Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and drive revenue growth. One of the most effective strategies involves integrating Customer Relationship Management (CRM) systems with payment gateways like PayPal. This powerful combination allows businesses to centralize customer data, automate payment processes, and gain valuable insights into customer behavior. This article dives deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices to help businesses unlock their full potential.

Understanding the Power of CRM and PayPal Integration

Before delving into the specifics, it’s crucial to grasp the individual strengths of CRM systems and PayPal. A CRM system serves as the central hub for managing customer interactions, tracking sales leads, and providing personalized customer service. It helps businesses understand their customers better, anticipate their needs, and build stronger relationships.

PayPal, on the other hand, is a global leader in online payment processing. It provides a secure and convenient way for businesses to accept payments from customers worldwide. PayPal’s ease of use, wide acceptance, and robust fraud protection make it a popular choice for both businesses and consumers.

When these two powerhouses are integrated, the benefits are significant:

- Automated Payment Processing: Automatically process payments from within the CRM system, eliminating manual data entry and reducing the risk of errors.

- Centralized Customer Data: Consolidate customer payment information, purchase history, and communication records in one centralized location.

- Enhanced Sales and Marketing: Gain insights into customer spending habits and preferences, enabling targeted marketing campaigns and personalized sales strategies.

- Improved Customer Experience: Provide a seamless and convenient payment experience, leading to increased customer satisfaction and loyalty.

- Reduced Administrative Overhead: Automate payment reconciliation, reporting, and other administrative tasks, freeing up valuable time and resources.

Key Benefits of CRM Integration with PayPal

The advantages of integrating CRM with PayPal extend far beyond mere convenience. Let’s explore some of the key benefits in detail:

1. Streamlined Payment Processing

Perhaps the most immediate benefit is the ability to streamline payment processing. Imagine a scenario where a customer places an order. With integration, the payment can be processed directly from within the CRM system. No more switching between different platforms, manually entering payment details, or dealing with reconciliation headaches. This automation saves time, reduces errors, and accelerates the sales cycle.

2. Enhanced Customer Data Management

Integration allows you to maintain a comprehensive view of each customer’s interactions and transactions. All payment information, including transaction amounts, dates, and payment methods, is automatically stored within the CRM system. This holistic view provides valuable insights into customer behavior, enabling you to tailor your marketing efforts and offer personalized customer service.

3. Improved Sales and Marketing Effectiveness

With integrated data, you can segment your customer base based on their purchase history, payment preferences, and other relevant criteria. This allows you to create highly targeted marketing campaigns, offer personalized product recommendations, and deliver relevant content that resonates with each customer. This level of personalization increases the likelihood of conversions and boosts customer loyalty.

4. Enhanced Customer Experience

A seamless payment experience is crucial for customer satisfaction. By integrating CRM with PayPal, you can offer your customers a smooth and convenient payment process. Customers can easily pay for their purchases from within the CRM system, without being redirected to external websites. This improves the overall customer experience, leading to increased satisfaction and repeat business.

5. Increased Efficiency and Reduced Costs

Automation is a key driver of efficiency. By automating payment processing, reconciliation, and reporting, you can significantly reduce the time and resources required for these tasks. This allows your team to focus on more strategic initiatives, such as sales, marketing, and customer service. Moreover, reducing errors and streamlining processes can also lead to cost savings.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

The process of integrating CRM with PayPal can vary depending on the specific CRM system you use. However, the general steps involved remain consistent:

1. Choose a Compatible CRM System

Not all CRM systems offer seamless integration with PayPal. Research and select a CRM system that supports PayPal integration. Popular CRM platforms like Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365 often provide built-in or readily available integration options.

2. Create a PayPal Business Account (If You Don’t Have One)

You’ll need a PayPal business account to accept payments. If you don’t already have one, sign up for a business account on the PayPal website. This will allow you to receive payments, manage transactions, and access other business-related features.

3. Connect Your PayPal Account to Your CRM System

This is typically done through the CRM system’s settings or integration options. You’ll need to enter your PayPal account credentials (username, password, and API credentials) to establish the connection. The specific steps will vary depending on your CRM system.

4. Configure Payment Settings

Once the connection is established, you’ll need to configure your payment settings within the CRM system. This may include setting up payment gateways, specifying currency preferences, and customizing the payment experience for your customers. You’ll also need to decide what data to sync between the two systems, such as customer details, transaction history, and invoice information.

5. Test the Integration

Before going live, thoroughly test the integration to ensure that payments are processed correctly and that data is synced accurately. Conduct test transactions and verify that all information is flowing seamlessly between the CRM system and PayPal. This will help you identify and resolve any issues before they impact your customers.

6. Train Your Team

Once the integration is live, train your team on how to use the new system. Provide clear instructions on how to process payments, manage customer data, and access transaction history. This will ensure that everyone is comfortable using the integrated system and can leverage its full potential.

Choosing the Right CRM System for PayPal Integration

Selecting the right CRM system is crucial for successful PayPal integration. Consider these factors when making your decision:

- Integration Capabilities: Ensure the CRM system offers native or readily available integration with PayPal. Check the system’s documentation and reviews to confirm its compatibility.

- Features and Functionality: Evaluate the CRM system’s features and functionality to ensure it meets your business needs. Consider factors such as contact management, sales automation, marketing automation, and reporting.

- Scalability: Choose a CRM system that can scale with your business. As your business grows, you’ll need a CRM system that can handle increasing volumes of data and transactions.

- Ease of Use: Select a CRM system that is user-friendly and easy to learn. This will help you to ensure that your team can quickly adapt to the new system and leverage its full potential.

- Cost: Consider the cost of the CRM system, including licensing fees, implementation costs, and ongoing maintenance expenses. Choose a system that fits your budget and offers a good return on investment.

- Customer Support: Look for a CRM system that offers excellent customer support. This will ensure that you can get help quickly if you encounter any issues.

Best Practices for Successful CRM and PayPal Integration

To maximize the benefits of CRM and PayPal integration, follow these best practices:

1. Plan Your Integration Strategy

Before you begin the integration process, develop a clear plan. Define your goals, identify your key requirements, and map out the steps involved. This will help you to ensure that the integration is successful and that it meets your business needs.

2. Clean and Organize Your Data

Before integrating your CRM system with PayPal, clean and organize your customer data. This includes removing duplicate records, correcting errors, and ensuring that all data is accurate and up-to-date. Clean data is essential for accurate reporting and effective marketing.

3. Customize the Payment Experience

Customize the payment experience to match your brand and provide a seamless experience for your customers. This includes customizing the payment forms, payment confirmations, and other aspects of the payment process. A customized payment experience can enhance customer satisfaction and increase conversions.

4. Train Your Team Thoroughly

Provide comprehensive training to your team on how to use the integrated system. This includes training on how to process payments, manage customer data, and access transaction history. Well-trained employees will be more productive and able to leverage the full potential of the integrated system.

5. Monitor and Analyze Your Results

Regularly monitor and analyze your results to ensure that the integration is performing as expected. Track key metrics such as payment processing times, conversion rates, and customer satisfaction. Use this data to identify areas for improvement and optimize your integration strategy.

6. Stay Updated

Keep your CRM system and PayPal integration up-to-date with the latest versions and security patches. This will help to ensure that your system is secure and that it is compatible with the latest features and functionality. Regularly review your integration configuration to ensure it still aligns with your business needs and goals.

Troubleshooting Common Issues

Even with careful planning, you may encounter some issues during the integration process. Here are solutions to some common problems:

1. Connection Problems

If you’re having trouble connecting your CRM system to PayPal, double-check your account credentials (username, password, and API credentials). Make sure the credentials are correct and that your PayPal account is active and in good standing. Also, verify that your CRM system supports the type of PayPal account you have.

2. Data Synchronization Issues

If data is not syncing correctly between your CRM system and PayPal, check the integration settings to ensure that the data mapping is correct. Make sure that the fields in your CRM system are mapped to the corresponding fields in PayPal. Also, check the data synchronization frequency to ensure that data is being synced regularly.

3. Payment Processing Errors

If you’re experiencing payment processing errors, check the error messages to identify the cause of the problem. Common causes include insufficient funds, invalid payment information, and security restrictions. Contact PayPal support or your CRM system’s support team for assistance.

4. Security Concerns

Ensure the security of your data by using a secure connection (HTTPS) and protecting your PayPal account credentials. Regularly review your security settings and implement any recommended security measures. Also, consider using a two-factor authentication for added security.

Real-World Examples of Successful CRM and PayPal Integration

Many businesses have successfully integrated their CRM systems with PayPal to streamline their operations and drive growth. Here are a few examples:

- E-commerce Businesses: E-commerce businesses use CRM integration with PayPal to automate payment processing, track customer purchases, and personalize marketing campaigns.

- Subscription-Based Services: Subscription-based services use CRM integration with PayPal to automate recurring billing, manage subscriptions, and track customer churn.

- Nonprofit Organizations: Nonprofit organizations use CRM integration with PayPal to manage donations, track donor information, and send personalized thank-you notes.

- Consulting Firms: Consulting firms use CRM integration with PayPal to invoice clients, track project payments, and manage customer relationships.

These are just a few examples of how businesses can leverage the power of CRM and PayPal integration. The specific benefits will vary depending on the nature of the business and its specific needs.

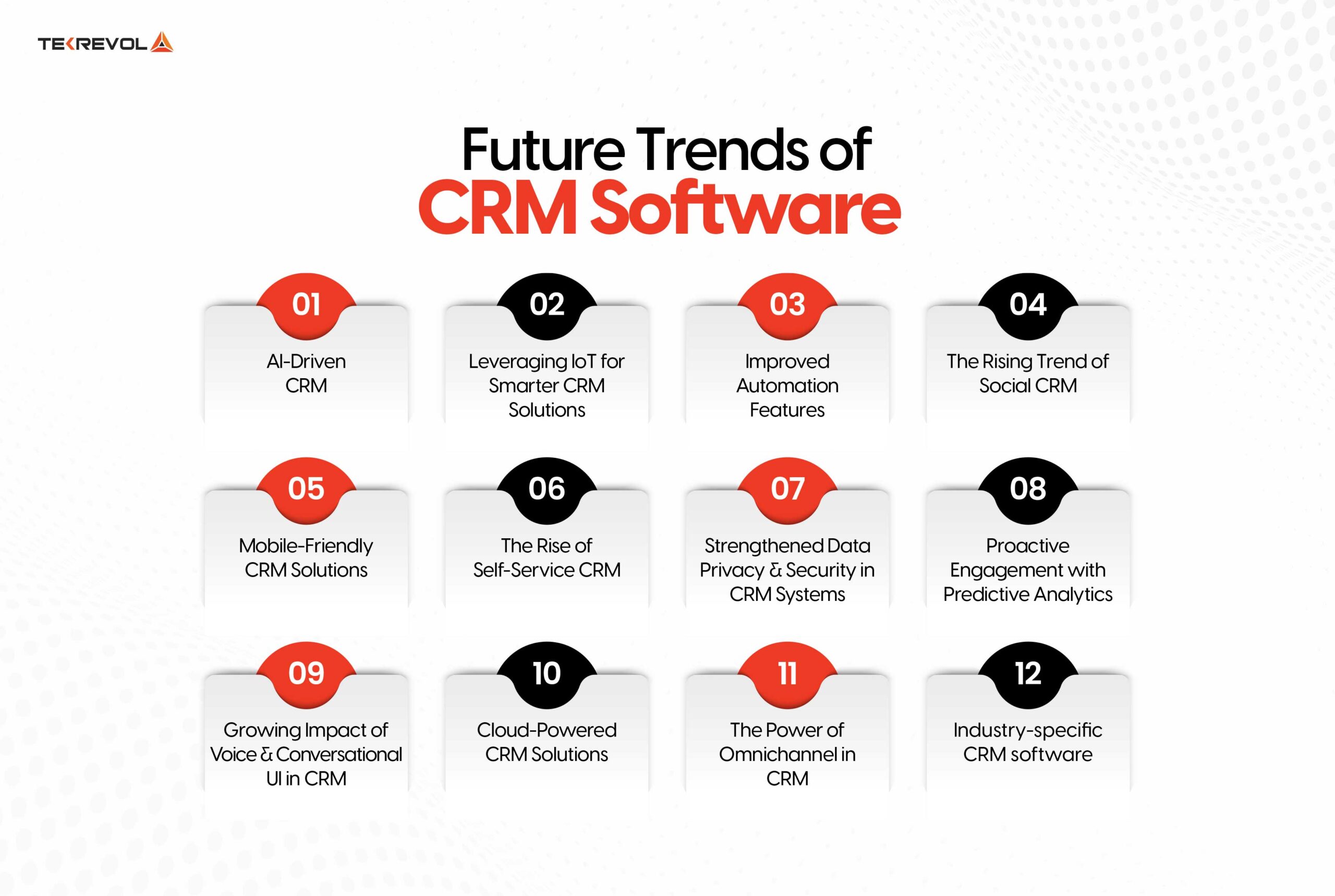

The Future of CRM and PayPal Integration

The integration of CRM systems with payment gateways like PayPal is constantly evolving. As technology advances, we can expect to see even more sophisticated integrations that offer new features and capabilities. Here are some trends to watch for:

- AI-Powered Insights: Artificial intelligence (AI) is being used to provide more in-depth insights into customer behavior and preferences. CRM systems with AI capabilities can analyze payment data and other customer data to identify patterns, predict future behavior, and personalize customer experiences.

- Mobile Payment Integration: Mobile payments are becoming increasingly popular. CRM systems will continue to integrate with mobile payment options, allowing businesses to accept payments from customers on the go.

- Blockchain Technology: Blockchain technology has the potential to revolutionize the way payments are processed. CRM systems may integrate with blockchain-based payment solutions to provide increased security and transparency.

- Enhanced Automation: Automation will continue to play a key role in CRM and PayPal integration. Businesses can expect to see even more automated processes, such as automated invoicing, automated payment reminders, and automated reconciliation.

These trends will enable businesses to further streamline their operations, enhance customer experiences, and drive revenue growth. The future of CRM and PayPal integration is bright, and businesses that embrace these technologies will be well-positioned for success.

Conclusion: Embracing the Power of Integration

Integrating your CRM system with PayPal is a strategic move that can significantly benefit your business. By automating payment processing, centralizing customer data, enhancing sales and marketing effectiveness, improving customer experience, and increasing efficiency, you can unlock new levels of growth and success. By following the steps outlined in this article and staying up-to-date with the latest trends, you can harness the full potential of this powerful integration and create a more efficient, customer-centric, and profitable business.

Don’t hesitate to explore the possibilities of CRM and PayPal integration for your own business. The benefits are clear, and the potential for growth is immense. Start today and take your business to the next level!