The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

Running a small accounting firm is no easy feat. You’re juggling client relationships, financial data, compliance, and the constant pressure to grow your business. In today’s digital landscape, having the right tools can make all the difference between struggling to stay afloat and thriving. One of the most crucial tools for any modern accounting practice is a Customer Relationship Management (CRM) system. But with so many options available, choosing the best CRM for small accountants can feel overwhelming.

This comprehensive guide will walk you through everything you need to know about CRMs for small accounting firms. We’ll explore the benefits, key features to look for, and provide in-depth reviews of some of the top CRM solutions tailored for accountants. By the end of this article, you’ll be well-equipped to choose the perfect CRM to streamline your operations, enhance client relationships, and ultimately, boost your profitability.

Why Your Small Accounting Firm Needs a CRM

In the past, many small accounting firms relied on spreadsheets, email inboxes, and memory to manage client interactions and data. This approach, while functional, is incredibly inefficient and prone to errors. A CRM system offers a centralized, organized, and automated solution to these challenges. Here’s why a CRM is essential for your small accounting firm:

- Improved Client Relationships: A CRM allows you to store detailed client information, including contact details, communication history, financial data, and preferences. This enables you to personalize your interactions, anticipate their needs, and provide exceptional service. Happy clients are loyal clients, and loyal clients are the lifeblood of any accounting practice.

- Enhanced Organization and Efficiency: Say goodbye to scattered spreadsheets and endless email searches. A CRM centralizes all client-related information in one place, making it easy to find what you need, when you need it. This saves you valuable time and reduces the risk of errors. Time is money, and a CRM helps you make the most of both.

- Automated Tasks and Workflows: CRMs can automate many repetitive tasks, such as sending appointment reminders, following up on leads, and generating invoices. This frees up your time to focus on more strategic activities, such as business development and providing high-value services to your clients.

- Better Lead Management: A CRM helps you track and nurture leads, ensuring that no potential client falls through the cracks. You can segment your leads based on their needs and interests, and tailor your marketing efforts accordingly. This leads to a higher conversion rate and more new clients.

- Data-Driven Decision Making: CRMs provide valuable insights into your client base, your sales process, and your overall business performance. By analyzing this data, you can identify areas for improvement, make informed decisions, and drive growth.

- Increased Revenue: By improving client relationships, streamlining operations, and optimizing your sales process, a CRM can directly contribute to increased revenue. Happy clients are more likely to refer new business, and a well-managed sales pipeline leads to more closed deals.

- Compliance and Security: Many CRMs offer robust security features and compliance capabilities, ensuring that your client data is protected and that you meet regulatory requirements. This is critical in the accounting industry, where data privacy is paramount.

Key Features to Look for in a CRM for Small Accountants

Not all CRMs are created equal. When choosing a CRM for your small accounting firm, it’s essential to focus on features that are specifically relevant to your needs. Here are some key features to prioritize:

- Contact Management: This is the core function of any CRM. It should allow you to store and organize client contact information, including names, addresses, phone numbers, email addresses, and other relevant details.

- Client Segmentation: The ability to segment your clients based on various criteria, such as industry, revenue, or service needs, is crucial for targeted marketing and personalized service.

- Communication Tracking: A CRM should track all communication with clients, including emails, phone calls, and meetings. This provides a complete history of your interactions and helps you stay organized.

- Task Management: The ability to create and assign tasks to team members is essential for managing deadlines and ensuring that all client-related activities are completed on time.

- Workflow Automation: Look for a CRM that can automate repetitive tasks, such as sending appointment reminders, following up on leads, and generating invoices.

- Reporting and Analytics: A CRM should provide reports and analytics on your client base, your sales process, and your overall business performance. This data will help you make informed decisions and track your progress.

- Integration with Accounting Software: Integration with your accounting software (e.g., QuickBooks, Xero) is crucial for seamless data transfer and eliminating manual data entry.

- Security and Compliance: Choose a CRM that offers robust security features and complies with industry regulations, such as GDPR and CCPA.

- Mobile Accessibility: The ability to access your CRM data from your mobile device is essential for staying connected and productive, especially if you meet with clients on-site.

- Scalability: Choose a CRM that can grow with your business. As your firm expands, you’ll need a CRM that can handle increased data volume and user access.

- User-Friendly Interface: The CRM should have an intuitive and easy-to-use interface to ensure that your team can quickly adopt and utilize the system.

- Customer Support: Reliable customer support is crucial for resolving any issues or questions you may have. Look for a CRM provider that offers responsive support channels, such as phone, email, and live chat.

Top CRM Solutions for Small Accountants: A Detailed Review

Now, let’s dive into some of the best CRM solutions specifically designed for small accounting firms. We’ll evaluate each CRM based on its features, pricing, ease of use, and overall suitability for the accounting industry.

1. HubSpot CRM

Overview: HubSpot CRM is a popular and versatile CRM platform that offers a free version with a wide range of features. It’s known for its user-friendliness and comprehensive marketing and sales tools. While it isn’t exclusively designed for accountants, its flexibility and extensive integrations make it a strong contender.

Key Features for Accountants:

- Contact Management: Robust contact management features allow you to store and organize client information, including custom properties for financial data.

- Communication Tracking: Tracks emails, calls, and meetings, providing a complete history of client interactions.

- Task Management: Create and assign tasks to team members to manage deadlines and ensure timely completion of client work.

- Sales Automation: Automate sales processes, such as lead nurturing and follow-up emails.

- Reporting and Analytics: Provides detailed reports on sales performance and client engagement.

- Integrations: Integrates with popular accounting software like QuickBooks and Xero through its vast app marketplace.

- Free Version: Offers a generous free plan with core CRM features.

Pros:

- User-friendly interface.

- Extensive free features.

- Strong marketing and sales tools.

- Large app marketplace for integrations.

Cons:

- The free version has limitations on features and storage.

- Some advanced features may require paid plans.

- Not specifically designed for accountants, requiring some customization.

Pricing: Free plan available. Paid plans start from around $45 per month, offering more features and usage limits.

2. Pipedrive

Overview: Pipedrive is a sales-focused CRM that’s known for its intuitive interface and visual pipeline management. While not specifically designed for accountants, its ease of use and focus on sales make it a good option for firms looking to streamline their lead management and sales processes.

Key Features for Accountants:

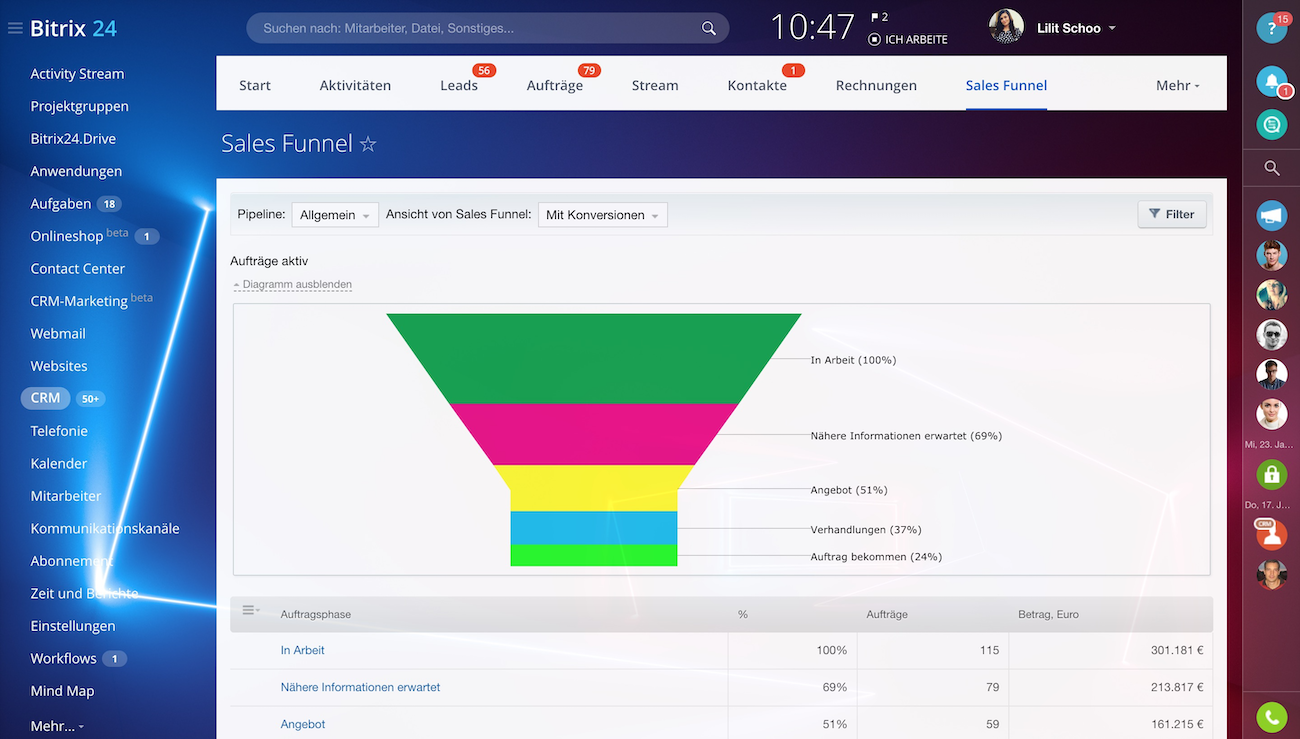

- Visual Pipeline Management: Track deals and progress through a visual sales pipeline.

- Contact Management: Store and organize client contact information.

- Communication Tracking: Track emails, calls, and meetings.

- Task Management: Create and assign tasks to team members.

- Workflow Automation: Automate sales tasks, such as sending follow-up emails.

- Reporting and Analytics: Provides reports on sales performance and pipeline activity.

- Integrations: Integrates with popular accounting software and other business tools.

Pros:

- User-friendly interface.

- Visual pipeline management.

- Strong focus on sales automation.

- Good integrations.

Cons:

- Less emphasis on marketing features compared to some other CRMs.

- May require some customization for accounting-specific needs.

Pricing: Paid plans start from around $12.50 per user per month, billed annually.

3. Zoho CRM

Overview: Zoho CRM is a comprehensive CRM platform that offers a wide range of features and customization options. It’s a good option for small accounting firms looking for a feature-rich CRM at a competitive price. Zoho CRM is a versatile CRM, suitable for various business types, including accounting firms, with its extensive features and customizability.

Key Features for Accountants:

- Contact Management: Robust contact management features, including custom fields for financial data.

- Lead Management: Track and nurture leads through the sales pipeline.

- Workflow Automation: Automate tasks, such as sending emails and updating records.

- Reporting and Analytics: Provides detailed reports on sales, marketing, and client engagement.

- Customization: Highly customizable to fit the specific needs of your accounting firm.

- Integrations: Integrates with a wide range of business tools, including accounting software like QuickBooks and Xero.

- Mobile App: Offers a mobile app for accessing data on the go.

Pros:

- Feature-rich platform.

- Highly customizable.

- Competitive pricing.

- Good integrations.

Cons:

- Can be overwhelming for beginners due to the wide range of features.

- The user interface can be less intuitive than some other CRMs.

Pricing: Free plan available for up to 3 users. Paid plans start from around $14 per user per month, billed annually.

4. Freshsales

Overview: Freshsales is a sales-focused CRM platform that’s known for its ease of use and affordability. It’s a good option for small accounting firms that prioritize sales and lead management. Freshsales is an ideal choice for accounting firms looking to streamline their sales processes and improve client relationships.

Key Features for Accountants:

- Contact Management: Organise contact information and client details effectively.

- Lead Management: Efficient lead tracking and nurturing capabilities.

- Email Integration: Seamless email integration for streamlined communication.

- Workflow Automation: Automate sales and client management tasks.

- Reporting and Analytics: Generate valuable insights with comprehensive reporting.

- Customization: Tailor the CRM to meet specific accounting firm needs.

- Integrations: Integrate with popular business tools, including accounting software.

Pros:

- User-friendly and intuitive interface.

- Affordable pricing plans.

- Excellent sales automation features.

- Good customer support.

Cons:

- May lack some advanced features compared to other CRMs.

- The free plan has limited functionality.

Pricing: Free plan available. Paid plans start at around $15 per user per month, billed annually.

5. Capsule CRM

Overview: Capsule CRM is a user-friendly CRM designed for small businesses. Its simplicity and ease of use make it a great choice for accounting firms that want a straightforward solution without a steep learning curve. Capsule CRM focuses on making customer relationship management simple and effective.

Key Features for Accountants:

- Contact Management: Organizes contact details and client information.

- Sales Pipeline: Manage and track sales opportunities effectively.

- Task Management: Assign tasks and set deadlines.

- Communication Tracking: Keep a record of interactions with clients.

- Integrations: Integrates with popular apps like Xero and Google Workspace.

- Reporting: Generate reports on sales and client activities.

Pros:

- Easy to set up and use.

- Straightforward interface.

- Good value for money.

- Excellent customer support.

Cons:

- May lack some advanced features for complex needs.

- Limited customization options.

Pricing: Paid plans start from around $18 per user per month, billed annually.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the best CRM for your small accounting firm requires careful consideration. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start evaluating CRM solutions, take the time to assess your firm’s specific needs. What are your pain points? What are your goals for using a CRM? Identify the features that are most important to you, such as contact management, lead tracking, or workflow automation.

- Define Your Budget: Determine how much you’re willing to spend on a CRM. Consider the initial setup costs, ongoing subscription fees, and any potential costs for training or customization. There are CRM options available at various price points, from free plans to enterprise-level solutions.

- Research CRM Options: Explore the different CRM solutions available, focusing on those that are specifically designed or well-suited for accounting firms. Read reviews, compare features, and consider the pros and cons of each option. The reviews above should give you a good starting point.

- Evaluate Key Features: Make a list of the key features that are essential for your firm. Prioritize features such as contact management, client segmentation, communication tracking, task management, and integration with your accounting software.

- Consider Integrations: Ensure that the CRM integrates with your existing software and tools, such as your accounting software (e.g., QuickBooks, Xero), email marketing platform, and calendar. Seamless integration will streamline your workflow and eliminate the need for manual data entry.

- Check for Security and Compliance: Verify that the CRM offers robust security features and complies with industry regulations, such as GDPR and CCPA. Data security and privacy are paramount in the accounting industry.

- Look for User-Friendliness: Choose a CRM with an intuitive and user-friendly interface. The system should be easy for your team to learn and use, minimizing training time and maximizing adoption.

- Test Drive the Software: Take advantage of free trials or demos to test out the CRM before committing to a subscription. This will give you a chance to evaluate the features, interface, and overall usability of the software.

- Consider Customer Support: Evaluate the level of customer support offered by the CRM provider. Look for responsive support channels, such as phone, email, and live chat, to ensure that you can get help when you need it.

- Plan for Implementation: Once you’ve chosen a CRM, develop a plan for implementation. This should include data migration, user training, and ongoing support. A well-planned implementation will ensure a smooth transition and maximize the benefits of your new CRM.

Tips for Successfully Implementing a CRM in Your Accounting Firm

Implementing a CRM is a significant step, and to ensure its success, consider these helpful tips:

- Get Buy-In from Your Team: Involve your team in the decision-making process and provide training to ensure they understand how to use the CRM effectively. This will increase adoption and maximize the benefits of the system.

- Migrate Data Carefully: Ensure that your client data is accurately migrated to the CRM. Clean up your data to remove duplicates and ensure that all information is up-to-date.

- Customize the CRM: Tailor the CRM to meet the specific needs of your accounting firm. Customize fields, workflows, and reports to optimize your operations.

- Integrate with Other Tools: Integrate the CRM with your existing software and tools to streamline your workflow and eliminate manual data entry.

- Establish Clear Processes: Define clear processes for using the CRM, such as how to enter data, manage leads, and communicate with clients. This will ensure consistency and efficiency.

- Provide Ongoing Training: Provide ongoing training to your team to ensure they stay up-to-date on the latest features and best practices.

- Monitor and Evaluate: Regularly monitor your CRM usage and evaluate its effectiveness. Make adjustments as needed to optimize your operations and maximize the benefits of the system.

- Use the CRM to its Full Potential: Don’t just use the CRM for basic contact management. Take advantage of its advanced features, such as workflow automation, reporting, and analytics, to streamline your operations and improve your client relationships.

- Stay Consistent: Consistency is key. Make sure your team regularly uses the CRM and follows established processes.

- Be Patient: Implementing a CRM takes time and effort. Be patient and persistent, and you’ll eventually see the benefits.

The Bottom Line: Choosing the Right CRM is an Investment in Your Future

Choosing the best CRM for small accountants is an investment in the future of your firm. By streamlining your operations, enhancing client relationships, and driving growth, a CRM can help you achieve your business goals. The right CRM can significantly improve how you manage your client interactions, track your sales pipeline, and automate your daily tasks. It will not only free up your time but also help you make data-driven decisions, leading to increased efficiency and profitability.

Consider the features, pricing, and ease of use of each CRM option. Evaluate your specific needs and choose the CRM that best fits your firm’s requirements. The best CRM is the one that empowers you to provide exceptional service, build strong client relationships, and ultimately, achieve long-term success. The right CRM can be the cornerstone of a thriving and successful accounting practice.

By following the advice in this guide and carefully selecting the right CRM, you can transform your small accounting firm and set it on the path to sustainable growth and success. Don’t delay – the time to streamline your business and elevate your client relationships is now.