Seamlessly Connecting Finances and Customer Relationships: CRM Integration with QuickBooks

Introduction: The Power of Synergy in Business

In the fast-paced world of business, efficiency and organization are paramount. Companies constantly seek ways to streamline their operations, reduce errors, and boost productivity. One of the most effective strategies for achieving these goals is the integration of different software systems. This is particularly true when it comes to customer relationship management (CRM) and accounting software. This article will delve deep into the benefits and practicalities of CRM integration with QuickBooks, a leading accounting software, exploring how this powerful combination can transform your business.

Think of it like this: your CRM system is the heart of your customer interactions, gathering data about leads, prospects, and existing clients. QuickBooks, on the other hand, is the brain of your finances, meticulously tracking income, expenses, and everything in between. When these two systems work in isolation, valuable information gets siloed, leading to inefficiencies and missed opportunities. However, when they’re integrated, they create a synergy that allows your business to thrive.

Understanding CRM and QuickBooks: A Quick Overview

What is CRM?

CRM, or Customer Relationship Management, is a system that helps businesses manage interactions with current and potential customers. It encompasses a range of functions, including:

- Contact Management: Storing and organizing contact information, including names, addresses, phone numbers, and email addresses.

- Lead Management: Tracking leads from initial contact through the sales pipeline.

- Sales Automation: Automating sales processes, such as sending follow-up emails and scheduling appointments.

- Marketing Automation: Automating marketing campaigns, such as email marketing and social media engagement.

- Customer Service: Managing customer inquiries, resolving issues, and providing support.

The primary goal of a CRM system is to improve customer relationships, increase sales, and boost customer satisfaction. Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Pipedrive.

What is QuickBooks?

QuickBooks is a popular accounting software designed to help small and medium-sized businesses manage their finances. It offers a comprehensive suite of features, including:

- Accounting: Managing financial transactions, such as income, expenses, and bank reconciliations.

- Invoicing: Creating and sending invoices to customers.

- Bill Payments: Paying bills to vendors.

- Reporting: Generating financial reports, such as profit and loss statements and balance sheets.

- Payroll: Processing payroll for employees (available in some versions).

QuickBooks helps businesses track their financial performance, make informed decisions, and comply with tax regulations. It is a widely used accounting solution, known for its user-friendliness and robust features.

The Benefits of CRM Integration with QuickBooks

Integrating your CRM with QuickBooks can unlock a wealth of benefits for your business, streamlining processes and improving overall efficiency. Here are some of the key advantages:

1. Enhanced Data Accuracy and Reduced Errors

One of the most significant advantages of integration is the elimination of manual data entry. When data flows seamlessly between your CRM and QuickBooks, you no longer need to manually enter information into both systems. This significantly reduces the risk of errors that can arise from manual data entry, such as typos or incorrect figures. This improved data accuracy ensures that your financial reports and customer records are reliable and up-to-date.

Imagine the time saved by not having to re-enter customer information, invoice details, and payment data. This time can be redirected to more strategic activities, such as customer relationship building and sales efforts.

2. Improved Efficiency and Time Savings

By automating the data transfer between your CRM and QuickBooks, you can save a considerable amount of time. Manual data entry is a time-consuming process, and integration eliminates the need for it. This allows your employees to focus on more valuable tasks, such as serving customers, generating leads, and closing deals. The time saved can translate into increased productivity and profitability.

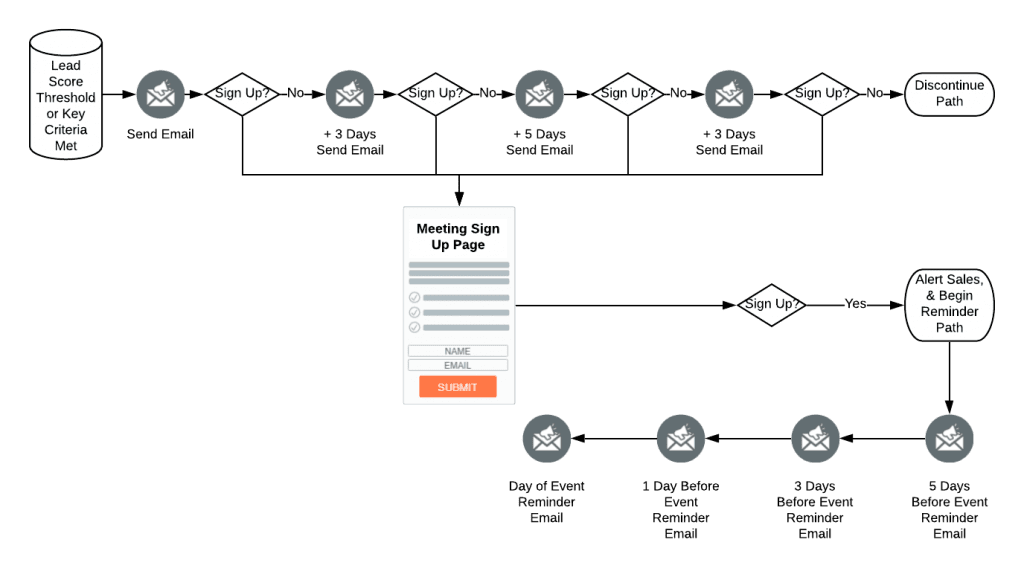

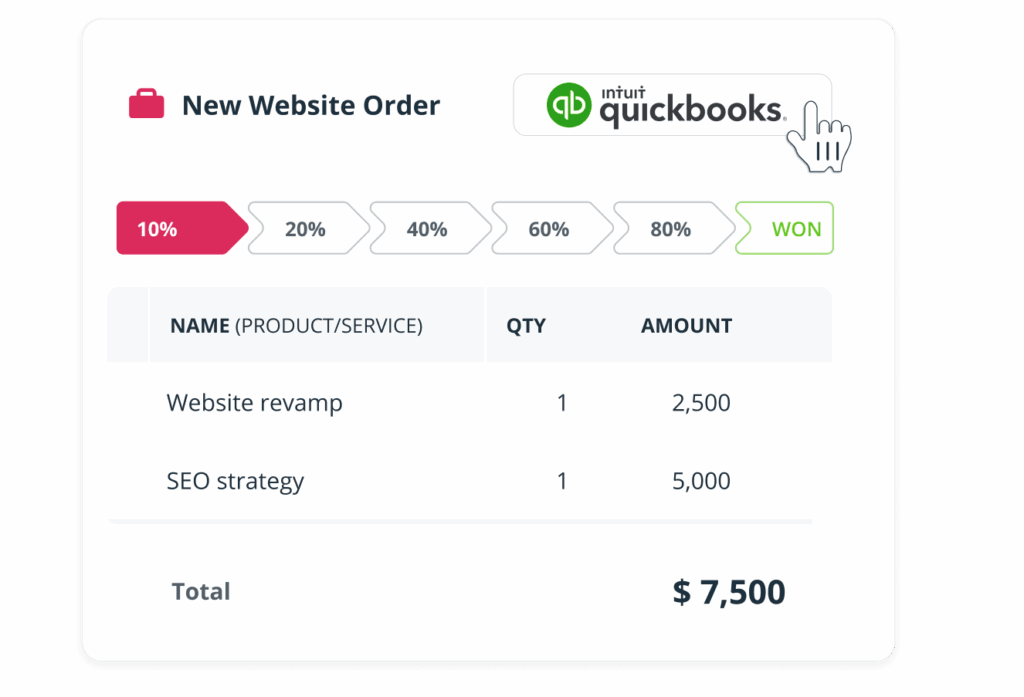

For example, when a sale is closed in your CRM, the invoice can automatically be generated and sent to the customer in QuickBooks. This eliminates the need for your sales team to manually create invoices and reduces the time it takes to get paid.

3. Streamlined Sales and Accounting Processes

Integration streamlines the entire sales and accounting cycle. When a lead is converted into a customer in your CRM, the relevant information, such as customer details and payment terms, can be automatically transferred to QuickBooks. This allows you to quickly create invoices, track payments, and manage your accounts receivable.

Furthermore, when a payment is received, the information can be automatically updated in both systems, eliminating the need for manual reconciliation. This streamlined process reduces the time it takes to close deals, get paid, and manage your finances.

4. Better Customer Insights and Improved Decision-Making

Integration allows you to gain a 360-degree view of your customers. By combining customer data from your CRM with financial data from QuickBooks, you can gain valuable insights into customer behavior, purchase patterns, and profitability. This information can be used to make more informed decisions about sales, marketing, and customer service.

For example, you can identify your most profitable customers, track their spending habits, and tailor your marketing efforts to their specific needs. This can lead to increased sales, improved customer retention, and a higher return on investment.

5. Enhanced Collaboration and Communication

Integration promotes better collaboration and communication between your sales, marketing, and accounting teams. When everyone has access to the same data, they can work together more effectively. Sales reps can see a customer’s payment history and outstanding invoices, while the accounting team can see the status of sales opportunities and customer interactions.

This improved collaboration can lead to better customer service, faster problem resolution, and increased overall efficiency. It breaks down silos and promotes a unified view of the customer.

6. Reduced Costs

By streamlining processes, reducing errors, and improving efficiency, CRM integration with QuickBooks can lead to significant cost savings. You can reduce the amount of time your employees spend on manual tasks, minimize errors, and improve your cash flow. This can free up resources that can be used for other business activities, such as marketing and product development.

Furthermore, by automating tasks and improving efficiency, you can reduce the need for additional staff, which can lead to further cost savings.

7. Improved Compliance

Integration can help you improve compliance with accounting regulations and tax laws. By automating data entry and ensuring data accuracy, you can reduce the risk of errors and penalties. Furthermore, integration can help you track and manage your financial data more effectively, making it easier to comply with reporting requirements.

How to Integrate CRM with QuickBooks: A Step-by-Step Guide

Integrating your CRM with QuickBooks can seem daunting, but with the right approach, it can be a straightforward process. Here’s a step-by-step guide to help you get started:

1. Choose the Right Integration Method

There are several ways to integrate your CRM with QuickBooks, including:

- Native Integration: Some CRM systems offer native integration with QuickBooks, meaning that the integration is built-in and easy to set up.

- Third-Party Integration Tools: There are many third-party integration tools available that can connect your CRM with QuickBooks. These tools often offer a range of features, such as data mapping, automation, and custom workflows.

- Custom Integration: If you have specific integration requirements, you may need to develop a custom integration. This involves using APIs (Application Programming Interfaces) to connect your CRM and QuickBooks.

The best integration method for your business will depend on your specific needs and technical expertise. Consider the features offered, the ease of use, and the cost of each option.

2. Select an Integration Platform

If you choose a third-party integration tool, you’ll need to select a platform that meets your needs. Some popular integration platforms include:

- Zapier: A popular automation platform that connects thousands of apps, including CRM systems and QuickBooks.

- PieSync: A platform specifically designed for CRM and accounting integration.

- Workato: An enterprise-grade integration platform that offers advanced features and customization options.

Consider factors such as the platform’s compatibility with your CRM and QuickBooks versions, its pricing, and its ease of use.

3. Plan Your Integration

Before you begin the integration process, it’s important to plan your integration carefully. This includes:

- Identifying the data you want to sync: Determine which data fields you want to transfer between your CRM and QuickBooks, such as customer information, invoice details, and payment data.

- Mapping the data fields: Map the data fields in your CRM to the corresponding fields in QuickBooks. This ensures that the data is transferred correctly.

- Defining your integration workflows: Determine how you want the data to flow between your CRM and QuickBooks. For example, you may want to automatically create invoices in QuickBooks when a deal is closed in your CRM.

Planning your integration will help you avoid errors and ensure that the integration meets your specific needs.

4. Set Up the Integration

Once you’ve planned your integration, you can begin setting it up. The specific steps will vary depending on the integration method you’ve chosen. However, the general process involves:

- Connecting your CRM and QuickBooks accounts: Authorize the integration platform to access your CRM and QuickBooks accounts.

- Mapping the data fields: Configure the data mapping between your CRM and QuickBooks.

- Setting up your workflows: Define the automation rules and workflows that will govern the data transfer.

- Testing the integration: Test the integration thoroughly to ensure that the data is being transferred correctly.

Follow the instructions provided by your integration platform or the native integration documentation.

5. Test and Monitor the Integration

After setting up the integration, it’s crucial to test it thoroughly. Create test records in your CRM and QuickBooks and verify that the data is being synced correctly. Monitor the integration regularly to ensure that it’s functioning properly. Check for any errors or issues and resolve them promptly.

Regular monitoring will help you identify and address any problems before they impact your business operations.

6. Provide Training and Support

Once the integration is up and running, provide training to your employees on how to use the integrated systems. This will ensure that they understand how to enter data, manage workflows, and access the information they need. Provide ongoing support to help your employees resolve any issues they may encounter.

Proper training and support will maximize the benefits of the integration and ensure that your employees can use the systems effectively.

Choosing the Right CRM and QuickBooks for Integration

The success of your integration depends, in part, on choosing the right CRM and QuickBooks solutions for your business. Here’s what to consider:

1. CRM System Selection

When selecting a CRM system, consider the following factors:

- Features: Choose a CRM that offers the features you need, such as contact management, lead management, sales automation, and marketing automation.

- Scalability: Select a CRM that can scale to meet your business’s future needs.

- Ease of Use: Choose a CRM that is user-friendly and easy to learn.

- Integration capabilities: Ensure that the CRM integrates seamlessly with QuickBooks.

- Pricing: Consider the pricing of the CRM and its features.

Popular CRM systems that integrate well with QuickBooks include Salesforce, HubSpot, Zoho CRM, and Pipedrive. Research and compare the features and pricing of different CRM systems to find the best fit for your business.

2. QuickBooks Version

QuickBooks offers several versions, including:

- QuickBooks Online: A cloud-based version that is accessible from any device with an internet connection.

- QuickBooks Desktop: A desktop-based version that is installed on your computer.

- QuickBooks Self-Employed: A simplified version designed for freelancers and self-employed individuals.

QuickBooks Online is generally recommended for integration with CRM systems, as it offers better integration capabilities and is easier to manage. However, QuickBooks Desktop can also be integrated with some CRM systems.

Ensure that your QuickBooks version is compatible with the CRM system you choose and the integration platform you plan to use.

3. Integration Compatibility

Before committing to a CRM and QuickBooks combination, carefully assess their integration compatibility. Here’s what to look for:

- Native Integration: Does the CRM offer a direct, built-in integration with QuickBooks? Native integrations often provide the most seamless and feature-rich experience.

- Third-Party Integrations: If a native integration isn’t available, check for third-party integration tools. Ensure these tools are compatible with both your CRM and QuickBooks versions.

- API Access: Does the CRM and QuickBooks offer open APIs? APIs (Application Programming Interfaces) allow for custom integration and data exchange.

- Data Mapping Capabilities: Verify that the integration solution allows you to map data fields accurately between the two systems.

- Workflow Automation: Can the integration automate critical tasks like invoice creation, payment tracking, and contact updates?

Verifying compatibility upfront will save you time and potential headaches later on.

Common Challenges and How to Overcome Them

While CRM integration with QuickBooks offers significant benefits, it’s not without its challenges. Here are some common hurdles and how to address them:

1. Data Mapping Issues

One of the most common challenges is data mapping. Ensuring that data fields in your CRM align correctly with the corresponding fields in QuickBooks can be tricky. Mismatched fields can lead to inaccurate data and reporting errors.

Solution: Carefully plan your data mapping process. Review the data fields in both systems and identify the corresponding fields. Use a data mapping tool or consult with an integration specialist to ensure accurate mapping. Test the integration thoroughly to identify and correct any mapping errors.

2. Complex Workflows

Setting up complex workflows can be time-consuming and require technical expertise. You may need to create custom workflows to automate specific processes, such as invoice generation or payment tracking.

Solution: Start with simple workflows and gradually add more complex ones as needed. Use a user-friendly integration platform that offers pre-built workflows. If you need to create custom workflows, consider hiring an integration specialist to help you.

3. Data Synchronization Delays

Data synchronization delays can occur, especially if you’re syncing a large amount of data. This can lead to inconsistencies between your CRM and QuickBooks.

Solution: Optimize your data synchronization settings to minimize delays. Schedule your data synchronization during off-peak hours. Monitor the integration regularly to identify and address any synchronization issues.

4. Version Compatibility

Ensuring that your CRM and QuickBooks versions are compatible can be a challenge. Older versions may not be compatible with newer integration platforms.

Solution: Upgrade your CRM and QuickBooks versions to the latest versions. Check the compatibility requirements of your integration platform. If you’re using older versions, consider upgrading or finding an integration platform that supports them.

5. Security Concerns

Integrating your CRM and QuickBooks can raise security concerns. You need to ensure that your data is protected from unauthorized access and breaches.

Solution: Choose a reputable integration platform that offers robust security features. Use strong passwords and enable two-factor authentication. Regularly review your security settings and update them as needed.

Real-World Examples: Success Stories of CRM and QuickBooks Integration

The benefits of integrating CRM and QuickBooks are not just theoretical; many businesses have experienced significant improvements. Here are a few real-world examples:

1. Increased Sales Efficiency

A marketing agency struggled with manually entering customer data and creating invoices. After integrating their CRM (HubSpot) with QuickBooks, they automated these processes. Sales reps could now generate invoices directly from their CRM, saving hours each week. This freed up their time to focus on lead generation and closing deals, resulting in a 15% increase in sales revenue.

2. Improved Cash Flow Management

A construction company faced challenges with late payments and manual reconciliation of invoices. By integrating their CRM (Zoho CRM) with QuickBooks, they automated invoice generation, payment tracking, and reconciliation. This led to faster payments, improved cash flow, and a reduction in late payment penalties. They saw a 10% reduction in outstanding invoices.

3. Better Customer Service

An e-commerce business struggled to provide personalized customer service due to siloed data. They integrated their CRM (Salesforce) with QuickBooks to gain a 360-degree view of their customers. Customer service reps could now access purchase history, payment information, and communication history in one place. This led to faster issue resolution, improved customer satisfaction, and a 20% increase in customer retention.

4. Streamlined Reporting and Analytics

A consulting firm spent significant time manually creating financial reports. After integrating their CRM (Pipedrive) with QuickBooks, they could generate reports automatically. They gained real-time insights into sales performance, customer profitability, and cash flow. This enabled them to make data-driven decisions and improve their overall business performance.

These examples demonstrate the diverse ways in which CRM and QuickBooks integration can benefit businesses across various industries. By automating processes, improving data accuracy, and gaining valuable insights, companies can achieve significant improvements in efficiency, profitability, and customer satisfaction.

Conclusion: Embrace the Power of Integration

CRM integration with QuickBooks is a powerful strategy for businesses looking to streamline their operations, improve data accuracy, and gain a competitive edge. By connecting your customer relationship management and accounting systems, you can unlock a wealth of benefits, including enhanced efficiency, improved customer insights, and better financial management.

While the integration process may seem daunting at first, with careful planning and the right approach, it can be a straightforward and rewarding endeavor. Choose the right CRM and QuickBooks versions, select a suitable integration method, and follow the steps outlined in this article. By embracing the power of integration, you can transform your business and achieve greater success.

In today’s competitive landscape, businesses that embrace technology and automation are best positioned to thrive. CRM integration with QuickBooks is a crucial step in that direction. It’s an investment that can pay dividends for years to come, helping you build stronger customer relationships, manage your finances more effectively, and ultimately, grow your business.

So, take the leap. Start exploring the possibilities of CRM integration with QuickBooks today and experience the transformative power of synergy in your business.