Seamlessly Connecting Customers and Cash: Mastering CRM Integration with PayPal

Introduction: The Power of Synergy in the Digital Age

In today’s fast-paced digital landscape, businesses are constantly seeking ways to streamline operations, enhance customer experiences, and boost profitability. A powerful combination that achieves all of these goals is the integration of a Customer Relationship Management (CRM) system with a payment gateway like PayPal. This article delves deep into the world of CRM integration with PayPal, exploring the benefits, implementation strategies, and real-world examples that can transform your business. We’ll uncover how this integration can lead to a more cohesive and efficient business model, ultimately driving growth and customer satisfaction.

Understanding CRM and PayPal: Two Pillars of Modern Business

Before we dive into the integration process, let’s first establish a clear understanding of the two key players: CRM and PayPal.

What is a CRM?

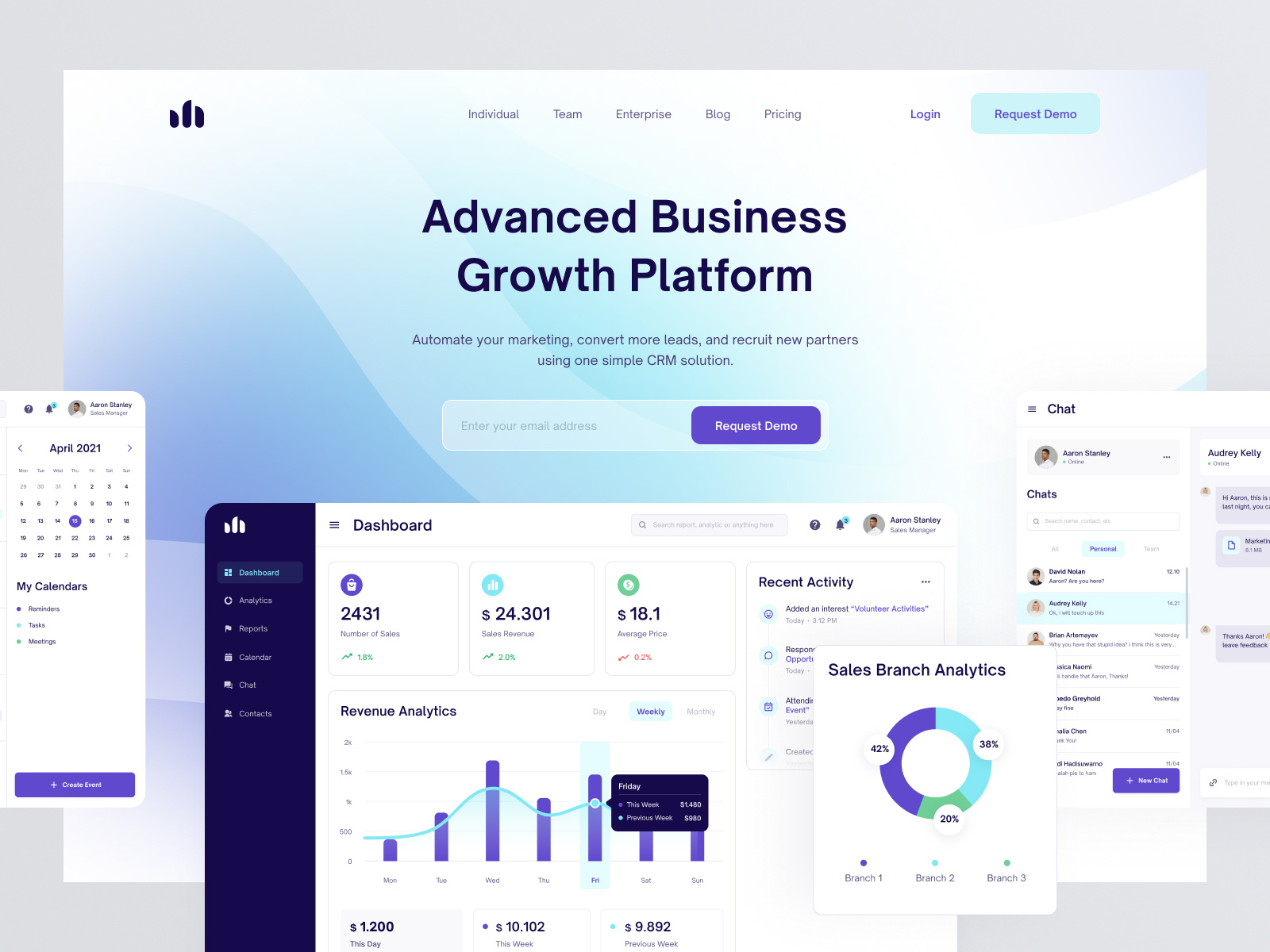

A Customer Relationship Management (CRM) system is a software solution designed to manage and analyze customer interactions and data throughout the customer lifecycle. It helps businesses build stronger relationships with their customers, improve customer retention, and drive sales growth. CRM systems typically encompass various functionalities, including:

- Contact Management: Storing and organizing customer information, such as names, contact details, and communication history.

- Sales Automation: Automating sales processes, managing leads, and tracking sales performance.

- Marketing Automation: Automating marketing campaigns, segmenting audiences, and tracking marketing ROI.

- Customer Service: Managing customer inquiries, resolving issues, and providing support.

- Reporting and Analytics: Providing insights into customer behavior, sales performance, and marketing effectiveness.

Popular CRM platforms include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365, among others. The choice of CRM depends on the specific needs and budget of a business.

What is PayPal?

PayPal is a global online payment system that enables businesses and individuals to send and receive money securely over the internet. It acts as an intermediary between customers and merchants, providing a convenient and secure way to make payments. PayPal offers a range of features, including:

- Online Payments: Accepting payments from credit cards, debit cards, and PayPal accounts.

- Invoicing: Creating and sending professional invoices to customers.

- Payment Processing: Processing payments and managing transactions.

- Fraud Protection: Providing security measures to protect against fraud.

- International Payments: Supporting payments in multiple currencies.

PayPal is widely used by businesses of all sizes, from small online stores to large e-commerce platforms. It’s known for its ease of use, security, and global reach.

The Benefits of CRM Integration with PayPal: A Match Made in Business Heaven

Integrating your CRM with PayPal offers a multitude of advantages that can significantly improve your business operations and customer relationships. Here are some key benefits:

1. Streamlined Payment Processing

One of the most significant benefits is the ability to streamline payment processing. When integrated, your CRM can automatically record payment information from PayPal, eliminating the need for manual data entry. This saves time, reduces errors, and ensures accurate financial records. Imagine the time saved by not having to manually reconcile PayPal transactions with your CRM – it’s a game-changer!

2. Enhanced Customer Experience

By integrating, you can provide a more seamless and convenient payment experience for your customers. Customers can make payments directly from within your CRM, eliminating the need to navigate to a separate payment gateway. This streamlined process leads to increased customer satisfaction and reduces the likelihood of abandoned transactions. Think about how much smoother the checkout process becomes – it’s a win-win!

3. Improved Sales and Revenue Tracking

CRM integration with PayPal allows you to track sales and revenue more accurately. Your CRM can automatically associate payments with specific customers and deals, providing a comprehensive view of your sales performance. This data can be used to identify top-performing products, track sales trends, and make data-driven decisions to improve your sales strategy. Having real-time insights into your revenue streams is invaluable for making informed business decisions.

4. Automated Invoicing and Billing

Many CRM systems allow for automated invoicing and billing. When integrated with PayPal, you can automate the process of generating and sending invoices, as well as tracking payments. This reduces the administrative burden on your team and ensures that invoices are sent and paid on time. This automation frees up valuable time for your team to focus on other critical tasks.

5. Better Customer Segmentation

With the combined data from your CRM and PayPal, you can segment your customers more effectively. You can create customer segments based on their payment history, purchase behavior, and other relevant data. This allows you to personalize your marketing efforts and tailor your offers to specific customer groups. Personalization is key to building stronger customer relationships and driving sales.

6. Reduced Manual Data Entry

Integrating your CRM with PayPal eliminates the need for manual data entry, which can be time-consuming and prone to errors. Automated data transfer ensures that your CRM is always up-to-date with the latest payment information, saving you time and improving data accuracy. This not only saves time but also reduces the risk of human error.

7. Improved Reporting and Analytics

The integration provides more comprehensive reporting and analytics capabilities. You can track key metrics, such as sales revenue, customer lifetime value, and conversion rates, in real-time. This data-driven approach helps you make informed decisions and optimize your business performance. Having access to detailed reports allows you to identify areas for improvement and track your progress.

8. Enhanced Fraud Prevention

PayPal’s built-in fraud protection mechanisms can be leveraged within your CRM. By integrating, you can monitor transactions for suspicious activity and take appropriate action to protect your business and your customers. This adds an extra layer of security to your payment processes. Protecting your business and your customers from fraud is a top priority.

How to Integrate CRM with PayPal: A Step-by-Step Guide

The integration process varies depending on the specific CRM and payment gateway you are using. However, the general steps involved are as follows:

1. Choose Your CRM and PayPal Account

The first step is to choose the CRM and PayPal account you want to integrate. Ensure that your chosen CRM offers integration with PayPal. Most popular CRM platforms have built-in integrations or offer third-party apps that facilitate the connection. Have your PayPal account details ready.

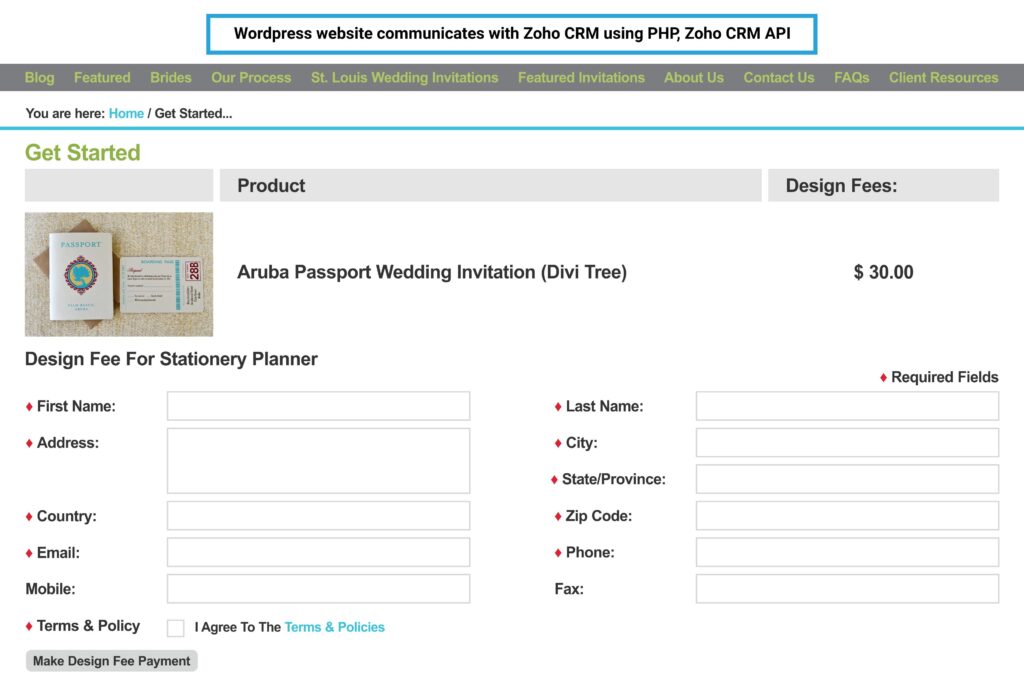

2. Access the Integration Settings

Log in to your CRM and navigate to the integration settings or app marketplace. Look for the PayPal integration option. The location of these settings will vary depending on your CRM platform. Check the documentation of your CRM for specific instructions.

3. Connect Your PayPal Account

Follow the on-screen instructions to connect your PayPal account to your CRM. This typically involves entering your PayPal credentials and authorizing the connection. You may be prompted to grant your CRM access to your PayPal account data.

4. Configure the Integration Settings

Customize the integration settings to suit your specific needs. This may include mapping data fields, setting up payment notifications, and configuring other options. Configure the settings to ensure that data is transferred accurately and efficiently. Consider which data fields you want to sync between your CRM and PayPal.

5. Test the Integration

Before going live, test the integration to ensure that it is working correctly. Make a test payment to verify that the data is being transferred accurately. This crucial step helps you identify and resolve any issues before they impact your actual transactions.

6. Monitor and Optimize

Once the integration is live, monitor its performance and make adjustments as needed. Regularly review your data to ensure that it is accurate and up-to-date. Continuously optimize the integration to improve its efficiency and effectiveness. Keep an eye on the performance of the integration and make adjustments as needed to enhance your business processes.

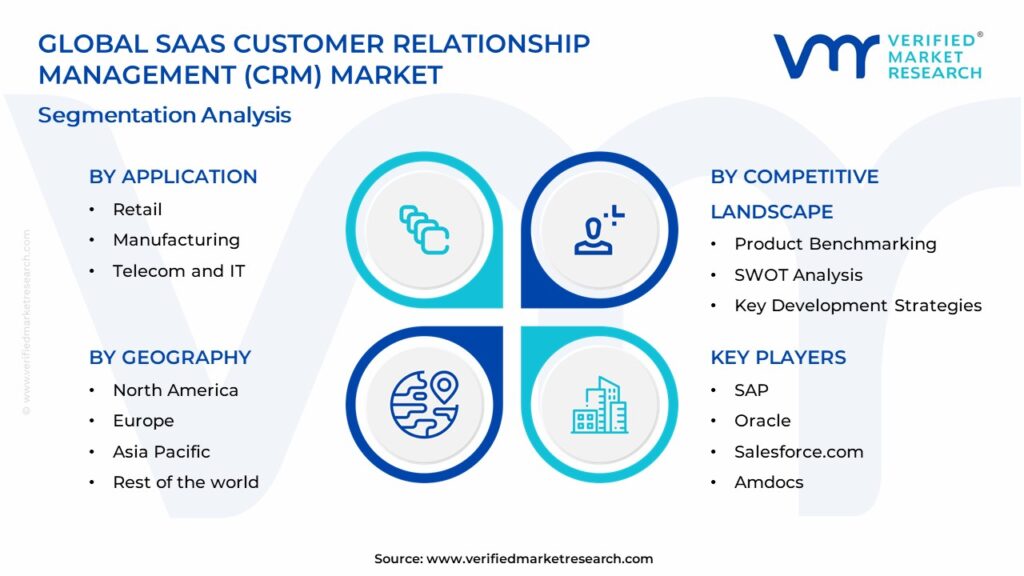

Popular CRM Platforms and Their PayPal Integration Capabilities

Here are some popular CRM platforms and their capabilities for PayPal integration:

1. Salesforce

Salesforce offers robust integration options with PayPal. You can use Salesforce’s built-in features or third-party apps to connect your PayPal account. This allows you to track payments, manage invoices, and automate sales processes. Salesforce’s AppExchange provides numerous apps that enhance the integration capabilities.

2. HubSpot

HubSpot offers seamless integration with PayPal through its integration marketplace. You can connect your PayPal account and track payments directly within HubSpot. This integration helps you manage your sales pipeline, automate marketing tasks, and improve customer relationships. The intuitive interface makes the integration process straightforward.

3. Zoho CRM

Zoho CRM provides a native integration with PayPal, allowing you to manage payments, track transactions, and automate billing. You can create and send invoices directly from Zoho CRM and receive payment notifications in real-time. Zoho CRM’s integration is designed to streamline your financial processes.

4. Microsoft Dynamics 365

Microsoft Dynamics 365 offers integration with PayPal through its integration marketplace. You can connect your PayPal account and track payments directly within Dynamics 365. This integration helps you manage your sales pipeline, automate marketing tasks, and improve customer relationships. Dynamics 365’s integration provides a unified view of your customer data.

5. Pipedrive

Pipedrive, a sales-focused CRM, integrates with PayPal to streamline payment processing. You can link your PayPal account and track transactions associated with your deals. This helps sales teams stay organized and manage their revenue streams effectively. The simplicity of Pipedrive makes it easy to set up and use the PayPal integration.

Real-World Examples: Businesses Thriving with CRM and PayPal Integration

Let’s explore some real-world examples of how businesses have successfully integrated their CRM systems with PayPal:

1. E-commerce Retailer

An e-commerce retailer integrates its CRM (e.g., Shopify with a CRM plugin) with PayPal to streamline the checkout process. Customers can make payments directly from within the CRM, and payment information is automatically recorded. This reduces cart abandonment rates, improves customer satisfaction, and simplifies the sales process. They can also track customer purchase history and personalize marketing campaigns based on this data.

2. Subscription-Based Service

A subscription-based service integrates its CRM (e.g., a custom-built system or a platform like Chargebee integrated with a CRM like Salesforce) with PayPal to automate recurring payments. The CRM automatically generates invoices, sends payment reminders, and tracks subscription renewals. This eliminates manual billing processes, reduces payment delays, and improves cash flow. The system can also automatically update customer subscription details based on payment status.

3. Non-Profit Organization

A non-profit organization integrates its CRM (e.g., a platform like NeonCRM) with PayPal to manage donations. Donors can make donations directly from within the CRM, and payment information is automatically recorded. This simplifies the donation process, improves data accuracy, and allows the organization to track donor engagement. The integration also allows for the sending of automated thank-you notes and donation receipts.

4. Consulting Firm

A consulting firm integrates its CRM (e.g., HubSpot) with PayPal to manage invoices and payments for client projects. The CRM automatically generates invoices, sends them to clients, and tracks payment status. This streamlines the billing process, reduces payment delays, and improves cash flow. The system also provides detailed reports on project profitability and client spending.

Troubleshooting Common Issues

While CRM integration with PayPal offers numerous benefits, you may encounter some common issues during the setup or operation. Here’s how to troubleshoot them:

1. Data Synchronization Problems

Problem: Data is not syncing correctly between your CRM and PayPal.

Solution: Verify the integration settings and ensure that the data fields are mapped correctly. Check your internet connection, and review the logs to identify any errors. Consult the documentation of your CRM and PayPal for troubleshooting tips.

2. Payment Errors

Problem: Customers are experiencing payment errors during checkout.

Solution: Verify that your PayPal account is active and in good standing. Check for any issues with your website’s SSL certificate or payment gateway configuration. Test the payment process yourself to identify any problems.

3. Incorrect Reporting

Problem: Sales and revenue data are not being reported accurately.

Solution: Review the integration settings to ensure that all transactions are being recorded correctly. Verify that the data fields are mapped correctly. Check for any errors in the data synchronization process. Make sure your CRM and PayPal accounts are properly connected.

4. Inconsistent Data

Problem: Data discrepancies between your CRM and PayPal.

Solution: Regularly review your data to ensure accuracy. Check for any data entry errors or manual adjustments. If you find discrepancies, reconcile the data and update your CRM and PayPal accounts accordingly. Implement processes to ensure data consistency.

5. Security Concerns

Problem: Security vulnerabilities or concerns about data privacy.

Solution: Ensure that your CRM and PayPal accounts are secured with strong passwords and multi-factor authentication. Review your data security policies and ensure that you comply with all relevant regulations. Regularly update your software to patch any security vulnerabilities.

Best Practices for Successful Integration

To maximize the benefits of your CRM and PayPal integration, follow these best practices:

1. Plan and Prepare

Before you begin the integration process, carefully plan your strategy. Determine your goals, identify your requirements, and choose the right CRM and PayPal account. Document your integration process and create a clear plan for implementation.

2. Choose the Right Integration Method

Select the integration method that best suits your needs. Consider using built-in integrations, third-party apps, or custom development. Evaluate the features, pricing, and support options of each method before making a decision. Choose the option that offers the best functionality and ease of use.

3. Test Thoroughly

Thoroughly test the integration before going live. Make test payments, verify data synchronization, and check for any errors. Conduct multiple tests to ensure that the integration is working correctly and that all functions are operating as expected. This will help you identify and resolve any issues before they affect your actual transactions.

4. Train Your Team

Train your team on how to use the integrated system. Provide them with clear instructions on how to process payments, manage customer data, and generate reports. Ensure that your team understands the benefits of the integration and how it can improve their daily tasks. Proper training will ensure that your team is comfortable and efficient using the new system.

5. Monitor and Maintain

Regularly monitor the performance of your integration. Review your data to ensure that it is accurate and up-to-date. Make adjustments as needed to optimize its efficiency and effectiveness. Keep your software updated to ensure security and compatibility. Regularly review your integration and ensure that it continues to meet your needs.

6. Prioritize Security

Always prioritize security when integrating your CRM with PayPal. Use strong passwords, enable multi-factor authentication, and regularly update your software. Comply with all relevant regulations and data security standards. Protect your business and your customers from fraud and data breaches.

Conclusion: Embracing the Future of Business with CRM and PayPal Integration

CRM integration with PayPal is a powerful strategy for businesses seeking to streamline operations, enhance customer experiences, and drive growth. By seamlessly connecting your CRM system with PayPal, you can unlock a range of benefits, including streamlined payment processing, improved sales tracking, and enhanced customer relationships. This integration is no longer a luxury; it’s becoming a necessity for businesses aiming to thrive in the digital age.

By following the steps outlined in this guide, you can successfully integrate your CRM with PayPal and begin reaping the rewards. Embrace the power of synergy and transform your business today. Take the leap and experience the difference that a well-integrated CRM and PayPal system can make. The future of business is here, and it’s more efficient, customer-centric, and profitable than ever before.