Unlocking Efficiency: The Best CRM Systems for Small Accounting Firms

Introduction: Navigating the CRM Landscape for Accountants

Running a small accounting firm is no walk in the park. You’re juggling client relationships, financial data, deadlines, and a whole host of other responsibilities. In today’s fast-paced world, efficiency is paramount. That’s where a Customer Relationship Management (CRM) system comes in. But not just any CRM will do. For small accounting firms, you need a system tailored to your specific needs – one that understands the intricacies of client management, data security, and compliance.

This article is your comprehensive guide to the best CRM systems for small accountants. We’ll delve into the key features you should look for, explore the top contenders in the market, and help you make an informed decision that will streamline your operations and boost your bottom line. Forget the days of scattered spreadsheets and missed opportunities. It’s time to embrace the power of a CRM and transform your accounting practice.

Why Your Accounting Firm Needs a CRM

You might be thinking, “Do I really need a CRM?” The answer, in most cases, is a resounding yes! Here’s why:

- Improved Client Relationship Management: A CRM centralizes all your client interactions, from initial inquiries to ongoing support. This means you have a complete view of each client’s history, preferences, and needs, enabling you to provide personalized service and build stronger relationships.

- Enhanced Communication and Collaboration: CRM systems facilitate seamless communication within your team. You can easily share client information, track progress on projects, and ensure everyone is on the same page.

- Increased Efficiency and Productivity: Automate repetitive tasks, such as appointment scheduling, follow-up emails, and data entry. This frees up your time to focus on more strategic initiatives, like business development and client advisory services.

- Better Data Management and Security: A CRM provides a secure and organized way to store client data, ensuring compliance with industry regulations and protecting sensitive information from loss or unauthorized access.

- Streamlined Sales and Marketing: CRM systems can help you track leads, manage your sales pipeline, and automate marketing campaigns, leading to more efficient lead generation and conversion.

- Data-Driven Decision Making: Access to real-time data and analytics allows you to track key performance indicators (KPIs), identify trends, and make informed decisions to improve your business performance.

In essence, a CRM is more than just a contact management tool. It’s a strategic asset that can transform your accounting firm from a reactive operation to a proactive, client-centric business.

Key Features to Look For in a CRM for Accountants

Not all CRMs are created equal. To ensure you choose the right one for your accounting firm, consider these essential features:

1. Contact Management

At its core, a CRM must excel at contact management. Look for features that allow you to:

- Store detailed client information, including contact details, financial data, and communication history.

- Segment clients based on various criteria, such as industry, revenue, or service needs.

- Easily search and filter your client database.

- Import and export contact data seamlessly.

2. Client Communication Tracking

Keep a record of every interaction with your clients:

- Track emails, phone calls, meetings, and other communications.

- Integrate with your email and phone systems for automatic logging.

- Set up automated email sequences for follow-ups and marketing campaigns.

3. Task and Project Management

Stay organized and on top of your projects:

- Create and assign tasks to team members.

- Set deadlines and track progress.

- Manage projects from start to finish, including budgeting and time tracking.

- Receive notifications and reminders to ensure timely completion of projects.

4. Reporting and Analytics

Gain insights into your business performance:

- Generate reports on key metrics, such as client acquisition cost, revenue per client, and project profitability.

- Visualize data with charts and graphs to identify trends and make informed decisions.

- Customize reports to meet your specific needs.

- Track KPIs and monitor progress towards your business goals.

5. Integration Capabilities

Seamless integration with your existing tools is crucial:

- Integrate with accounting software like QuickBooks, Xero, or Sage.

- Connect with email marketing platforms like Mailchimp or Constant Contact.

- Integrate with calendar and scheduling tools like Google Calendar or Outlook Calendar.

- Ensure compatibility with other essential software used in your practice.

6. Security and Compliance

Data security and compliance are non-negotiable:

- Ensure the CRM offers robust security features, such as data encryption, access controls, and regular backups.

- Comply with industry regulations, such as GDPR and CCPA.

- Look for certifications and accreditations that demonstrate a commitment to data security.

7. User-Friendly Interface and Ease of Use

A CRM is only effective if your team actually uses it. Choose a system that is:

- Intuitive and easy to navigate.

- Offers a clean and uncluttered interface.

- Provides adequate training and support.

- Accessible on various devices, including desktops, tablets, and smartphones.

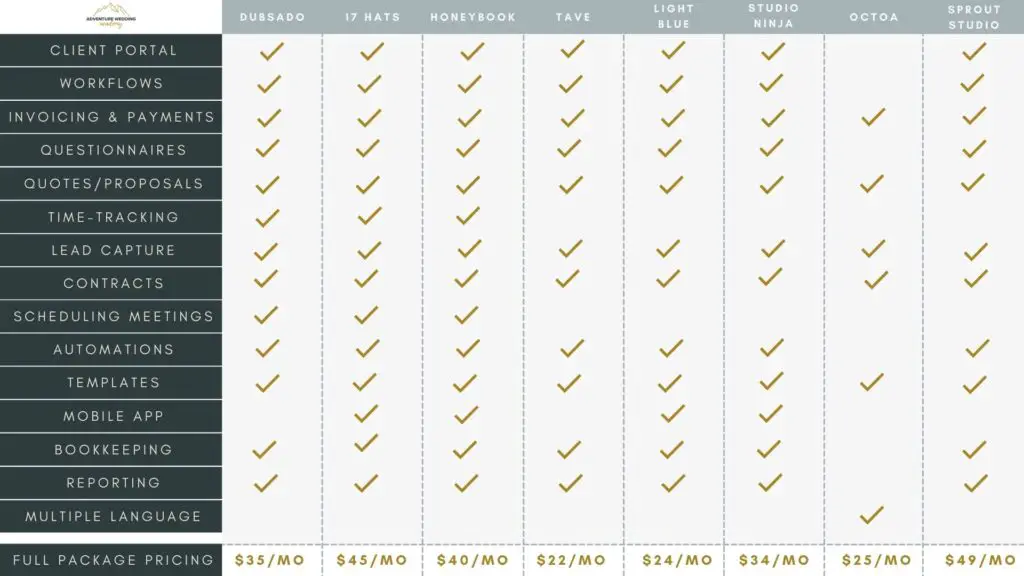

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the leading CRM systems that are particularly well-suited for small accounting firms. Each platform has its own strengths and weaknesses, so consider your specific needs and budget when making your selection.

1. HubSpot CRM

Overview: HubSpot CRM is a popular choice for businesses of all sizes, and it’s particularly attractive to small accounting firms due to its free version and robust features.

Key Features:

- Free CRM with unlimited users and contacts.

- Contact management, deal tracking, and task management.

- Sales and marketing automation tools.

- Integration with popular accounting software and other tools.

- User-friendly interface and excellent support.

Pros:

- Free plan is very generous and sufficient for many small firms.

- Easy to learn and use.

- Comprehensive features, including marketing and sales tools.

- Strong integration capabilities.

Cons:

- Limited features in the free plan.

- Advanced features require paid subscriptions.

- Can be overwhelming for very small firms with simple needs.

2. Zoho CRM

Overview: Zoho CRM offers a wide range of features and customization options, making it a versatile solution for accounting firms.

Key Features:

- Contact management, lead management, and sales force automation.

- Workflow automation and customization options.

- Integration with Zoho’s suite of business applications.

- Robust reporting and analytics.

- Affordable pricing plans.

Pros:

- Highly customizable and flexible.

- Wide range of features and integrations.

- Competitive pricing.

- Scalable to accommodate growing firms.

Cons:

- Can have a steeper learning curve than some other CRMs.

- The interface can feel a bit cluttered.

- Free plan has limited functionality.

3. Pipedrive

Overview: Pipedrive is designed with sales teams in mind, making it a great option for accounting firms that want to streamline their sales process.

Key Features:

- Visual sales pipeline management.

- Contact management and deal tracking.

- Automation features for repetitive tasks.

- Integration with various tools.

- User-friendly interface.

Pros:

- Intuitive and easy to use, especially for sales-focused tasks.

- Visually appealing sales pipeline.

- Effective for managing leads and converting them into clients.

Cons:

- May lack some of the more advanced features found in other CRMs.

- Less focused on marketing automation compared to some competitors.

- Pricing can be a bit higher than some alternatives.

4. Less Annoying CRM

Overview: As the name suggests, Less Annoying CRM is designed to be simple and straightforward, making it an excellent choice for firms that want a user-friendly experience.

Key Features:

- Simple contact management and task management.

- Calendar integration.

- Email integration.

- Affordable pricing.

- Excellent customer support.

Pros:

- Extremely easy to learn and use.

- No complicated features or unnecessary clutter.

- Excellent customer support.

- Affordable pricing.

Cons:

- Limited features compared to more complex CRMs.

- May not be suitable for firms with complex needs.

5. Keap (formerly Infusionsoft)

Overview: Keap is a powerful CRM designed for sales and marketing automation, making it a good option for accounting firms that want to automate their client acquisition and nurturing processes.

Key Features:

- Contact management, sales pipeline management, and marketing automation.

- Email marketing and campaign management.

- Sales automation and follow-up sequences.

- E-commerce integration.

- Advanced reporting and analytics.

Pros:

- Powerful marketing automation features.

- Effective for lead generation and nurturing.

- Integration with e-commerce platforms.

Cons:

- Can be expensive.

- Steeper learning curve than some other CRMs.

- May have more features than some small firms need.

Choosing the Right CRM: A Step-by-Step Guide

Selecting the right CRM is a crucial decision. Here’s a step-by-step guide to help you make the best choice for your accounting firm:

1. Assess Your Needs

Before you start evaluating CRM systems, take some time to understand your firm’s specific requirements. Ask yourself:

- What are our primary goals for implementing a CRM? (e.g., improve client relationships, increase efficiency, streamline sales)

- What are our biggest pain points in managing client data and interactions?

- What features are essential for our business? (e.g., contact management, task management, reporting)

- What integrations do we need with our existing software?

- What is our budget?

- How many users will need access to the CRM?

Answering these questions will give you a clear understanding of your needs and help you narrow down your options.

2. Research and Compare Options

Once you know your needs, start researching different CRM systems. Consider the following:

- Features: Does the CRM offer the features you need?

- Pricing: Is the pricing within your budget?

- Ease of Use: Is the system user-friendly and easy to learn?

- Integrations: Does the CRM integrate with your existing software?

- Reviews and Ratings: What are other users saying about the CRM?

- Customer Support: Does the vendor offer good customer support?

Create a spreadsheet to compare the features, pricing, and pros and cons of each CRM you’re considering.

3. Request Demos and Free Trials

Most CRM vendors offer demos and free trials. Take advantage of these opportunities to:

- See the CRM in action and get a feel for the user interface.

- Test out the features and functionality.

- Ask questions and get clarification on any concerns.

- Evaluate the customer support.

During the trial period, involve your team members to get their feedback.

4. Consider Implementation and Training

Implementing a CRM can be a significant undertaking. Consider the following:

- Data Migration: How will you migrate your existing client data into the new CRM?

- Training: Will the vendor provide training for your team?

- Implementation Support: Does the vendor offer implementation support?

A smooth implementation process is essential for the successful adoption of your new CRM.

5. Choose the Best CRM for Your Firm

Based on your research, demos, and trials, make a final decision. Choose the CRM that best meets your needs, budget, and goals.

6. Implement and Train Your Team

Once you’ve chosen your CRM, it’s time to implement it. Follow these steps:

- Migrate your data.

- Customize the CRM to fit your firm’s specific needs.

- Train your team on how to use the CRM.

- Provide ongoing support and training as needed.

7. Regularly Evaluate and Optimize

After you’ve implemented your CRM, regularly evaluate its performance. Ask yourself:

- Are we achieving our goals?

- Are we using the CRM to its full potential?

- Are there any areas where we can improve?

Make adjustments and optimizations as needed to ensure your CRM is delivering the desired results. CRM systems are not a “set it and forget it” solution. Continuous evaluation and optimization are key to maximizing their value.

CRM Best Practices for Accounting Firms

To get the most out of your CRM, follow these best practices:

- Keep your data clean and accurate: Regularly update client information and remove any outdated data.

- Use the CRM consistently: Encourage your team to log all client interactions and use the CRM for all client-related tasks.

- Customize the CRM to fit your firm’s workflow: Tailor the system to your specific needs and processes.

- Automate repetitive tasks: Use automation features to streamline your workflow and save time.

- Track key metrics: Monitor your CRM’s performance and track key metrics to measure your success.

- Provide ongoing training and support: Ensure your team has the knowledge and skills they need to use the CRM effectively.

- Regularly review and update your CRM strategy: As your business evolves, your CRM strategy should also evolve.

Conclusion: Embracing the Future of Accounting with CRM

In today’s competitive landscape, a CRM is no longer a luxury but a necessity for small accounting firms. By choosing the right CRM and implementing it effectively, you can:

- Improve client relationships.

- Increase efficiency and productivity.

- Streamline your sales and marketing efforts.

- Make data-driven decisions.

The tools and technologies available to accounting professionals are constantly evolving. Embracing a CRM is a significant step towards the future of your business, and it’s an investment that will pay dividends for years to come. The journey of implementing a CRM might seem daunting at first, but the benefits for your accounting firm will be well worth the effort. It will become an indispensable tool, empowering you to better serve your clients, grow your business, and achieve your goals. So, take the leap, explore the options, and find the CRM that is the perfect fit for your firm. Your clients, your team, and your bottom line will thank you for it.