The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

Running a small accounting practice can feel like a juggling act. You’re managing client relationships, tracking deadlines, handling finances, and trying to stay on top of everything. It’s a demanding job, and efficiency is key to success. That’s where a Customer Relationship Management (CRM) system comes in. But not just any CRM; you need the best CRM for small accountants. This guide will walk you through everything you need to know to choose the right CRM, implement it effectively, and reap the rewards of a streamlined and profitable practice.

Why Small Accountants Need a CRM

You might be thinking, “Do I really need a CRM? I’m a small accounting firm, not a massive corporation.” The truth is, a CRM is invaluable for businesses of all sizes, especially for small accounting firms. Here’s why:

- Improved Client Relationships: A CRM centralizes all your client information – contact details, communication history, past projects, financial data – in one accessible place. This allows you to personalize your interactions, anticipate client needs, and provide exceptional service.

- Enhanced Organization and Efficiency: Say goodbye to spreadsheets, scattered emails, and missed deadlines. A CRM streamlines your workflows, automates tasks, and keeps everything organized, freeing up your time to focus on what matters most: your clients.

- Increased Productivity: Automation features within a CRM, such as automated email reminders, task assignments, and report generation, significantly boost your productivity. You can accomplish more with less effort.

- Better Lead Management: A CRM helps you track potential clients, nurture leads, and convert them into paying customers. You can easily manage your sales pipeline and identify opportunities for growth.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, your business performance, and your marketing efforts. This data allows you to make informed decisions and optimize your strategies for maximum impact.

- Compliance and Security: Many CRM systems offer features designed to help you comply with data privacy regulations and protect sensitive client information. This is crucial in the accounting industry.

Key Features to Look for in a CRM for Accountants

Choosing the right CRM is crucial. You need a system tailored to the specific needs of an accounting practice. Here are the essential features to look for:

1. Client Management

This is the heart of any CRM. It should allow you to:

- Store and organize client contact information, including addresses, phone numbers, email addresses, and social media profiles.

- Track client interactions, such as emails, calls, meetings, and notes.

- Segment clients based on criteria like industry, revenue, or service type.

- Manage client profiles with custom fields to capture specific financial data, tax information, and project details.

2. Contact and Lead Management

Effectively managing leads is crucial for practice growth. The CRM should:

- Capture leads from various sources, such as website forms, social media, and referrals.

- Track lead interactions and progress through the sales pipeline.

- Automate lead nurturing campaigns with targeted emails and follow-up tasks.

- Assign leads to team members and track their performance.

3. Task and Project Management

Accounting involves numerous tasks and projects. The CRM should help you:

- Create and assign tasks to team members.

- Set deadlines and track progress.

- Automate recurring tasks, such as sending invoices and preparing reports.

- Manage projects, including budgets, timelines, and deliverables.

4. Time Tracking and Billing

Accurate time tracking and billing are essential for profitability. The CRM should integrate with or offer:

- Time tracking tools to record time spent on client projects.

- Automated invoice generation and sending.

- Payment processing integration.

- Reporting on billable hours and revenue.

5. Reporting and Analytics

Data is power. The CRM should provide:

- Customizable reports on client performance, revenue, and key metrics.

- Dashboards to visualize key data and track progress.

- Analytics to identify trends and opportunities.

6. Integrations

Seamless integration with other tools is crucial for efficiency. The CRM should integrate with:

- Accounting software (e.g., QuickBooks, Xero).

- Email marketing platforms (e.g., Mailchimp, Constant Contact).

- Calendar and scheduling tools (e.g., Google Calendar, Outlook Calendar).

- Payment gateways (e.g., Stripe, PayPal).

- Document management systems.

7. Security and Compliance

Data security is paramount. The CRM should offer:

- Secure data storage and encryption.

- Compliance with data privacy regulations (e.g., GDPR, CCPA).

- User access controls and permissions.

8. Mobile Accessibility

Accountants are often on the go. The CRM should offer:

- Mobile apps for iOS and Android devices.

- Access to client information and tasks from anywhere.

- Ability to update records and communicate with clients on the go.

Top CRM Systems for Small Accountants: A Detailed Comparison

Now that you know what to look for, let’s dive into some of the best CRM systems for small accountants. We’ll compare their features, pricing, and ease of use to help you make the right choice.

1. HubSpot CRM

HubSpot CRM is a popular choice for small businesses, and for good reason. It offers a robust set of features, is relatively easy to use, and has a generous free plan. While not specifically designed for accountants, it is highly customizable and integrates well with many accounting tools.

- Key Features: Contact management, lead tracking, sales pipeline management, email marketing, task management, reporting and analytics, free plan available.

- Pros: User-friendly interface, powerful free plan, extensive integrations, excellent customer support.

- Cons: Some advanced features require paid plans, not specifically tailored for accounting, limited time tracking in the free version.

- Pricing: Free plan available. Paid plans start at around $45/month.

- Best for: Small accounting firms looking for a versatile and user-friendly CRM with a strong free option.

2. Zoho CRM

Zoho CRM is another strong contender, offering a wide range of features at a competitive price point. It’s a good option for accountants who want a CRM with robust customization options and strong integration capabilities. Zoho also offers a suite of other business applications, which can be integrated with the CRM.

- Key Features: Contact management, lead management, sales automation, workflow automation, reporting and analytics, extensive integrations.

- Pros: Highly customizable, affordable pricing, strong integration capabilities, comprehensive feature set.

- Cons: Can be overwhelming for new users due to the number of features, the user interface isn’t as intuitive as HubSpot.

- Pricing: Free plan available. Paid plans start at around $14/user/month.

- Best for: Small accounting firms that want a highly customizable and feature-rich CRM with a budget-friendly price tag.

3. Pipedrive

Pipedrive is a sales-focused CRM that’s known for its intuitive interface and ease of use. While not specifically designed for accountants, it’s a great choice for managing the sales pipeline and tracking leads. It’s particularly well-suited for firms that want a CRM that’s focused on converting leads into clients.

- Key Features: Contact management, sales pipeline management, lead tracking, email integration, reporting and analytics.

- Pros: User-friendly interface, easy to set up and use, strong sales focus, good for lead management.

- Cons: Limited features for client management and project management, not as many integrations as other options.

- Pricing: Paid plans start at around $12.50/user/month.

- Best for: Small accounting firms that want a simple, easy-to-use CRM focused on managing their sales pipeline and converting leads.

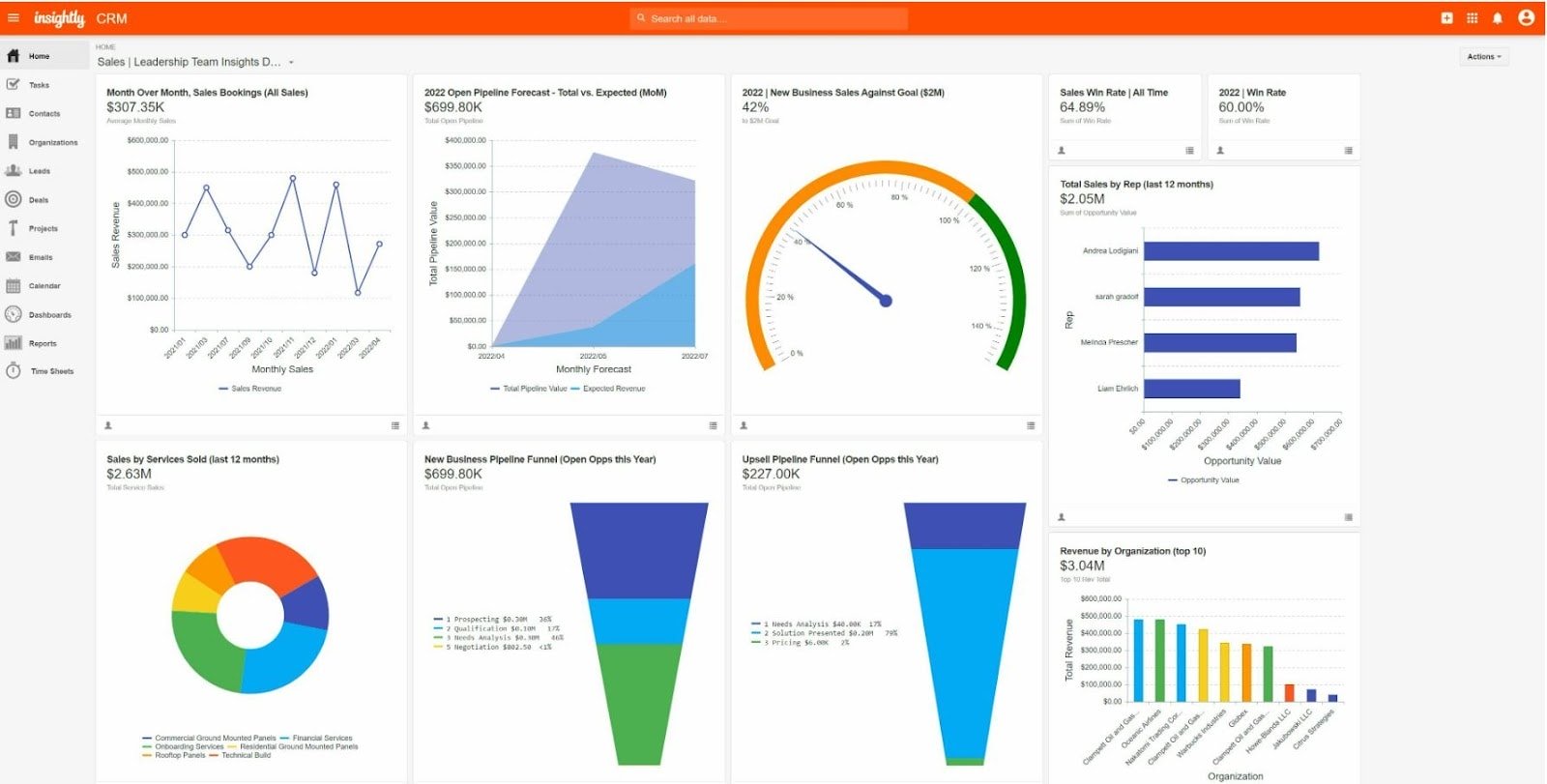

4. Insightly

Insightly is a CRM that’s known for its project management capabilities, making it a good fit for accountants who need a system to manage client projects and tasks. It also offers robust features for contact management and lead tracking.

- Key Features: Contact management, lead tracking, project management, task management, reporting and analytics, sales pipeline management.

- Pros: Strong project management features, user-friendly interface, good for managing client projects, affordable pricing.

- Cons: Less focus on marketing automation compared to other options, may not have as many integrations.

- Pricing: Paid plans start at around $29/user/month.

- Best for: Small accounting firms that need a CRM with strong project management capabilities to help them manage client projects and tasks efficiently.

5. Agile CRM

Agile CRM is a well-rounded CRM that offers a comprehensive set of features at a competitive price. It’s a good option for accountants who want a CRM that can handle both client management and marketing automation.

- Key Features: Contact management, lead tracking, sales automation, marketing automation, project management, reporting and analytics.

- Pros: Affordable pricing, comprehensive feature set, good for both client management and marketing automation, ease of use.

- Cons: The user interface can feel a bit dated compared to some other options, some advanced features are only available on higher-tier plans.

- Pricing: Free plan available. Paid plans start at around $9.99/user/month.

- Best for: Small accounting firms that want a cost-effective CRM with a good balance of features for both client management and marketing automation.

6. Capsule CRM

Capsule CRM is a simple and intuitive CRM that’s focused on managing contacts and sales. It’s a good option for small accounting firms that want a CRM that’s easy to set up and use. It’s designed to be user-friendly and help you stay organized.

- Key Features: Contact management, sales pipeline management, task management, reporting.

- Pros: Simple and easy to use, intuitive interface, good for small teams, affordable pricing.

- Cons: Limited features compared to other options, less focus on marketing automation.

- Pricing: Free plan available. Paid plans start at around $18/user/month.

- Best for: Small accounting firms that want a simple, user-friendly CRM for contact and sales management.

Choosing the Right CRM: A Step-by-Step Guide

Choosing the best CRM for your accounting practice is a significant decision. Here’s a step-by-step guide to help you find the perfect fit:

1. Assess Your Needs

Before you start looking at specific CRM systems, take some time to assess your needs. Consider the following:

- What are your current challenges? What are the pain points in your current workflow? Are you struggling with client communication, lead management, or project organization?

- What are your goals? What do you want to achieve with a CRM? Do you want to improve client relationships, increase efficiency, or grow your business?

- What features are essential? Make a list of the must-have features based on your needs and goals.

- What is your budget? Determine how much you’re willing to spend on a CRM system.

- What integrations do you need? Identify the other software and tools you need the CRM to integrate with (e.g., accounting software, email marketing platforms).

2. Research Potential CRM Systems

Once you know your needs, start researching potential CRM systems. Use the information in this guide as a starting point and explore other options as well. Consider the following:

- Read reviews: See what other accountants are saying about the different CRM systems.

- Compare features: Compare the features of each CRM system to your list of essential features.

- Check integrations: Make sure the CRM integrates with the other tools you use.

- Consider pricing: Compare the pricing plans of each CRM system.

- Look at ease of use: Consider how easy it is to learn and use the system.

3. Take Free Trials and Request Demos

Most CRM systems offer free trials or demos. Take advantage of these opportunities to:

- Test the system: Try out the system and see if it meets your needs.

- Explore the features: Get a hands-on feel for the different features.

- Evaluate the user interface: See if the system is easy to use and navigate.

- Ask questions: Ask the vendor any questions you have.

4. Choose the Right CRM and Implement It Effectively

Once you’ve tested the different CRM systems, choose the one that best meets your needs. Then, implement it effectively by:

- Planning your implementation: Create a plan for how you’ll implement the CRM.

- Importing your data: Import your client data and other information into the system.

- Training your team: Train your team on how to use the system.

- Customizing the system: Customize the system to meet your specific needs.

- Integrating with other tools: Integrate the CRM with your other tools.

- Monitoring and optimizing: Monitor the system’s performance and make adjustments as needed.

Maximizing Your CRM Investment

Once you’ve chosen and implemented a CRM, it’s important to maximize your investment. Here are some tips:

- Use the system consistently: Make sure your team uses the CRM consistently to track client interactions, manage tasks, and stay organized.

- Update your data regularly: Keep your client data up-to-date to ensure accuracy.

- Take advantage of automation: Automate tasks and workflows to save time and improve efficiency.

- Use the reporting features: Use the reporting features to track your performance and identify areas for improvement.

- Provide ongoing training: Provide ongoing training to your team to ensure they’re using the system effectively.

- Seek support: Don’t hesitate to contact the vendor’s customer support if you have any questions or issues.

The Benefits of the Best CRM for Small Accountants: A Recap

Investing in a CRM system can significantly improve your accounting practice. Let’s recap the key benefits:

- Improved Client Relationships: Build stronger relationships with your clients by personalizing your interactions and providing exceptional service.

- Enhanced Efficiency: Streamline your workflows, automate tasks, and stay organized.

- Increased Productivity: Accomplish more with less effort through automation and efficient task management.

- Better Lead Management: Convert more leads into paying clients and grow your business.

- Data-Driven Decision Making: Make informed decisions based on data and optimize your strategies.

- Increased Profitability: Improve efficiency, reduce costs, and increase revenue.

- Compliance and Security: Ensure the security of your client data and meet compliance requirements.

Conclusion: Choosing the Right CRM is an Investment in Your Future

Choosing the best CRM for small accountants is an investment in your future. By streamlining your operations, improving client relationships, and gaining valuable insights, you can build a more profitable and successful accounting practice. Take the time to research your options, assess your needs, and choose the CRM system that’s right for you. The rewards are well worth the effort.

Ready to take the next step? Start by assessing your needs and exploring the CRM systems mentioned in this guide. Your journey to a more efficient and profitable accounting practice starts now!