Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

In the fast-paced world of accounting, juggling clients, deadlines, and financial intricacies can feel like a never-ending balancing act. Small accounting firms, in particular, often face the challenge of delivering top-notch service while managing limited resources. That’s where a Customer Relationship Management (CRM) system steps in – a powerful tool designed to streamline operations, enhance client relationships, and ultimately, boost profitability. Choosing the right CRM, however, can be a daunting task. This comprehensive guide delves into the best CRM solutions specifically tailored for small accounting firms, exploring their features, benefits, and how they can transform your practice.

Why Your Small Accounting Firm Needs a CRM

Before diving into specific CRM recommendations, let’s understand why a CRM is indispensable for small accounting firms. In essence, a CRM acts as a centralized hub for all client-related information. It’s far more than just a contact list; it’s a dynamic platform that empowers you to:

- Improve Client Management: Centralize client data, including contact details, communication history, financial records, and service agreements. This provides a 360-degree view of each client, enabling personalized interactions and proactive service.

- Streamline Communication: Manage all client communications, from emails and phone calls to meeting notes and document sharing, within a single system. This ensures that everyone on your team has access to the latest information and avoids communication silos.

- Enhance Collaboration: Facilitate seamless collaboration among team members by sharing client information and project updates in real-time. This fosters transparency, reduces errors, and improves overall efficiency.

- Automate Tasks: Automate repetitive tasks, such as appointment scheduling, email marketing, and follow-up reminders. This frees up valuable time for your team to focus on more strategic activities.

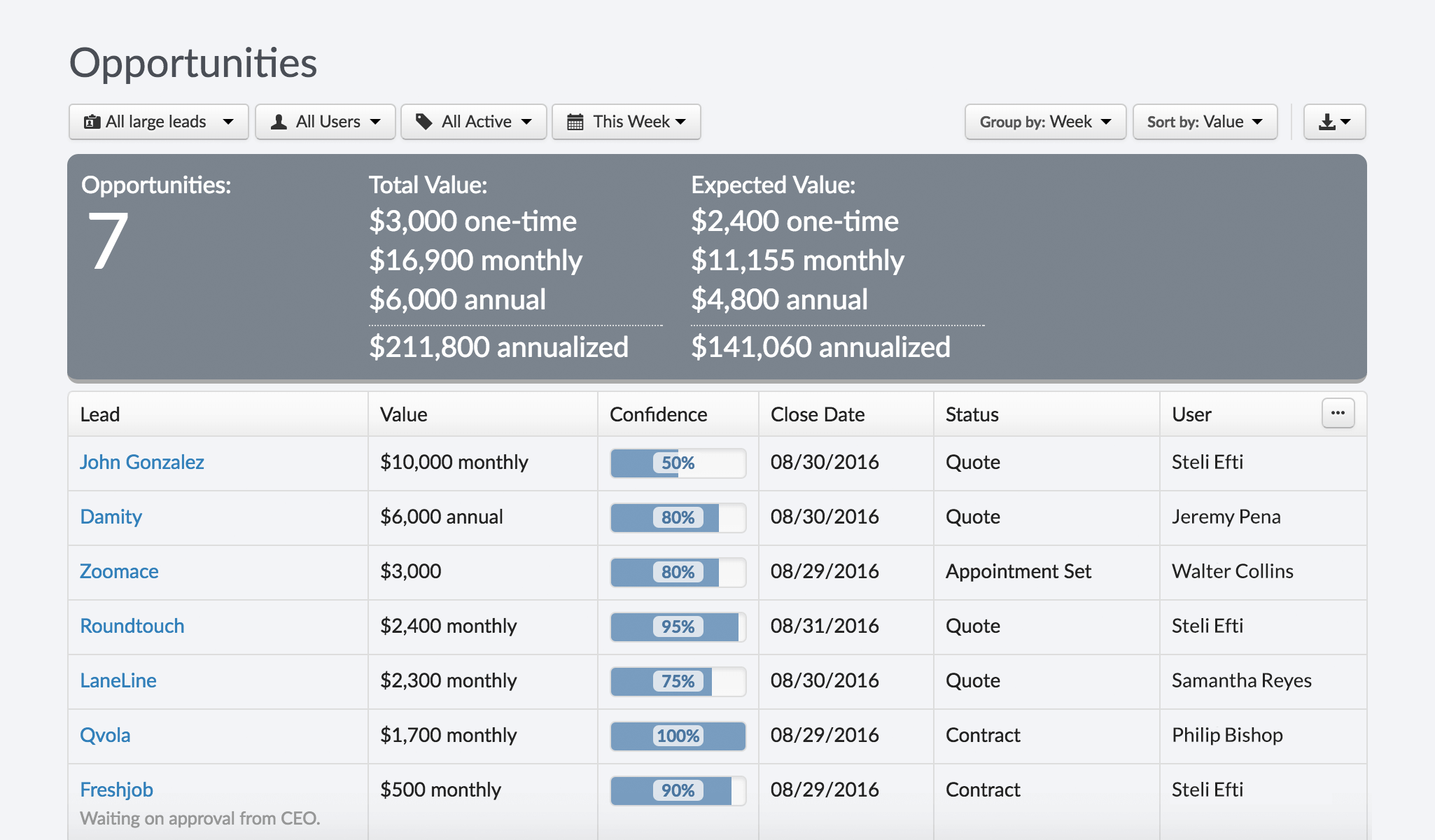

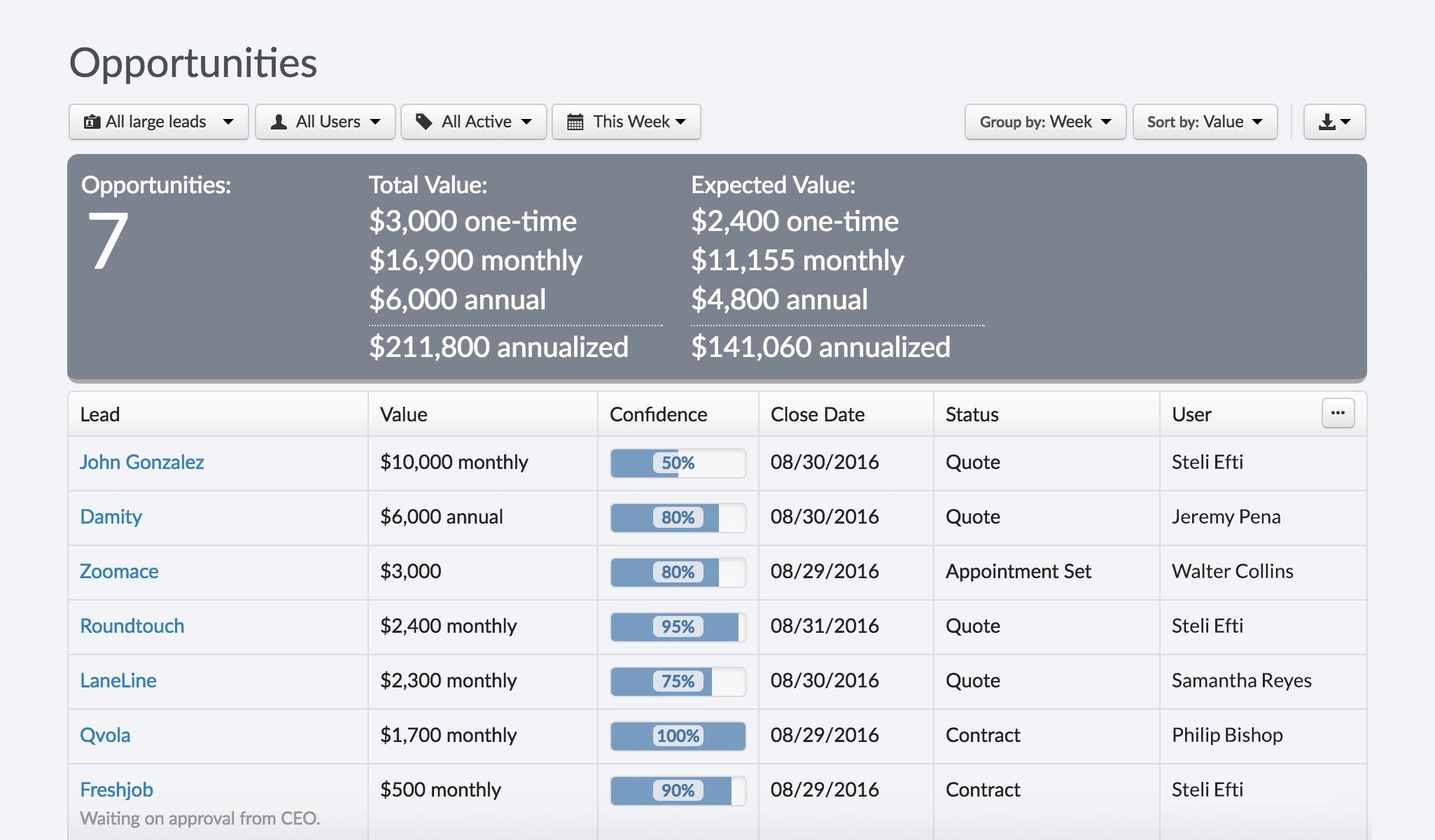

- Boost Sales and Marketing: Track leads, manage sales pipelines, and personalize marketing campaigns to attract new clients and grow your business.

- Increase Efficiency: Automate tasks and streamline workflows, reducing manual data entry and administrative burdens. This leads to increased productivity and allows you to serve more clients without increasing overhead.

- Improve Data Security: Many CRM systems offer robust security features, including data encryption, access controls, and compliance with industry regulations. This helps protect sensitive client information and maintain client trust.

Without a CRM, small accounting firms often rely on spreadsheets, email inboxes, and fragmented systems, leading to inefficiencies, missed opportunities, and a less-than-stellar client experience. A CRM solves these problems by providing a centralized, accessible, and user-friendly platform for managing all aspects of your client relationships.

Key Features to Look for in a CRM for Accountants

When selecting a CRM for your accounting firm, consider these essential features:

- Contact Management: Comprehensive contact management capabilities, including the ability to store and organize client information, track communication history, and manage relationships.

- Lead Management: Features for capturing, nurturing, and tracking leads throughout the sales process, including lead scoring, pipeline management, and automated follow-ups.

- Task and Activity Management: Tools for creating, assigning, and tracking tasks, appointments, and other activities related to client interactions and project management.

- Document Management: Secure storage and organization of client documents, such as tax returns, financial statements, and contracts.

- Email Integration: Seamless integration with your email provider, allowing you to send and receive emails directly from the CRM and track email interactions.

- Reporting and Analytics: Customizable reports and dashboards that provide insights into your firm’s performance, client engagement, and sales activities.

- Integration with Accounting Software: Compatibility with your existing accounting software, such as QuickBooks, Xero, or Sage, to streamline data entry and improve accuracy.

- Workflow Automation: Automation capabilities for streamlining repetitive tasks, such as appointment scheduling, email marketing, and follow-up reminders.

- Mobile Access: Mobile apps or responsive design for accessing client information and managing your CRM on the go.

- Security Features: Robust security features, including data encryption, access controls, and compliance with industry regulations, to protect sensitive client information.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed or well-suited for small accounting firms:

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for its user-friendliness, comprehensive features, and free version. It’s a strong contender for small accounting firms because it offers a robust set of tools, even in its free tier, to manage contacts, track deals, and automate marketing efforts. The intuitive interface makes it easy to learn and implement, which is a significant advantage for firms that may not have dedicated IT staff.

Key Features for Accountants:

- Contact Management: Centralized contact database, allowing accountants to store detailed client information, communication history, and interactions.

- Deal Tracking: Manage potential leads and track them through the sales pipeline.

- Email Integration: Integrates with email providers like Gmail and Outlook, allowing you to track email opens, clicks, and replies.

- Marketing Automation: Automate marketing tasks such as email campaigns and follow-up sequences.

- Reporting and Analytics: Provides insights into sales performance and client engagement.

- Free Version: Offers a powerful free version with core CRM features.

Pros: Free version available, user-friendly interface, strong marketing automation capabilities, good integration with other tools.

Cons: The free version has limitations on the number of contacts and features. More advanced features require paid plans, which can become costly as your firm grows.

2. Zoho CRM

Overview: Zoho CRM is a versatile and affordable CRM system suitable for small businesses. It offers a wide range of features and customization options, making it a good fit for accounting firms looking for a solution that can adapt to their specific needs. Zoho CRM provides excellent value for its price point.

Key Features for Accountants:

- Contact Management: Comprehensive contact management features to store and organize client data.

- Lead Management: Manage leads through the sales pipeline and track their progress.

- Workflow Automation: Automate tasks and processes to improve efficiency.

- Sales Force Automation: Streamline sales activities, such as tracking opportunities and managing quotes.

- Reporting and Analytics: Provides detailed reports and analytics to track performance.

- Integration: Integrates with various apps, including accounting software, email marketing tools, and more.

Pros: Affordable pricing, extensive features, highly customizable, robust integration capabilities.

Cons: The interface can be overwhelming due to the number of features. The learning curve might be steeper than with some other CRM systems.

3. Pipedrive

Overview: Pipedrive is designed with sales teams in mind, making it a strong option for accounting firms that want a CRM focused on managing their sales pipeline and converting leads into clients. It’s known for its visual interface and ease of use. The platform helps accountants stay organized and focused on the most important tasks.

Key Features for Accountants:

- Visual Sales Pipeline: Offers a clear visual representation of the sales pipeline, helping accountants track deals.

- Contact Management: Store and organize client contact information.

- Deal Tracking: Manage deals and track their progress through the pipeline.

- Activity Tracking: Schedule and track activities, such as calls, meetings, and emails.

- Reporting: Provides insights into sales performance.

- Email Integration: Integrates with email providers.

Pros: User-friendly interface, visual sales pipeline, easy to track deals.

Cons: Less focus on marketing automation compared to other CRMs. May not be as feature-rich for non-sales-related activities.

4. Salesforce Sales Cloud

Overview: Salesforce is a leading CRM platform with a wide range of features and customization options. While it can be more complex and expensive than other options, it’s a powerful choice for larger accounting firms or those with complex needs. Salesforce offers a high degree of flexibility and scalability.

Key Features for Accountants:

- Contact Management: Comprehensive contact management features.

- Lead Management: Robust lead management capabilities.

- Sales Automation: Automate sales processes.

- Reporting and Analytics: Offers advanced reporting and analytics.

- Customization: Highly customizable to meet specific business needs.

- Integration: Integrates with a wide range of apps and services.

Pros: Feature-rich, highly customizable, scalable, excellent for larger firms.

Cons: Can be expensive, complex to set up and manage, may be overkill for small firms.

5. Freshsales

Overview: Freshsales is designed for sales-focused teams and provides a user-friendly CRM experience. It’s known for its ease of use and affordability. For accounting firms, it offers a streamlined approach to managing leads and clients.

Key Features for Accountants:

- Contact Management: Store and organize client contact information.

- Lead Management: Manage leads and track them through the sales pipeline.

- Email Tracking: Track email opens, clicks, and replies.

- Built-in Phone: Make and receive calls directly from the CRM.

- Reporting: Provides insights into sales performance.

- Automation: Automate tasks and processes.

Pros: User-friendly interface, affordable pricing, built-in phone features.

Cons: Less feature-rich compared to some other CRMs, may not be ideal for firms with complex needs.

6. Less Annoying CRM

Overview: As the name suggests, Less Annoying CRM focuses on simplicity. It is designed for small businesses and offers a straightforward, easy-to-use interface. For accounting firms, it provides a no-frills solution for managing contacts, tasks, and client interactions.

Key Features for Accountants:

- Contact Management: Simple and effective contact management.

- Task Management: Create and manage tasks related to client interactions.

- Calendar: Integrated calendar for scheduling appointments.

- Reporting: Basic reporting capabilities.

- Affordable Pricing: Offers a straightforward, affordable pricing plan.

Pros: Very easy to use, affordable pricing, no-frills approach.

Cons: Limited features compared to other CRM systems. May not be suitable for firms with complex needs.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM for your small accounting firm requires careful consideration. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Determine your firm’s specific needs and goals. What challenges are you trying to solve? What processes do you want to streamline? What features are essential?

- Define Your Budget: Set a realistic budget for your CRM investment, considering both the initial setup costs and ongoing subscription fees.

- Research CRM Options: Explore the CRM systems mentioned above and other options, taking into account their features, pricing, and reviews.

- Request Demos and Trials: Request demos or free trials from the CRM vendors to experience the software firsthand.

- Evaluate Key Features: Evaluate the CRM systems based on the essential features you identified earlier, such as contact management, lead management, workflow automation, and integration capabilities.

- Consider User-Friendliness: Choose a CRM that is easy to use and has a user-friendly interface. The easier it is to use, the more likely your team will adopt it.

- Assess Integration Capabilities: Ensure that the CRM integrates with your existing accounting software, email provider, and other essential tools.

- Read Reviews and Testimonials: Read online reviews and testimonials from other accounting firms to get insights into their experiences with different CRM systems.

- Consider Scalability: Choose a CRM that can scale with your firm as it grows.

- Make a Decision and Implement: Select the CRM system that best meets your needs and budget, and then develop a detailed implementation plan.

Tips for Successful CRM Implementation

Once you’ve chosen a CRM, proper implementation is crucial for success. Here are some tips:

- Plan Your Implementation: Develop a detailed implementation plan, including timelines, responsibilities, and data migration strategies.

- Clean Up Your Data: Before migrating your data, clean up your existing client data to ensure accuracy and consistency.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM system effectively.

- Customize the CRM: Customize the CRM to meet your firm’s specific needs and workflows.

- Integrate with Other Tools: Integrate the CRM with your existing accounting software, email provider, and other essential tools.

- Monitor and Evaluate: Monitor the CRM’s performance and make adjustments as needed.

- Encourage Adoption: Encourage your team to use the CRM consistently and provide ongoing support.

- Seek Ongoing Support: Take advantage of the vendor’s support resources, such as online documentation, tutorials, and customer support.

The Benefits of a Well-Implemented CRM

Implementing a CRM is an investment that pays dividends. Here are some of the key benefits you can expect:

- Improved Client Satisfaction: By providing personalized service and proactive communication, a CRM can significantly boost client satisfaction.

- Increased Efficiency: Automating tasks and streamlining workflows frees up your team to focus on more value-added activities.

- Enhanced Collaboration: A centralized platform fosters better communication and collaboration among team members.

- Better Decision-Making: Data-driven insights from the CRM enable you to make better decisions about client service, marketing, and business development.

- Increased Revenue: By improving client relationships, streamlining sales processes, and attracting new clients, a CRM can contribute to increased revenue growth.

- Reduced Costs: Automation and increased efficiency can lead to reduced operational costs.

- Improved Data Security: Many CRMs offer robust security features, helping to protect sensitive client information.

Conclusion: Embrace the Power of CRM

Choosing the right CRM for your small accounting firm is a pivotal step toward achieving greater efficiency, improved client relationships, and increased profitability. By carefully evaluating your firm’s needs, researching the best CRM options, and following the implementation tips provided, you can unlock the full potential of a CRM and transform your practice. Don’t let your firm fall behind. Embrace the power of CRM and take your accounting business to the next level. The right CRM system can be a game-changer, providing the tools and insights needed to thrive in today’s competitive landscape. Embrace the future of client management and empower your accounting firm with the right CRM solution.