Seamlessly Connecting Your Finances: CRM Integration with QuickBooks for Business Growth

Introduction: The Power of Unified Data

In the fast-paced world of business, efficiency and organization are paramount. Businesses are constantly seeking ways to streamline their operations, reduce manual errors, and gain a comprehensive view of their performance. One of the most effective strategies for achieving these goals is integrating a Customer Relationship Management (CRM) system with accounting software like QuickBooks. This article delves into the benefits, processes, and best practices of CRM integration with QuickBooks, providing a comprehensive guide for businesses looking to optimize their financial and customer management processes.

Think of your business as a complex engine. Each department, from sales and marketing to finance and customer service, plays a vital role in its smooth operation. CRM software acts as the central nervous system, collecting and organizing data about your customers, interactions, and sales opportunities. QuickBooks, on the other hand, is the financial heart of your business, managing your income, expenses, and overall financial health. When these two systems are integrated, they create a powerful synergy, providing a holistic view of your business and enabling data-driven decision-making.

Understanding CRM and QuickBooks: Two Pillars of Business Success

What is CRM?

Customer Relationship Management (CRM) software is a system designed to manage all your company’s interactions with current and potential customers. It’s more than just a contact list; it’s a comprehensive tool that helps you:

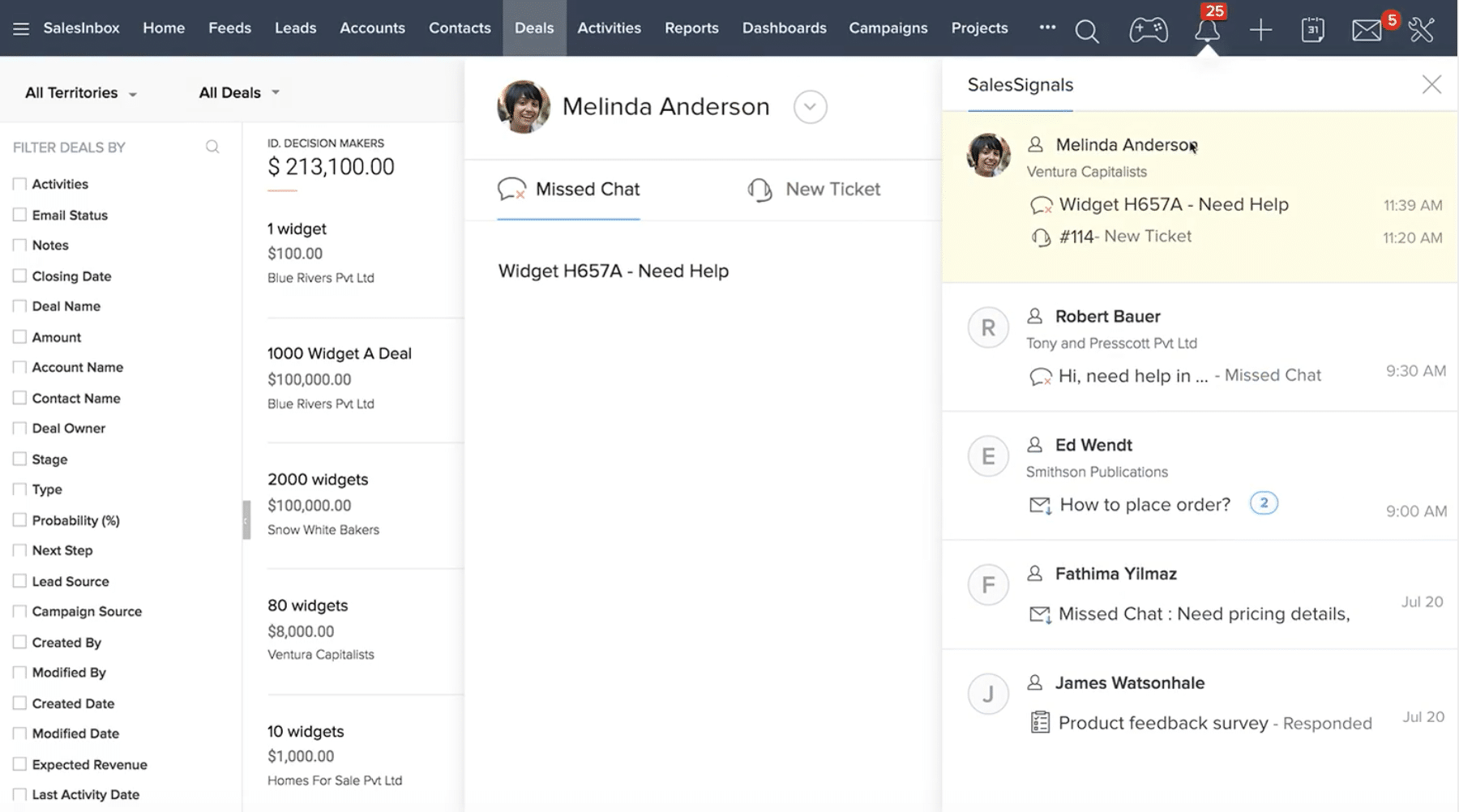

- Track customer interactions: Emails, calls, meetings, and support tickets are all recorded in one central location.

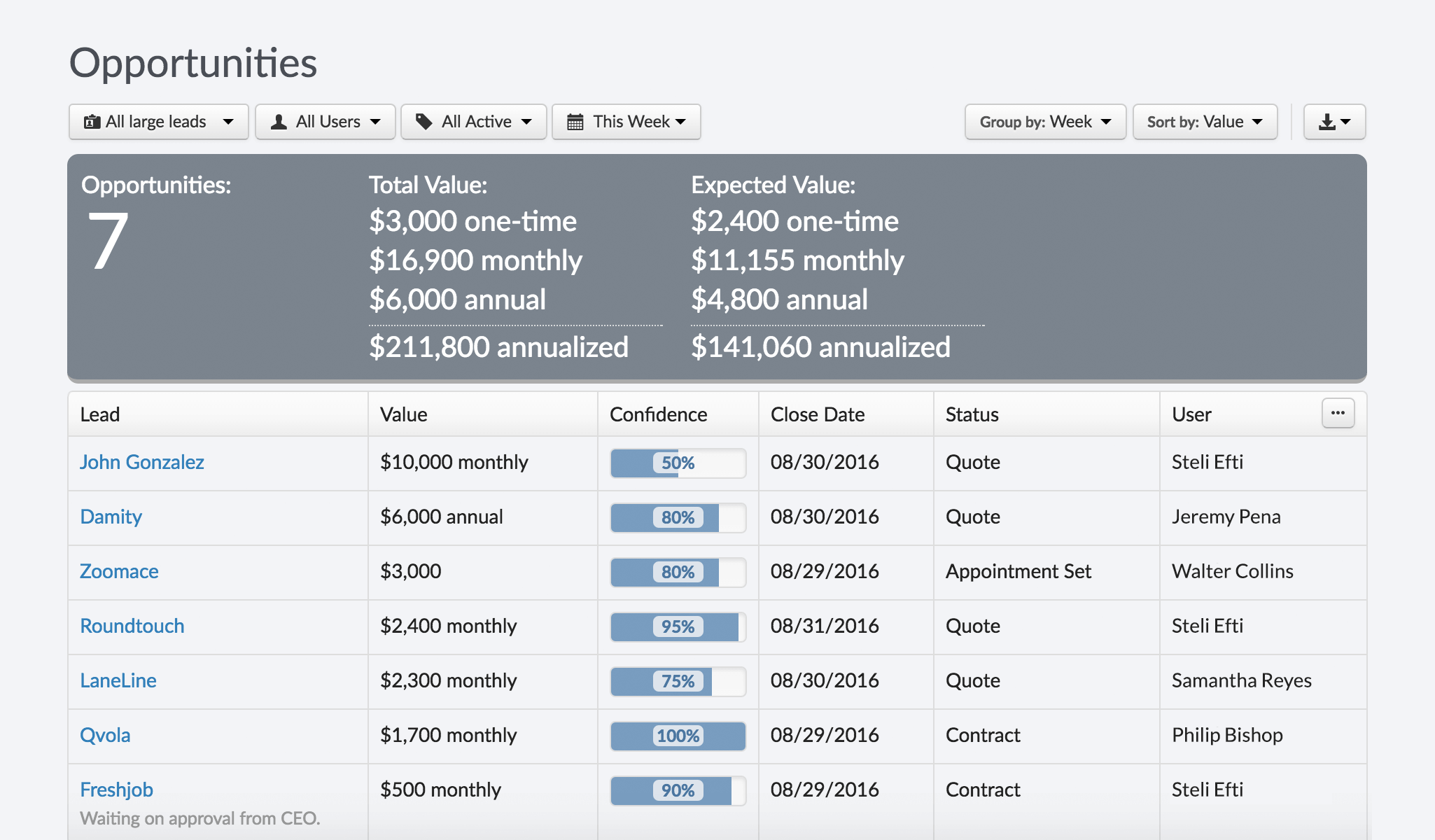

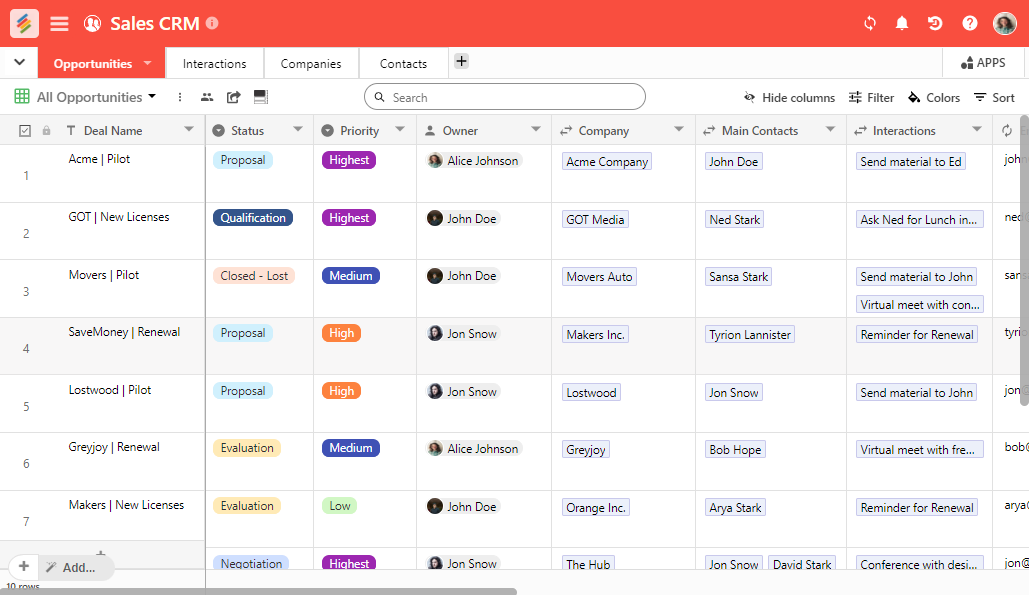

- Manage sales opportunities: From lead generation to deal closure, CRM helps you track the sales pipeline and forecast revenue.

- Improve customer service: CRM allows you to provide personalized and responsive customer support, leading to higher customer satisfaction.

- Analyze customer data: Gain insights into customer behavior, preferences, and purchasing patterns to make informed decisions.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, each offering a range of features and functionalities to suit different business needs.

What is QuickBooks?

QuickBooks is a leading accounting software solution designed for small and medium-sized businesses. It simplifies financial management by:

- Tracking income and expenses: Manage your cash flow, track invoices, and record payments.

- Generating financial reports: Create profit and loss statements, balance sheets, and cash flow statements to understand your financial performance.

- Managing payroll: Process employee salaries, track taxes, and generate payroll reports.

- Automating financial tasks: Automate tasks such as invoice generation, payment reminders, and bank reconciliation.

QuickBooks offers various versions, including QuickBooks Online and QuickBooks Desktop, catering to different business sizes and requirements.

The Benefits of Integrating CRM with QuickBooks

Integrating your CRM with QuickBooks unlocks a wealth of benefits that can significantly improve your business operations. These advantages include:

Enhanced Data Accuracy and Reduced Errors

Manual data entry is a common source of errors in business. Integrating CRM and QuickBooks eliminates the need for manual data transfer between systems. This reduces the risk of errors and ensures that financial and customer data are always up-to-date and accurate. For instance, sales data from your CRM can automatically flow into QuickBooks, eliminating the need to manually create invoices and record payments.

Improved Efficiency and Time Savings

Automation is key to efficiency. Integration automates many tasks, saving valuable time and resources. Sales teams can focus on selling rather than data entry, and finance teams can streamline their accounting processes. Imagine the time saved by automatically syncing customer information, invoices, and payments between your CRM and QuickBooks. This frees up your team to focus on more strategic initiatives.

Better Customer Insights and Personalized Experiences

By integrating customer data from your CRM with financial data from QuickBooks, you gain a 360-degree view of your customers. This allows you to understand their purchasing history, payment behavior, and overall value to your business. This insight enables you to provide personalized experiences, tailor your marketing efforts, and offer targeted promotions, ultimately leading to increased customer satisfaction and loyalty.

Streamlined Sales and Financial Processes

Integration streamlines the entire sales cycle, from lead generation to invoice payment. Sales reps can quickly access customer financial information, and finance teams can easily track sales performance. This seamless flow of information improves collaboration between sales and finance departments, leading to faster deal closures and improved cash flow management.

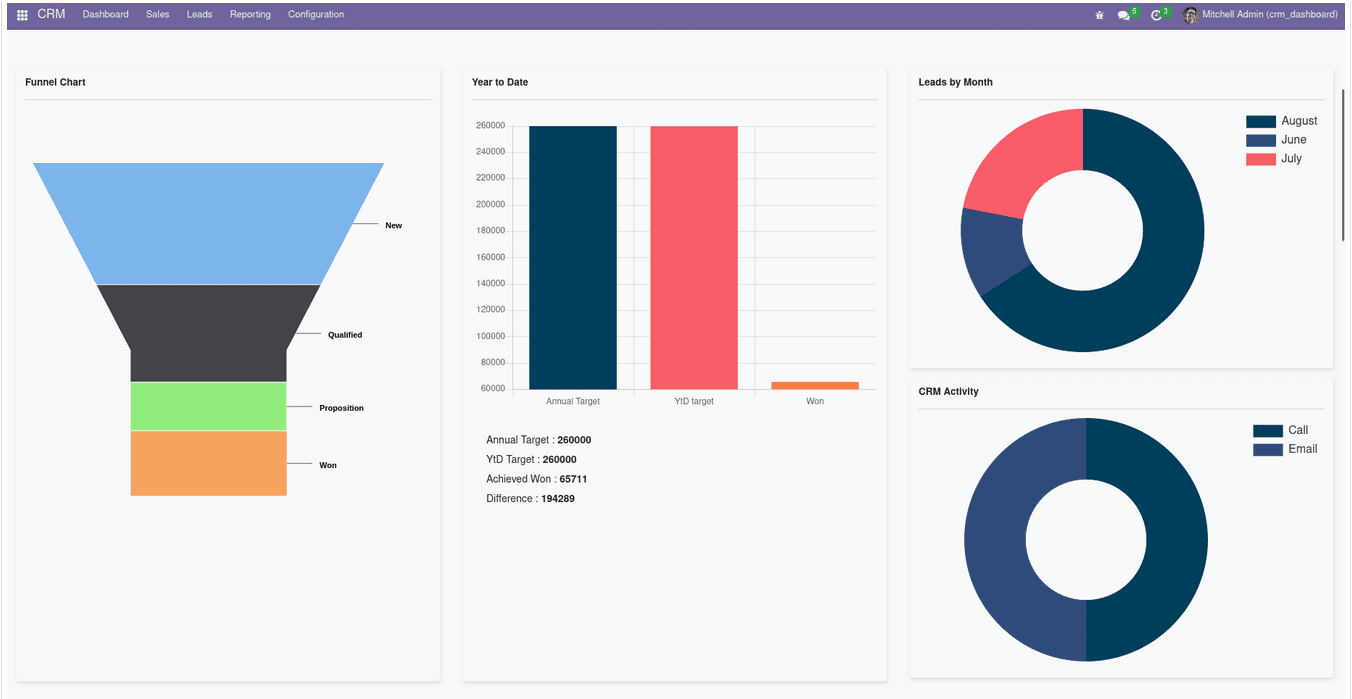

Improved Reporting and Decision-Making

Integrated systems provide a more comprehensive view of your business performance. You can generate reports that combine sales data, customer data, and financial data to gain deeper insights into your business. This data-driven approach enables you to make informed decisions about pricing, marketing, product development, and resource allocation, ultimately driving business growth.

How CRM and QuickBooks Integration Works

The integration process typically involves the following steps:

Choosing the Right Integration Method

There are several ways to integrate CRM with QuickBooks, including:

- Native Integrations: Some CRM and QuickBooks versions offer native integrations, which are pre-built and easy to set up.

- Third-Party Integration Tools: Several third-party tools, such as Zapier, PieSync, and DBSync, facilitate the integration process. These tools act as a bridge between the two systems, allowing data to be synchronized automatically.

- Custom Integrations: For more complex requirements, you can develop a custom integration using APIs (Application Programming Interfaces) provided by both CRM and QuickBooks.

The best integration method depends on your specific needs, technical expertise, and budget.

Selecting Data to Sync

Determine which data you want to sync between your CRM and QuickBooks. Common data points to sync include:

- Customer information (names, addresses, contact details)

- Invoices

- Payments

- Products and services

- Sales orders

Carefully consider the data fields that are essential for your business operations and ensure that they are mapped correctly during the integration process.

Mapping Data Fields

Data mapping is the process of matching the corresponding fields between your CRM and QuickBooks. For example, the “Customer Name” field in your CRM should be mapped to the “Customer Name” field in QuickBooks. This ensures that data is accurately transferred between the two systems. Incorrect data mapping can lead to errors and data inconsistencies.

Testing the Integration

Before going live, thoroughly test the integration to ensure that data is syncing correctly. Create test records in your CRM and QuickBooks and verify that the data is transferred accurately. This step helps identify and resolve any potential issues before they impact your business operations.

Implementing and Monitoring

Once you are satisfied with the testing results, implement the integration. Monitor the integration closely to ensure that data continues to sync correctly. Regularly review the data in both systems to identify any discrepancies and address them promptly. Consider establishing a regular schedule for reviewing the integration’s performance.

Popular CRM Systems and Their QuickBooks Integration Options

Several CRM systems offer robust integration options with QuickBooks. Here are some popular examples:

Salesforce

Salesforce, a leading CRM platform, offers various integration options with QuickBooks. You can use pre-built connectors or custom integrations to sync data between the two systems. Salesforce integration with QuickBooks is often used by larger businesses that need advanced CRM functionalities.

HubSpot

HubSpot, a popular CRM for marketing and sales, provides seamless integration with QuickBooks. The integration allows you to sync contacts, deals, and invoices, streamlining your sales and financial processes. HubSpot’s integration with QuickBooks is often a great choice for businesses that prioritize marketing and sales automation.

Zoho CRM

Zoho CRM offers a user-friendly integration with QuickBooks, allowing you to sync customer data, invoices, and payments. The integration is easy to set up and manage, making it a good option for small and medium-sized businesses. Zoho CRM is known for its affordability and ease of use.

Microsoft Dynamics 365

Microsoft Dynamics 365 provides robust integration capabilities with QuickBooks. The integration allows you to sync data between your CRM and accounting systems, providing a unified view of your business. Dynamics 365 is often chosen by businesses that use other Microsoft products.

Best Practices for CRM Integration with QuickBooks

To ensure a successful integration, follow these best practices:

Plan and Define Your Goals

Before starting the integration process, clearly define your goals and objectives. Identify the specific data you want to sync and the benefits you hope to achieve. This will help you choose the right integration method and ensure that the integration meets your business needs.

Choose the Right Integration Method

Select the integration method that best suits your business needs and technical expertise. Consider factors such as cost, ease of use, and the level of customization required. Native integrations are often the easiest to set up, while third-party tools offer more flexibility. Custom integrations provide the most control but require more technical knowledge.

Clean and Organize Your Data

Before integrating your CRM and QuickBooks, clean and organize your data in both systems. This includes removing duplicate entries, correcting errors, and standardizing data formats. Clean data ensures that the integration runs smoothly and that your reports are accurate.

Map Data Fields Carefully

Pay close attention to data mapping during the integration process. Ensure that the corresponding fields between your CRM and QuickBooks are mapped correctly. Incorrect data mapping can lead to errors and data inconsistencies. Test the mapping thoroughly before going live.

Test Thoroughly

Before implementing the integration, test it thoroughly to ensure that data is syncing correctly. Create test records in both systems and verify that the data is transferred accurately. This will help you identify and resolve any potential issues before they impact your business operations.

Monitor and Maintain the Integration

Once the integration is live, monitor it closely to ensure that data continues to sync correctly. Regularly review the data in both systems to identify any discrepancies and address them promptly. Update the integration as needed to accommodate changes in your business processes or software updates.

Provide Training and Support

Train your employees on how to use the integrated systems and provide ongoing support. This will help them understand how the integration works and how to leverage its benefits. Proper training ensures that your team can effectively use the integrated systems to improve their productivity and efficiency.

Common Challenges and Solutions

While CRM integration with QuickBooks offers numerous benefits, you may encounter some challenges. Here are some common issues and their solutions:

Data Synchronization Issues

Challenge: Data may not sync correctly or may be delayed. This can be caused by incorrect data mapping, network issues, or software glitches.

Solution: Review your data mapping, ensure that your network connection is stable, and contact the integration provider for assistance.

Data Conflicts

Challenge: Conflicts may arise when data is updated in both systems simultaneously. This can lead to data inconsistencies.

Solution: Implement rules for data synchronization and designate a primary system for data entry. Use conflict resolution features provided by the integration tool.

Security Concerns

Challenge: Protecting sensitive financial and customer data is crucial. Ensure that the integration tool uses secure data transfer methods.

Solution: Choose a reputable integration provider that uses encryption and other security measures. Review the provider’s security policies and ensure that they comply with your company’s security standards.

Complexity and Technical Issues

Challenge: Some integration methods can be complex and require technical expertise.

Solution: Consider using a pre-built integration or third-party tool to simplify the process. If you require a custom integration, seek assistance from a qualified IT professional.

Conclusion: Embracing a Connected Future

CRM integration with QuickBooks is a powerful strategy for businesses seeking to streamline their operations, improve efficiency, and gain a competitive edge. By integrating these two essential systems, you can unlock a wealth of benefits, including enhanced data accuracy, improved efficiency, better customer insights, streamlined processes, and improved reporting. While challenges may arise during the integration process, careful planning, proper implementation, and ongoing monitoring can ensure a successful outcome.

Embrace the power of unified data and take your business to the next level. By connecting your CRM and QuickBooks, you’ll be well-equipped to make informed decisions, improve customer relationships, and drive sustainable growth in today’s dynamic business environment.

The future of business is connected. By integrating your CRM and QuickBooks, you’re not just automating tasks; you’re building a foundation for a more efficient, customer-centric, and data-driven future.