The Ultimate Guide to the Best CRM for Small Accounting Firms: Boost Efficiency and Client Satisfaction

The Ultimate Guide to the Best CRM for Small Accounting Firms: Boost Efficiency and Client Satisfaction

Running a small accounting firm is no walk in the park. You’re juggling numbers, deadlines, clients, and a whole lot more. In the whirlwind of it all, it’s easy for things to slip through the cracks, clients to feel neglected, and opportunities to be missed. But what if there was a way to streamline your operations, keep your clients happy, and ultimately, grow your business? The answer lies in a Customer Relationship Management (CRM) system specifically tailored for small accounting firms. This comprehensive guide will delve into the world of CRM, explore the best options available, and show you how to choose the perfect one to transform your practice.

Why Your Small Accounting Firm Needs a CRM

You might be thinking, “I’m a small firm; do I really need a CRM?” The short answer is a resounding yes. While the initial investment might seem daunting, the long-term benefits of a CRM far outweigh the costs. Let’s break down why a CRM is essential for your accounting firm:

- Centralized Client Information: Imagine having all your client data – contact details, financial history, communication logs, and project status – in one easily accessible place. No more sifting through spreadsheets, emails, and sticky notes. A CRM provides a single source of truth for all client-related information, saving you time and reducing the risk of errors.

- Improved Client Relationships: A CRM allows you to personalize your interactions with clients. By understanding their needs, preferences, and past interactions, you can provide tailored services and build stronger, more trusting relationships. Happy clients are loyal clients, and loyal clients are the lifeblood of any accounting firm.

- Streamlined Workflow and Increased Efficiency: CRM systems automate many of the repetitive tasks associated with client management, such as sending reminders, scheduling appointments, and tracking progress. This frees up your time to focus on more strategic activities, like providing expert advice and growing your business.

- Enhanced Collaboration: A CRM facilitates seamless collaboration among your team members. Everyone has access to the same client information, ensuring that everyone is on the same page and can contribute effectively.

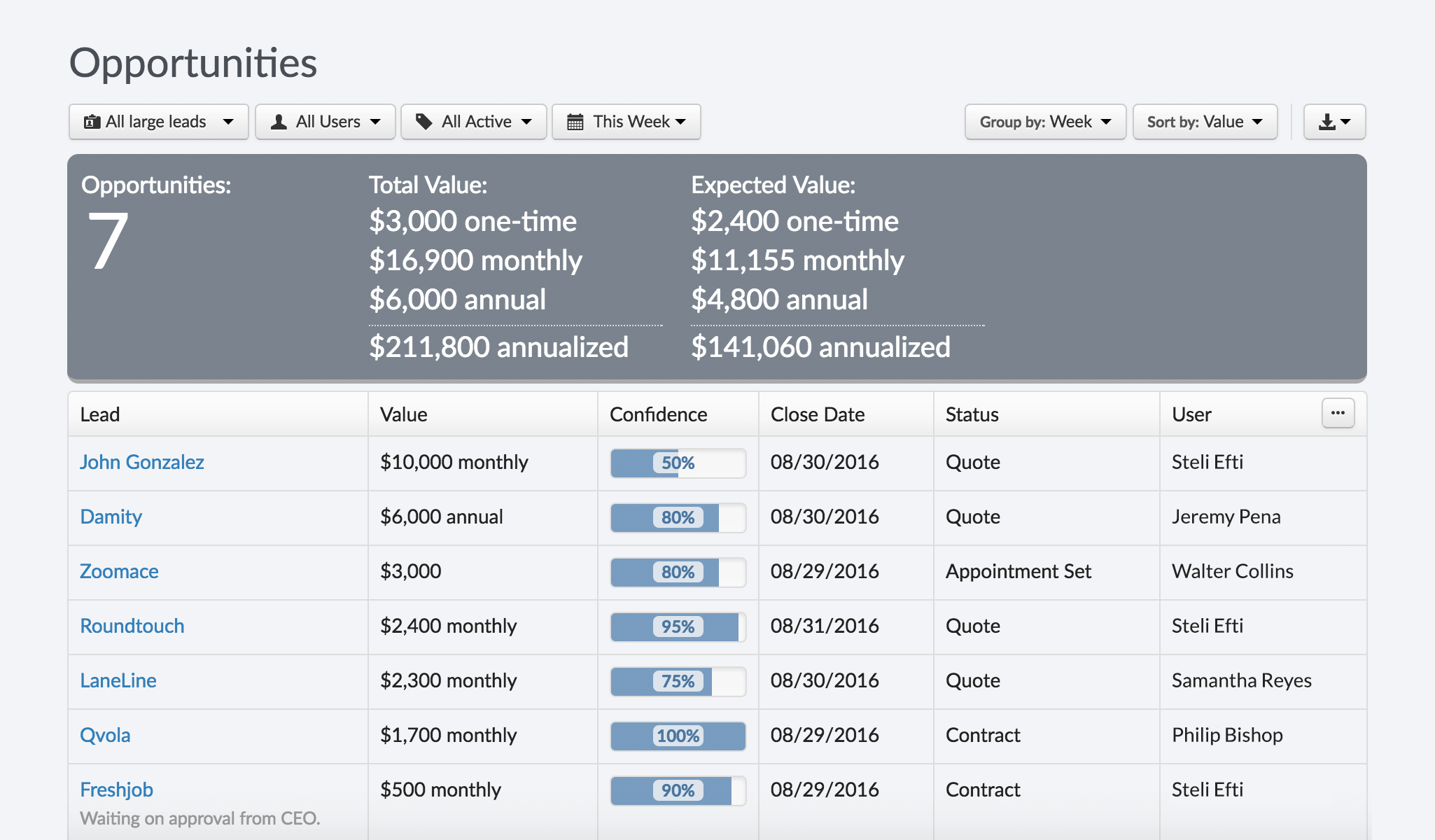

- Better Lead Management: A CRM can help you track and manage potential clients, from initial contact to conversion. You can nurture leads, identify opportunities, and close deals more effectively.

- Data-Driven Decision Making: CRM systems provide valuable insights into your business performance. You can track key metrics, analyze trends, and make data-driven decisions to improve your operations and profitability.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider the following key features:

- Contact Management: The ability to store and organize client contact information, including names, addresses, phone numbers, email addresses, and more.

- Client Segmentation: The ability to segment your clients based on various criteria, such as industry, revenue, or service needs. This allows you to personalize your marketing and service offerings.

- Communication Tracking: The ability to track all communications with clients, including emails, phone calls, and meetings.

- Task Management: The ability to create and assign tasks to team members, track deadlines, and monitor progress.

- Appointment Scheduling: The ability to schedule and manage appointments with clients.

- Reporting and Analytics: The ability to generate reports and analyze data to track key metrics and identify areas for improvement.

- Integration with Accounting Software: Seamless integration with your existing accounting software (e.g., QuickBooks, Xero) is crucial to avoid data silos and streamline your workflow.

- Security and Compliance: The CRM should offer robust security features to protect sensitive client data and comply with relevant regulations, such as GDPR and CCPA.

- Mobile Accessibility: The ability to access the CRM from your mobile devices, so you can stay connected with clients and your team, even when you’re on the go.

- Automation: Automate repetitive tasks like sending invoices and payment reminders.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed for small accounting firms. Each has its own strengths and weaknesses, so consider your specific needs and budget when making your decision.

1. HubSpot CRM

Overview: HubSpot CRM is a free, powerful, and user-friendly CRM that’s a great starting point for small businesses. While the free version has limitations, it offers a robust set of features that can help you manage contacts, track deals, and automate marketing tasks.

Key Features for Accountants:

- Free forever plan with core CRM functionality.

- Contact management, deal tracking, and task management.

- Email tracking and templates.

- Integration with popular marketing and sales tools.

- Excellent user-friendly interface and ease of use.

Pros: Free to start, easy to use, strong features for contact management and sales. Excellent for lead management and nurturing.

Cons: The free version has limitations on the number of contacts, emails, and storage. Advanced features require paid upgrades.

2. Zoho CRM

Overview: Zoho CRM is a comprehensive CRM solution that offers a wide range of features at a competitive price. It’s a good choice for small accounting firms that need a feature-rich CRM without breaking the bank.

Key Features for Accountants:

- Contact management, lead management, and sales automation.

- Workflow automation to streamline tasks.

- Customizable dashboards and reports.

- Integration with Zoho’s suite of business apps.

- Good pricing plans, including a free plan for a limited number of users.

Pros: Feature-rich, affordable, and offers a wide range of integrations. Excellent for sales and marketing automation.

Cons: Can be overwhelming for beginners due to the sheer number of features. The interface can be a bit clunky.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM that is known for its intuitive interface and visual pipeline management. It’s a great option for accounting firms that want to track their sales process and close more deals.

Key Features for Accountants:

- Visual sales pipeline management.

- Contact and deal management.

- Email integration and tracking.

- Workflow automation.

- Easy-to-use interface.

Pros: User-friendly, visually appealing, and excellent for sales pipeline management. Easy to set up and get started.

Cons: Less focus on marketing automation compared to some other CRMs. Might not be ideal if you need a full-fledged marketing suite.

4. Freshsales (by Freshworks)

Overview: Freshsales is a CRM that focuses on sales and customer engagement. It offers features like built-in phone, email, and chat to help accounting firms engage with their clients effectively.

Key Features for Accountants:

- Contact management and lead scoring.

- Built-in phone, email, and chat.

- Sales automation and workflow automation.

- Customizable reports and dashboards.

- Excellent for sales and customer service.

Pros: Affordable, easy to use, and strong features for sales and customer engagement. Great for businesses that value communication.

Cons: Can be overwhelming with its numerous features. Some users report occasional performance issues.

5. Salesforce Sales Cloud

Overview: Salesforce is a leading CRM provider, and Sales Cloud is its flagship product. While it’s a more complex and expensive option, it offers a vast array of features and customization options, making it suitable for larger, more established accounting firms.

Key Features for Accountants:

- Comprehensive contact and account management.

- Sales process automation.

- Extensive reporting and analytics.

- Customization options to tailor the CRM to your specific needs.

- Integration with a wide range of third-party apps.

Pros: Feature-rich, scalable, and highly customizable. Offers a wide range of integrations and a large ecosystem of apps.

Cons: Expensive, complex to set up and manage, and requires a significant time investment to learn. Might be overkill for smaller firms.

6. Insightly

Overview: Insightly is a CRM designed to help businesses manage their sales, marketing, and project management all in one place. It’s particularly well-suited for small businesses looking for a CRM that combines client management with project tracking.

Key Features for Accountants:

- Contact and lead management.

- Project management capabilities.

- Workflow automation.

- Integration with popular business apps.

- User-friendly interface.

Pros: Combines CRM and project management. Easy to use and offers a good balance of features. Affordable pricing.

Cons: Project management features might not be as robust as dedicated project management software. Reporting capabilities could be more advanced.

7. Keap (formerly Infusionsoft)

Overview: Keap is a CRM and sales and marketing automation platform designed for small businesses. It’s a great choice for accounting firms that want to automate their sales and marketing efforts.

Key Features for Accountants:

- Contact management and lead scoring.

- Email marketing automation.

- Sales automation and pipeline management.

- E-commerce integration (if applicable).

- Powerful automation capabilities.

Pros: Excellent for sales and marketing automation. Offers a wide range of features. Good for lead generation and nurturing.

Cons: Can be expensive, and the learning curve can be steep. The interface might seem complex initially.

8. Monday.com

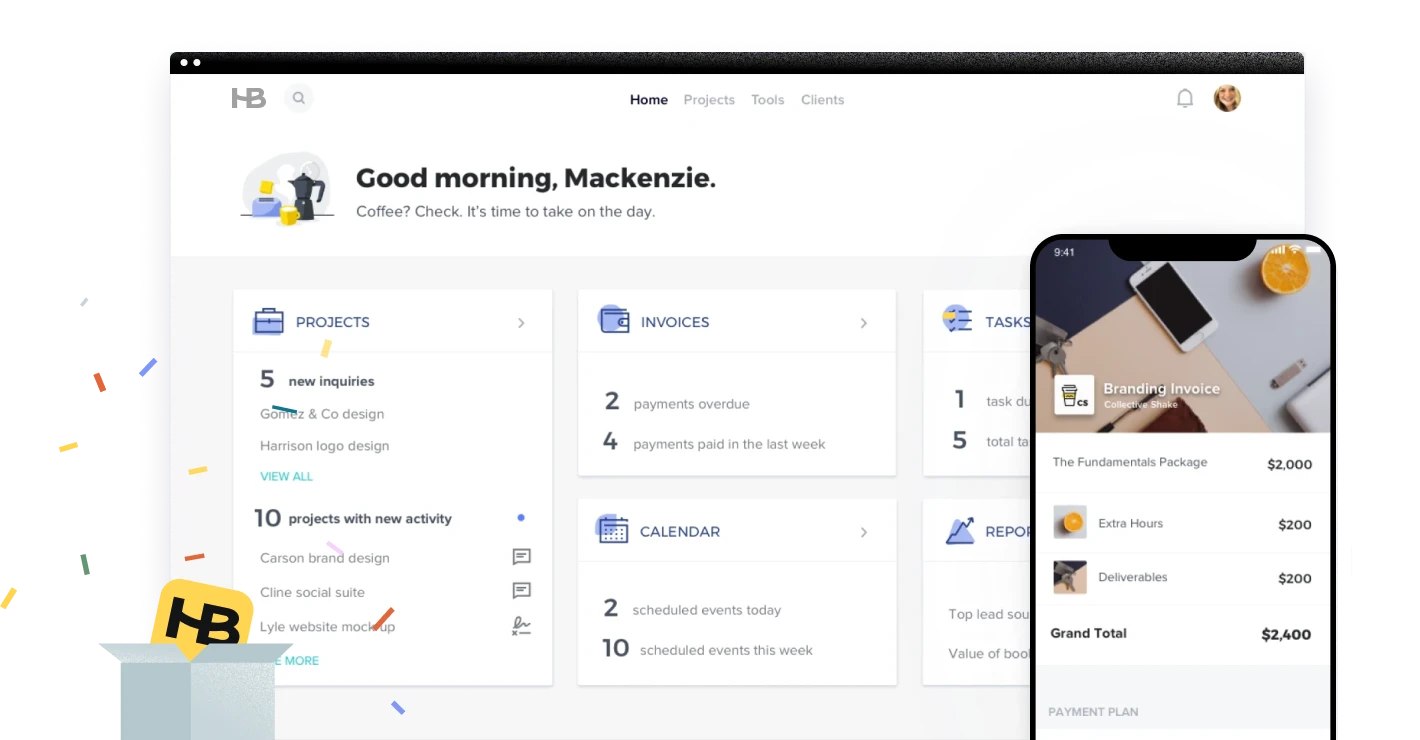

Overview: While not strictly a CRM, Monday.com is a versatile work operating system that can be used as a CRM. It’s ideal for accounting firms that want a highly customizable and visually appealing platform to manage their client relationships and projects.

Key Features for Accountants:

- Highly customizable boards for client management.

- Workflow automation.

- Project management capabilities.

- Collaboration tools.

- Visual and user-friendly interface.

Pros: Highly customizable and visually appealing. Excellent for project management and collaboration. Easy to adapt to your workflow.

Cons: Might require more setup and customization than dedicated CRMs. Not specifically designed for CRM, so some features might be missing.

Choosing the Right CRM for Your Accounting Firm: A Step-by-Step Guide

Choosing the right CRM is a critical decision. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start shopping for a CRM, take some time to assess your firm’s specific needs. What are your pain points? What tasks do you want to automate? What features are most important to you?

- Define Your Budget: CRM systems vary in price, from free to thousands of dollars per month. Determine how much you’re willing to spend on a CRM, considering the initial setup costs, ongoing subscription fees, and any training or support costs.

- Identify Your Must-Have Features: Make a list of the features that are essential for your firm. This might include contact management, client segmentation, communication tracking, integration with your accounting software, and mobile accessibility.

- Research CRM Options: Once you know your needs, start researching different CRM systems. Read reviews, compare features, and consider the pricing plans.

- Request Demos and Free Trials: Most CRM providers offer demos and free trials. Take advantage of these opportunities to test the software and see if it’s a good fit for your firm.

- Consider Integration with Other Tools: Make sure the CRM integrates with your existing accounting software, email marketing platform, and other tools you use.

- Evaluate User Friendliness: Choose a CRM that is easy to use and navigate. The more user-friendly the CRM, the more likely your team will actually use it.

- Think About Scalability: Consider your firm’s growth plans. Choose a CRM that can scale with your business as you add more clients and team members.

- Consider Security and Compliance: Ensure that the CRM offers robust security features to protect sensitive client data and complies with relevant regulations.

- Get Input from Your Team: Involve your team in the decision-making process. Get their feedback on the different CRM options and choose the one that best meets everyone’s needs.

Implementing Your New CRM: Best Practices

Once you’ve chosen a CRM, the real work begins: implementation. Here are some best practices to ensure a smooth implementation process:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps involved, the timeline, and the resources needed.

- Clean Up Your Data: Before importing your data into the CRM, clean it up to remove duplicates, correct errors, and ensure accuracy.

- Import Your Data: Import your client data, including contact information, financial history, and communication logs.

- Customize the CRM: Customize the CRM to meet your specific needs, such as adding custom fields, creating workflows, and setting up reports.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM. Ensure that everyone understands the features and how to use them effectively.

- Establish Clear Processes: Define clear processes for how your team will use the CRM, such as how to enter data, track communications, and manage tasks.

- Monitor and Refine: Monitor your team’s use of the CRM and make adjustments as needed. Regularly review your processes and identify areas for improvement.

- Provide Ongoing Support: Provide ongoing support to your team to help them use the CRM effectively. This might include regular training sessions, online documentation, and access to technical support.

- Integrate, Integrate, Integrate: Ensure the CRM integrates with the other tools your firm uses, like accounting software and email marketing platforms.

- Stay Committed: CRM implementation is an ongoing process. Stay committed to using the CRM and regularly reviewing and refining your processes to get the most out of your investment.

Maximizing the Benefits of Your CRM

To truly maximize the benefits of your CRM, consider these tips:

- Use the CRM Consistently: Make sure everyone on your team uses the CRM consistently to ensure data accuracy and completeness.

- Track Key Metrics: Track key metrics, such as client acquisition cost, client retention rate, and revenue per client, to measure the effectiveness of your CRM.

- Analyze Your Data: Regularly analyze your CRM data to identify trends, insights, and areas for improvement.

- Personalize Your Client Interactions: Use the CRM to personalize your interactions with clients, such as sending birthday greetings, providing tailored advice, and offering customized services.

- Automate Your Tasks: Automate repetitive tasks, such as sending invoices, scheduling appointments, and following up with leads, to save time and improve efficiency.

- Integrate with Other Tools: Integrate your CRM with other tools you use, such as your accounting software, email marketing platform, and project management software, to streamline your workflow.

- Provide Excellent Customer Service: Use your CRM to provide excellent customer service, such as responding to client inquiries promptly, resolving issues efficiently, and exceeding client expectations.

- Continuously Improve: Continuously review your CRM processes and identify areas for improvement. Make adjustments as needed to optimize your CRM and maximize its benefits.

The Future of CRM in Accounting

The world of CRM is constantly evolving, and the future holds exciting possibilities for accounting firms. Here are some trends to watch:

- Artificial Intelligence (AI): AI-powered CRM systems will become more prevalent, automating tasks, providing insights, and personalizing client interactions.

- Increased Automation: CRM systems will offer even more automation capabilities, streamlining workflows and freeing up accountants to focus on higher-value activities.

- Enhanced Integration: CRM systems will integrate with a wider range of tools and platforms, creating a more seamless and efficient workflow.

- Mobile-First Design: CRM systems will become even more mobile-friendly, allowing accountants to stay connected with clients and their team from anywhere.

- Focus on Client Experience: CRM systems will increasingly focus on enhancing the client experience, providing personalized services and building stronger relationships.

Conclusion: Embracing CRM for a Thriving Accounting Firm

Choosing and implementing the right CRM is a significant step towards building a successful and thriving accounting firm. By centralizing client information, improving client relationships, streamlining your workflow, and gaining valuable insights, you can transform your practice and achieve your business goals.

The key is to choose a CRM that aligns with your firm’s specific needs, budget, and growth plans. Remember to assess your needs, define your budget, research your options, and take advantage of demos and free trials. Once you’ve chosen a CRM, implement it carefully, train your team, and establish clear processes.

By embracing CRM, you’ll not only improve your efficiency and client satisfaction but also position your firm for long-term success in an increasingly competitive market. So, take the plunge, explore the options, and embark on the journey to a more efficient, client-focused, and profitable accounting firm. The future is now, and it’s powered by CRM.