Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Introduction: The Power of Synergy

In today’s dynamic business landscape, efficiency and customer experience reign supreme. Businesses are constantly seeking ways to streamline their operations, enhance customer relationships, and drive revenue growth. One powerful strategy that achieves all three is the integration of a Customer Relationship Management (CRM) system with a leading payment gateway like PayPal. This article delves deep into the world of CRM integration with PayPal, exploring its benefits, implementation strategies, and real-world applications. Prepare to unlock a new level of business agility and customer satisfaction.

Understanding the Fundamentals: CRM and PayPal

What is a CRM?

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It serves as a centralized hub for all customer-related information, including contact details, purchase history, communication logs, and more. CRM systems empower businesses to:

- Improve customer relationships

- Enhance customer service

- Automate marketing and sales processes

- Gain valuable insights into customer behavior

- Increase sales and revenue

Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

What is PayPal?

PayPal is a global online payment system that enables businesses and individuals to send and receive money securely online. It’s a widely recognized and trusted payment gateway, offering a convenient and secure way for customers to make payments. PayPal supports various payment methods, including credit cards, debit cards, and bank transfers. Its ease of use and global reach make it a preferred choice for businesses of all sizes.

The Benefits of CRM Integration with PayPal

Integrating your CRM with PayPal offers a multitude of advantages that can significantly impact your business’s performance. Here’s a breakdown of the key benefits:

1. Streamlined Payment Processing

One of the most significant advantages is the ability to streamline payment processing. CRM integration with PayPal allows you to:

- Automate invoice generation and payment reminders: Reduce manual tasks and ensure timely payments.

- Process payments directly within your CRM: Eliminate the need to switch between different platforms.

- Track payment status in real-time: Gain instant visibility into payment activity.

- Offer a seamless checkout experience: Provide customers with a frictionless payment process, which can boost conversions.

2. Improved Customer Experience

A seamless payment experience is crucial for customer satisfaction. Integration with PayPal enhances the customer journey by:

- Providing a secure and trusted payment option: PayPal’s reputation for security builds customer confidence.

- Offering multiple payment methods: Cater to different customer preferences and increase the likelihood of successful transactions.

- Personalizing the payment process: Tailor the payment experience based on customer data stored in your CRM.

- Reducing payment errors: Minimize the risk of payment failures, leading to a more positive customer experience.

3. Enhanced Sales and Revenue

CRM integration with PayPal can directly contribute to increased sales and revenue:

- Faster payment cycles: Expedite the time it takes to receive payments, improving cash flow.

- Reduced cart abandonment: A smooth checkout process decreases the likelihood of customers abandoning their purchases.

- Improved conversion rates: A seamless payment experience can lead to higher conversion rates.

- Data-driven insights: Gain valuable insights into customer payment behavior, enabling you to optimize your sales strategies.

4. Better Data Management and Reporting

Integration allows for more comprehensive data management and reporting capabilities:

- Centralized payment data: All payment information is stored within your CRM, providing a single source of truth.

- Automated reporting: Generate detailed reports on sales, revenue, and payment trends.

- Improved data accuracy: Reduce the risk of manual data entry errors.

- Enhanced decision-making: Make informed business decisions based on accurate and up-to-date payment data.

5. Increased Efficiency and Productivity

Automation is key to efficiency. Integration streamlines processes, freeing up your team’s time and resources:

- Automated payment reconciliation: Simplify the process of matching payments with invoices.

- Reduced manual data entry: Eliminate the need to manually enter payment information.

- Improved team collaboration: Provide all team members with access to the same payment data.

- More time for strategic initiatives: Free up your team to focus on higher-value tasks, such as customer engagement and sales strategies.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

Integrating your CRM with PayPal can seem daunting, but with a structured approach, it can be a smooth and rewarding process. Here’s a step-by-step guide:

1. Choose Your CRM and PayPal Integration Method

The first step is to select the CRM platform you’ll be using and determine the integration method that best suits your needs. There are several options:

- Native Integrations: Many CRM platforms offer native integrations with PayPal, which are often the easiest to implement. These integrations are pre-built and require minimal configuration.

- Third-Party Apps and Plugins: If your CRM doesn’t have a native integration, you can often find third-party apps or plugins that provide the necessary functionality. These apps are typically available in the CRM’s app marketplace.

- Custom Integrations: For more complex needs, you might need to develop a custom integration using APIs (Application Programming Interfaces). This option requires technical expertise but offers the most flexibility.

2. Set Up Your PayPal Business Account

If you don’t already have one, you’ll need to create a PayPal business account. This account will allow you to accept payments from customers. Ensure your account is verified and configured to receive payments. Familiarize yourself with PayPal’s terms and conditions and any associated fees.

3. Connect Your CRM to PayPal

The specific steps for connecting your CRM to PayPal will vary depending on the integration method you choose. Generally, you’ll need to:

- Access the integration settings: Within your CRM, locate the settings related to payment gateways or integrations.

- Enter your PayPal credentials: Provide your PayPal business account username and password.

- Configure payment options: Specify the payment methods you want to offer, such as credit cards, debit cards, and PayPal balance.

- Test the integration: Conduct a test transaction to ensure the integration is working correctly.

4. Configure Settings and Customize the Integration

Once the basic connection is established, you can customize the integration to meet your specific business needs. This may include:

- Mapping CRM fields to PayPal fields: Ensure that customer data is accurately synchronized between your CRM and PayPal.

- Setting up automated workflows: Automate tasks such as invoice generation, payment reminders, and order confirmations.

- Customizing the checkout experience: Tailor the payment process to match your brand and customer preferences.

- Configuring reporting and analytics: Set up reports to track sales, revenue, and payment trends.

5. Test Thoroughly and Go Live

Before going live, it’s crucial to thoroughly test the integration. Perform a series of test transactions to ensure that payments are processed correctly, data is synchronized accurately, and automated workflows are functioning as expected. Once you’re confident that everything is working as intended, you can go live and start accepting payments through your integrated system.

6. Monitor and Optimize

After the integration is live, continuously monitor its performance and make adjustments as needed. Review your sales and revenue data, customer feedback, and payment trends. Identify areas for improvement and optimize the integration to maximize its effectiveness. Regularly update the integration to take advantage of new features and functionalities offered by both your CRM and PayPal.

Choosing the Right CRM and Integration Tools

Selecting the right CRM and integration tools is crucial for a successful implementation. Consider the following factors when making your choices:

CRM Platform Considerations

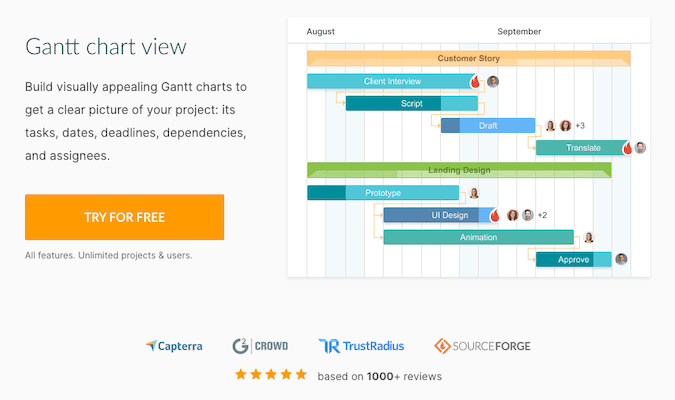

- Features and Functionality: Does the CRM offer the features and functionality you need to manage your customer relationships effectively?

- Scalability: Can the CRM scale to accommodate your business’s growth?

- Ease of Use: Is the CRM user-friendly and easy to learn?

- Price: Does the CRM fit within your budget?

- Integration Capabilities: Does the CRM offer native integrations with PayPal or support third-party apps and plugins?

- Customer Support: Does the CRM provider offer reliable customer support?

Integration Tool Considerations

- Compatibility: Is the integration tool compatible with your CRM and PayPal accounts?

- Features: Does the integration tool offer the features you need, such as automated invoice generation, payment reminders, and real-time payment tracking?

- Ease of Use: Is the integration tool easy to set up and use?

- Security: Does the integration tool provide secure payment processing?

- Pricing: Does the integration tool fit within your budget?

- Reviews and Ratings: Read reviews and ratings from other users to assess the tool’s reliability and performance.

Real-World Examples: Businesses Leveraging CRM and PayPal Integration

Many businesses across various industries are successfully using CRM integration with PayPal to streamline their operations and enhance customer experiences. Here are a few examples:

E-commerce Businesses

E-commerce businesses can leverage CRM integration with PayPal to:

- Automate order processing: Automatically update order statuses and send order confirmations.

- Track customer payments: Gain real-time visibility into payment activity.

- Reduce cart abandonment: Offer a seamless checkout experience with PayPal.

- Personalize customer communication: Send targeted email campaigns based on purchase history and payment behavior.

Service-Based Businesses

Service-based businesses can use CRM integration with PayPal to:

- Generate invoices and send payment reminders: Automate the invoicing process and ensure timely payments.

- Track client payments: Maintain a comprehensive record of client payments.

- Offer online payment options: Provide clients with a convenient way to pay for services.

- Manage client subscriptions: Automate subscription billing and renewals.

Nonprofit Organizations

Nonprofit organizations can benefit from CRM integration with PayPal to:

- Process donations: Accept online donations securely and efficiently.

- Track donor information: Maintain a comprehensive record of donor contributions.

- Send donation receipts: Automatically generate and send donation receipts.

- Manage fundraising campaigns: Track the progress of fundraising campaigns and engage with donors.

Troubleshooting Common Issues

While CRM integration with PayPal offers numerous benefits, you may encounter some challenges during implementation or operation. Here are some common issues and how to address them:

Integration Errors

Problem: The integration fails to connect to your PayPal account or synchronize data.

Solution: Double-check your PayPal credentials, ensure your account is active and verified, and verify that you have the correct API permissions. Review the CRM’s documentation and troubleshooting guides for specific error messages and solutions.

Data Synchronization Issues

Problem: Customer data or payment information is not syncing correctly between your CRM and PayPal.

Solution: Review the field mapping settings in your integration configuration. Ensure that the fields are correctly mapped and that the data types are compatible. Check for any data validation rules that might be preventing data from being synchronized. If the problem persists, consult the documentation or contact support.

Payment Processing Errors

Problem: Payments are being declined or failing to process.

Solution: Verify that your PayPal account is in good standing and that you have sufficient funds. Check the customer’s payment information for errors. Review PayPal’s transaction logs for specific error messages. Consult PayPal’s support documentation or contact their support team for assistance.

Security Concerns

Problem: Concerns about the security of your payment data.

Solution: Ensure that your CRM and integration tools use secure payment processing methods, such as SSL encryption. Comply with PCI DSS (Payment Card Industry Data Security Standard) requirements. Regularly update your CRM and integration tools to address security vulnerabilities. Only share your sensitive information on secure, encrypted connections.

Best Practices for Successful Integration

To maximize the benefits of CRM integration with PayPal, follow these best practices:

- Plan Carefully: Before you begin, clearly define your goals, requirements, and integration strategy.

- Choose the Right Tools: Select a CRM and integration tools that meet your specific needs and budget.

- Test Thoroughly: Conduct comprehensive testing to ensure that the integration is working correctly.

- Train Your Team: Provide your team with adequate training on how to use the integrated system.

- Monitor Performance: Continuously monitor the performance of the integration and make adjustments as needed.

- Stay Updated: Keep your CRM, integration tools, and PayPal account up to date to take advantage of the latest features and security updates.

- Prioritize Security: Implement robust security measures to protect your payment data and customer information.

- Provide Excellent Customer Support: Offer responsive and helpful customer support to address any issues that may arise.

The Future of CRM and Payment Integration

The integration of CRM and payment gateways like PayPal is constantly evolving. As technology advances, we can expect to see even more sophisticated and seamless integrations. Here are some trends to watch:

- AI-Powered Insights: Artificial intelligence (AI) will play an increasingly important role in analyzing customer payment behavior and providing actionable insights.

- Personalized Payment Experiences: Businesses will be able to personalize the payment experience based on customer data stored in their CRM.

- Mobile-First Approach: Integration will be optimized for mobile devices, providing a seamless payment experience on the go.

- Enhanced Security: Advanced security measures, such as tokenization and biometric authentication, will be used to protect payment data.

- Integration with Emerging Payment Methods: Integration will expand to include emerging payment methods, such as cryptocurrencies and digital wallets.

Conclusion: Embrace the Power of Integration

CRM integration with PayPal is a powerful strategy for businesses seeking to streamline their operations, enhance customer experiences, and drive revenue growth. By following the steps outlined in this article, you can seamlessly integrate your CRM with PayPal and unlock a new level of business agility and customer satisfaction. Embrace the power of integration and watch your business thrive in today’s competitive market.