Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, efficiency is the name of the game. Juggling client relationships, tracking projects, managing invoices, and staying compliant can feel like a Herculean task. That’s where a Customer Relationship Management (CRM) system steps in. A well-chosen CRM can be the secret weapon that small accounting firms need to thrive, streamlining operations, boosting client satisfaction, and ultimately, driving growth. But with so many CRM options available, selecting the right one can feel overwhelming. This article delves into the best CRM systems tailored for small accounting firms, providing a comprehensive guide to help you make the right choice.

Why Your Accounting Firm Needs a CRM

Before we dive into specific CRM solutions, let’s explore why a CRM is essential for small accounting firms. The benefits extend far beyond simply organizing client contact information. A CRM acts as a central hub for all client-related data, fostering better communication, improving service delivery, and maximizing profitability.

Enhanced Client Relationship Management

At its core, a CRM helps you build and nurture strong client relationships. It allows you to:

- Centralize Client Data: Store all client information in one accessible location, including contact details, communication history, financial records, and project status.

- Improve Communication: Track all interactions with clients, ensuring that no communication falls through the cracks. You can easily see past emails, phone calls, and meetings, providing context for future interactions.

- Personalize Interactions: With a 360-degree view of your clients, you can tailor your communication and services to their specific needs and preferences.

- Proactively Manage Relationships: Set reminders for important dates, such as tax deadlines, financial reviews, and contract renewals, ensuring that you never miss a crucial opportunity to connect with your clients.

Streamlined Workflow and Increased Efficiency

A CRM can significantly streamline your firm’s workflow, saving you time and resources. Key benefits include:

- Automated Tasks: Automate repetitive tasks, such as sending follow-up emails, scheduling appointments, and generating reports, freeing up your time to focus on more strategic activities.

- Improved Collaboration: Facilitate seamless collaboration among team members by providing a shared platform for client information and project updates.

- Enhanced Data Management: Eliminate the need for manual data entry and reduce the risk of errors by automating data capture and storage.

- Better Time Management: Track time spent on client projects and tasks, allowing you to accurately bill clients and identify areas for improvement in your processes.

Increased Revenue and Profitability

Ultimately, a CRM can help you increase revenue and profitability by:

- Improving Lead Management: Track leads, nurture them through the sales pipeline, and convert them into paying clients.

- Identifying Upselling and Cross-selling Opportunities: Identify opportunities to offer additional services to existing clients, such as financial planning or tax advisory services.

- Reducing Churn: Improve client satisfaction and retention by providing excellent service and proactively addressing client needs.

- Optimizing Pricing and Billing: Track project costs and billable hours to ensure that you are pricing your services competitively and accurately.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider the following key features:

Contact Management

This is the foundational feature of any CRM. It should allow you to:

- Store and organize client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Segment clients based on various criteria, such as industry, revenue, or service needs.

- Add custom fields to capture specific information relevant to your accounting practice.

Lead Management

A good CRM should help you manage your leads effectively. Look for features like:

- Lead capture forms to collect information from website visitors or other sources.

- Lead scoring to prioritize leads based on their potential value.

- Sales pipeline management to track leads through the sales process.

- Automated follow-up sequences to nurture leads and convert them into clients.

Task and Project Management

This is crucial for managing client projects and ensuring that tasks are completed on time. Look for features like:

- Task assignment and tracking.

- Project timelines and deadlines.

- Collaboration tools for team members.

- Time tracking to monitor time spent on client projects.

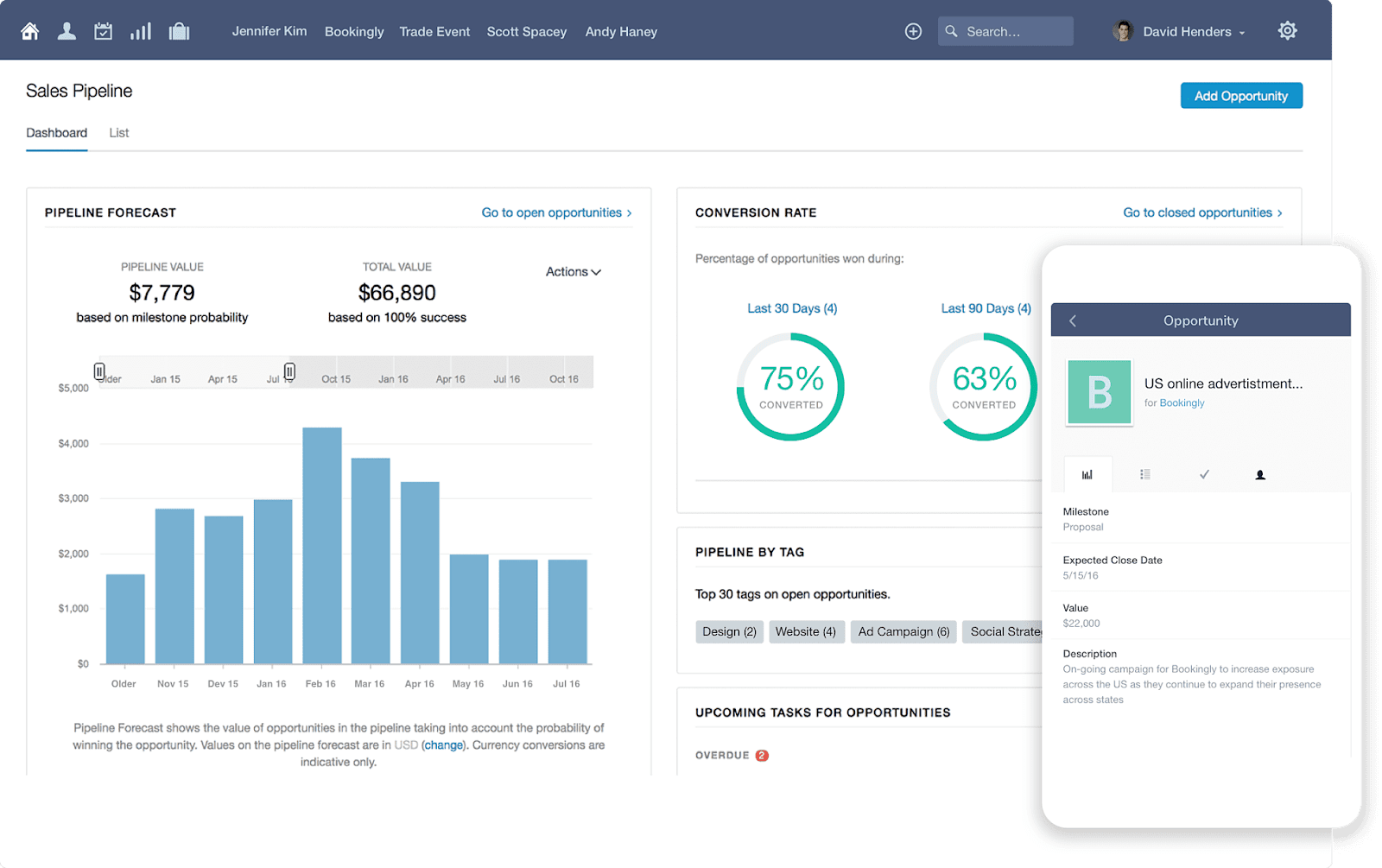

Reporting and Analytics

Reporting and analytics provide insights into your firm’s performance and help you make data-driven decisions. Look for features like:

- Customizable dashboards to visualize key metrics.

- Reporting on client acquisition, retention, and profitability.

- Performance tracking of individual team members.

- Integration with accounting software for comprehensive financial reporting.

Integration with Accounting Software

Seamless integration with your existing accounting software is essential for streamlining your workflow and avoiding data silos. Make sure the CRM you choose integrates with popular accounting platforms like:

- QuickBooks

- Xero

- Sage Intacct

- Other accounting software relevant to your firm.

Security and Compliance

Data security and compliance are paramount, especially when dealing with sensitive financial information. Ensure that the CRM you choose has robust security features, including:

- Data encryption.

- Two-factor authentication.

- Compliance with relevant regulations, such as GDPR and CCPA.

Mobile Accessibility

In today’s mobile world, it’s crucial to have access to your CRM on the go. Look for a CRM with a mobile app or a responsive web design that allows you to access client information and manage tasks from your smartphone or tablet.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed for small accounting firms:

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses, including accounting firms, due to its user-friendliness and comprehensive features. It offers a free plan that provides a solid foundation for managing contacts, tracking deals, and automating marketing tasks. HubSpot’s key strengths include:

- Free Plan: Offers a generous free plan with essential features.

- User-Friendly Interface: Easy to navigate and use, even for those with limited CRM experience.

- Marketing Automation: Powerful marketing automation tools to nurture leads and engage clients.

- Integration: Integrates with a wide range of other tools, including popular accounting software.

- Scalability: Suitable for small and growing businesses.

Considerations: The free plan has limitations on the number of contacts and features. Advanced features require paid subscriptions.

2. Zoho CRM

Zoho CRM is another robust CRM system that offers a wide range of features at competitive prices. It’s a good option for accounting firms that need a comprehensive solution with advanced customization options. Zoho CRM’s key strengths include:

- Customization: Highly customizable to fit the specific needs of your accounting firm.

- Automation: Powerful automation features to streamline workflows.

- Integration: Integrates with a wide range of apps, including accounting software, email marketing platforms, and social media.

- Scalability: Suitable for businesses of all sizes.

- Pricing: Offers various pricing plans to suit different budgets.

Considerations: The interface can be overwhelming for new users. Some advanced features require a steeper learning curve.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s particularly well-suited for accounting firms that want to optimize their sales process. It’s known for its visual pipeline management and ease of use. Pipedrive’s key strengths include:

- User-Friendly Interface: Easy to learn and use, with a focus on visual pipeline management.

- Sales Automation: Automates sales tasks and follow-ups.

- Reporting: Provides clear and concise sales reports.

- Integration: Integrates with popular tools, including email and calendar apps.

- Focus on Sales: Ideal for firms focused on lead generation and sales conversion.

Considerations: May not have all the features needed for comprehensive client management beyond the sales process.

4. Insightly

Insightly is a CRM that focuses on building strong client relationships. It’s a good option for accounting firms that want a CRM that’s easy to use and helps them manage client interactions effectively. Insightly’s key strengths include:

- Ease of Use: Intuitive interface that’s easy to navigate.

- Project Management: Integrated project management features to manage client projects.

- Relationship Linking: Allows you to link contacts, organizations, and projects to gain a 360-degree view of client relationships.

- Integration: Integrates with popular apps, including Google Workspace and Mailchimp.

- Affordable Pricing: Offers affordable pricing plans.

Considerations: The reporting features are less comprehensive than some other CRM systems.

5. Freshsales

Freshsales is a sales CRM that’s part of the Freshworks suite of products. It offers a user-friendly interface and a range of features designed to help accounting firms manage leads, track sales, and improve customer relationships. Freshsales’ key strengths include:

- User-Friendly Interface: Easy to navigate and use.

- Built-in Phone and Email: Offers built-in phone and email functionality.

- Sales Automation: Automates sales tasks and follow-ups.

- Reporting: Provides insightful sales reports.

- Affordable Pricing: Offers competitive pricing plans.

Considerations: May not have all the advanced features of more comprehensive CRM systems.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the best CRM for your small accounting firm requires careful consideration of your specific needs and goals. Here’s a step-by-step guide to help you make the right decision:

1. Assess Your Needs

Before you start evaluating CRM systems, take the time to assess your firm’s needs. Consider the following questions:

- What are your current challenges with client management, sales, and workflow?

- What features are most important to you? (e.g., contact management, lead management, project management, reporting)

- What is your budget?

- What is your team’s technical proficiency?

- Do you need integration with specific accounting software or other tools?

2. Define Your Goals

Clearly define your goals for implementing a CRM. What do you hope to achieve? (e.g., improve client satisfaction, increase revenue, streamline workflows)

3. Research and Compare CRM Systems

Once you have a clear understanding of your needs and goals, research different CRM systems. Compare their features, pricing, and ease of use. Read reviews from other accounting firms to get insights into their experiences.

4. Prioritize Features

Create a list of must-have features and nice-to-have features. This will help you narrow down your options and prioritize the CRM systems that best meet your needs.

5. Consider Integrations

Ensure that the CRM you choose integrates seamlessly with your existing accounting software and other tools. This will save you time and effort and prevent data silos.

6. Evaluate Pricing

Compare the pricing plans of different CRM systems. Consider the cost per user, the features included in each plan, and any hidden fees. Be sure to factor in the long-term cost of the CRM, including any potential upgrades or add-ons.

7. Try Free Trials or Demos

Most CRM systems offer free trials or demos. Take advantage of these opportunities to test the software and see if it’s a good fit for your firm. Involve your team in the trial process to get their feedback.

8. Implement and Train Your Team

Once you’ve chosen a CRM, implement it and train your team on how to use it effectively. Provide ongoing support and training to ensure that your team is using the CRM to its full potential.

9. Monitor and Optimize

Regularly monitor your CRM’s performance and make adjustments as needed. Track key metrics, such as client satisfaction, lead conversion rates, and revenue, to measure the impact of the CRM on your firm’s performance. Continuously optimize your CRM setup to improve efficiency and effectiveness.

Beyond the Basics: Advanced CRM Strategies for Accountants

Once you’ve implemented a CRM, you can leverage advanced strategies to maximize its value and take your accounting firm to the next level:

1. Segment Your Client Base

Segment your client base based on various criteria, such as industry, revenue, or service needs. This allows you to tailor your communication and services to specific client groups, improving client satisfaction and retention.

2. Automate Marketing Campaigns

Use your CRM to automate marketing campaigns, such as email newsletters, targeted promotions, and follow-up sequences. This helps you nurture leads, engage clients, and build brand awareness.

3. Implement a Client Portal

Consider implementing a client portal within your CRM. This allows clients to access their financial documents, communicate with your team, and track the progress of their projects. This improves client convenience and streamlines communication.

4. Integrate with Other Tools

Integrate your CRM with other tools, such as project management software, time tracking software, and document management systems. This creates a seamless workflow and eliminates the need for manual data entry.

5. Analyze Data and Make Data-Driven Decisions

Use the reporting and analytics features of your CRM to analyze your firm’s performance. Identify areas for improvement, track key metrics, and make data-driven decisions to optimize your operations and increase profitability.

The Future of CRM in Accounting

The landscape of CRM is constantly evolving, with new technologies and features emerging all the time. Here are some trends to watch for in the future:

1. Artificial Intelligence (AI)

AI is increasingly being integrated into CRM systems, providing features such as automated data entry, predictive analytics, and personalized recommendations. AI can help accounting firms automate tasks, improve decision-making, and enhance client experiences.

2. Mobile CRM

Mobile CRM is becoming increasingly important, as accounting professionals need to access client information and manage tasks on the go. Expect to see more robust mobile CRM apps with advanced features and seamless integration with other tools.

3. Enhanced Security

Data security is paramount, and CRM systems are investing heavily in enhanced security features, such as data encryption, two-factor authentication, and compliance with data privacy regulations. This will help accounting firms protect sensitive client information and maintain client trust.

4. Integration with Emerging Technologies

CRM systems are integrating with emerging technologies, such as blockchain and cloud computing, to provide new features and capabilities. This will help accounting firms improve efficiency, enhance security, and gain a competitive edge.

Conclusion: Choosing the Right CRM is an Investment in Your Firm’s Future

Choosing the right CRM system is a critical investment for any small accounting firm. By carefully evaluating your needs, researching different CRM options, and implementing a well-designed strategy, you can unlock significant benefits, including enhanced client relationships, streamlined workflows, and increased revenue. Take the time to explore the options, and don’t hesitate to leverage free trials and demos to find the perfect fit for your firm. With the right CRM in place, you’ll be well-equipped to thrive in today’s competitive accounting landscape. Embrace the power of a CRM, and watch your firm flourish!