Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

Introduction: The Power of Synergy – CRM and PayPal

In today’s fast-paced business environment, efficiency and customer satisfaction are paramount. Businesses are constantly seeking ways to streamline their operations, improve customer experiences, and ultimately, boost their bottom line. One powerful strategy to achieve these goals is through the integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This article delves into the intricacies of CRM integration with PayPal, exploring its benefits, implementation strategies, and best practices. We’ll unpack how this integration can transform your business, making your operations smoother, more efficient, and more customer-centric.

Understanding the Core Components: CRM and PayPal

What is a CRM System?

A CRM system is more than just a contact database; it’s a comprehensive platform designed to manage and analyze customer interactions and data throughout the customer lifecycle. CRM systems help businesses improve customer relationships, retain customers, and drive sales growth. Key functionalities of a CRM system include contact management, sales automation, marketing automation, and customer service support. Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

What is PayPal?

PayPal is a globally recognized online payment system that enables businesses to securely process payments from customers. It offers a convenient and reliable way for customers to pay for goods and services online, and it’s widely accepted by businesses of all sizes. PayPal provides features like payment processing, invoicing, and fraud protection, making it a popular choice for both businesses and consumers. Its ease of use and global reach make it an indispensable tool for e-commerce and online businesses.

The Benefits of CRM Integration with PayPal

Streamlined Payment Processing

Integrating your CRM with PayPal significantly streamlines the payment process. Sales representatives can generate invoices, process payments, and track transactions directly from the CRM interface. This eliminates the need to switch between different platforms, saving time and reducing the risk of errors. It also provides a centralized view of all financial transactions, making it easier to manage and reconcile payments.

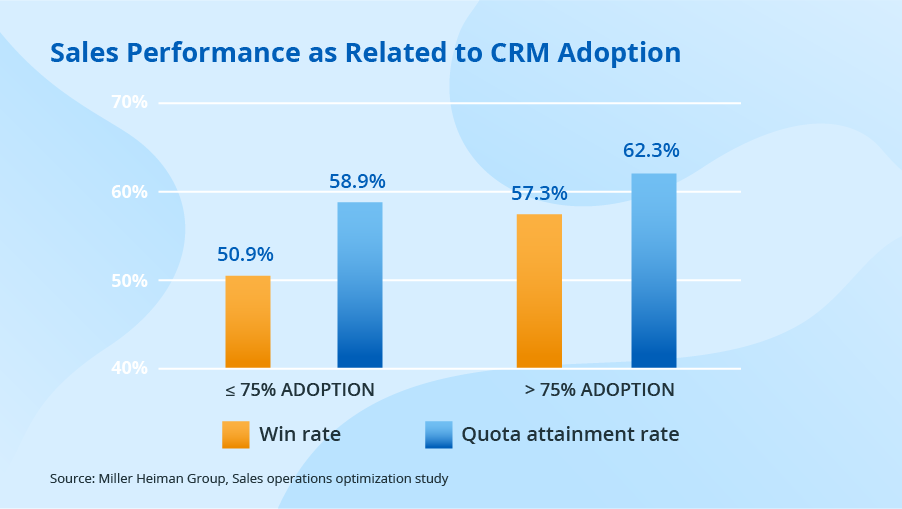

Improved Sales Efficiency

With PayPal integration, sales teams can close deals faster. They can send payment requests directly from the CRM, track payment statuses, and automatically update customer records upon successful payment. This automation reduces manual tasks and allows sales representatives to focus on building relationships and closing more deals.

Enhanced Customer Experience

A seamless payment experience is crucial for customer satisfaction. PayPal integration provides customers with a familiar and secure payment method. Customers can easily make payments, view their transaction history, and receive automated payment confirmations. This streamlined process enhances the customer experience, leading to increased customer loyalty and repeat business.

Better Data Insights and Reporting

CRM integration with PayPal provides valuable data insights into your sales and payment activities. You can track payment trends, identify top-performing products or services, and analyze customer spending habits. This data can be used to make informed business decisions, optimize sales strategies, and improve marketing campaigns. Reporting becomes much more comprehensive, providing a holistic view of your financial performance.

Reduced Manual Data Entry and Errors

Manual data entry is time-consuming and prone to errors. CRM integration with PayPal automates the transfer of payment data, eliminating the need for manual data entry. This reduces the risk of errors, saves time, and ensures that your customer data is accurate and up-to-date. This automation frees up your team to focus on more strategic tasks.

Choosing the Right CRM and PayPal Integration Method

Native Integrations

Many CRM platforms offer native integrations with PayPal. This means that the integration is built directly into the CRM system, making it easy to set up and use. Native integrations typically provide a seamless user experience and offer a wide range of features. Salesforce, HubSpot, and Zoho CRM, for instance, often have native integrations with PayPal or offer apps within their marketplaces that facilitate the connection.

Third-Party Integrations

If your CRM doesn’t offer a native integration, you can use third-party integration tools. These tools act as a bridge between your CRM and PayPal, allowing you to connect the two systems. Third-party integrations can be a cost-effective solution, especially if you’re using a CRM platform that doesn’t have a native PayPal integration. Examples of third-party integration platforms include Zapier, Automate.io, and PieSync.

Custom Integrations

For businesses with specific requirements, custom integrations may be the best option. Custom integrations are developed to meet the unique needs of your business and can provide a high level of customization. This approach requires technical expertise and can be more expensive than native or third-party integrations. It is often used when you need very specific data mapping or functionality that is not available through other methods.

Step-by-Step Guide to Implementing CRM Integration with PayPal

1. Assess Your Needs and Goals

Before you start the integration process, it’s important to assess your needs and goals. Determine what you want to achieve with the integration, such as streamlining payment processing, improving sales efficiency, or enhancing customer experience. Identify the specific features and functionalities you need, and choose an integration method that meets your requirements.

2. Choose Your Integration Method

Based on your needs and goals, choose the appropriate integration method. If your CRM offers a native integration, this is often the easiest and most straightforward option. If not, consider using a third-party integration tool or developing a custom integration. Research the different options available and compare their features, pricing, and ease of use.

3. Set Up Your PayPal Account

If you don’t already have a PayPal business account, you’ll need to create one. Follow the instructions provided by PayPal to set up your account and configure your payment preferences. Ensure that your account is verified and that you have enabled the necessary features for processing payments. Make sure to understand PayPal’s fees and policies.

4. Configure the Integration

Once you’ve chosen your integration method and set up your PayPal account, you can start configuring the integration. Follow the instructions provided by your CRM platform or integration tool to connect your CRM and PayPal accounts. This typically involves entering your PayPal API credentials and mapping the necessary data fields. Test the integration thoroughly to ensure that it’s working correctly.

5. Test and Refine

Before you start using the integration in production, it’s essential to test it thoroughly. Create test transactions to verify that payments are processed correctly and that data is transferred accurately between your CRM and PayPal. Identify any issues or errors and make the necessary adjustments. Refine your integration based on your testing results to ensure that it meets your needs and goals.

6. Train Your Team

Once the integration is set up and tested, train your team on how to use it. Provide them with clear instructions and documentation on how to generate invoices, process payments, and track transactions. Ensure that they understand the benefits of the integration and how it can improve their work. Regular training and support will help ensure that your team can effectively utilize the integration.

Best Practices for CRM Integration with PayPal

Data Mapping and Synchronization

Carefully map the data fields between your CRM and PayPal to ensure that data is synchronized accurately. This includes mapping customer information, product details, and payment amounts. Regularly review your data mapping to ensure that it’s up-to-date and that all relevant data is being transferred. Use appropriate data formats to avoid any compatibility issues.

Security and Compliance

Security is paramount when dealing with financial data. Ensure that your CRM and PayPal integration is secure and compliant with industry standards. Use secure connections, encrypt sensitive data, and implement appropriate security measures to protect your customer data. Regularly review your security practices and update them as needed.

Automation and Workflow Optimization

Leverage the automation capabilities of your CRM and PayPal integration to streamline your workflows. Automate tasks such as invoice generation, payment reminders, and customer record updates. Optimize your workflows to reduce manual tasks and improve efficiency. Regularly review your workflows to identify areas for improvement.

Regular Monitoring and Maintenance

Monitor your CRM and PayPal integration regularly to ensure that it’s functioning correctly. Check for any errors or issues and address them promptly. Perform regular maintenance tasks, such as updating your software and backing up your data. Keep your integration up-to-date with the latest security patches and features.

Customer Communication and Transparency

Keep your customers informed about the payment process. Provide clear and concise information about payment methods, processing times, and payment confirmations. Be transparent about your fees and policies. This will enhance the customer experience and build trust.

Advanced Features and Considerations

Recurring Payments and Subscriptions

If your business offers recurring payments or subscriptions, CRM integration with PayPal can automate the billing process. You can set up recurring payment profiles, manage subscription plans, and track payment statuses. This simplifies the billing process and reduces the risk of missed payments. Many CRM systems and integration tools offer specific features to handle recurring payments.

Multi-Currency Support

If you operate internationally, ensure that your CRM and PayPal integration supports multiple currencies. This allows you to process payments from customers in different countries and avoid currency conversion issues. Check the currency conversion rates and fees charged by PayPal and your CRM platform.

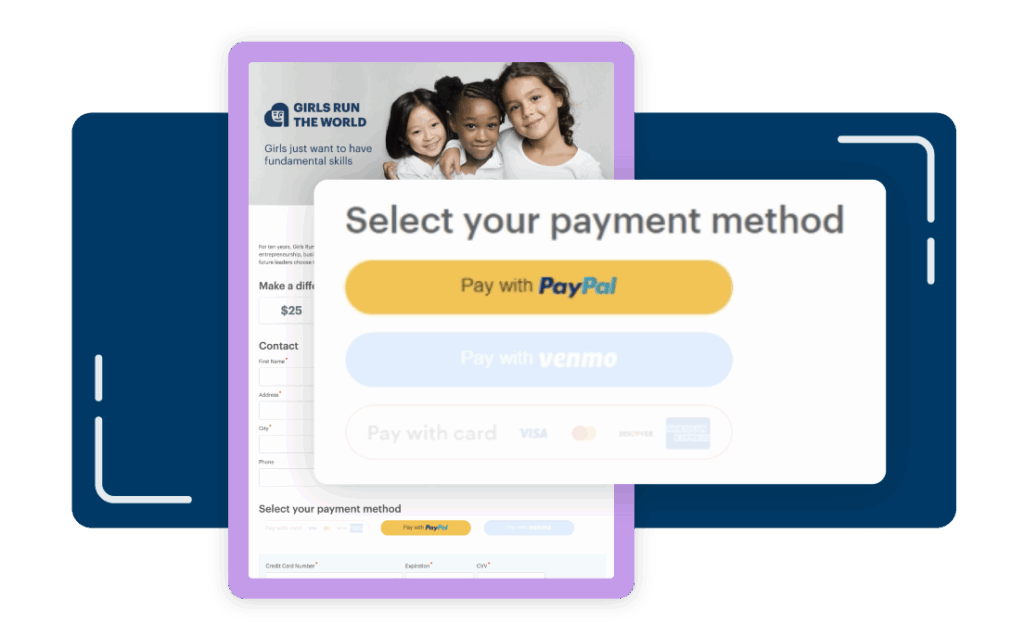

Mobile Payment Integration

With the increasing use of mobile devices, consider integrating mobile payment options. PayPal offers mobile payment solutions that can be integrated with your CRM. This allows customers to make payments easily from their smartphones or tablets. Mobile payment integration can improve the customer experience and increase sales.

Reporting and Analytics

Take advantage of the reporting and analytics capabilities of your CRM and PayPal integration. Track key metrics such as sales revenue, payment volume, and customer retention. Use this data to gain insights into your business performance and make data-driven decisions. Generate custom reports to analyze specific aspects of your business.

Troubleshooting Common Integration Issues

Connection Errors

If you encounter connection errors, double-check your API credentials and ensure that your CRM and PayPal accounts are properly connected. Verify that your internet connection is stable and that there are no firewall restrictions. Consult the documentation for your CRM platform or integration tool for troubleshooting tips.

Data Synchronization Problems

If data is not synchronizing correctly between your CRM and PayPal, review your data mapping settings. Ensure that the data fields are mapped correctly and that the data formats are compatible. Check for any errors in your data and correct them. Consider using a data validation tool to identify and fix data quality issues.

Payment Processing Failures

If payment processing fails, check the transaction details and ensure that the customer has sufficient funds. Verify that your PayPal account is in good standing and that there are no restrictions on your account. Contact PayPal support for assistance if the issue persists. Review your payment gateway settings and ensure that they are configured correctly.

Security Issues

If you suspect a security issue, review your security settings and implement appropriate security measures. Change your passwords regularly and enable two-factor authentication. Monitor your account activity for any suspicious transactions. Contact PayPal support immediately if you detect any unauthorized activity.

Case Studies: Success Stories of CRM and PayPal Integration

E-commerce Business

An e-commerce business integrated its CRM with PayPal to streamline the payment process and improve customer experience. The integration allowed the business to automatically generate invoices, process payments, and update customer records. As a result, the business saw a significant increase in sales, reduced manual errors, and improved customer satisfaction.

Service-Based Company

A service-based company integrated its CRM with PayPal to automate the billing process and improve cash flow. The integration allowed the company to set up recurring payment profiles, manage subscription plans, and track payment statuses. As a result, the company experienced a significant reduction in payment delays and improved financial planning.

Non-Profit Organization

A non-profit organization integrated its CRM with PayPal to facilitate online donations and track donor contributions. The integration allowed the organization to accept online donations, generate donation receipts, and track donor information. As a result, the organization increased its fundraising efforts and improved donor engagement.

Conclusion: Embracing the Future of Business with CRM and PayPal

Integrating your CRM system with PayPal is a strategic move that can significantly benefit your business. It streamlines payment processing, improves sales efficiency, enhances customer experience, and provides valuable data insights. By following the best practices outlined in this article, you can successfully implement this integration and unlock its full potential. Embrace the power of synergy and transform your business for sustainable growth. The future of business is about seamless experiences, efficient operations, and customer-centric approaches. CRM integration with PayPal is a powerful tool in achieving these goals. Start exploring the possibilities today and see how it can revolutionize your business.

FAQs

1. What are the main benefits of integrating CRM with PayPal?

The main benefits include streamlined payment processing, improved sales efficiency, enhanced customer experience, better data insights, and reduced manual data entry.

2. How do I choose the right integration method?

Consider your needs, goals, and technical expertise. Native integrations are often the easiest, while third-party tools offer flexibility. Custom integrations provide the most customization.

3. What data should I map between my CRM and PayPal?

Map customer information, product details, payment amounts, and any other relevant data fields necessary for your business processes.

4. How can I ensure the security of my CRM and PayPal integration?

Use secure connections, encrypt sensitive data, and implement appropriate security measures. Regularly review your security practices and update them as needed.

5. What should I do if I encounter connection errors?

Double-check your API credentials, verify your internet connection, and consult the documentation for your CRM platform or integration tool.