The Ultimate Guide to the Best CRM for Small Accountants: Streamline Your Practice and Boost Profits

The Accountant’s Secret Weapon: Why You Need a CRM

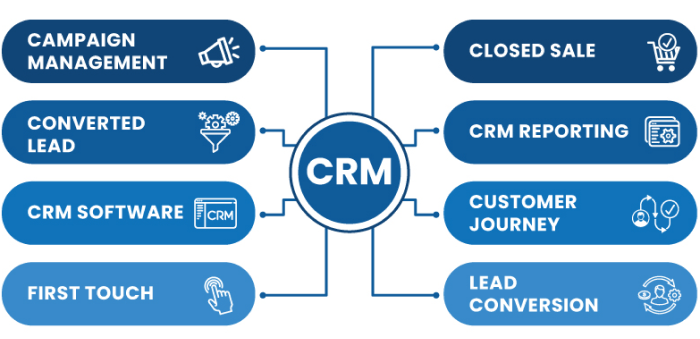

Let’s be honest, running a small accounting practice is a juggling act. You’re managing client relationships, tracking billable hours, chasing down invoices, and, oh yeah, actually doing the accounting! In the whirlwind of spreadsheets and tax codes, it’s easy to let things slip through the cracks. That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your central hub, your organizational command center, and your secret weapon for success.

This isn’t just for big corporations. For small accountants, a CRM is crucial. It’s about more than just storing contact information; it’s about building stronger client relationships, automating tedious tasks, and ultimately, growing your business. Without a CRM, you’re likely spending too much time on administrative tasks, missing out on valuable follow-up opportunities, and potentially losing clients to the competition.

This comprehensive guide dives deep into the world of CRM systems specifically tailored for small accounting firms. We’ll explore the benefits, the key features to look for, and, most importantly, the best CRM solutions available today. Get ready to transform your practice from chaotic to streamlined, from reactive to proactive, and from surviving to thriving.

The Benefits of a CRM for Small Accounting Firms

Why should you invest in a CRM? The benefits are numerous and far-reaching. Here’s a breakdown of how a CRM can revolutionize your accounting practice:

1. Enhanced Client Relationship Management

At its core, a CRM is all about building and nurturing relationships. It allows you to:

- Centralize client data: Store all client information – contact details, communication history, financial data, and project details – in one easily accessible place. No more searching through scattered spreadsheets or email threads.

- Improve communication: Track all interactions with clients, including emails, phone calls, meetings, and invoices. This provides a complete picture of your relationship with each client and helps you personalize your communication.

- Personalize interactions: With a CRM, you can tailor your communication based on client preferences, past interactions, and specific needs. This makes clients feel valued and understood.

- Proactively engage clients: Set up automated reminders for important deadlines, follow-up calls, and check-ins. This helps you stay top-of-mind and ensures clients feel supported.

2. Increased Efficiency and Productivity

Time is money, and a CRM can help you save both. Here’s how:

- Automate repetitive tasks: Automate tasks like sending invoices, scheduling appointments, and sending follow-up emails. This frees up your time to focus on more strategic work.

- Streamline workflows: Create automated workflows for common processes, such as onboarding new clients or managing project timelines.

- Reduce errors: By automating tasks and centralizing data, you minimize the risk of human error.

- Improve collaboration: Share client information and project updates with your team in real-time, making it easier to collaborate and stay on the same page.

3. Improved Sales and Marketing

A CRM isn’t just for managing existing clients; it can also help you attract new ones.

- Track leads and opportunities: Manage your sales pipeline, track potential clients, and follow up on leads effectively.

- Segment your audience: Segment your client base based on demographics, needs, or services used. This allows you to target your marketing efforts more effectively.

- Personalize marketing campaigns: Create personalized email campaigns and other marketing materials based on client data and preferences.

- Measure your results: Track the performance of your marketing campaigns and identify what’s working and what’s not.

4. Better Data Insights and Reporting

A CRM provides valuable data that can help you make informed decisions.

- Track key performance indicators (KPIs): Monitor metrics like client acquisition cost, client retention rate, and revenue per client.

- Generate custom reports: Create reports to analyze your business performance, identify trends, and make data-driven decisions.

- Gain a 360-degree view of your business: Get a comprehensive understanding of your clients, your team, and your overall business performance.

Key Features to Look for in a CRM for Accountants

Not all CRMs are created equal. When choosing a CRM for your accounting practice, consider these essential features:

1. Contact Management

This is the foundation of any good CRM. Look for a system that allows you to:

- Store comprehensive client information, including contact details, communication history, and financial data.

- Easily search and filter your client data.

- Import and export data seamlessly.

2. Task Management and Automation

Automate repetitive tasks to save time and improve efficiency. Look for a CRM that offers:

- Task creation and assignment.

- Automated email marketing and follow-up sequences.

- Workflow automation for common processes.

- Appointment scheduling.

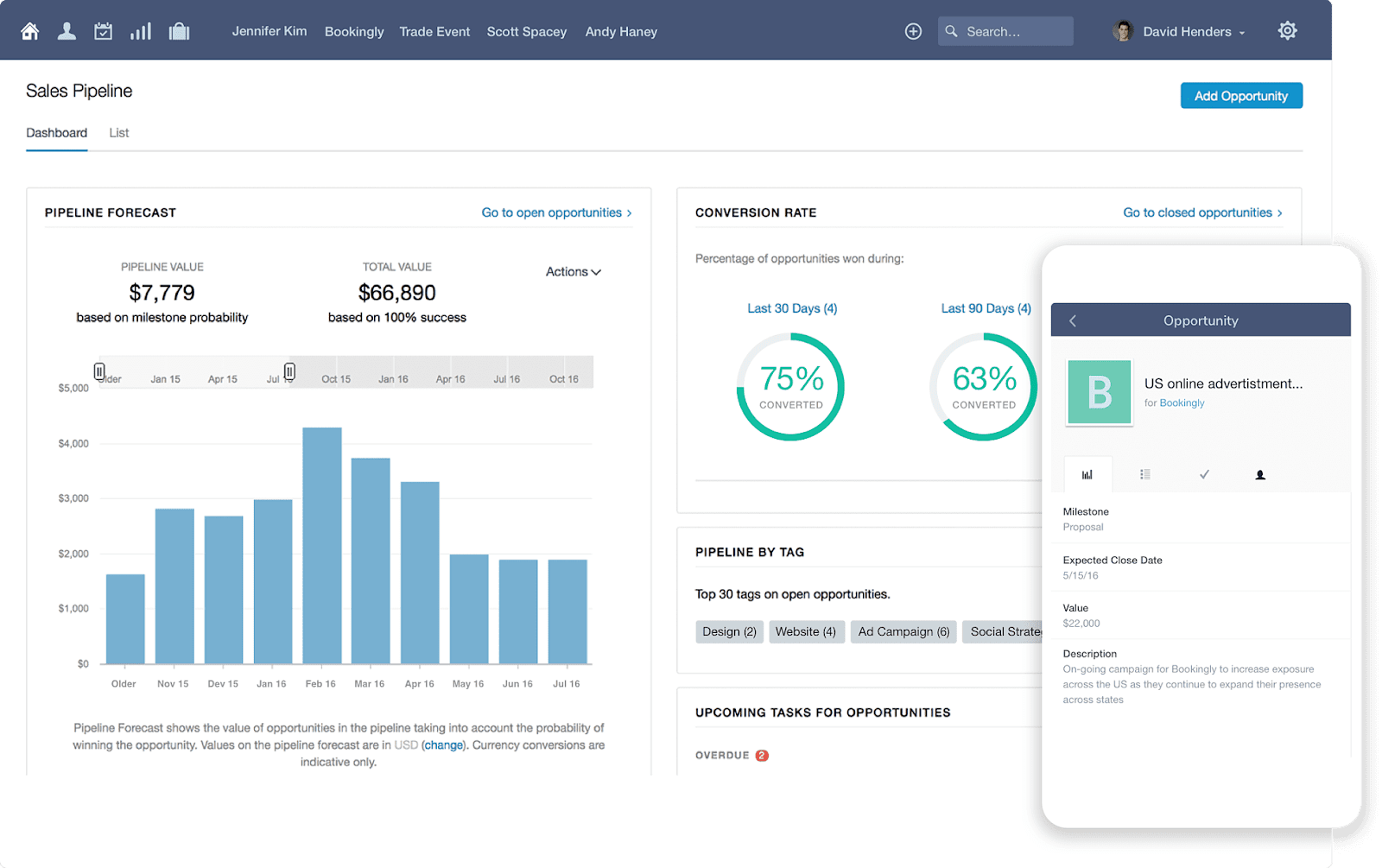

3. Reporting and Analytics

Gain valuable insights into your business performance. Choose a CRM that provides:

- Customizable dashboards and reports.

- Key performance indicator (KPI) tracking.

- Data visualization tools.

- Ability to export data for further analysis.

4. Integrations

Seamlessly integrate with your existing accounting software and other tools. Look for a CRM that integrates with:

- Accounting software (e.g., QuickBooks, Xero).

- Email marketing platforms.

- Payment processing systems.

- Calendar and scheduling tools.

5. Security and Compliance

Protect your clients’ sensitive financial data. Ensure the CRM you choose offers:

- Data encryption.

- Regular security audits.

- Compliance with relevant regulations (e.g., GDPR, CCPA).

6. Mobile Accessibility

Access your CRM data on the go. Choose a CRM that offers:

- A mobile app or a responsive web design that works well on mobile devices.

- Ability to access and update client information from anywhere.

7. User-Friendly Interface

A CRM should be easy to use and navigate. Look for a system that offers:

- An intuitive user interface.

- Easy-to-understand features and functionality.

- Helpful tutorials and support resources.

Top CRM Solutions for Small Accountants

Now, let’s dive into the best CRM options specifically designed for small accounting firms. We’ll explore their key features, pricing, and pros and cons to help you find the perfect fit for your needs.

1. HubSpot CRM

Overview: HubSpot CRM is a popular, all-in-one CRM platform that offers a free version suitable for small businesses. It’s known for its user-friendly interface and robust features.

Key Features:

- Contact management

- Deal tracking

- Email marketing

- Marketing automation

- Reporting and analytics

- Integrations with popular apps

Pros:

- Free version available

- User-friendly interface

- Comprehensive features

- Excellent integrations

Cons:

- Limited features in the free version

- Can be overwhelming for beginners

Pricing: Free, with paid plans starting at $45 per month.

Why it’s good for accountants: HubSpot CRM offers a great balance of features and affordability, making it an excellent choice for small accounting firms looking to get started with CRM. Its strong contact management and marketing automation capabilities are particularly beneficial.

2. Zoho CRM

Overview: Zoho CRM is a powerful and customizable CRM platform that caters to businesses of all sizes. It offers a wide range of features and integrations at a competitive price.

Key Features:

- Contact management

- Lead management

- Sales automation

- Workflow automation

- Reporting and analytics

- Integrations with Zoho apps and third-party apps

Pros:

- Highly customizable

- Affordable pricing

- Wide range of features

- Strong integrations

Cons:

- Can be complex to set up and configure

- User interface can be overwhelming for some

Pricing: Paid plans starting at $14 per user per month.

Why it’s good for accountants: Zoho CRM’s flexibility and affordability make it a great option for small accounting firms that want a powerful CRM solution without breaking the bank. Its strong sales automation features can help you manage leads and grow your client base.

3. Pipedrive

Overview: Pipedrive is a sales-focused CRM designed for small businesses. It’s known for its intuitive interface and focus on the sales pipeline.

Key Features:

- Contact management

- Deal tracking

- Sales pipeline management

- Workflow automation

- Reporting and analytics

- Integrations with popular apps

Pros:

- User-friendly interface

- Focus on sales pipeline management

- Easy to set up and use

Cons:

- Fewer features than some other CRMs

- Can be less suitable for complex workflows

Pricing: Paid plans starting at $14.90 per user per month.

Why it’s good for accountants: Pipedrive’s simplicity and focus on sales make it a good choice for accountants who want a CRM to help them manage leads and close deals efficiently. Its intuitive interface makes it easy to learn and use.

4. Freshsales

Overview: Freshsales is a sales CRM designed to help businesses manage leads, track deals, and close sales faster. It offers a user-friendly interface and a range of features.

Key Features:

- Contact management

- Lead management

- Deal tracking

- Sales automation

- Reporting and analytics

- Integrations with popular apps

Pros:

- User-friendly interface

- Affordable pricing

- Good customer support

Cons:

- Fewer integrations than some other CRMs

- Limited features in the free version

Pricing: Free, with paid plans starting at $15 per user per month.

Why it’s good for accountants: Freshsales is a solid choice for small accounting firms looking for an easy-to-use and affordable CRM. Its focus on sales and lead management can help you grow your client base.

5. Insightly

Overview: Insightly is a CRM and project management platform designed for small businesses. It offers a range of features for managing contacts, leads, projects, and sales.

Key Features:

- Contact management

- Lead management

- Project management

- Sales pipeline management

- Reporting and analytics

- Integrations with popular apps

Pros:

- Combines CRM and project management features

- User-friendly interface

- Good for managing client projects

Cons:

- Can be more expensive than some other CRMs

- Project management features may be overkill for some accountants

Pricing: Paid plans starting at $29 per user per month.

Why it’s good for accountants: Insightly is a good option for small accounting firms that want a CRM that also includes project management features. This can be helpful for managing client projects and deadlines.

6. Agile CRM

Overview: Agile CRM is a comprehensive CRM platform that offers a wide range of features, including sales, marketing, and customer service tools. It’s known for its affordability and ease of use.

Key Features:

- Contact management

- Deal tracking

- Sales automation

- Marketing automation

- Helpdesk

- Reporting and analytics

- Integrations with popular apps

Pros:

- Affordable pricing

- Comprehensive features

- User-friendly interface

Cons:

- Limited customer support

- Can be less powerful than some other CRMs

Pricing: Free, with paid plans starting at $9.99 per user per month.

Why it’s good for accountants: Agile CRM offers a great value proposition for small accounting firms. Its affordable pricing and comprehensive features make it a good choice for businesses that want a lot of functionality without breaking the bank.

Choosing the Right CRM for Your Accounting Practice

Selecting the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the best choice:

1. Assess Your Needs

Before you start comparing CRMs, take some time to assess your specific needs. Consider these questions:

- What are your goals? What do you hope to achieve with a CRM? (e.g., improve client relationships, increase efficiency, grow your client base)

- What are your pain points? What challenges are you currently facing in managing your clients and your business? (e.g., disorganized data, inefficient communication, missed deadlines)

- What features do you need? Which features are essential for your practice? (e.g., contact management, task automation, reporting)

- How many users will you have? This will affect the pricing and scalability of the CRM.

- What is your budget? Determine how much you’re willing to spend on a CRM.

2. Research and Compare Options

Once you understand your needs, start researching different CRM options. Compare the features, pricing, and reviews of each platform. Consider these factors:

- Features: Does the CRM offer the features you need?

- Pricing: Is the pricing affordable and scalable?

- Ease of use: Is the interface user-friendly?

- Integrations: Does the CRM integrate with your existing software?

- Customer support: Does the CRM offer good customer support?

- Reviews: Read reviews from other accounting firms to get insights into their experiences.

3. Consider a Free Trial

Most CRM providers offer free trials. Take advantage of these trials to test out the platform and see if it’s a good fit for your practice. This allows you to:

- Explore the features: Get hands-on experience with the CRM’s features.

- Test the interface: See if the user interface is intuitive and easy to navigate.

- Evaluate the integrations: Test the integrations with your existing software.

- Assess the support: Contact customer support to see how responsive and helpful they are.

4. Choose the Right CRM

After evaluating your needs, researching options, and testing out free trials, choose the CRM that best fits your practice. Consider these factors when making your final decision:

- Features: Does the CRM offer all the features you need?

- Ease of use: Is the CRM easy to learn and use?

- Pricing: Is the pricing affordable and sustainable?

- Integrations: Does the CRM integrate with your existing software?

- Customer support: Does the CRM offer good customer support?

Implementing Your New CRM: A Smooth Transition

Once you’ve chosen your CRM, the next step is implementation. Here’s how to ensure a smooth transition:

1. Data Migration

Transferring your existing client data to the new CRM is a crucial step. Make sure to:

- Clean up your data: Remove any outdated or inaccurate information.

- Organize your data: Ensure your data is organized in a consistent format.

- Import your data: Follow the CRM’s instructions for importing your data.

2. Training

Train your team on how to use the new CRM. This will help them understand the features and functionality of the system. Provide:

- Training materials: Provide training materials, such as user manuals, video tutorials, and online resources.

- Hands-on training: Provide hands-on training to help your team learn how to use the CRM.

- Ongoing support: Provide ongoing support to answer questions and help your team with any challenges they may face.

3. Customization

Customize the CRM to fit your specific needs. This may involve:

- Setting up workflows: Create automated workflows for common processes.

- Customizing reports: Create custom reports to track your key performance indicators.

- Integrating with other tools: Integrate the CRM with your existing software.

4. Ongoing Maintenance

Maintain your CRM on an ongoing basis. This includes:

- Regular data updates: Regularly update your client data to ensure it’s accurate.

- Reviewing and optimizing workflows: Review and optimize your workflows to ensure they’re efficient.

- Staying up-to-date with new features: Stay up-to-date with the latest features and functionality of the CRM.

The Future of Accounting and CRM

The accounting industry is constantly evolving, and CRM systems are keeping pace. Here are some trends to watch:

- Artificial intelligence (AI): AI-powered CRMs can automate tasks, provide insights, and personalize client interactions.

- Mobile accessibility: CRMs are becoming increasingly mobile-friendly, allowing accountants to access their data and manage their clients from anywhere.

- Integration with cloud-based accounting software: CRMs are increasingly integrating with cloud-based accounting software, providing a seamless flow of information.

- Focus on client experience: CRMs are becoming more focused on improving the client experience, with features like client portals and self-service options.

Conclusion: Embrace the Power of CRM

In today’s competitive landscape, a CRM is no longer a luxury; it’s a necessity for small accounting firms. By implementing a CRM, you can streamline your operations, strengthen client relationships, and ultimately, grow your business. Take the time to research your options, choose the right CRM for your needs, and implement it effectively. Your practice will thank you for it.

Investing in a CRM is investing in the future of your accounting practice. It’s about more than just managing contacts; it’s about building a thriving business. So, take the plunge and embrace the power of CRM. You won’t regret it.