Unlocking Efficiency: The Ultimate Guide to the Best CRM for Small Accountants

Unlocking Efficiency: The Ultimate Guide to the Best CRM for Small Accountants

Running a small accounting firm can feel like juggling a dozen different things at once. You’re managing client relationships, tracking billable hours, sending invoices, and, of course, staying on top of the ever-changing tax regulations. It’s a demanding job, and the last thing you need is to be bogged down by inefficient processes and disorganized data. That’s where a Customer Relationship Management (CRM) system comes in. But with so many options on the market, choosing the right CRM for your small accounting firm can feel overwhelming. Don’t worry, this comprehensive guide will break down everything you need to know to make the right decision. We’ll explore the benefits of CRM for accountants, delve into the key features to look for, and highlight some of the best CRM solutions specifically tailored for small accounting practices.

Why Your Small Accounting Firm Needs a CRM

In the past, many accountants relied on spreadsheets, email inboxes, and memory to manage their client relationships. While this might have worked in the early days, it’s simply not sustainable as your practice grows. A CRM system is more than just a contact database; it’s a central hub for all your client information, communication, and interactions. Here’s why a CRM is essential for small accounting firms:

- Improved Client Relationship Management: A CRM allows you to store detailed information about your clients, including contact details, communication history, financial data, and preferences. This centralized view helps you personalize your interactions, provide better service, and build stronger relationships.

- Increased Efficiency and Productivity: Automate repetitive tasks like sending appointment reminders, follow-up emails, and invoice tracking. This frees up your time to focus on more strategic activities, such as providing financial advice and growing your business.

- Enhanced Communication and Collaboration: A CRM facilitates seamless communication between team members. You can easily share client information, track conversations, and collaborate on projects, ensuring everyone is on the same page.

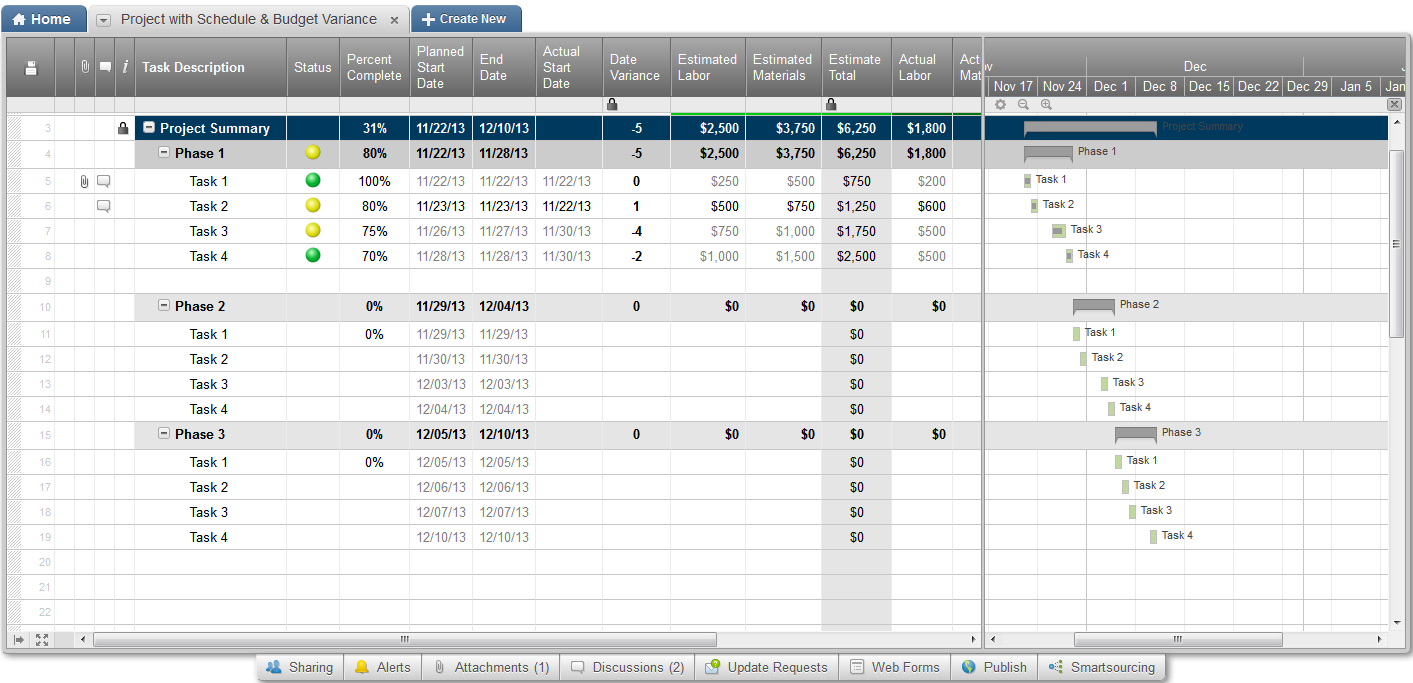

- Better Data Organization and Reporting: Say goodbye to scattered spreadsheets and disorganized files. A CRM provides a centralized repository for all your client data, making it easy to generate reports, track key performance indicators (KPIs), and gain valuable insights into your business.

- Improved Lead Management and Sales Conversion: If you’re actively seeking new clients, a CRM can help you manage leads, track your sales pipeline, and nurture prospects through the sales process. This leads to higher conversion rates and increased revenue.

- Compliance and Security: Many CRM systems offer robust security features and compliance tools, helping you protect sensitive client data and meet industry regulations.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your small accounting firm, you need to look for features that are specifically designed to meet your needs. Here are some essential features to consider:

Contact Management

This is the foundation of any CRM. Look for a system that allows you to easily store, organize, and access client contact information. Key features include:

- Customizable Fields: The ability to add custom fields to store specific information relevant to your accounting practice, such as tax IDs, financial goals, and preferred communication methods.

- Segmentation: The ability to segment clients based on various criteria, such as industry, revenue, or service type, for targeted marketing and communication.

- Import/Export Capabilities: Easy import and export of contact data to and from other applications, such as spreadsheets and accounting software.

Communication Tracking

Keep track of all your interactions with clients, including emails, phone calls, meetings, and notes. Key features include:

- Email Integration: Seamless integration with your email provider (e.g., Gmail, Outlook) to track email conversations and automatically log them in the CRM.

- Call Logging: The ability to log phone calls and record notes about the conversation. Some systems offer call recording capabilities.

- Meeting Scheduling: Integrated calendar and meeting scheduling features to streamline the process of booking appointments with clients.

Workflow Automation

Automate repetitive tasks to save time and improve efficiency. Key features include:

- Email Automation: Automatically send welcome emails, appointment reminders, follow-up emails, and other communications.

- Task Automation: Automate tasks such as creating client profiles, updating contact information, and generating reports.

- Process Automation: Automate entire workflows, such as the onboarding process for new clients.

Reporting and Analytics

Gain valuable insights into your business performance with robust reporting and analytics tools. Key features include:

- Customizable Dashboards: Create dashboards to track key performance indicators (KPIs) such as client acquisition cost, client retention rate, and revenue per client.

- Report Generation: Generate reports on various aspects of your business, such as client demographics, sales performance, and marketing campaign effectiveness.

- Data Visualization: Visualize your data with charts and graphs to identify trends and patterns.

Integration with Accounting Software

Seamless integration with your existing accounting software is crucial. Key features include:

- Data Synchronization: Automatically synchronize client data, invoices, and other financial information between your CRM and accounting software.

- Real-time Data Updates: Ensure that your data is always up-to-date and accurate.

- Improved Efficiency: Eliminate manual data entry and reduce the risk of errors.

Security and Compliance

Protecting your clients’ sensitive financial data is paramount. Key features include:

- Data Encryption: Securely encrypt your data to protect it from unauthorized access.

- Role-Based Access Control: Control who has access to specific data within the CRM.

- Compliance with Industry Regulations: Ensure that the CRM meets industry regulations such as GDPR and CCPA.

Top CRM Systems for Small Accountants

Now that you know what to look for in a CRM, let’s explore some of the best options available for small accounting firms. We’ve considered factors such as features, pricing, ease of use, and integrations to compile this list.

1. HubSpot CRM

Best for: All-in-one CRM with strong free plan and marketing automation capabilities.

HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly well-suited for small accounting firms. It offers a comprehensive suite of features, including contact management, email marketing, sales automation, and reporting. The free plan is surprisingly robust, making it an excellent option for firms just starting out. HubSpot’s user-friendly interface and extensive documentation make it easy to learn and use. It integrates with popular accounting software like Xero and QuickBooks.

Key Features:

- Free forever CRM plan

- Contact management

- Email marketing and automation

- Sales pipeline management

- Reporting and analytics

- Integration with accounting software

Pros:

- Free plan with a lot of features

- User-friendly interface

- Excellent customer support

- Strong marketing automation capabilities

- Scalable for growing businesses

Cons:

- The free plan has limitations on features

- Advanced features require paid plans

2. Zoho CRM

Best for: Customizable CRM with a wide range of integrations and affordable pricing.

Zoho CRM is a powerful and flexible CRM system that offers a wide range of features at an affordable price. It’s highly customizable, allowing you to tailor the system to your specific needs. Zoho CRM integrates with a vast array of third-party applications, including accounting software, email marketing platforms, and social media channels. It’s a great option for firms that want a feature-rich CRM without breaking the bank.

Key Features:

- Contact management

- Sales automation

- Workflow automation

- Reporting and analytics

- Integration with accounting software and other apps

- Customization options

Pros:

- Affordable pricing

- Highly customizable

- Wide range of integrations

- Excellent customer support

- Mobile apps for iOS and Android

Cons:

- Interface can be overwhelming for new users

- Some advanced features require paid plans

3. Pipedrive

Best for: Sales-focused CRM with a user-friendly interface and pipeline management features.

Pipedrive is designed with sales teams in mind, making it a good choice for accounting firms that are actively pursuing new clients. Its intuitive interface and visual pipeline management features make it easy to track leads, manage deals, and close sales. Pipedrive integrates with many popular apps, including email providers and accounting software. While it may not have as many features as some other CRM systems, it excels at helping you manage your sales process.

Key Features:

- Visual sales pipeline management

- Contact management

- Deal tracking

- Email integration

- Reporting and analytics

- Integration with accounting software

Pros:

- User-friendly interface

- Visual pipeline management

- Easy to set up and use

- Focus on sales productivity

- Good customer support

Cons:

- Less feature-rich than some other CRM systems

- Not ideal for complex workflows

4. Salesforce Sales Cloud

Best for: Large accounting firms or those with complex needs and the budget for advanced features.

Salesforce Sales Cloud is a comprehensive CRM system that’s well-suited for larger accounting firms with complex needs. It offers a wide range of features, including contact management, sales automation, marketing automation, and customer service tools. Salesforce is highly customizable and scalable, allowing you to adapt the system to your specific requirements. However, it can be more expensive and complex to set up and use than other CRM systems.

Key Features:

- Contact management

- Sales automation

- Marketing automation

- Customer service tools

- Reporting and analytics

- Customization options

Pros:

- Comprehensive feature set

- Highly customizable

- Scalable for growing businesses

- Wide range of integrations

- Strong customer support

Cons:

- Expensive

- Complex to set up and use

- Requires specialized training

5. Insightly

Best for: Small to medium-sized businesses looking for a simple, user-friendly CRM with project management features.

Insightly is a CRM and project management software that’s designed to help businesses manage their contacts, sales, and projects in one place. It’s a good option for accounting firms that want a CRM that also helps them manage their projects. Insightly offers a user-friendly interface, making it easy to learn and use. It integrates with many popular apps, including email providers and accounting software.

Key Features:

- Contact management

- Sales pipeline management

- Project management

- Reporting and analytics

- Integration with accounting software

Pros:

- User-friendly interface

- Project management features

- Affordable pricing

- Good customer support

- Easy to set up and use

Cons:

- Fewer features than some other CRM systems

- Limited customization options

How to Choose the Right CRM for Your Firm

Choosing the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start looking at CRM systems, take the time to assess your firm’s specific needs. What are your goals? What are your pain points? What features are most important to you?

- Define Your Budget: Determine how much you’re willing to spend on a CRM system. Consider both the initial cost and the ongoing costs, such as monthly subscriptions and training.

- Research CRM Systems: Research different CRM systems and compare their features, pricing, and integrations. Read reviews and compare different options.

- Consider Integrations: Make sure the CRM system integrates with your existing accounting software, email provider, and other tools.

- Test Drive: Take advantage of free trials or demos to test out the CRM system and see if it’s a good fit for your firm.

- Consider Training and Support: Choose a CRM system that offers adequate training and support to help you get started and use the system effectively.

- Start Small and Scale: Don’t try to implement everything at once. Start with the core features and gradually add more features as your firm grows.

Implementation Tips for CRM Success

Once you’ve chosen a CRM system, it’s essential to implement it effectively to maximize its benefits. Here are some tips for a successful CRM implementation:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps you need to take to set up the CRM system.

- Clean Your Data: Before importing your data into the CRM, clean it up to ensure accuracy and consistency.

- Train Your Team: Provide adequate training to your team members on how to use the CRM system.

- Customize the System: Customize the CRM system to meet your specific needs.

- Monitor and Evaluate: Monitor your CRM usage and evaluate its effectiveness. Make adjustments as needed.

- Integrate with Other Systems: Integrate the CRM system with your other business systems, such as your accounting software and email marketing platform.

- Get Buy-In from Your Team: Ensure that your team understands the benefits of the CRM and is committed to using it.

The Long-Term Benefits of CRM for Accountants

Investing in a CRM system is an investment in the future of your accounting firm. Here are some of the long-term benefits you can expect:

- Increased Client Retention: By providing better service and building stronger relationships, you can increase client retention rates.

- Improved Client Satisfaction: A CRM helps you provide a more personalized and responsive service, leading to higher client satisfaction.

- Increased Revenue: By attracting new clients and retaining existing ones, you can increase your firm’s revenue.

- Enhanced Business Growth: A CRM can help you streamline your operations, improve efficiency, and grow your business.

- Better Decision-Making: With access to real-time data and insights, you can make better decisions about your business.

- Reduced Costs: Automating tasks and improving efficiency can help you reduce operational costs.

Conclusion

Choosing the best CRM for your small accounting firm is a significant step towards streamlining your operations, improving client relationships, and driving business growth. By carefully considering your needs, researching the available options, and implementing the system effectively, you can unlock the full potential of a CRM and take your firm to the next level. From the user-friendly interface of HubSpot CRM to the customization options of Zoho CRM, or the sales-focused approach of Pipedrive, there is a solution tailored to your unique requirements. Remember to assess your specific needs, define your budget, and consider integrations before making your final decision. With the right CRM in place, you can transform your accounting practice into a more efficient, productive, and client-focused business.

So, take the leap, explore the options, and invest in a CRM that will empower your firm to thrive in today’s competitive landscape. Your clients, and your bottom line, will thank you for it.