The Ultimate Guide to the Best CRM for Small Accountants: Boost Efficiency and Client Relationships

As a small accountant, you wear many hats. You’re a number cruncher, a tax advisor, a financial planner, and, let’s be honest, sometimes a therapist to your clients. Juggling all these responsibilities can feel like spinning plates, and the last thing you need is to drop the ball on client relationships or lose track of crucial financial data. That’s where a Customer Relationship Management (CRM) system comes in. But not just any CRM – you need the *best* CRM for small accountants, one that’s tailored to your specific needs and budget.

This comprehensive guide dives deep into the world of CRM for accountants, exploring the benefits, key features, and, most importantly, the top CRM solutions designed to help you streamline your operations, enhance client communication, and ultimately, grow your accounting practice. We’ll cover everything from the basics of CRM to detailed reviews of the best platforms, helping you make an informed decision that aligns with your unique business goals.

Why Do Small Accountants Need a CRM?

You might be thinking, “I’m a small accounting firm; do I really need a CRM?” The short answer is a resounding yes. While you might be managing your client interactions and data using spreadsheets, email, and a handful of other tools, this approach is often inefficient, prone to errors, and ultimately, limits your growth potential. Here’s why a CRM is essential for small accountants:

- Centralized Client Data: A CRM provides a single source of truth for all your client information. No more sifting through multiple spreadsheets, emails, and notes to find what you need. Everything – contact details, communication history, financial data (if integrated), and more – is stored in one accessible location.

- Improved Client Communication: CRM systems help you track all interactions with clients, ensuring that no communication falls through the cracks. You can easily see past conversations, upcoming appointments, and any outstanding tasks, allowing you to provide timely and personalized service.

- Enhanced Organization and Efficiency: Automate repetitive tasks like sending follow-up emails, scheduling appointments, and generating reports. This frees up your time to focus on higher-value activities, like providing strategic financial advice to your clients.

- Increased Sales and Revenue: While you might not think of yourself as a “salesperson,” a CRM can help you identify and nurture potential clients, track leads, and manage the sales pipeline more effectively. This can lead to more new clients and increased revenue.

- Better Client Retention: Happy clients are loyal clients. A CRM helps you build stronger relationships by providing personalized service, proactive communication, and timely follow-ups. This leads to higher client retention rates and a more stable business.

- Data-Driven Decision Making: CRM systems provide valuable insights into your business performance. You can track key metrics like client acquisition cost, client lifetime value, and the success rate of your marketing campaigns, allowing you to make data-driven decisions to improve your profitability.

Key Features to Look for in a CRM for Accountants

Choosing the right CRM for your accounting firm requires careful consideration. Not all CRM systems are created equal, and some are better suited for accountants than others. Here are some key features to prioritize when evaluating CRM platforms:

- Contact Management: This is the foundation of any CRM. Look for features like contact import/export, segmentation, custom fields (to store client-specific information), and the ability to easily search and filter your contact database.

- Client Communication Tracking: The ability to track all communication with clients, including emails, phone calls, and meetings, is crucial. Look for features like email integration (to automatically log emails), call logging, and meeting scheduling.

- Task and Workflow Automation: Automate repetitive tasks to save time and improve efficiency. Look for features like automated email sequences, task reminders, and workflow automation (e.g., automatically creating a task when a new client is onboarded).

- Reporting and Analytics: Gain insights into your business performance with robust reporting and analytics features. Look for features like customizable dashboards, key performance indicators (KPIs) tracking, and the ability to generate reports on client acquisition, client retention, and revenue.

- Integration with Accounting Software: This is a critical feature for accountants. Look for CRM systems that integrate seamlessly with your existing accounting software (e.g., QuickBooks, Xero, Sage) to streamline data entry and avoid manual errors.

- Security and Data Privacy: Ensure that the CRM platform complies with all relevant data privacy regulations (e.g., GDPR, CCPA) and has robust security measures in place to protect your client data.

- Mobile Accessibility: Access your client data and manage your tasks on the go with a mobile-friendly CRM platform.

- Customization Options: Choose a CRM that allows you to customize the platform to meet your specific needs. Look for features like custom fields, workflow automation, and the ability to create custom reports.

- User-Friendly Interface: The CRM should be easy to use and navigate. A complicated interface will hinder adoption and reduce the benefits of the CRM.

- Pricing and Value: Consider the pricing structure and the features offered by each CRM platform. Choose a platform that provides the best value for your money.

Top CRM Platforms for Small Accountants: In-Depth Reviews

Now, let’s dive into some of the best CRM platforms specifically tailored for small accountants. We’ll review the key features, pros, cons, and pricing of each platform to help you make an informed decision.

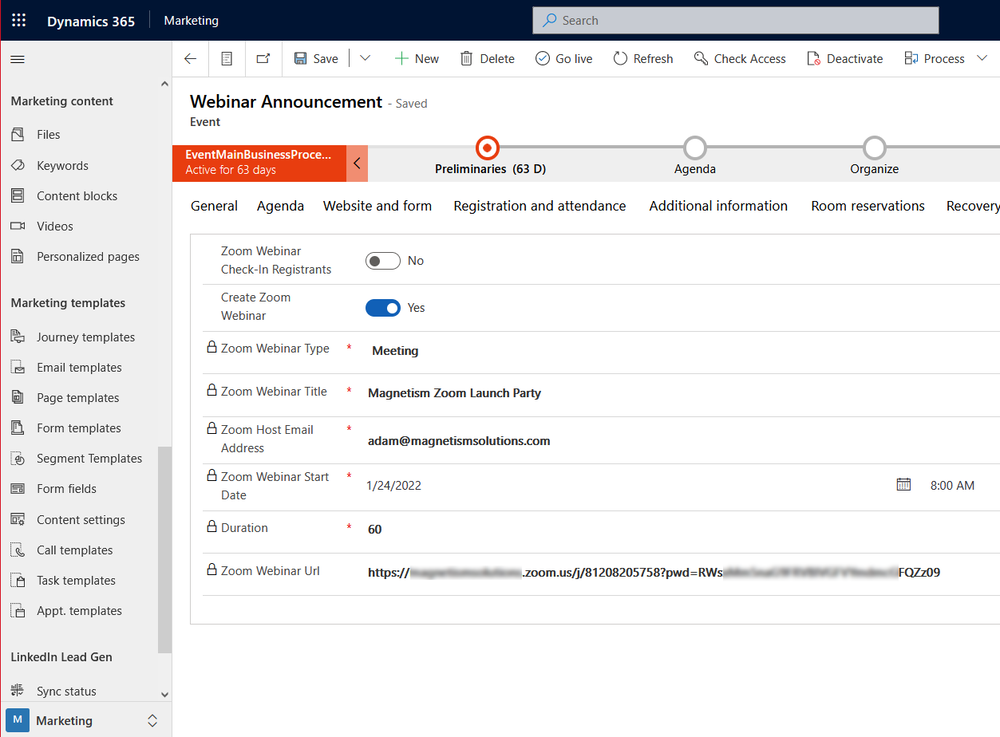

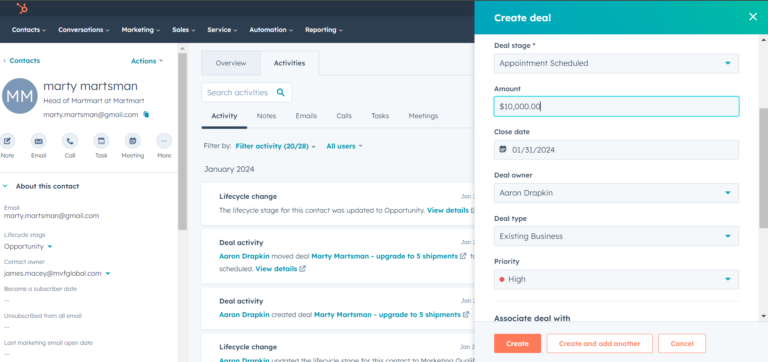

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. Its free version offers a robust set of features, and the paid plans provide even more advanced capabilities. HubSpot CRM is known for its user-friendly interface, powerful automation features, and seamless integration with other HubSpot tools, such as marketing and sales software.

- Key Features: Contact management, deal tracking, email marketing, sales automation, reporting and analytics, integration with popular accounting software (via third-party integrations).

- Pros: Free version is generous, user-friendly interface, powerful automation capabilities, extensive integrations, excellent customer support.

- Cons: Limited features in the free version, some advanced features are only available in the paid plans, can be overwhelming for beginners due to the wide range of features.

- Pricing: Free plan available. Paid plans start at $45 per month.

- Best for: Small accounting firms looking for a free or affordable CRM with powerful features and excellent usability.

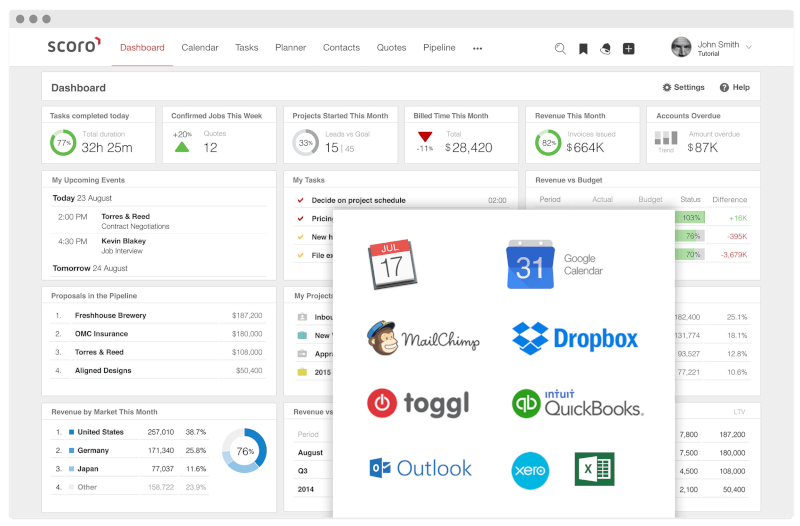

2. Zoho CRM

Zoho CRM is a comprehensive CRM platform that offers a wide range of features and customization options. It’s a great choice for small accounting firms that need a CRM that can grow with their business. Zoho CRM is known for its competitive pricing, extensive integrations, and robust reporting and analytics capabilities.

- Key Features: Contact management, lead management, sales automation, workflow automation, reporting and analytics, integration with accounting software (via third-party integrations), custom fields, and modules.

- Pros: Highly customizable, affordable pricing, extensive integrations, powerful reporting and analytics, good customer support.

- Cons: Interface can be overwhelming for beginners, some features require a learning curve, the level of customization can be time-consuming to set up.

- Pricing: Free plan available for up to 3 users. Paid plans start at $14 per user per month.

- Best for: Small accounting firms looking for a highly customizable and affordable CRM with a wide range of features.

3. Pipedrive

Pipedrive is a sales-focused CRM platform that’s designed to help businesses manage their sales pipeline and close more deals. While it’s not specifically designed for accountants, its intuitive interface and powerful sales automation features make it a good option for small accounting firms that are focused on attracting new clients. Pipedrive is known for its user-friendly interface, visual pipeline management, and powerful sales automation features.

- Key Features: Contact management, deal tracking, sales pipeline management, sales automation, email integration, reporting and analytics, integrations with popular accounting software (via third-party integrations).

- Pros: User-friendly interface, intuitive pipeline management, powerful sales automation, excellent integrations, affordable pricing.

- Cons: Less focus on client communication features, may not be as suitable for accountants who prioritize client relationship management over sales.

- Pricing: Paid plans start at $14.90 per user per month.

- Best for: Small accounting firms focused on attracting new clients and managing their sales pipeline.

4. Freshsales

Freshsales is another sales-focused CRM platform that’s designed to help businesses manage their sales pipeline and close more deals. It’s part of the Freshworks suite of products, which also includes Freshdesk (help desk software) and Freshchat (live chat software). Freshsales is known for its user-friendly interface, built-in phone and email features, and affordable pricing.

- Key Features: Contact management, lead management, sales pipeline management, sales automation, built-in phone and email, reporting and analytics, integration with popular accounting software (via third-party integrations).

- Pros: User-friendly interface, built-in phone and email features, affordable pricing, good customer support.

- Cons: Less focus on client communication features, may not be as suitable for accountants who prioritize client relationship management over sales.

- Pricing: Free plan available. Paid plans start at $15 per user per month.

- Best for: Small accounting firms focused on attracting new clients and managing their sales pipeline, particularly those who want built-in phone and email features.

5. Capsule CRM

Capsule CRM is a straightforward and user-friendly CRM platform that’s designed for small businesses. It focuses on simplicity and ease of use, making it a good choice for accountants who want a CRM that’s easy to set up and manage. Capsule CRM is known for its clean interface, simple features, and affordable pricing.

- Key Features: Contact management, task management, sales pipeline management, email integration, reporting, integrations with popular accounting software (via third-party integrations).

- Pros: User-friendly interface, easy to set up and manage, affordable pricing, good customer support.

- Cons: Fewer advanced features compared to other CRM platforms, less focus on automation.

- Pricing: Paid plans start at $18 per user per month.

- Best for: Small accounting firms looking for a simple and user-friendly CRM that’s easy to set up and manage.

6. Insightly

Insightly is a CRM platform that offers a blend of contact management, project management, and sales automation features. It’s a good choice for small accounting firms that need a CRM that can help them manage both client relationships and internal projects. Insightly is known for its project management features, user-friendly interface, and affordable pricing.

- Key Features: Contact management, lead management, sales pipeline management, project management, task management, reporting, integrations with popular accounting software (via third-party integrations).

- Pros: Project management features, user-friendly interface, affordable pricing, good customer support.

- Cons: Fewer advanced features compared to other CRM platforms, some users find the interface slightly less intuitive than other options.

- Pricing: Paid plans start at $29 per user per month.

- Best for: Small accounting firms that need a CRM that can help them manage both client relationships and internal projects.

Choosing the Right CRM: A Step-by-Step Guide

With so many CRM options available, choosing the right one for your small accounting firm can feel overwhelming. Here’s a step-by-step guide to help you make the right decision:

- Assess Your Needs: Before you start evaluating CRM platforms, take some time to assess your specific needs and requirements. What are your biggest pain points? What features are most important to you? What are your goals for using a CRM?

- Define Your Budget: Determine how much you’re willing to spend on a CRM. Consider both the monthly or annual subscription fees and any potential implementation costs.

- Research CRM Platforms: Research the CRM platforms that are most relevant to your needs. Read reviews, compare features, and look for platforms that are specifically designed for accountants or have integrations with accounting software.

- Create a Shortlist: Narrow down your choices to a shortlist of 2-3 CRM platforms that seem like the best fit for your needs.

- Request Demos or Free Trials: Request demos or free trials of the shortlisted CRM platforms. This will allow you to test the platforms and see how they work in practice.

- Evaluate the Platforms: During the demos or free trials, evaluate the platforms based on the key features you identified in Step 1. Consider the user interface, ease of use, integration capabilities, and customer support.

- Consider the Long-Term: Think about the long-term scalability of the CRM platform. Will it be able to grow with your business?

- Make a Decision: Based on your evaluation, choose the CRM platform that best meets your needs and budget.

- Implement the CRM: Once you’ve chosen a CRM, implement it by importing your client data, setting up your workflows, and training your staff.

- Monitor and Optimize: Continuously monitor the performance of your CRM and make adjustments as needed. Regularly review your workflows, identify areas for improvement, and take advantage of new features and integrations.

Tips for a Successful CRM Implementation

Implementing a CRM is a significant undertaking, but with the right approach, you can ensure a smooth and successful transition. Here are some tips to help you get the most out of your new CRM:

- Get Buy-In from Your Team: Involve your team in the CRM selection and implementation process. This will help them feel invested in the new system and more likely to use it effectively.

- Provide Comprehensive Training: Provide thorough training to your staff on how to use the CRM. Offer ongoing support and resources to help them master the platform.

- Import Your Data Accurately: Make sure you import your client data accurately and completely. This is crucial for the CRM to be effective.

- Customize Your Workflows: Customize the CRM to match your specific workflows and processes. This will help you streamline your operations and improve efficiency.

- Integrate with Your Existing Tools: Integrate your CRM with your existing accounting software and other tools to streamline data entry and avoid manual errors.

- Establish Clear Processes and Procedures: Establish clear processes and procedures for using the CRM. This will help ensure that everyone is on the same page and that the CRM is used consistently.

- Monitor and Analyze Your Results: Regularly monitor the performance of your CRM and analyze your results. This will help you identify areas for improvement and make data-driven decisions.

- Be Patient: Implementing a CRM takes time and effort. Be patient and persistent, and don’t be afraid to ask for help.

The Benefits of Using a CRM for Accountants: Beyond the Basics

We’ve covered the core advantages, but let’s delve deeper into the specific benefits a CRM offers for accountants:

- Improved Client Onboarding: A CRM streamlines the client onboarding process. Automate tasks like sending welcome emails, gathering necessary documents, and setting up initial appointments. This creates a positive first impression and saves you valuable time.

- Enhanced Tax Season Management: During tax season, a CRM is a lifesaver. Track the status of tax returns, send automated reminders to clients about deadlines, and manage client communication efficiently.

- Proactive Client Relationship Management: Go beyond simply reacting to client inquiries. Use your CRM to proactively reach out to clients, offer valuable financial advice, and build stronger relationships.

- Opportunities for Upselling and Cross-selling: Identify opportunities to offer additional services to your clients, such as financial planning, retirement planning, or business consulting. A CRM helps you track these opportunities and manage the sales process.

- Better Time Management: By automating tasks and organizing your client data, a CRM frees up your time to focus on higher-value activities, such as strategic financial planning and client consultations.

- Enhanced Collaboration: If you have a team, a CRM facilitates collaboration by providing a central repository for client information and communication.

- Data Security and Compliance: Choose a CRM that prioritizes data security and complies with relevant regulations like GDPR and CCPA. This is crucial for protecting your clients’ sensitive financial information.

Overcoming the Challenges of CRM Implementation

While a CRM offers numerous benefits, implementing one can present challenges. Here’s how to overcome them:

- Resistance to Change: Some team members may resist adopting a new system. Address this by involving them in the selection process, providing adequate training, and highlighting the benefits of the CRM.

- Data Migration Challenges: Migrating your existing client data can be time-consuming. Plan this process carefully, ensuring data accuracy and completeness.

- Integration Issues: Integrating your CRM with your existing accounting software and other tools can sometimes be complex. Choose a CRM with robust integration capabilities and seek assistance if needed.

- Lack of User Adoption: If your team doesn’t use the CRM, it won’t be effective. Provide ongoing training, offer support, and monitor user activity to ensure adoption.

- Cost Concerns: CRM platforms can vary in price. Carefully evaluate the costs and benefits of each platform to choose one that fits your budget. Consider starting with a free plan or a trial period before committing to a paid plan.

The Future of CRM for Accountants

The world of CRM is constantly evolving, and the future holds exciting possibilities for accountants. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered CRM platforms can automate tasks, provide insights, and personalize client interactions.

- Increased Automation: Expect to see even more automation features, such as automated email campaigns, automated task creation, and automated report generation.

- Enhanced Integrations: CRM platforms will continue to integrate with a wider range of accounting software and other tools.

- Mobile-First Design: CRM platforms will become increasingly mobile-friendly, allowing accountants to access their client data and manage their tasks on the go.

- Focus on Data Privacy and Security: Data privacy and security will continue to be a top priority, with CRM platforms implementing robust security measures to protect client data.

Conclusion: Embrace the Power of CRM

In today’s competitive landscape, small accountants need every advantage they can get. A CRM system is no longer a luxury; it’s a necessity. By implementing the right CRM platform, you can streamline your operations, enhance client relationships, and drive growth for your accounting practice.

This guide has provided you with the knowledge you need to choose the best CRM for your small accounting firm. Remember to assess your needs, define your budget, research your options, and choose a platform that aligns with your business goals. With the right CRM in place, you can transform your practice and achieve lasting success.

So, take the leap. Explore the options. Embrace the power of CRM, and watch your accounting practice thrive.