The Ultimate Guide to the Best CRM for Small Accountants: Boost Your Practice’s Efficiency and Client Relationships

The Ultimate Guide to the Best CRM for Small Accountants: Boost Your Practice’s Efficiency and Client Relationships

Running a small accounting firm is a juggling act. You’re managing client finances, staying up-to-date on regulations, and trying to grow your business – all while wearing multiple hats. In this fast-paced environment, having the right tools can make all the difference. One of the most crucial tools for any successful accounting practice is a Customer Relationship Management (CRM) system. But with so many options available, choosing the best CRM for small accountants can feel overwhelming. This comprehensive guide will break down everything you need to know to select the perfect CRM to streamline your operations, nurture client relationships, and ultimately, boost your bottom line.

Why Your Small Accounting Firm NEEDS a CRM

You might be thinking, “Do I really need a CRM?” The short answer is: absolutely. Even if you’re a solo practitioner, a CRM offers invaluable benefits. Think of it as your central hub for all client-related information. Here’s why a CRM is essential for small accounting firms:

- Improved Client Management: A CRM centralizes all client data, including contact information, communication history, financial details, and project progress. This allows you to quickly access the information you need, when you need it, leading to better client service.

- Enhanced Communication: CRM systems often include features like email integration, task management, and appointment scheduling. This makes it easier to communicate with clients, track interactions, and ensure nothing falls through the cracks.

- Increased Efficiency: Automate repetitive tasks, such as sending invoices, following up on leads, and scheduling meetings. This frees up your time to focus on more strategic activities, like providing financial advice and growing your business.

- Better Lead Management: Track potential clients, nurture leads, and convert them into paying customers. CRM systems help you identify and prioritize the most promising leads, so you can focus your efforts where they’ll have the greatest impact.

- Data-Driven Decision Making: Gain valuable insights into your client base, marketing efforts, and overall business performance. CRM systems provide reports and analytics that help you make informed decisions and optimize your strategies.

- Improved Collaboration: If you have a team, a CRM facilitates seamless collaboration. Team members can easily access and share client information, ensuring everyone is on the same page.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting practice, it’s important to consider the specific features that will benefit your business. Here are some essential features to look for:

- Contact Management: This is the foundation of any CRM. It should allow you to store and organize all client contact information, including names, addresses, phone numbers, email addresses, and social media profiles.

- Lead Management: The ability to track potential clients, capture lead information, and nurture them through the sales pipeline. Look for features like lead scoring, lead segmentation, and automated follow-up sequences.

- Task Management: The ability to create, assign, and track tasks. This is crucial for managing client projects, following up on leads, and ensuring deadlines are met.

- Appointment Scheduling: Integrated calendar and scheduling features that allow clients to book appointments online and sync with your calendar.

- Email Integration: Seamless integration with your email provider (e.g., Gmail, Outlook) to track email communication with clients and send mass emails.

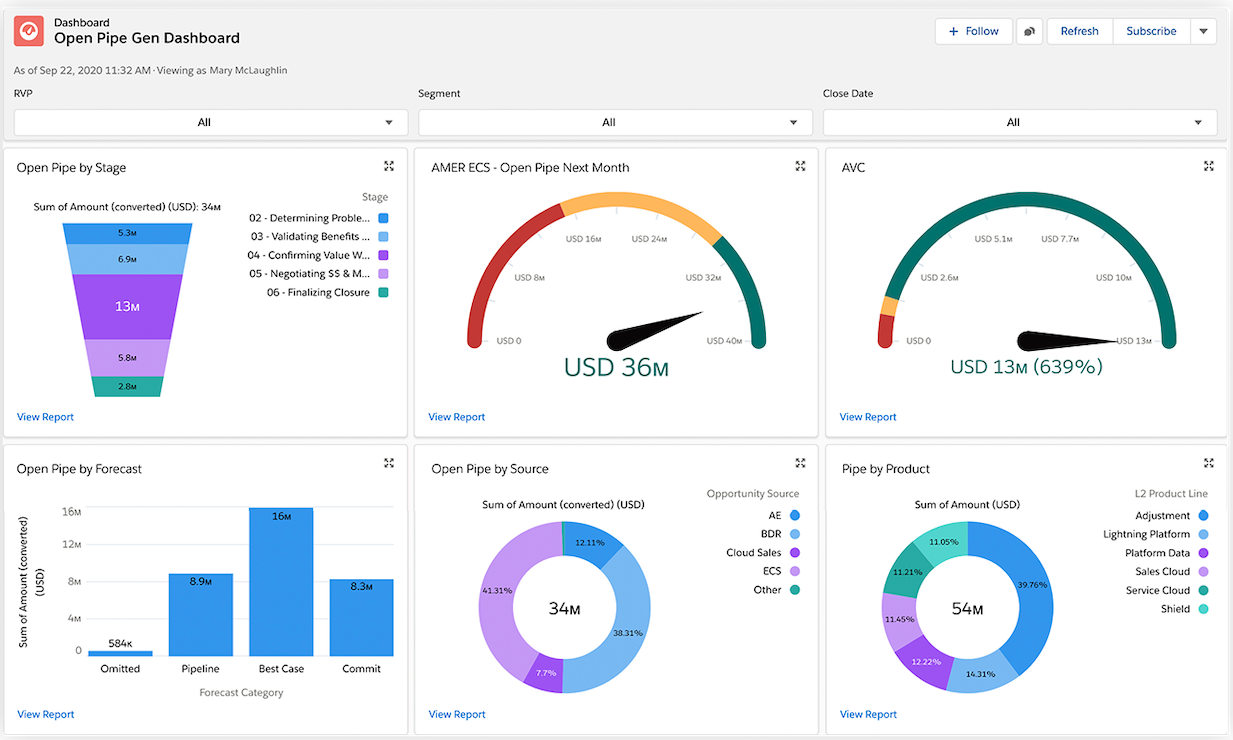

- Reporting and Analytics: Customizable reports and dashboards that provide insights into your client base, sales performance, and marketing efforts.

- Document Management: The ability to store and manage client documents, such as tax returns, financial statements, and contracts.

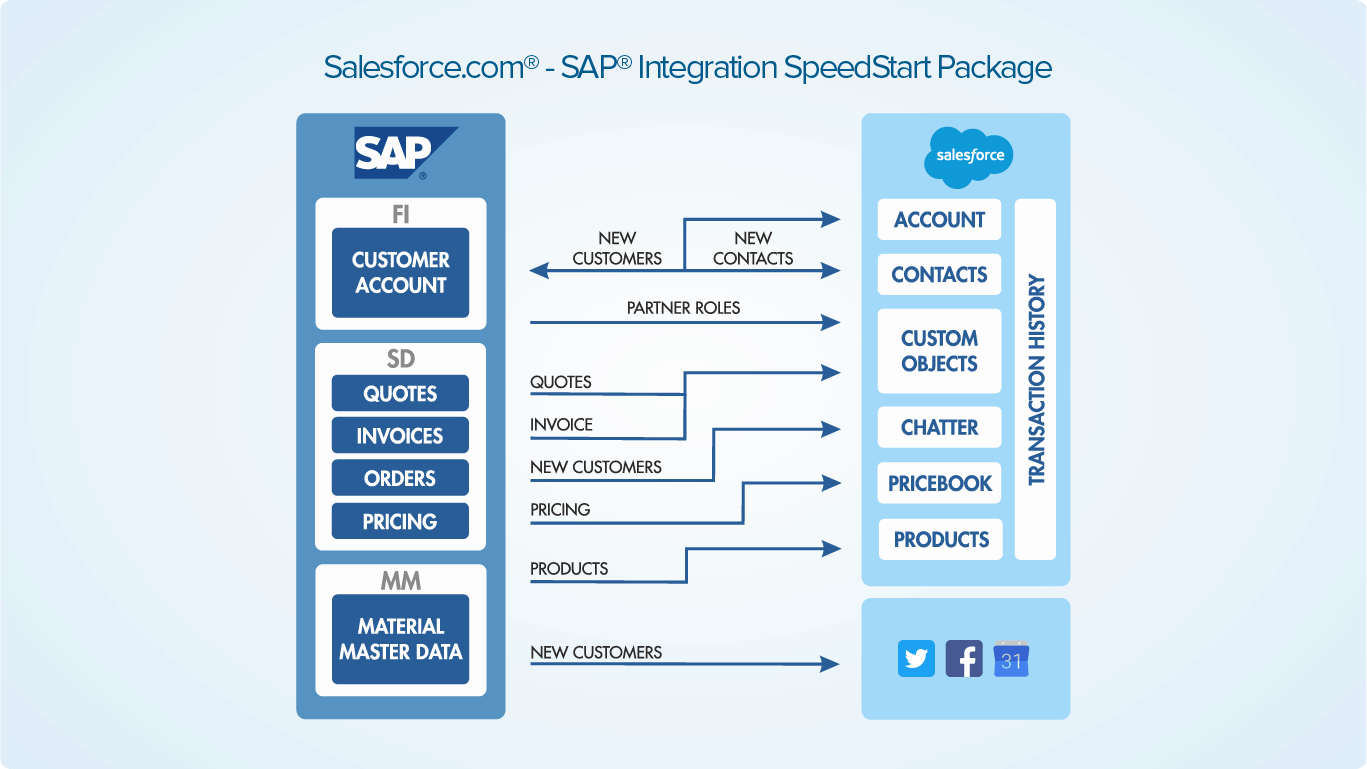

- Integration with Accounting Software: This is a must-have. The CRM should integrate with your existing accounting software (e.g., QuickBooks, Xero) to streamline data entry and eliminate manual processes.

- Customization: The ability to customize the CRM to fit your specific needs and workflows. Look for features like custom fields, custom reports, and workflow automation.

- Mobile Access: The ability to access the CRM from your smartphone or tablet, so you can stay connected with clients and manage your business on the go.

- Security and Compliance: Ensure the CRM offers robust security features and complies with relevant data privacy regulations (e.g., GDPR, CCPA).

Top CRM Systems for Small Accountants (and Why They’re Great)

Now, let’s dive into some of the best CRM systems specifically tailored for small accounting firms. We’ll explore their key features, pricing, and what makes them stand out.

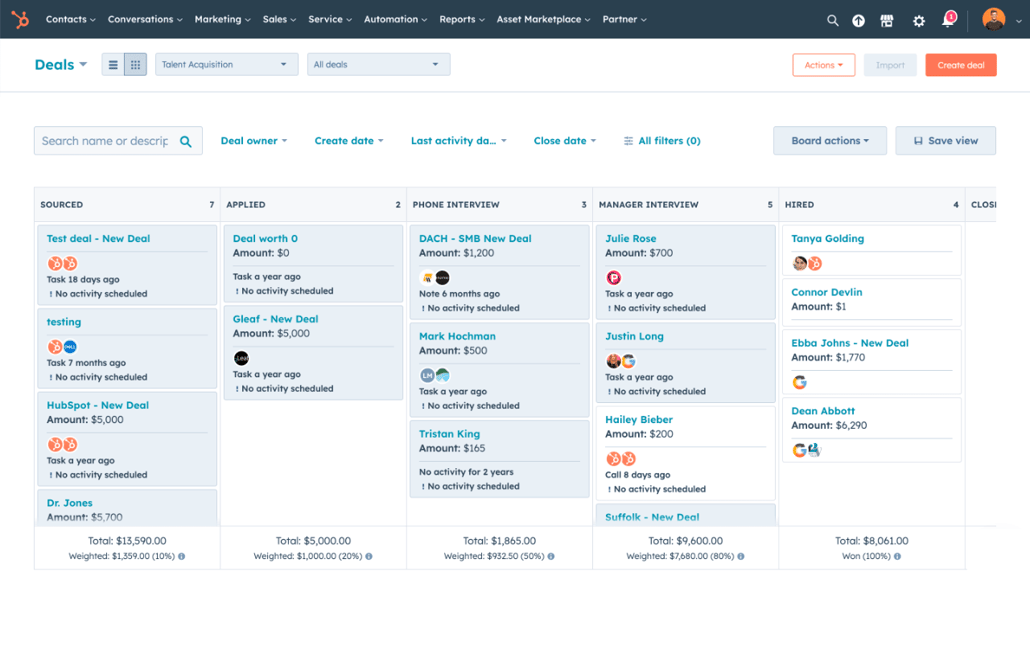

1. HubSpot CRM

Why it’s great: HubSpot CRM is a popular choice, especially for businesses new to CRM systems. It’s known for its user-friendly interface and robust free plan, making it an excellent starting point for small accounting firms. HubSpot offers a comprehensive suite of tools, including contact management, lead tracking, email marketing, and sales automation. Its free plan is surprisingly generous, allowing you to manage a significant number of contacts and utilize essential features. The paid plans offer more advanced features, such as marketing automation, reporting, and custom objects.

- Key Features:

- Free CRM with generous limits

- Contact management

- Lead tracking

- Email marketing and automation

- Sales pipeline management

- Reporting and analytics

- Integration with popular accounting software (via third-party integrations)

- Pricing: Free plan; Paid plans start at $45/month (billed annually).

- Pros: User-friendly, free plan, comprehensive features, strong marketing automation capabilities, excellent support.

- Cons: Limited direct integrations with accounting software (requires third-party integrations), paid plans can become expensive as you scale.

2. Pipedrive

Why it’s great: Pipedrive is a sales-focused CRM designed to help businesses close deals more effectively. It’s known for its visual pipeline management, which allows you to easily track leads through the sales process. While it might not be as feature-rich as HubSpot in terms of marketing automation, Pipedrive excels at helping you manage your sales pipeline and stay on top of client interactions. Its clean and intuitive interface makes it easy to use and understand. Pipedrive offers integrations with various accounting software, making it a good choice for those who prioritize sales and client relationship management.

- Key Features:

- Visual sales pipeline management

- Contact management

- Lead tracking

- Email integration

- Sales automation

- Reporting and analytics

- Strong integrations with accounting software

- Pricing: Starts at $12.50/user/month (billed annually).

- Pros: Excellent sales pipeline management, intuitive interface, strong integrations, affordable.

- Cons: Less focus on marketing automation compared to HubSpot, can feel limiting for firms that need a broader range of features.

3. Zoho CRM

Why it’s great: Zoho CRM is a versatile and feature-rich CRM that offers a wide range of tools for sales, marketing, and customer service. It’s a great option for small accounting firms that want a comprehensive CRM solution without breaking the bank. Zoho CRM offers a free plan for up to three users, making it a good starting point for very small firms. Its paid plans offer a wide range of features, including sales automation, workflow automation, and advanced reporting. Zoho CRM also integrates seamlessly with other Zoho apps, creating a powerful ecosystem for your business.

- Key Features:

- Contact management

- Lead tracking

- Sales automation

- Marketing automation

- Workflow automation

- Reporting and analytics

- Integration with Zoho suite of apps

- Integration with accounting software (via third-party integrations)

- Pricing: Free plan (up to 3 users); Paid plans start at $14/user/month (billed annually).

- Pros: Versatile and feature-rich, affordable, free plan, strong automation capabilities, integrates with other Zoho apps.

- Cons: Interface can feel overwhelming for some users, integrations with accounting software might require third-party apps.

4. Salesforce Sales Cloud

Why it’s great: Salesforce is a leading CRM provider, and its Sales Cloud offers a comprehensive suite of features for businesses of all sizes. While it can be more complex than other options, Salesforce provides unparalleled customization and scalability. For small accounting firms that anticipate rapid growth, Salesforce can be a good long-term investment. Its AppExchange marketplace offers a vast selection of integrations and add-ons, allowing you to tailor the CRM to your specific needs. Salesforce can be a bit of an investment, but its robust capabilities make it a powerful tool for managing clients and driving sales.

- Key Features:

- Contact management

- Lead tracking

- Sales automation

- Marketing automation

- Workflow automation

- Reporting and analytics

- AppExchange marketplace for integrations

- Highly customizable

- Extensive integrations with accounting software (through AppExchange)

- Pricing: Starts at $25/user/month (billed annually).

- Pros: Highly customizable, scalable, extensive features, large AppExchange marketplace, robust reporting.

- Cons: Can be complex to set up and manage, more expensive than other options, may be overkill for very small firms.

5. Insightly

Why it’s great: Insightly is a CRM designed specifically for small to medium-sized businesses. It’s known for its ease of use and affordability, making it a good choice for accounting firms that need a straightforward CRM solution. Insightly offers a user-friendly interface and a range of features, including contact management, lead tracking, project management, and task management. It integrates with popular accounting software and offers a free plan for up to two users. Insightly’s focus on project management can be particularly helpful for accounting firms that manage multiple client projects simultaneously.

- Key Features:

- Contact management

- Lead tracking

- Project management

- Task management

- Email integration

- Reporting and analytics

- Integration with accounting software

- Pricing: Free plan (up to 2 users); Paid plans start at $29/user/month (billed annually).

- Pros: Easy to use, affordable, good project management features, integrates with accounting software.

- Cons: Fewer features than some other options, can be limiting for firms that need advanced marketing automation.

6. Agile CRM

Why it’s great: Agile CRM is a great option for small accounting firms that want a CRM that integrates sales, marketing, and customer service into a single platform. It offers a free plan for up to 10 users, making it attractive for small teams. Agile CRM provides a user-friendly interface and a range of features, including contact management, lead tracking, email marketing, and helpdesk functionality. Its focus on automation allows you to streamline your workflows and improve efficiency. Agile CRM also offers a good selection of integrations, including accounting software, making it a versatile choice for accounting practices.

- Key Features:

- Contact management

- Lead tracking

- Email marketing

- Helpdesk functionality

- Sales automation

- Reporting and analytics

- Good selection of integrations

- Free plan for up to 10 users

- Pricing: Free plan (up to 10 users); Paid plans start at $9.99/user/month (billed annually).

- Pros: All-in-one platform, affordable, free plan, good automation features.

- Cons: Interface can feel less polished than some other options, reporting capabilities may be less advanced than other CRMs.

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision, and it’s not a one-size-fits-all situation. Here’s a step-by-step guide to help you select the perfect CRM for your small accounting firm:

- Assess Your Needs: Before you start looking at different CRM systems, take some time to assess your firm’s specific needs. What are your pain points? What processes do you want to improve? What features are most important to you? Consider factors like the size of your team, your budget, and your long-term growth goals.

- Define Your Goals: What do you hope to achieve with a CRM? Are you looking to improve client relationships, increase efficiency, generate more leads, or all of the above? Having clear goals will help you evaluate different CRM systems and determine which ones align with your objectives.

- Set Your Budget: CRM systems vary widely in price. Determine how much you’re willing to spend on a CRM, and factor in the cost of implementation, training, and ongoing maintenance. Remember to consider the long-term return on investment (ROI) when evaluating different pricing plans.

- Research Different CRM Systems: Once you have a clear understanding of your needs, goals, and budget, start researching different CRM systems. Read reviews, compare features, and visit vendor websites. Consider the options we’ve discussed above, and look for CRMs that are specifically designed for accountants or have strong integrations with accounting software.

- Prioritize Key Features: Make a list of the features that are most important to your firm. This might include contact management, lead tracking, email integration, reporting and analytics, and integration with your accounting software.

- Evaluate Integrations: Ensure the CRM you choose integrates with your existing software, including your accounting software, email provider, and other tools you use. This will streamline your workflows and eliminate manual data entry.

- Consider User-Friendliness: The CRM should be easy for your team to use. Look for a user-friendly interface, intuitive navigation, and helpful tutorials or training resources.

- Read Reviews and Testimonials: See what other accountants are saying about different CRM systems. Read online reviews, case studies, and testimonials to get a sense of the pros and cons of each option.

- Request Demos and Trials: Most CRM vendors offer free demos or trial periods. Take advantage of these opportunities to test out different systems and see how they work in practice.

- Choose a System and Implement It: Once you’ve narrowed down your options, choose the CRM that best fits your needs and budget. Develop an implementation plan, train your team, and start using the CRM to manage your client relationships and grow your business.

Tips for Successful CRM Implementation

Implementing a CRM system can be a game-changer for your accounting firm, but it’s important to do it right. Here are some tips for a successful CRM implementation:

- Get Buy-In from Your Team: Involve your team in the decision-making process and get their buy-in. Explain the benefits of the CRM and how it will improve their workflows. Provide adequate training and support to ensure they feel comfortable using the system.

- Clean Up Your Data: Before you import your client data into the CRM, take the time to clean it up. Remove duplicate entries, correct errors, and ensure all information is accurate and up-to-date.

- Customize the CRM to Your Needs: Tailor the CRM to your specific needs and workflows. Customize fields, create custom reports, and automate tasks to streamline your processes.

- Integrate with Your Existing Software: Integrate the CRM with your accounting software, email provider, and other tools you use. This will eliminate manual data entry and ensure data consistency.

- Provide Ongoing Training and Support: CRM systems are constantly evolving. Provide ongoing training and support to your team to ensure they’re using the system effectively.

- Monitor and Evaluate Your Results: Track your progress and measure the ROI of your CRM implementation. Use the data and analytics provided by the CRM to identify areas for improvement and optimize your strategies.

- Be Patient and Persistent: It takes time to fully implement a CRM and see the benefits. Be patient, persistent, and stay committed to using the system effectively.

The Bottom Line: Choosing the Best CRM for Your Accounting Firm

Choosing the best CRM for small accountants is an investment in your firm’s future. By carefully considering your needs, researching different options, and following the tips outlined in this guide, you can select a CRM that will help you streamline your operations, nurture client relationships, and achieve your business goals. Remember to focus on the features that matter most to your practice, prioritize integrations with your existing software, and get your team on board. With the right CRM in place, you’ll be well-equipped to thrive in today’s competitive accounting landscape.

The perfect CRM is out there. By taking the time to find the right solution, you can equip your firm with the tools it needs to not only survive but also to thrive. Good luck, and happy CRM-ing!