Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Introduction: The Power of Synergy – CRM and PayPal Unite

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost revenue. Two powerful tools that can significantly contribute to these goals are Customer Relationship Management (CRM) systems and PayPal. CRM systems help businesses manage interactions with current and potential customers, while PayPal provides a secure and convenient payment gateway. The true magic happens when you integrate these two, creating a synergy that can transform your business.

This article delves into the intricacies of integrating CRM systems with PayPal, exploring the benefits, implementation strategies, and best practices. We’ll cover everything from understanding the core concepts to choosing the right integration method and troubleshooting common issues. Get ready to unlock the full potential of your business by leveraging the power of CRM and PayPal working in perfect harmony.

Understanding the Fundamentals: CRM and PayPal Explained

What is CRM?

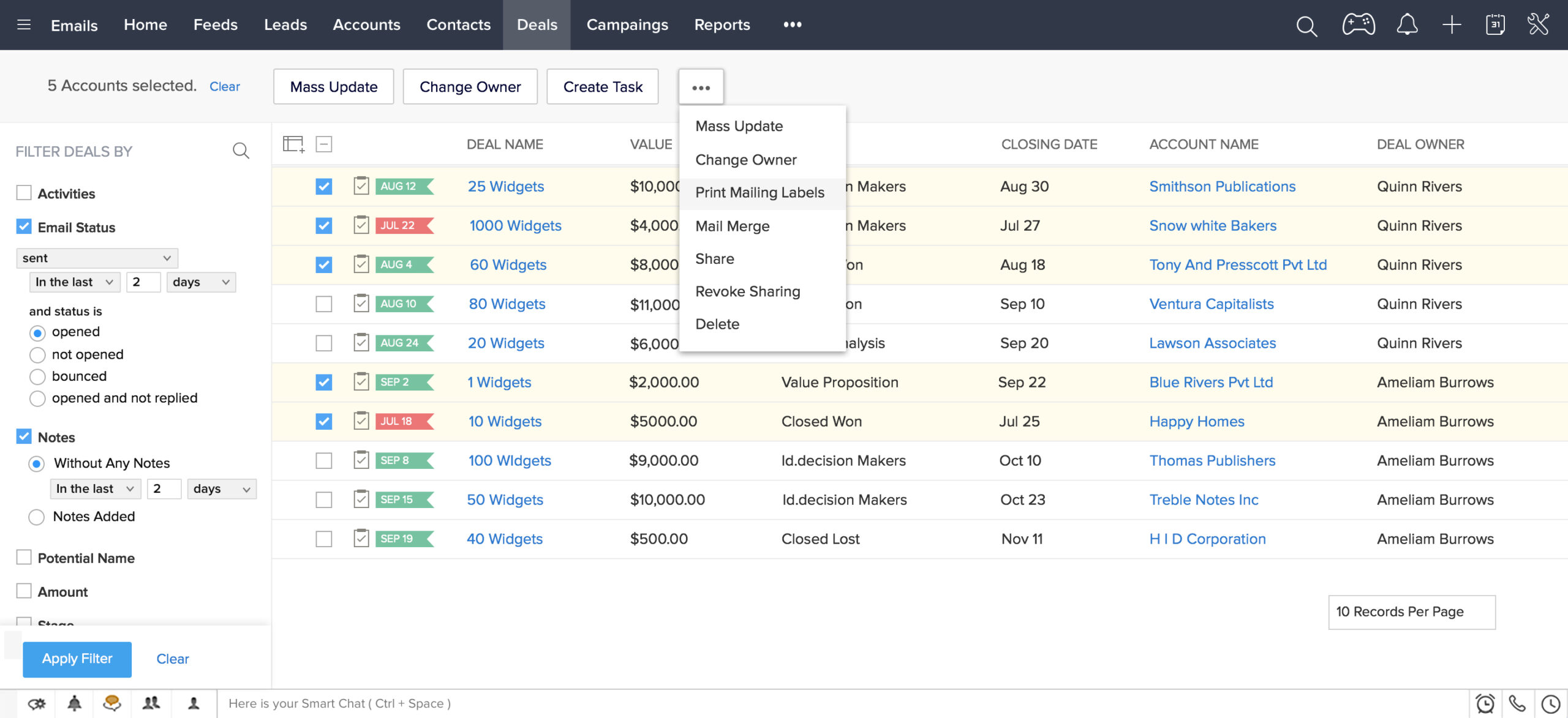

Customer Relationship Management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: Improve business relationships. CRM systems help you stay connected to customers, streamline processes, and improve profitability. When people talk about CRM, they’re usually referring to a CRM system – a tool that helps with contact management, sales, productivity, and more.

Key features of a CRM system often include contact management, sales force automation, marketing automation, and customer service support. By centralizing customer data, CRM systems provide a 360-degree view of each customer, enabling businesses to personalize interactions, improve customer satisfaction, and drive sales growth.

What is PayPal?

PayPal is a global online payment system that supports online money transfers and serves as an electronic alternative to traditional methods like checks and money orders. It’s a secure platform that allows businesses to receive payments from customers worldwide. PayPal acts as an intermediary, processing payments without requiring businesses to handle sensitive financial information directly.

PayPal offers various features, including secure payment processing, fraud protection, and dispute resolution. It’s widely used by businesses of all sizes, from small startups to large enterprises, due to its ease of use, global reach, and robust security features.

The Benefits of CRM Integration with PayPal

Integrating your CRM system with PayPal is a game-changer. It’s not just about convenience; it’s about efficiency, data accuracy, and, ultimately, a better customer experience. Here’s a look at the compelling advantages:

Streamlined Payment Processing

Imagine the convenience of automatically logging payment information directly into your CRM. No more manual data entry, no more errors. This integration streamlines the payment process, saving you time and reducing the risk of human error. You can track payments, refunds, and payment statuses all within your CRM, providing a complete view of your customer’s financial interactions.

Improved Customer Experience

Seamless payment experiences lead to happy customers. With CRM integration, you can personalize payment options, send automated payment reminders, and offer a smooth, hassle-free checkout process. This enhances customer satisfaction and builds loyalty, encouraging repeat business and positive word-of-mouth referrals.

Enhanced Data Accuracy and Reporting

Accuracy is crucial for sound decision-making. Integrating PayPal with your CRM ensures that payment data is automatically synced, eliminating manual data entry errors. You gain access to reliable, real-time data, enabling you to generate accurate reports on sales, revenue, and customer behavior. This data-driven approach empowers you to make informed decisions and optimize your business strategies.

Increased Efficiency and Productivity

Automation is the key to efficiency. By integrating your CRM with PayPal, you can automate tasks such as payment tracking, invoice generation, and payment reminders. This frees up your team to focus on more strategic activities, such as building customer relationships and driving sales. With less time spent on manual tasks, your team can become more productive and achieve better results.

Better Sales and Marketing Insights

The integration provides a wealth of data that can be used to improve sales and marketing efforts. By analyzing payment data within your CRM, you can gain insights into customer purchasing behavior, identify trends, and personalize marketing campaigns. This data-driven approach enables you to target the right customers with the right offers, increasing your chances of converting leads into sales.

Reduced Manual Errors

Manual data entry is prone to errors. Integrating PayPal with your CRM automates the process of recording payment information, reducing the risk of human error. This ensures that your data is accurate, reliable, and consistent, allowing you to make informed decisions based on reliable information.

Choosing the Right Integration Method

There are several ways to integrate your CRM with PayPal. The best method depends on your specific needs, technical expertise, and budget. Here are some common approaches:

Native Integrations

Many popular CRM systems, such as Salesforce, HubSpot, and Zoho CRM, offer native integrations with PayPal. These integrations are typically easy to set up and provide a seamless experience. Native integrations often include pre-built functionalities, such as automatic payment tracking, invoice generation, and customer data synchronization.

Third-Party Integration Tools

If your CRM system doesn’t have a native PayPal integration, or if you need more advanced features, you can use third-party integration tools. These tools act as a bridge between your CRM and PayPal, allowing you to automate data transfer and streamline workflows. Examples of third-party integration tools include Zapier, Automate.io, and PieSync.

Custom Development

For businesses with highly specific requirements, custom development may be the best option. This involves hiring a developer to build a custom integration that meets your exact needs. While this approach can be more expensive and time-consuming, it offers the greatest flexibility and control.

Key Considerations When Choosing a Method

- CRM Compatibility: Ensure the integration method is compatible with your CRM system.

- PayPal Account Type: Determine whether the integration supports your PayPal account type (e.g., Business, Premier, or Personal).

- Features and Functionality: Evaluate the features and functionality offered by each integration method.

- Ease of Use: Choose an integration method that is easy to set up and use.

- Cost: Consider the cost of the integration method, including any subscription fees or development costs.

- Security: Ensure the integration method is secure and protects your customer data.

Step-by-Step Guide to Integrating CRM with PayPal

The exact steps for integrating your CRM with PayPal will vary depending on the integration method you choose. However, the general process typically involves the following steps:

1. Choose Your Integration Method

Decide whether to use a native integration, a third-party tool, or custom development, based on the factors discussed above.

2. Set Up Your PayPal Account

Ensure your PayPal account is set up and ready to accept payments. This may involve verifying your account and configuring your payment preferences.

3. Configure Your CRM System

Depending on the integration method, you may need to configure your CRM system to connect to PayPal. This may involve entering your PayPal API credentials or connecting your accounts through a third-party tool.

4. Test the Integration

Before launching the integration, test it thoroughly to ensure that it’s working correctly. This may involve making test payments and verifying that the data is being synced accurately.

5. Customize the Integration (If Needed)

Some integration methods allow you to customize the integration to meet your specific needs. This may involve configuring payment options, setting up automated workflows, or creating custom reports.

6. Monitor and Maintain the Integration

Once the integration is live, monitor it regularly to ensure that it’s working as expected. This may involve reviewing payment data, checking for errors, and updating the integration as needed.

Popular CRM Systems with PayPal Integration

Several CRM systems offer seamless integration with PayPal. Here are some of the most popular options:

Salesforce

Salesforce, a leading CRM platform, offers robust integration capabilities with PayPal. Users can connect their PayPal accounts to Salesforce to track payments, manage invoices, and automate payment reminders. Salesforce’s integration is particularly valuable for businesses that rely on complex sales processes and need a comprehensive view of their customer interactions.

HubSpot

HubSpot CRM provides a user-friendly interface and a wide range of features, including integration with PayPal. Users can connect their PayPal accounts to HubSpot to track payments, manage invoices, and automate payment reminders. HubSpot’s integration is particularly well-suited for small to medium-sized businesses that want an easy-to-use CRM with integrated payment processing.

Zoho CRM

Zoho CRM offers a comprehensive CRM solution with strong integration capabilities, including PayPal integration. Users can connect their PayPal accounts to Zoho CRM to track payments, manage invoices, and automate payment reminders. Zoho CRM’s integration is well-suited for businesses that need a cost-effective CRM with powerful features.

Pipedrive

Pipedrive, known for its sales-focused approach, integrates well with PayPal. You can easily connect your PayPal account to Pipedrive to track payments, manage invoices, and streamline your sales workflows. This is an excellent choice for sales teams looking to close deals more efficiently.

Freshsales

Freshsales offers a user-friendly CRM platform with PayPal integration. Connect your PayPal account to manage payments, track invoices, and streamline your sales processes. Freshsales is known for its intuitive interface and is a good option for businesses that value ease of use.

Troubleshooting Common CRM and PayPal Integration Issues

Even with the best integrations, you might run into a few hiccups. Here’s how to troubleshoot some common issues:

Payment Data Not Syncing

If payment data isn’t syncing correctly, double-check your connection settings. Ensure your API keys are correct and that the integration has the necessary permissions. Also, review your transaction logs in both your CRM and PayPal to identify any errors.

Incorrect Data Mapping

Incorrect data mapping can lead to inaccurate information in your CRM. Review the mapping settings to ensure that the correct data fields are being synced. If you’re using a third-party tool, consult their documentation for guidance on data mapping.

Errors During Payment Processing

If you encounter errors during payment processing, check your PayPal account to ensure it’s in good standing. Also, review the integration settings to ensure that the payment gateway is configured correctly. If the problem persists, contact PayPal or your integration provider for assistance.

Slow Synchronization

Slow synchronization can be frustrating. Check the integration settings to see if there are any options to improve synchronization speed. You may also need to optimize your CRM system or contact your integration provider for assistance.

Security Concerns

Always prioritize security. Ensure that the integration uses secure protocols, such as HTTPS. Also, review your integration settings to ensure that you’re not storing sensitive data unnecessarily. Regularly update your integration to protect against security vulnerabilities.

Best Practices for Successful CRM and PayPal Integration

To ensure a smooth and effective integration, follow these best practices:

Plan and Define Your Goals

Before you begin, define your goals for the integration. What do you want to achieve? What data do you need to sync? Having a clear plan will help you choose the right integration method and configure it correctly.

Choose the Right Integration Method

Select the integration method that best suits your needs, technical expertise, and budget. Consider factors such as CRM compatibility, PayPal account type, features, ease of use, and cost.

Test Thoroughly

Before launching the integration, test it thoroughly to ensure that it’s working correctly. Make test payments and verify that the data is being synced accurately.

Monitor and Maintain

Once the integration is live, monitor it regularly to ensure that it’s working as expected. Review payment data, check for errors, and update the integration as needed.

Train Your Team

Train your team on how to use the integrated system effectively. Provide them with the necessary training and documentation to ensure they can use the system to its full potential.

Keep Your Software Updated

Regularly update your CRM system, PayPal account, and integration tools to ensure that you’re using the latest features and security patches.

Conclusion: Embrace the Power of Integration

Integrating your CRM system with PayPal is a strategic move that can significantly enhance your business operations. By streamlining payment processing, improving customer experiences, and gaining valuable data insights, you can drive sales growth and build stronger customer relationships. Whether you choose a native integration, a third-party tool, or custom development, the key is to select the right method, plan carefully, and test thoroughly. Embrace the power of integration and unlock the full potential of your business.

The combination of a robust CRM system and the flexibility of PayPal creates a powerful synergy. It’s about more than just processing payments; it’s about creating a seamless experience for your customers, empowering your team, and making data-driven decisions that propel your business forward. So, take the first step today and start integrating your CRM with PayPal. The benefits are well worth the effort.