’t offer a native integration with PayPal, you can use third-party integration tools. These tools act as a bridge between your CRM and PayPal, allowing them to share data and automate processes. Popular integration tools include Zapier, Integromat, and Automate.io.

5. Connect Your Accounts

Follow the instructions provided by your CRM or integration tool to connect your CRM and PayPal accounts. This typically involves entering your PayPal login credentials and authorizing the CRM to access your PayPal data.

6. Configure Settings

Once your accounts are connected, configure the integration settings. This may include mapping data fields, setting up automated workflows, and customizing the payment experience. You can define which data fields should be synced between your CRM and PayPal, such as customer information, invoice details, and payment status.

7. Test the Integration

Before going live, thoroughly test the integration to ensure that it’s working correctly. Create test invoices, process test payments, and verify that the data is being synced accurately between your CRM and PayPal. This will help you identify and resolve any issues before they impact your live transactions.

8. Train Your Team

Provide training to your team on how to use the integrated system. Explain the new workflows, how to generate invoices, how to track payments, and how to access the data. This will ensure that everyone is on the same page and can use the system effectively.

9. Monitor and Optimize

After the integration is live, monitor its performance and make adjustments as needed. Analyze the data, identify any issues, and optimize the workflows to maximize efficiency and effectiveness. Regularly review the integration to ensure it continues to meet your business needs.

Choosing the Right CRM for PayPal Integration

Selecting the right CRM is critical for a successful integration with PayPal. Here are some factors to consider when choosing a CRM:

- Native Integration: Does the CRM offer a native integration with PayPal? This simplifies the setup process and ensures seamless data synchronization.

- Ease of Use: Is the CRM user-friendly and easy to navigate? A user-friendly interface will make it easier for your team to adopt the system and use it effectively.

- Features and Functionality: Does the CRM offer the features and functionality you need, such as lead management, sales tracking, and reporting?

- Scalability: Can the CRM scale with your business as it grows? Consider the platform’s ability to handle increasing data volumes and user numbers.

- Pricing: Does the CRM fit within your budget? Compare pricing plans and features to find the best value for your money.

- Customer Support: Does the CRM provide adequate customer support? Choose a platform with responsive customer support to help you resolve any issues.

- Reviews and Ratings: Research customer reviews and ratings to get an idea of the CRM’s reputation and user satisfaction.

Some popular CRM platforms that offer strong PayPal integration capabilities include:

- Salesforce: A comprehensive CRM platform with a wide range of features and strong integration capabilities.

- HubSpot: A user-friendly CRM platform with a focus on marketing and sales automation.

- Zoho CRM: A versatile CRM platform with a range of features and affordable pricing.

- Microsoft Dynamics 365: A powerful CRM platform with strong integration with other Microsoft products.

- Pipedrive: A sales-focused CRM platform with a simple and intuitive interface.

Best Practices for CRM Integration with PayPal

To maximize the benefits of CRM integration with PayPal, follow these best practices:

1. Plan and Strategize

Before you start the integration process, take the time to plan and strategize. Define your goals, identify your needs, and determine how you want the integration to work. This will help you choose the right CRM, configure the settings effectively, and ensure a successful implementation.

2. Data Mapping

Carefully map the data fields between your CRM and PayPal. Ensure that the data is synced accurately and consistently. Pay attention to data formats and field types to avoid errors. Proper data mapping is critical for ensuring that the integration functions correctly and that your data is accurate.

3. Automate Workflows

Leverage the automation capabilities of your CRM and PayPal integration. Automate tasks such as invoice generation, payment reminders, and data synchronization. This will save you time, reduce errors, and improve efficiency.

4. Customize the Payment Experience

Customize the payment experience to match your brand and provide a seamless experience for your customers. Include your logo, branding, and messaging in the invoices and payment pages. This will build trust and professionalism and improve the customer experience.

5. Secure Your Data

Prioritize data security. Ensure that your CRM and PayPal accounts are protected with strong passwords and two-factor authentication. Regularly back up your data and monitor your systems for any security threats. Protect your customer data to maintain their trust and comply with privacy regulations.

6. Train Your Team Thoroughly

Provide comprehensive training to your team on how to use the integrated system. Explain the new workflows, how to generate invoices, how to track payments, and how to access the data. This will ensure that everyone is on the same page and can use the system effectively. Invest in ongoing training to keep your team up-to-date on the latest features and best practices.

7. Monitor Performance and Optimize

Regularly monitor the performance of the integration and make adjustments as needed. Analyze the data, identify any issues, and optimize the workflows to maximize efficiency and effectiveness. Continuously evaluate the integration to ensure it continues to meet your business needs and delivers value.

8. Stay Updated

Keep your CRM and PayPal accounts up-to-date with the latest versions and security patches. This will ensure that you have access to the latest features, security updates, and bug fixes. Stay informed about any changes to the platforms and their integration capabilities.

9. Provide Excellent Customer Support

Be responsive to customer inquiries and provide excellent customer support. If customers have any questions or issues with their payments, address them promptly and professionally. Excellent customer support builds trust and fosters loyalty.

10. Leverage Reporting and Analytics

Utilize the reporting and analytics capabilities of your CRM and PayPal integration. Generate reports on sales, revenue, customer behavior, and payment trends. Use this data to make informed decisions, identify areas for improvement, and optimize your business strategies.

Troubleshooting Common Issues

Even with careful planning, you might encounter issues during the CRM integration with PayPal. Here’s how to troubleshoot some common problems:

1. Data Synchronization Errors

If data isn’t syncing correctly between your CRM and PayPal, check the following:

- Data Mapping: Verify that the data fields are mapped correctly.

- Permissions: Ensure that your CRM has the necessary permissions to access your PayPal data.

- API Limits: Be aware of any API limits imposed by PayPal or your CRM.

- Connection Issues: Check the connection between your CRM and PayPal.

2. Payment Processing Errors

If you encounter payment processing errors, check the following:

- Account Status: Ensure that your PayPal account is active and in good standing.

- Payment Method: Verify that the customer’s payment method is valid.

- Transaction Limits: Check for any transaction limits imposed by PayPal or your account.

- Currency Issues: Ensure that the currency used in the transaction is supported by PayPal.

3. Invoice Issues

If you have problems with invoices, check the following:

- Invoice Settings: Verify that the invoice settings in your CRM and PayPal are configured correctly.

- Email Delivery: Ensure that the invoices are being sent to the correct email addresses.

- Payment Links: Check the payment links in the invoices to make sure they are working.

4. Integration Errors

If you experience general integration errors, try the following:

- Restart the Integration: Try disconnecting and reconnecting your CRM and PayPal accounts.

- Check Documentation: Consult the documentation for your CRM and PayPal integration for troubleshooting steps.

- Contact Support: If you’re still having trouble, contact the support teams of your CRM or PayPal.

The Future of CRM and PayPal Integration

The integration of CRM and PayPal is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch for:

- AI-Powered Automation: Expect to see more AI-powered automation features that can streamline workflows, personalize customer experiences, and provide data-driven insights.

- Enhanced Security: Security will continue to be a top priority, with more advanced security measures being implemented to protect customer data and prevent fraud.

- Mobile Optimization: The integration will become increasingly mobile-friendly, allowing businesses to manage their CRM and PayPal accounts on the go.

- Cross-Platform Integration: Expect to see more integrations with other popular platforms and services, such as e-commerce platforms, social media platforms, and marketing automation tools.

- Personalized Customer Experiences: Businesses will leverage the integration to deliver more personalized customer experiences, with tailored recommendations, targeted offers, and proactive customer support.

As technology advances, the integration of CRM and PayPal will become even more seamless and powerful, helping businesses of all sizes thrive in the digital age.

Conclusion: Embrace the Power of Integration

CRM integration with PayPal is a powerful tool that can transform your business operations, improve customer relationships, and drive growth. By streamlining payment processing, automating workflows, and gaining valuable insights, you can create a more efficient, customer-centric, and profitable business. By following the best practices outlined in this article and staying up-to-date with the latest trends, you can unlock the full potential of this powerful combination and take your business to the next level. Don’t hesitate to explore the possibilities and embrace the power of integration to achieve your business goals.