Seamlessly Streamline Your Finances: Mastering CRM Integration with QuickBooks

Introduction: Bridging the Gap Between Sales and Finance

In the bustling world of business, where every efficiency counts, the seamless flow of information between departments is paramount. Imagine a scenario where your sales team effortlessly passes customer data to your finance department, eliminating manual data entry, reducing errors, and accelerating the entire financial cycle. This, in essence, is the power of CRM (Customer Relationship Management) integration with QuickBooks, a leading accounting software. This integration isn’t just about connecting two software programs; it’s about fostering a symbiotic relationship that boosts productivity, minimizes costly mistakes, and ultimately, strengthens your bottom line. This comprehensive guide will delve deep into the intricacies of CRM integration with QuickBooks, providing you with the knowledge and insights needed to optimize your business operations and achieve unparalleled financial clarity.

Understanding the Fundamentals: CRM and QuickBooks Defined

What is CRM?

Customer Relationship Management (CRM) is more than just a software; it’s a philosophy centered around understanding and nurturing customer relationships. A CRM system acts as a centralized hub for all customer-related information, including contact details, communication history, sales interactions, and purchase patterns. This holistic view empowers businesses to personalize customer experiences, improve sales strategies, enhance customer service, and ultimately, drive revenue growth. Think of it as the brain of your sales and marketing efforts, meticulously tracking every interaction and providing valuable insights into customer behavior.

What is QuickBooks?

QuickBooks, on the other hand, is the backbone of financial management for countless small and medium-sized businesses (SMBs). It’s a robust accounting software that simplifies tasks such as invoicing, expense tracking, payroll, and financial reporting. QuickBooks provides a clear picture of your financial health, allowing you to make informed decisions, manage cash flow effectively, and stay compliant with tax regulations. Essentially, QuickBooks is the heart of your financial operations, ensuring that every transaction is accurately recorded and accounted for.

The Synergy: Why Integrate CRM with QuickBooks?

The true magic happens when you bring these two powerhouses together. CRM integration with QuickBooks eliminates the frustrating and time-consuming process of manual data entry, which is not only prone to errors but also a significant drain on resources. By automating data transfer between your sales and finance departments, you can unlock a wealth of benefits.

Key Advantages of Integration:

- Eliminate Data Entry Errors: Manual data entry is a breeding ground for mistakes. Integration ensures data accuracy by automating the transfer of information, reducing the risk of costly errors in invoices, customer records, and financial reports.

- Save Time and Boost Efficiency: Manual data entry consumes valuable time that could be better spent on core business activities. Integration streamlines workflows, freeing up your team to focus on strategic initiatives and revenue-generating tasks.

- Improve Cash Flow Management: With real-time access to sales and financial data, you can gain a clearer understanding of your cash flow. This enables you to make informed decisions about spending, investments, and collections.

- Enhance Sales Team Productivity: Sales reps can instantly access customer payment history, outstanding invoices, and other financial information within their CRM, allowing them to close deals faster and provide superior customer service.

- Gain a Complete Customer View: Integration provides a 360-degree view of your customers, combining sales interactions, financial transactions, and other relevant data into a single, unified record.

- Reduce Redundancy: Eliminate the need to enter the same data multiple times across different systems, reducing the risk of inconsistencies and errors.

- Make Better Business Decisions: Access to accurate, real-time data empowers you to make data-driven decisions about pricing, product development, marketing campaigns, and other crucial business aspects.

- Streamline Reporting: Generate comprehensive reports that combine sales and financial data, providing a holistic view of your business performance.

Choosing the Right Integration Method: Options and Considerations

The method you choose to integrate your CRM with QuickBooks depends on several factors, including the specific CRM and QuickBooks versions you use, your budget, your technical expertise, and your business needs. Here are the primary options:

1. Native Integrations

Some CRM and QuickBooks versions offer native integrations, meaning they are designed to work seamlessly together out of the box. These integrations often provide the most straightforward setup and require minimal technical expertise. However, native integrations might not be available for all CRM and QuickBooks combinations, and the features offered may be limited. Check the compatibility and feature set of native integrations before committing.

2. Third-Party Integration Tools

A wide variety of third-party integration tools are available, ranging from simple connectors to more sophisticated platforms. These tools act as a bridge between your CRM and QuickBooks, automating data transfer and synchronization. Popular choices include Zapier, PieSync (now part of HubSpot), and various specialized integration platforms. Third-party tools offer greater flexibility and often support a wider range of CRM and QuickBooks versions. They also tend to offer more advanced features, such as customizable data mapping and automated workflows. Research the features and pricing of different third-party tools to find the best fit for your business.

3. Custom Integrations

For businesses with highly specialized needs or complex data structures, custom integrations may be the best option. This involves developing a custom solution that connects your CRM and QuickBooks. Custom integrations offer the greatest flexibility and control, but they also require significant technical expertise and can be expensive to develop and maintain. Consider this option if you have unique requirements that cannot be met by native integrations or third-party tools. You’ll typically need to work with a developer or integration specialist to build and implement a custom solution.

Step-by-Step Guide: Implementing CRM Integration with QuickBooks

The specific steps for integrating your CRM with QuickBooks will vary depending on the integration method you choose. However, the general process typically involves these key steps:

1. Planning and Preparation

Before you begin, carefully plan your integration strategy. Define your goals, identify the data you want to synchronize, and map the fields between your CRM and QuickBooks. Determine which integration method is best suited for your needs. Review your current CRM and QuickBooks setups to ensure they are up-to-date and configured correctly. Consider the security implications of the integration and implement appropriate security measures.

2. Choosing the Integration Method

Based on your research and planning, select the integration method that best aligns with your requirements. This might involve selecting a native integration, choosing a third-party tool, or engaging a developer to build a custom solution.

3. Setting Up the Integration

Follow the specific instructions for your chosen integration method. This typically involves connecting your CRM and QuickBooks accounts, configuring data mapping, and setting up automated workflows. Test the integration thoroughly to ensure data flows correctly and that the system functions as expected.

4. Data Mapping and Configuration

Data mapping is a crucial step in the integration process. It involves defining how data fields in your CRM will be mapped to corresponding fields in QuickBooks. For example, you’ll need to map customer names, addresses, and contact information. You’ll also need to map sales data, such as invoices, payments, and products. Carefully configure the data mapping to ensure that data is transferred accurately and consistently. Consider the implications of data mapping on reporting and analysis.

5. Testing and Validation

Once you’ve set up the integration, thoroughly test it to ensure that data flows correctly between your CRM and QuickBooks. Create test records in your CRM and verify that they are accurately reflected in QuickBooks. Generate test invoices, process payments, and run various reports to validate the integration’s functionality. Address any errors or inconsistencies that you encounter during testing.

6. Training and Documentation

Train your team on how to use the integrated system and document the integration process. Provide clear instructions on how to enter data, generate reports, and troubleshoot common issues. Create documentation that outlines the integration setup, data mapping, and workflow processes. This documentation will be invaluable for onboarding new employees and maintaining the integration over time.

7. Monitoring and Maintenance

Regularly monitor the integration to ensure that it continues to function correctly. Check for any errors or issues that may arise. Review the data flow and make adjustments as needed. Update the integration as your CRM and QuickBooks systems evolve. Keep the integration secure by implementing appropriate security measures and regularly reviewing your security settings.

Specific Integration Scenarios: Data Synchronization Examples

Let’s explore some common scenarios where CRM integration with QuickBooks can streamline your workflows:

1. Customer Data Synchronization

Imagine a new lead enters your CRM. With integration, this customer’s information (name, contact details, address, etc.) automatically syncs to QuickBooks, creating a new customer record. This eliminates the need to manually enter customer data in both systems, saving time and reducing errors. Any updates to customer information in either system will be automatically reflected in the other.

2. Invoice and Payment Synchronization

When a sale is closed in your CRM, an invoice can automatically be generated in QuickBooks. This seamless transfer of data ensures that invoices are accurate and up-to-date. As payments are received, they are automatically synced back to the CRM, updating the customer’s payment history and the sales rep’s view of the deal’s status. This improves cash flow visibility and reduces the risk of missed payments.

3. Sales Order Synchronization

When a sales order is placed in your CRM, the details of the order (products, quantities, prices) can be automatically synced to QuickBooks, creating a sales order record. This streamlines the order fulfillment process and ensures that inventory levels are accurately reflected. This integration is particularly beneficial for businesses that sell physical products.

4. Product and Inventory Synchronization

If you sell products, integration can synchronize product information (names, descriptions, prices, inventory levels) between your CRM and QuickBooks. This ensures that your sales team has access to the most up-to-date product information, and that inventory levels are accurately tracked. This integration helps prevent overselling and ensures that you can fulfill orders efficiently.

Choosing the Right CRM for QuickBooks Integration

The effectiveness of your integration depends, in part, on the CRM system you choose. Several CRM systems are known for their robust integration capabilities with QuickBooks. Here are a few popular options:

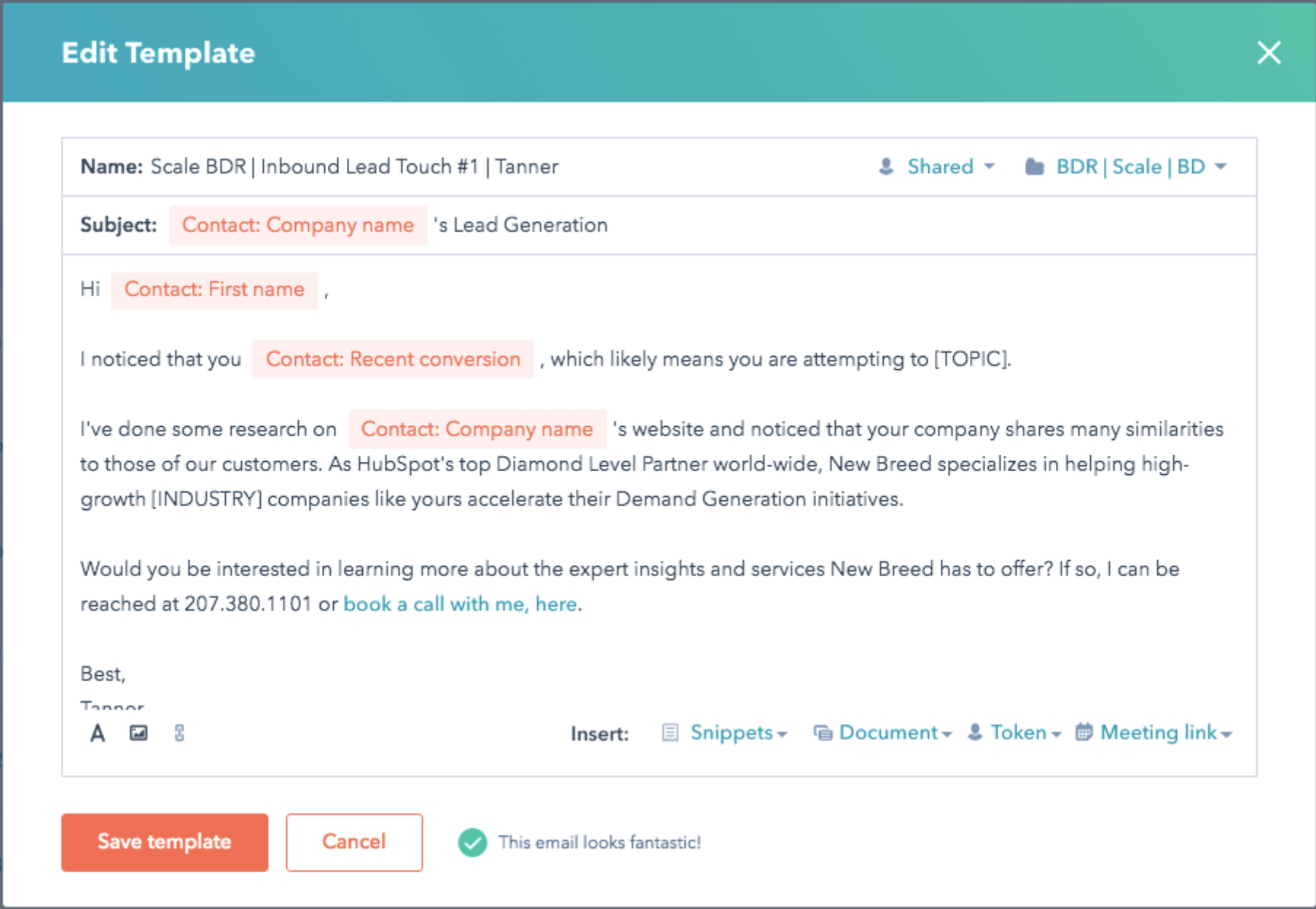

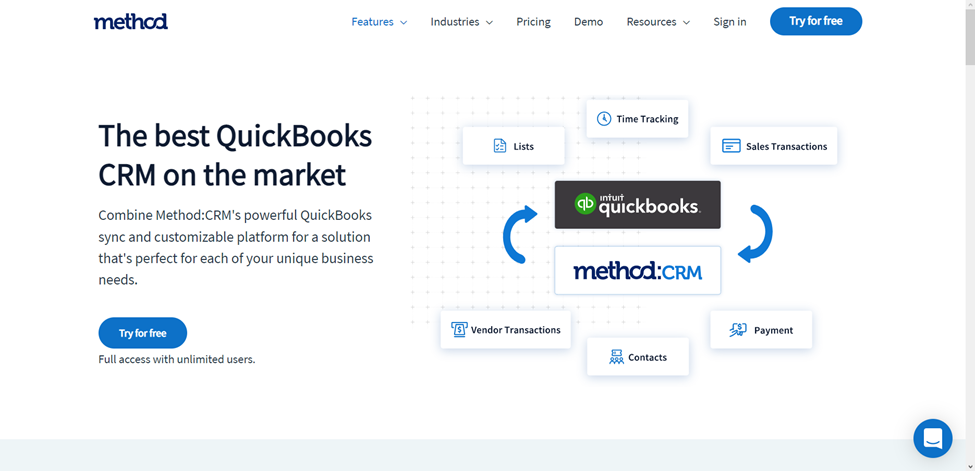

1. HubSpot CRM

HubSpot CRM is a popular and user-friendly CRM system that offers a strong integration with QuickBooks. HubSpot provides a free CRM with basic features, making it an attractive option for small businesses. The integration allows for seamless data synchronization, including contact information, deals, invoices, and payments. HubSpot’s marketing automation features complement the QuickBooks integration, enabling you to nurture leads and track the ROI of your marketing efforts.

2. Salesforce

Salesforce is a leading CRM platform that offers a highly customizable and feature-rich integration with QuickBooks. Salesforce’s integration with QuickBooks is typically achieved through third-party apps available on the Salesforce AppExchange. Salesforce offers a wide range of features, including sales automation, marketing automation, and customer service tools. This integration is well-suited for businesses with complex sales processes and a need for advanced reporting and analytics.

3. Zoho CRM

Zoho CRM is a versatile and affordable CRM system that offers a robust integration with QuickBooks. Zoho CRM provides a wide array of features, including sales force automation, marketing automation, and customer service tools. The integration enables you to synchronize data between Zoho CRM and QuickBooks, automating key tasks such as invoice generation, payment tracking, and customer data management. This integration is a great option for businesses seeking a comprehensive CRM solution at a competitive price point.

4. Pipedrive

Pipedrive is a sales-focused CRM system that offers a straightforward integration with QuickBooks. Pipedrive is designed to help sales teams manage their pipelines and close deals more efficiently. The integration enables you to sync customer data, invoices, and payment information between Pipedrive and QuickBooks. Pipedrive’s focus on sales makes it an ideal choice for businesses that prioritize sales performance and deal management.

Troubleshooting Common Integration Issues

Even with careful planning and implementation, you may encounter some issues during the integration process. Here are some common problems and how to resolve them:

1. Data Synchronization Errors

Data synchronization errors can occur due to a variety of reasons, such as incorrect data mapping, formatting issues, or network connectivity problems. To troubleshoot these errors, check the error logs provided by your integration tool or CRM. Review the data mapping configuration to ensure that fields are correctly aligned. Verify your network connection and ensure that your CRM and QuickBooks systems can communicate with each other. Contact the support team for your integration tool or CRM for assistance if needed.

2. Duplicate Records

Duplicate records can arise if your integration is not configured correctly or if data is entered manually in both systems. To prevent duplicate records, carefully configure your integration to avoid creating duplicate entries. Implement data validation rules to prevent users from entering duplicate customer records. Regularly review your CRM and QuickBooks data to identify and merge any duplicate records. Use de-duplication tools provided by your CRM or integration tool.

3. Slow Synchronization Speeds

Slow synchronization speeds can be caused by a variety of factors, such as large data volumes, network congestion, or inefficient integration configurations. To improve synchronization speeds, optimize your data mapping to transfer only the necessary data. Schedule synchronization during off-peak hours to minimize the impact on system performance. Ensure that your network connection is stable and has sufficient bandwidth. Contact the support team for your integration tool or CRM for assistance if needed.

4. Security Concerns

Security is a paramount concern when integrating your CRM with QuickBooks. Ensure that your integration is secure by implementing appropriate security measures. Use strong passwords and enable multi-factor authentication. Regularly review your security settings and update them as needed. Only grant access to authorized users. Protect your data by encrypting sensitive information. Consider using a secure integration platform that offers robust security features.

The Future of CRM and QuickBooks Integration

As technology continues to evolve, the integration between CRM and QuickBooks will become even more sophisticated and seamless. Here are some trends to watch for:

1. AI-Powered Automation

Artificial intelligence (AI) will play an increasingly important role in automating workflows and improving data accuracy. AI-powered tools will be able to identify and resolve data synchronization errors, predict customer behavior, and automate tasks such as invoice generation and payment processing.

2. Enhanced Data Analytics

Integration will provide even richer data insights, enabling businesses to make more informed decisions. Advanced analytics tools will analyze combined CRM and QuickBooks data to identify trends, predict future performance, and optimize business processes.

3. Increased Personalization

Integration will enable businesses to personalize customer experiences even further. By combining sales and financial data, businesses can gain a deeper understanding of customer preferences and tailor their interactions accordingly.

4. More Seamless Integrations

We can expect even more native integrations and user-friendly third-party tools, making it easier than ever to connect CRM and QuickBooks. Integration will become a standard feature of both CRM and QuickBooks platforms.

Conclusion: Embrace the Power of Integration

CRM integration with QuickBooks is a strategic investment that can revolutionize your business operations. By automating data transfer, streamlining workflows, and gaining a complete view of your customers, you can unlock significant benefits, including increased efficiency, improved cash flow, and enhanced customer satisfaction. Whether you choose a native integration, a third-party tool, or a custom solution, the key is to carefully plan your integration strategy, select the right tools, and implement the integration effectively. Embrace the power of integration and watch your business thrive in today’s competitive landscape.