Unlocking Growth: The Best CRM Systems for Small Accounting Firms

Unlocking Growth: The Best CRM Systems for Small Accounting Firms

In today’s fast-paced business environment, small accounting firms are facing increasing pressure to not only provide accurate financial services but also to build and maintain strong client relationships. This is where a Customer Relationship Management (CRM) system becomes an invaluable asset. Choosing the right CRM can be the difference between struggling to manage client interactions and effortlessly nurturing lasting relationships that drive growth. This article delves into the best CRM systems specifically designed for small accounting firms, exploring their key features, benefits, and how they can transform your business.

Why a CRM is Essential for Small Accounting Firms

Before we dive into specific CRM solutions, let’s understand why a CRM is not just a luxury, but a necessity for small accounting firms. In the past, accountants may have relied on spreadsheets, email inboxes, and memory to keep track of client information. However, this approach is inefficient, prone to errors, and limits your ability to provide exceptional service. A CRM system centralizes all client data, providing a 360-degree view of each client’s interactions, financial history, and preferences. This allows you to:

- Improve Client Relationships: By understanding your clients better, you can personalize your interactions, anticipate their needs, and provide proactive advice.

- Increase Efficiency: Automate repetitive tasks, such as appointment scheduling, email follow-ups, and report generation, freeing up your time to focus on more strategic activities.

- Boost Sales and Revenue: Identify and nurture leads, track sales opportunities, and close deals more effectively.

- Enhance Collaboration: Facilitate seamless communication and collaboration among your team members, ensuring everyone is on the same page.

- Ensure Data Security and Compliance: Protect sensitive client data with robust security features and comply with industry regulations.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. When choosing a CRM for your accounting firm, consider the following essential features:

Client Management

The core function of any CRM is client management. Look for a system that allows you to:

- Store Comprehensive Client Data: Capture all relevant client information, including contact details, financial history, tax returns, and communication logs.

- Segment Clients: Group clients based on various criteria, such as industry, revenue, or service needs, to tailor your marketing and service delivery.

- Manage Client Interactions: Track all interactions with clients, including emails, phone calls, meetings, and document sharing.

Workflow Automation

Automation is key to improving efficiency and reducing manual errors. Look for a CRM that can automate the following tasks:

- Appointment Scheduling: Allow clients to book appointments online and send automated reminders.

- Email Marketing: Create and send targeted email campaigns to nurture leads and engage with clients.

- Task Management: Automate task assignments and reminders to ensure deadlines are met.

- Report Generation: Generate custom reports to track key performance indicators (KPIs) and gain insights into your business performance.

Integration with Accounting Software

Seamless integration with your existing accounting software is crucial for data accuracy and efficiency. Choose a CRM that integrates with popular accounting platforms like:

- QuickBooks: A widely used accounting software for small businesses.

- Xero: A cloud-based accounting software with a strong focus on user-friendliness.

- Sage: A comprehensive accounting solution for businesses of all sizes.

Reporting and Analytics

A good CRM should provide powerful reporting and analytics capabilities to help you track your performance and make data-driven decisions. Look for features such as:

- Customizable Dashboards: Create personalized dashboards to display key metrics and track your progress.

- Sales Pipeline Tracking: Visualize your sales pipeline and identify opportunities to close deals.

- Performance Reports: Generate reports on client acquisition, retention, and revenue.

Security and Compliance

Protecting client data is paramount in the accounting industry. Choose a CRM that offers robust security features, such as:

- Data Encryption: Encrypt sensitive client data to protect it from unauthorized access.

- Access Controls: Control user access to specific data and features.

- Compliance with Industry Regulations: Ensure the CRM complies with relevant data privacy regulations, such as GDPR and CCPA.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed for small accounting firms:

1. HubSpot CRM

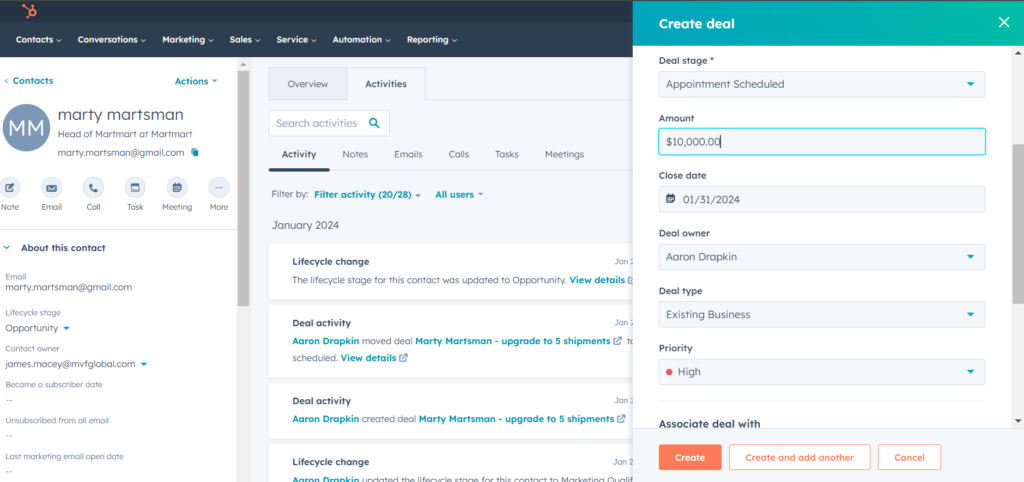

HubSpot CRM is a popular and user-friendly option, particularly for businesses new to CRM. It offers a free version with a range of features, making it an excellent starting point. HubSpot CRM is known for its:

- Ease of Use: The intuitive interface makes it easy for anyone to learn and use.

- Free Version: The free version provides a solid foundation for managing contacts, tracking deals, and automating marketing tasks.

- Integration with Marketing Tools: Seamlessly integrates with HubSpot’s marketing, sales, and customer service tools.

- Customization Options: Offers a wide range of customization options to tailor the CRM to your specific needs.

Pros:

- Free version with essential features

- User-friendly interface

- Strong integration capabilities

- Excellent customer support

Cons:

- Limited features in the free version

- More advanced features require paid subscriptions

2. Zoho CRM

Zoho CRM is a comprehensive CRM system that offers a wide range of features at a competitive price point. It’s a great option for small accounting firms that want a powerful CRM without breaking the bank. Key features include:

- Customization: Highly customizable to fit your specific business needs.

- Workflow Automation: Powerful automation capabilities to streamline your business processes.

- Sales Force Automation: Tools to manage leads, track deals, and close sales.

- Integration with Zoho Suite: Seamlessly integrates with other Zoho apps, such as Zoho Books (accounting software).

Pros:

- Affordable pricing

- Highly customizable

- Robust automation capabilities

- Strong integration with Zoho Suite

Cons:

- Interface can be overwhelming for beginners

- Some integrations may require additional fees

3. Pipedrive

Pipedrive is a sales-focused CRM that is particularly well-suited for small accounting firms that want to improve their sales process. It’s known for its:

- Visual Sales Pipeline: Provides a clear and intuitive view of your sales pipeline.

- Deal Tracking: Makes it easy to track deals and manage sales opportunities.

- Automation: Automates repetitive sales tasks.

- User-Friendly Interface: Easy to learn and use.

Pros:

- Intuitive and user-friendly interface

- Excellent sales pipeline visualization

- Strong automation capabilities

- Mobile app for on-the-go access

Cons:

- Limited features for non-sales-related tasks

- Can be more expensive than other options

4. Salesforce Sales Cloud

Salesforce Sales Cloud is a powerful and scalable CRM system suitable for businesses of all sizes, including small accounting firms that anticipate growth. It offers a wide range of features, including:

- Comprehensive Features: Offers a vast array of features for sales, marketing, and customer service.

- Scalability: Can scale to meet the needs of growing businesses.

- Customization: Highly customizable to fit your specific business needs.

- Extensive App Ecosystem: Integrates with a wide range of third-party apps through the Salesforce AppExchange.

Pros:

- Comprehensive features

- Highly scalable

- Extensive customization options

- Large app ecosystem

Cons:

- Can be expensive, especially for small businesses

- Steep learning curve

- Can be overwhelming for users new to CRM

5. Insightly

Insightly is a CRM designed to help businesses build strong relationships with their customers. It’s a good option for small accounting firms that value client relationship management. Key features include:

- Contact Management: Keeps all your client information in one place.

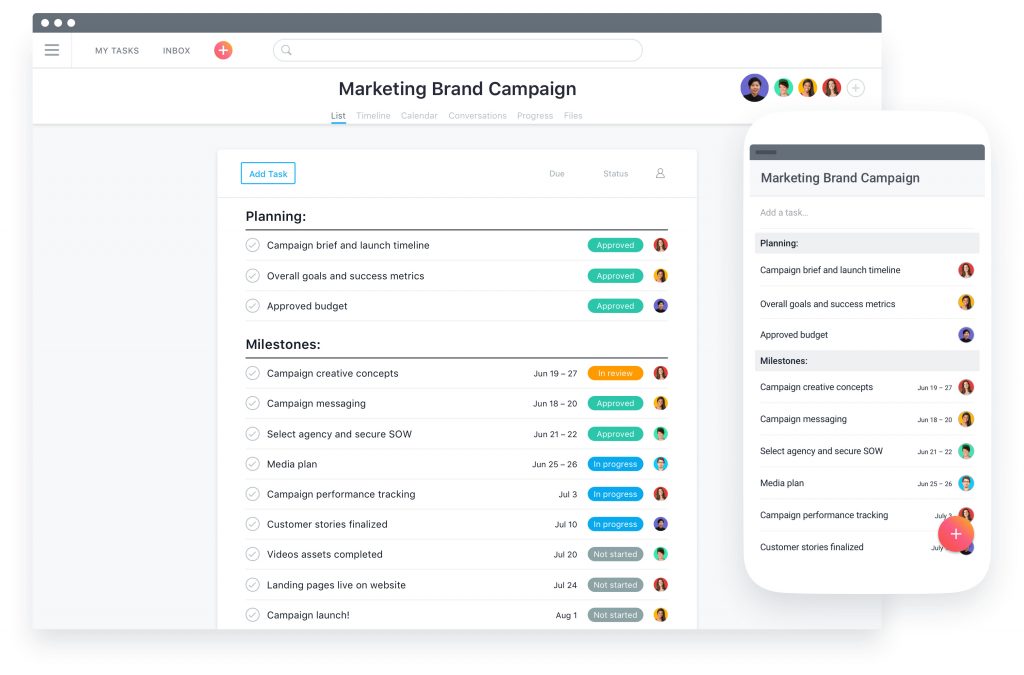

- Project Management: Helps you manage client projects and deadlines.

- Lead Management: Tracks leads and opportunities.

- Integration with Google Workspace: Integrates with Google Workspace apps for easy collaboration.

Pros:

- Focus on client relationship management

- Project management features

- Easy to use

- Good value for the price

Cons:

- Limited features compared to more comprehensive CRM systems

- Reporting capabilities could be improved

How to Choose the Right CRM for Your Accounting Firm

Choosing the right CRM is a crucial decision that can significantly impact your firm’s success. Here’s a step-by-step guide to help you make the right choice:

1. Define Your Needs and Goals

Before you start evaluating CRM systems, take the time to define your firm’s specific needs and goals. Consider the following questions:

- What are your primary objectives? (e.g., improve client relationships, increase sales, streamline operations)

- What are your biggest challenges? (e.g., managing client data, tracking leads, automating tasks)

- What features are essential? (e.g., client management, workflow automation, integration with accounting software)

- What is your budget?

- How many users will need access to the CRM?

2. Research and Evaluate CRM Systems

Once you have a clear understanding of your needs, start researching and evaluating different CRM systems. Consider the following factors:

- Features: Does the CRM offer the features you need?

- Ease of Use: Is the interface intuitive and easy to learn?

- Integration: Does it integrate with your existing accounting software and other tools?

- Pricing: Is the pricing affordable and transparent?

- Customer Support: Does the vendor offer good customer support?

- Reviews and Ratings: Read reviews and ratings from other accounting firms.

3. Request Demos and Trials

Narrow down your choices to a few top contenders and request demos and free trials. This will give you the opportunity to:

- See the CRM in action: Get a feel for the interface and features.

- Test the features: Try out the features that are most important to you.

- Ask questions: Get your questions answered by the vendor.

4. Consider Implementation and Training

Implementing a new CRM system can be a significant undertaking. Consider the following:

- Implementation Support: Does the vendor offer implementation support?

- Training: Does the vendor provide training for your team?

- Data Migration: How easy is it to migrate your existing data to the new CRM?

5. Make Your Decision and Implement

Based on your research, demos, and trials, choose the CRM that best meets your needs and goals. Once you’ve made your decision, implement the CRM and train your team. Be sure to:

- Develop a clear implementation plan: Outline the steps involved in implementing the CRM.

- Migrate your data: Transfer your existing data to the new CRM.

- Train your team: Provide training to your team members on how to use the CRM.

- Monitor and evaluate: Track your progress and make adjustments as needed.

Benefits Beyond the Basics: CRM and the Accounting Firm’s Future

Beyond the immediate benefits of improved client management and streamlined processes, a well-chosen CRM system can position your small accounting firm for long-term success. Here’s how:

Data-Driven Decision Making

CRMs provide valuable data and analytics that can inform your business decisions. By tracking key metrics such as client acquisition cost, client retention rate, and revenue per client, you can identify areas for improvement and make data-driven decisions to drive growth.

Personalized Client Experiences

In today’s competitive market, clients expect personalized experiences. A CRM allows you to tailor your interactions with each client based on their individual needs and preferences. This can lead to increased client satisfaction, loyalty, and referrals.

Proactive Client Service

With a CRM, you can proactively identify opportunities to provide value to your clients. For example, you can use the CRM to track upcoming tax deadlines, identify potential tax savings, and offer personalized advice. This proactive approach can help you build stronger client relationships and differentiate your firm from the competition.

Scalability and Growth

As your firm grows, a CRM can scale with you. A well-chosen CRM can adapt to your changing needs, whether you’re adding new clients, expanding your service offerings, or hiring new team members. This scalability is essential for long-term success.

Enhanced Team Collaboration

A CRM fosters better collaboration among your team members. By centralizing client data and communication, the CRM ensures that everyone has access to the information they need. This can lead to improved efficiency, reduced errors, and a more cohesive team.

Overcoming Challenges: Common CRM Implementation Pitfalls

While the benefits of a CRM are clear, implementing a new system can present challenges. Here are some common pitfalls to avoid:

Lack of Planning

Failing to plan adequately is one of the most common mistakes. Before implementing a CRM, define your goals, identify your needs, and create a detailed implementation plan. Without a solid plan, your implementation may be delayed or fail altogether.

Poor Data Migration

Migrating your existing data to the new CRM can be a complex process. Ensure that your data is accurate, complete, and properly formatted before migrating it. Consider using a data migration tool to streamline the process.

Inadequate Training

If your team isn’t properly trained on how to use the CRM, they won’t be able to take full advantage of its features. Invest in thorough training for all team members. Provide ongoing support and resources to ensure that everyone is comfortable using the system.

Resistance to Change

Change can be difficult, and some team members may resist adopting the new CRM. Communicate the benefits of the CRM to your team and address any concerns they may have. Involve your team in the implementation process to gain their buy-in.

Failure to Customize

Don’t be afraid to customize the CRM to fit your specific business needs. Tailor the system to your workflows, processes, and reporting requirements. This will help you get the most value from the CRM.

Ignoring Data Security

Always prioritize data security. Implement strong security measures to protect your client data from unauthorized access. Ensure that the CRM complies with all relevant data privacy regulations.

Conclusion: Empowering Your Accounting Firm with the Right CRM

Choosing the best CRM for your small accounting firm is a critical investment that can significantly impact your success. By selecting a system that meets your specific needs, you can improve client relationships, increase efficiency, boost sales, and position your firm for long-term growth. Take the time to research, evaluate, and implement the right CRM, and you’ll be well on your way to unlocking your firm’s full potential.