Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

body { font-family: Arial, sans-serif; line-height: 1.6; margin: 20px; }

h2, h3 { color: #333; }

a { color: #007bff; text-decoration: none; }

a:hover { text-decoration: underline; }

ul, ol { margin-bottom: 15px; }

li { margin-bottom: 5px; }

.highlight { background-color: #ffffcc; padding: 2px 5px; border-radius: 3px; }

Seamless Transactions: Mastering CRM Integration with PayPal for Business Growth

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline their operations, enhance customer experiences, and boost their bottom lines. A crucial element in achieving these goals is the integration of Customer Relationship Management (CRM) systems with payment gateways. This article delves into the powerful synergy of CRM integration with PayPal, exploring its benefits, implementation strategies, and the transformative impact it can have on your business. We’ll uncover how this integration can automate processes, provide valuable insights, and ultimately drive sustainable growth.

Understanding the Fundamentals: CRM and PayPal

Before we dive into the specifics of integration, let’s establish a solid understanding of the two core components: CRM and PayPal.

What is a CRM System?

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It serves as a central hub for all customer-related information, including contact details, purchase history, communication records, and more. CRM systems empower businesses to:

- Improve customer relationships.

- Personalize customer interactions.

- Automate sales and marketing processes.

- Gain actionable insights into customer behavior.

- Increase customer retention and loyalty.

Popular CRM systems include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, among others. The choice of CRM depends on the specific needs and size of your business.

What is PayPal?

PayPal is a globally recognized online payment platform that enables businesses and individuals to send and receive money securely over the internet. It acts as an intermediary between the customer’s bank account or credit card and the merchant’s account. PayPal offers a convenient and trusted way to process online payments, making it a popular choice for businesses of all sizes. Its key features include:

- Secure payment processing.

- Support for multiple currencies.

- Fraud protection.

- Easy integration with websites and e-commerce platforms.

- User-friendly interface.

The Power of Integration: Why CRM Integration with PayPal Matters

Integrating your CRM system with PayPal unlocks a wealth of benefits that can significantly improve your business operations and customer experiences. This powerful combination allows for:

Automated Payment Processing

One of the most significant advantages is the ability to automate payment processing. When a customer makes a purchase through your website or platform, the transaction data is automatically synchronized with your CRM system. This eliminates the need for manual data entry, reducing errors and saving valuable time. The process is streamlined, making it easier for both your customers and your team.

Enhanced Customer Data Management

Integrating PayPal with your CRM allows you to capture and store valuable customer payment information directly within your CRM database. This includes transaction history, payment methods used, and any associated notes. This comprehensive view of customer payment behavior enables you to:

- Personalize customer interactions based on their purchase history.

- Identify and address potential payment issues promptly.

- Gain insights into customer spending habits.

- Improve customer segmentation and targeting.

Improved Sales and Marketing Effectiveness

The integration provides valuable data that can be leveraged for more effective sales and marketing campaigns. You can track which marketing efforts are driving the most sales, identify high-value customers, and tailor your messaging to specific customer segments. This data-driven approach leads to:

- Increased conversion rates.

- Higher customer lifetime value.

- More efficient marketing spend.

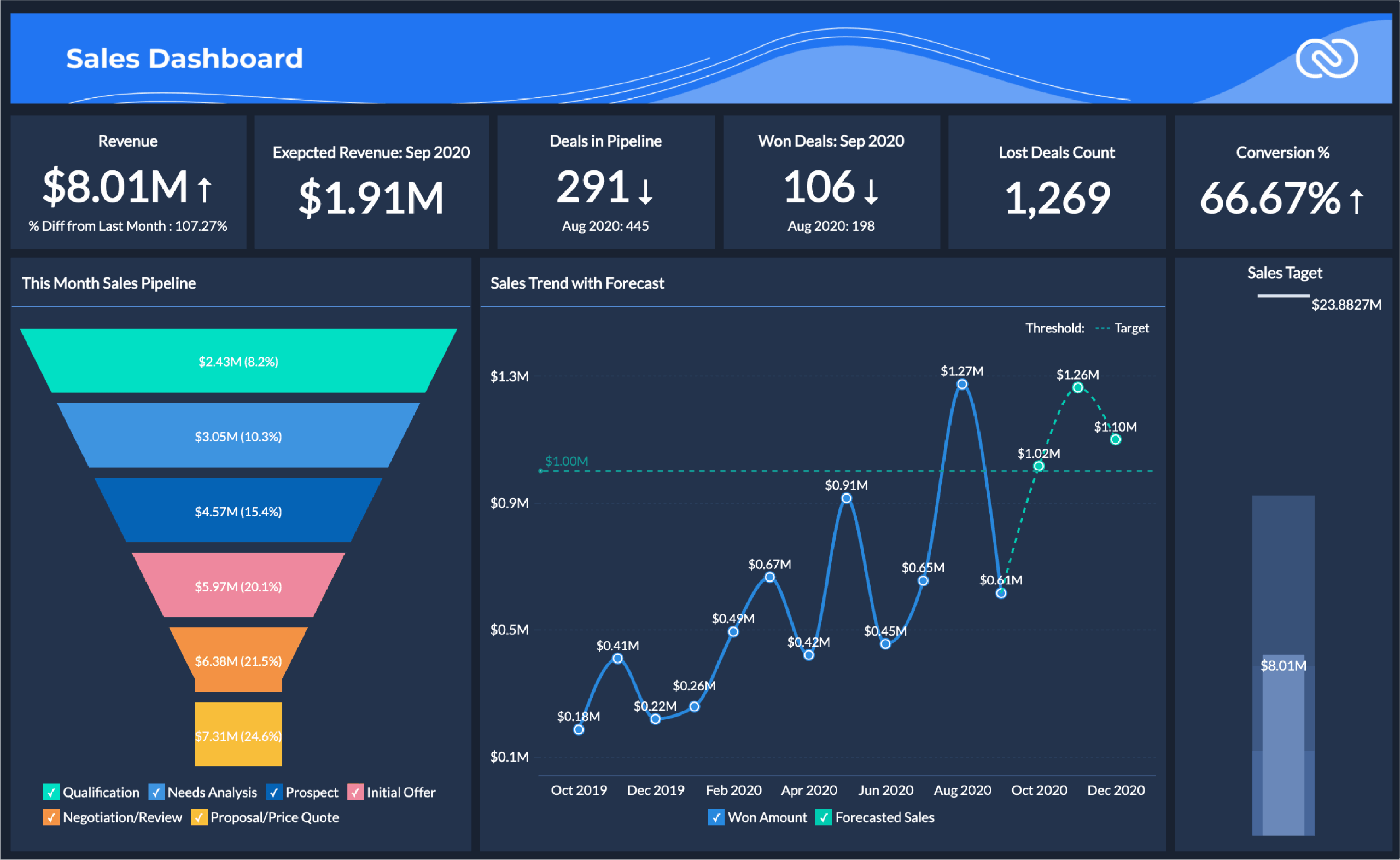

Streamlined Reporting and Analytics

With integrated data, generating comprehensive reports and analyzing key performance indicators (KPIs) becomes effortless. You can track sales trends, identify revenue sources, and monitor customer payment patterns in real-time. This allows you to make informed decisions and optimize your business strategies for better outcomes.

Enhanced Customer Experience

By providing a seamless and secure payment experience, you can significantly improve customer satisfaction. Customers appreciate the convenience of online payments and the ability to easily track their transactions. Furthermore, the integration allows you to:

- Send automated payment confirmations and receipts.

- Provide personalized customer service based on payment history.

- Reduce the risk of payment-related issues.

Implementing CRM Integration with PayPal: A Step-by-Step Guide

The process of integrating your CRM system with PayPal may vary slightly depending on the specific CRM and PayPal solutions you use. However, the general steps involved are as follows:

1. Choose Your Integration Method

There are several ways to integrate your CRM with PayPal:

- Native Integration: Some CRM systems offer built-in integrations with PayPal. This is often the easiest and most straightforward method.

- Third-Party Plugins/Apps: Many third-party plugins and apps are available that facilitate the integration. These often provide additional features and customization options.

- Custom Development: If you have specific requirements or your CRM doesn’t offer native integration or a suitable plugin, you may need to develop a custom integration using APIs (Application Programming Interfaces) provided by both PayPal and your CRM system. This option requires technical expertise.

2. Set Up Your PayPal Account

If you don’t already have one, you’ll need to create a PayPal Business account. Ensure your account is verified and configured to accept payments. You’ll need to provide the necessary business information and link your bank account.

3. Configure Your CRM System

Within your CRM system, locate the integration settings for PayPal. This might involve entering your PayPal API credentials (username, password, and signature). You’ll often need to specify which payment methods you want to support and configure how payment data is mapped to your CRM fields.

4. Test the Integration

Before going live, thoroughly test the integration to ensure it works correctly. Make a test transaction to verify that payment information is accurately synced with your CRM system. Check that all data fields are being populated as expected.

5. Configure Notifications and Automation

Set up automated notifications and workflows based on payment events. For example, you can configure your CRM to automatically send a thank-you email to a customer after a successful payment or trigger a task for your sales team when a payment is received. This will save you time and allow for more efficient operations.

6. Train Your Team

Train your team on how to use the integrated system. Ensure they understand how to access payment information, manage customer records, and troubleshoot any potential issues. Providing adequate training is crucial for a smooth transition and optimal use of the integrated system.

7. Monitor and Optimize

After the integration is live, continuously monitor its performance. Review reports, analyze data, and identify any areas for improvement. Regularly update your integration to take advantage of new features and enhancements. Don’t hesitate to consult the documentation or reach out to the support teams of PayPal and your CRM system for help.

Choosing the Right CRM and PayPal Integration for Your Business

The optimal CRM and PayPal integration solution depends on several factors, including:

Your Business Size and Complexity

Small businesses with simpler needs may find native integrations or readily available plugins sufficient. Larger businesses with more complex requirements might need to consider custom development or more robust integration solutions.

Your Budget

Native integrations and plugins are usually more cost-effective. Custom development can be more expensive but offers greater flexibility. Weigh the costs and benefits carefully.

Your Technical Expertise

Native integrations and plugins are easier to implement and require less technical knowledge. Custom development requires a skilled developer or team. Consider your internal resources and expertise when making your decision.

Features and Functionality

Evaluate the features and functionality offered by each integration option. Ensure it meets your specific requirements, such as support for different currencies, recurring payments, and custom fields.

Troubleshooting Common Integration Issues

While CRM and PayPal integration offers significant benefits, you may encounter some common issues. Here’s how to troubleshoot them:

Payment Data Not Syncing

If payment data isn’t syncing correctly, check the following:

- API Credentials: Verify that your API credentials are correct and up-to-date.

- Mapping: Ensure that the fields in your CRM system are correctly mapped to the corresponding fields in PayPal.

- Permissions: Confirm that your PayPal account has the necessary permissions to access and share data with your CRM.

- Firewall/Security Settings: Check your firewall and security settings to ensure they aren’t blocking the connection between your CRM and PayPal.

Incorrect Currency or Payment Methods

If you’re experiencing issues with currency or payment methods, check the following:

- Currency Settings: Verify that your currency settings are correctly configured in both PayPal and your CRM system.

- Supported Payment Methods: Ensure that the payment methods you want to offer are enabled in your PayPal account and supported by your CRM integration.

- Region Restrictions: Be aware of any regional restrictions that may affect the availability of certain payment methods.

Errors During Transactions

If you’re encountering errors during transactions, check the following:

- Transaction Limits: Verify that you haven’t exceeded any transaction limits set by PayPal or your CRM system.

- Account Status: Ensure that your PayPal account is in good standing and hasn’t been suspended or limited.

- Network Connectivity: Check your internet connection to ensure it’s stable.

- Error Logs: Review the error logs in both your CRM system and PayPal for more detailed information about the problem.

Maximizing the Value of Your Integration: Best Practices

To get the most out of your CRM and PayPal integration, consider these best practices:

Automate as Much as Possible

Leverage automation features to streamline your processes. Automate tasks like sending payment confirmations, updating customer records, and triggering follow-up actions. This will reduce manual effort and increase efficiency.

Personalize Customer Interactions

Use the data from your integration to personalize customer interactions. Tailor your messaging, offers, and support based on their purchase history, payment behavior, and other relevant information. This will improve customer engagement and drive sales.

Analyze Data Regularly

Regularly analyze the data from your integration to gain insights into your business performance. Track key metrics like sales, customer lifetime value, and marketing campaign effectiveness. Use these insights to make data-driven decisions and optimize your strategies.

Ensure Data Security

Prioritize data security. Implement appropriate security measures to protect customer payment information. Follow industry best practices for data encryption, access control, and compliance with relevant regulations (e.g., PCI DSS).

Stay Updated

Keep your CRM system and PayPal integration up-to-date. Regularly update your software to take advantage of new features, security patches, and performance improvements. This will ensure your integration remains secure, efficient, and effective.

Real-World Examples: Success Stories

Many businesses have successfully leveraged CRM integration with PayPal to achieve significant results. Here are a few examples:

E-commerce Business

An e-commerce business integrated its CRM system with PayPal to automate payment processing, track customer purchases, and personalize marketing campaigns. As a result, they saw a 20% increase in sales and a 15% improvement in customer retention.

Subscription Service Provider

A subscription service provider integrated its CRM with PayPal to automate recurring payments, manage customer subscriptions, and reduce churn. They were able to streamline their billing process and increase customer satisfaction.

Nonprofit Organization

A nonprofit organization integrated its CRM with PayPal to streamline donation processing, track donor contributions, and personalize donor communications. They saw a significant increase in donations and improved donor engagement.

The Future of CRM and PayPal Integration

The integration of CRM systems with payment gateways like PayPal is an evolving landscape. As technology advances, we can expect to see further innovations in this area. Some potential future trends include:

- AI-Powered Automation: Artificial intelligence (AI) will play an increasingly important role in automating tasks, personalizing customer interactions, and providing data-driven insights.

- Enhanced Security: Businesses will continue to prioritize data security, with advanced encryption and fraud prevention measures.

- Mobile Optimization: Mobile payments and mobile CRM solutions will become even more prevalent, providing customers with a seamless experience on their smartphones and tablets.

- Integration with Emerging Payment Methods: CRM systems will integrate with new and emerging payment methods, such as cryptocurrencies and digital wallets, to cater to evolving customer preferences.

By staying informed about these trends and adapting to changing market demands, businesses can ensure they remain competitive and continue to provide exceptional customer experiences.

Conclusion: Embrace the Power of Integration

CRM integration with PayPal is a powerful combination that can transform your business operations, enhance customer experiences, and drive sustainable growth. By automating payment processing, gaining valuable customer insights, and improving sales and marketing effectiveness, you can unlock a new level of efficiency and profitability. Start by understanding the fundamentals, implementing the integration effectively, and following best practices. Embrace the power of integration and take your business to the next level.