Seamlessly Integrate CRM with PayPal: A Comprehensive Guide to Boosting Sales and Streamlining Payments

Seamlessly Integrate CRM with PayPal: A Comprehensive Guide to Boosting Sales and Streamlining Payments

In today’s fast-paced digital landscape, businesses are constantly seeking innovative ways to optimize their operations, enhance customer experiences, and drive revenue growth. One of the most effective strategies involves the seamless integration of Customer Relationship Management (CRM) systems with payment gateways like PayPal. This powerful combination empowers businesses to streamline their sales processes, automate payment collection, and gain valuable insights into customer behavior, ultimately leading to increased efficiency and profitability.

This comprehensive guide delves into the intricacies of CRM integration with PayPal, providing a detailed overview of the benefits, implementation steps, and best practices. Whether you’re a small business owner, a seasoned entrepreneur, or a marketing professional, this guide will equip you with the knowledge and tools necessary to leverage the power of CRM and PayPal integration to its fullest potential.

Understanding the Synergy: CRM and PayPal Working Together

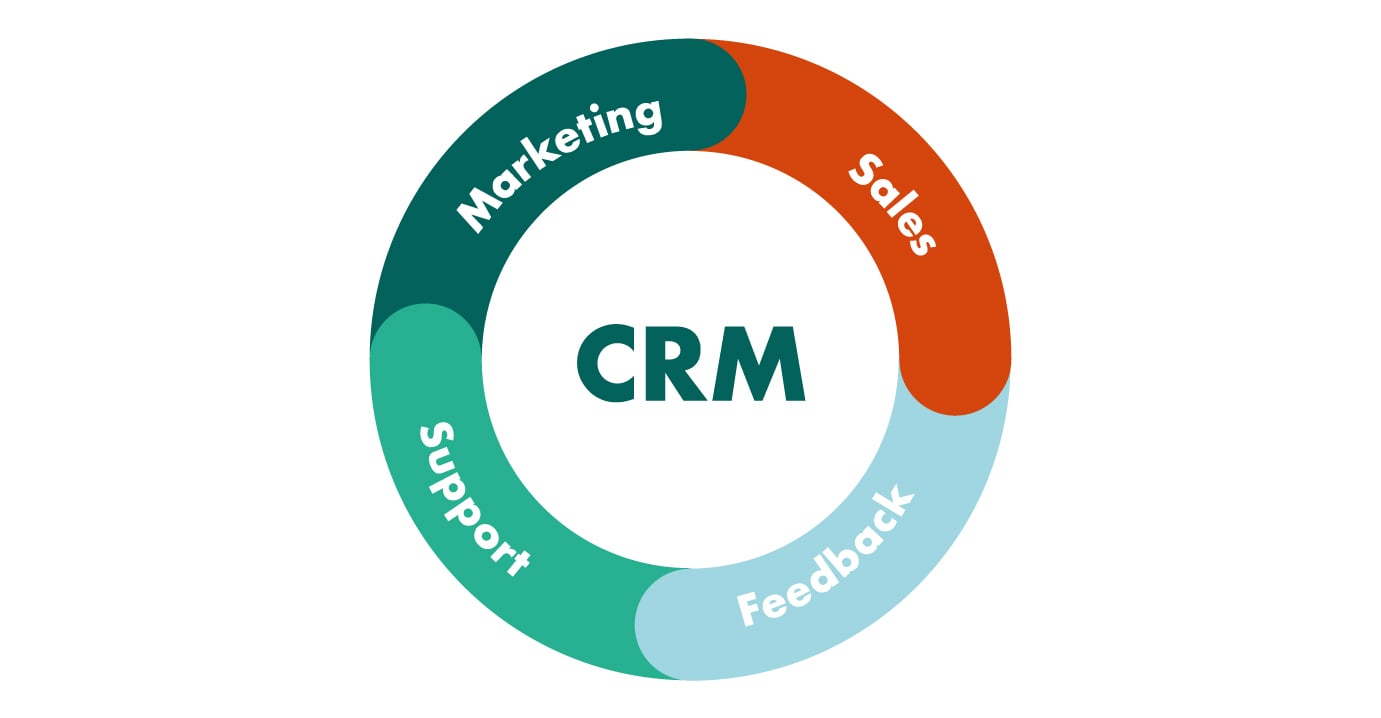

Before we dive into the specifics of integration, it’s crucial to understand the individual strengths of CRM systems and PayPal, and how they complement each other when combined.

CRM: The Heart of Customer Relationships

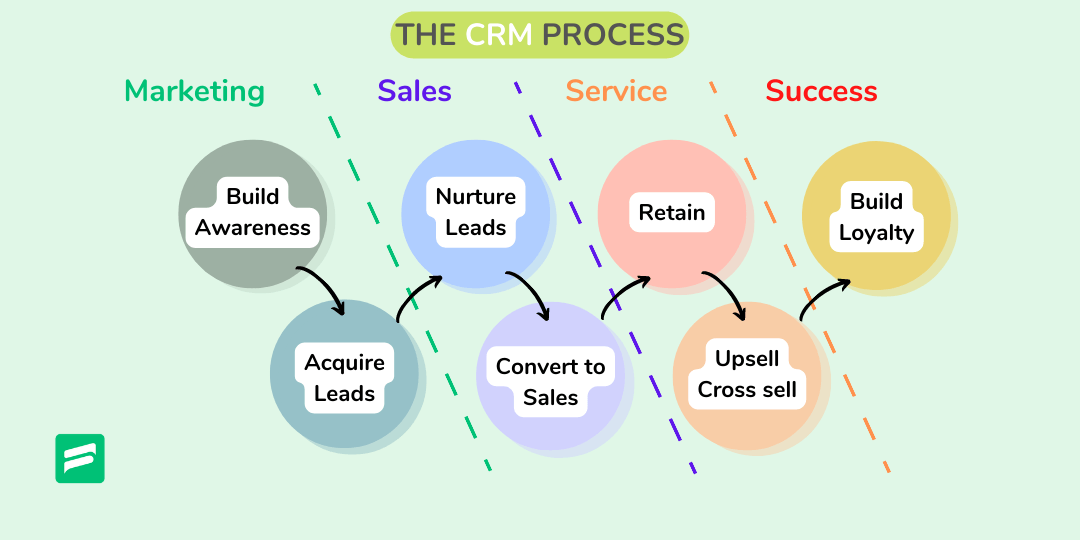

A CRM system serves as the central hub for managing all aspects of customer interactions. It allows businesses to:

- Store and organize customer data (contact information, purchase history, communication logs, etc.)

- Track sales leads and opportunities

- Automate marketing campaigns

- Provide personalized customer service

- Analyze customer behavior and identify trends

By centralizing customer data and streamlining customer-facing processes, CRM systems empower businesses to build stronger customer relationships, improve customer satisfaction, and ultimately, drive sales growth.

PayPal: The Global Payment Gateway

PayPal is a widely recognized and trusted online payment gateway that enables businesses to securely accept payments from customers worldwide. It offers a range of features, including:

- Secure payment processing

- Support for multiple currencies

- Integration with various e-commerce platforms

- Fraud protection

- Easy-to-use payment buttons and links

PayPal’s global reach and user-friendly interface make it an ideal choice for businesses of all sizes looking to expand their online presence and accept payments from customers around the globe.

The Power of Integration: A Synergistic Relationship

When CRM and PayPal are integrated, the benefits are amplified. The integration allows data to flow seamlessly between the two systems, creating a more efficient and effective sales and payment process. Here’s how it works:

- Automated Payment Tracking: CRM systems can automatically track payments made through PayPal, eliminating the need for manual data entry and reducing the risk of errors.

- Improved Sales Cycle Management: Sales representatives can view a customer’s payment history directly within the CRM, providing valuable insights into their purchasing behavior and enabling them to tailor their sales strategies accordingly.

- Enhanced Reporting and Analytics: Integrated data allows businesses to generate comprehensive reports on sales performance, customer behavior, and payment trends, providing valuable insights for data-driven decision-making.

- Streamlined Order Fulfillment: CRM systems can automatically update order statuses and trigger notifications based on payment confirmations, streamlining the order fulfillment process.

- Personalized Customer Experiences: By combining customer data from the CRM with payment information from PayPal, businesses can personalize their marketing efforts, offer targeted promotions, and provide a more tailored customer experience.

Benefits of CRM Integration with PayPal

Integrating your CRM with PayPal offers a multitude of advantages that can significantly impact your business’s bottom line. Here are some of the key benefits:

Increased Efficiency and Productivity

Integration automates many manual tasks, freeing up valuable time and resources for your team. This includes automated payment tracking, eliminating the need for manual data entry, and reducing the risk of errors. It also streamlines the order fulfillment process by automatically updating order statuses and triggering notifications based on payment confirmations. This leads to increased efficiency and productivity across your sales, marketing, and customer service teams.

Improved Sales Cycle Management

With integrated data, your sales team gains a 360-degree view of each customer, including their payment history and purchasing behavior. This allows them to personalize their sales approach, offer targeted promotions, and close deals more effectively. Sales representatives can access payment information directly within the CRM, providing valuable insights into customer behavior and enabling them to tailor their sales strategies accordingly. This leads to shorter sales cycles and increased conversion rates.

Enhanced Customer Experience

Integration enables you to provide a more personalized and seamless customer experience. By combining customer data from the CRM with payment information from PayPal, you can tailor your marketing efforts, offer targeted promotions, and provide a more personalized customer experience. Customers appreciate a smooth and hassle-free payment process, which leads to increased customer satisfaction and loyalty.

Better Reporting and Analytics

Integrated data allows you to generate comprehensive reports on sales performance, customer behavior, and payment trends. This provides valuable insights for data-driven decision-making. You can track key metrics such as sales volume, revenue generated, customer lifetime value, and payment success rates. This data allows you to identify areas for improvement and make informed decisions to optimize your sales and marketing strategies.

Reduced Errors and Improved Accuracy

Automated payment tracking eliminates the need for manual data entry, reducing the risk of errors and improving the accuracy of your financial records. This ensures that you have a clear and accurate picture of your sales performance and financial health. By automating the process, you minimize the chance of human error, leading to more reliable data and improved financial reporting.

Fraud Prevention and Security

Both CRM systems and PayPal offer robust security features to protect your business and your customers from fraud. PayPal’s fraud protection measures help to minimize the risk of fraudulent transactions. When integrated with a CRM, you can track and analyze payment data to identify suspicious activity and take proactive measures to prevent fraud. This enhances the security of your payment processes and protects your business from financial losses.

How to Integrate Your CRM with PayPal: A Step-by-Step Guide

Integrating your CRM with PayPal can seem daunting, but with the right approach, the process can be straightforward. Here’s a step-by-step guide to help you get started:

1. Choose Your CRM and PayPal Integration Method

There are several methods for integrating your CRM with PayPal, depending on the CRM system you’re using and your technical expertise. The most common methods include:

- Native Integration: Some CRM systems offer native integrations with PayPal, which means that the integration is built directly into the CRM platform. This is often the easiest and most seamless method.

- Third-Party Integration: Third-party integration platforms, such as Zapier or Automate.io, allow you to connect your CRM with PayPal using pre-built integrations or custom workflows.

- Custom Integration: If you have the technical expertise, you can develop a custom integration using the PayPal API and your CRM’s API.

Choose the method that best suits your needs and technical capabilities.

2. Set Up Your PayPal Account

If you don’t already have a PayPal business account, you’ll need to create one. During the setup process, you’ll need to provide information about your business, including your business name, address, and contact information. You’ll also need to link your bank account to your PayPal account to receive payments.

3. Configure Your CRM

Depending on the integration method you’ve chosen, you’ll need to configure your CRM to connect with PayPal. This may involve entering your PayPal API credentials, selecting the data you want to sync, and setting up workflows to automate tasks. Consult your CRM’s documentation or contact their support team for specific instructions.

4. Connect PayPal to Your CRM

Once you’ve configured your CRM, you’ll need to connect it to your PayPal account. The exact steps will vary depending on the integration method, but typically involve entering your PayPal API credentials or authorizing the connection through the third-party integration platform.

5. Test the Integration

Before going live, it’s essential to test the integration to ensure that it’s working correctly. Make a test transaction to verify that payments are being processed and that data is being synced between your CRM and PayPal. Check that payment information, such as transaction ID, amount, and date, is accurately recorded in your CRM.

6. Customize and Optimize Your Integration

Once the integration is set up and tested, you can customize and optimize it to meet your specific business needs. This may involve setting up automated workflows to trigger actions based on payment confirmations, such as updating order statuses or sending thank-you emails. You can also create custom reports and dashboards to track key metrics and gain insights into your sales and payment performance.

Best Practices for CRM Integration with PayPal

To ensure a successful CRM integration with PayPal, it’s important to follow these best practices:

Plan and Define Your Goals

Before you start the integration process, define your goals and objectives. What do you want to achieve with the integration? Do you want to automate payment tracking, improve sales cycle management, or enhance customer experience? Having clear goals will help you choose the right integration method and configure your CRM and PayPal accounts effectively.

Choose the Right Integration Method

Select the integration method that best suits your technical expertise, budget, and business needs. Native integrations are often the easiest and most seamless option, while third-party integration platforms offer more flexibility and customization options. Custom integrations provide the most control, but require more technical expertise.

Map Your Data Fields

Carefully map the data fields between your CRM and PayPal accounts to ensure that data is synced accurately. Identify the key data fields that you want to sync, such as customer name, email address, transaction ID, and payment amount. Make sure that the data fields are compatible between the two systems and that the data is formatted correctly.

Test Thoroughly

Test the integration thoroughly before going live. Make test transactions to verify that payments are being processed correctly and that data is being synced between your CRM and PayPal. Check that all data fields are being populated accurately and that any automated workflows are functioning as expected.

Monitor and Maintain Your Integration

Once the integration is live, monitor it regularly to ensure that it’s functioning correctly. Check for any errors or issues and take corrective action as needed. Keep your CRM and PayPal accounts updated with the latest software versions and security patches. Regularly review your integration settings and workflows to ensure that they are still meeting your business needs.

Prioritize Security

Security should be a top priority when integrating your CRM with PayPal. Protect your API credentials and other sensitive information. Use strong passwords and enable two-factor authentication. Regularly review your security settings and monitor for any suspicious activity.

Train Your Team

Train your team on how to use the integrated system effectively. Provide them with clear instructions on how to access and interpret data from both your CRM and PayPal accounts. Ensure that they understand how to use the automated workflows and how to troubleshoot any issues that may arise.

Stay Updated

Keep up-to-date with the latest features and updates from both your CRM and PayPal. Regularly review the documentation and release notes for both platforms to stay informed of any changes that may affect your integration. Consider attending webinars or training sessions to learn about new features and best practices.

Choosing the Right CRM for PayPal Integration

The choice of CRM plays a crucial role in the success of your PayPal integration. Here are some popular CRM systems that offer seamless integration with PayPal:

Salesforce

Salesforce is a leading CRM platform that offers robust integration capabilities with PayPal through its AppExchange marketplace. Salesforce provides a range of pre-built integrations and customization options to streamline the sales and payment processes. It is a powerful platform suitable for businesses of all sizes, but it can be complex to set up and may require specialized expertise.

HubSpot CRM

HubSpot CRM is a popular and user-friendly CRM platform that offers a free version and affordable paid plans. It integrates with PayPal through third-party integrations, such as Zapier. HubSpot CRM is known for its ease of use and its focus on marketing and sales automation. It is a great option for small to medium-sized businesses looking for a comprehensive CRM solution.

Zoho CRM

Zoho CRM is a versatile and affordable CRM platform that offers a range of features and integrations. It integrates with PayPal through its own integrations or via third-party platforms. Zoho CRM is known for its customization options and its ability to adapt to the specific needs of different businesses. It is a good choice for businesses that want a flexible and cost-effective CRM solution.

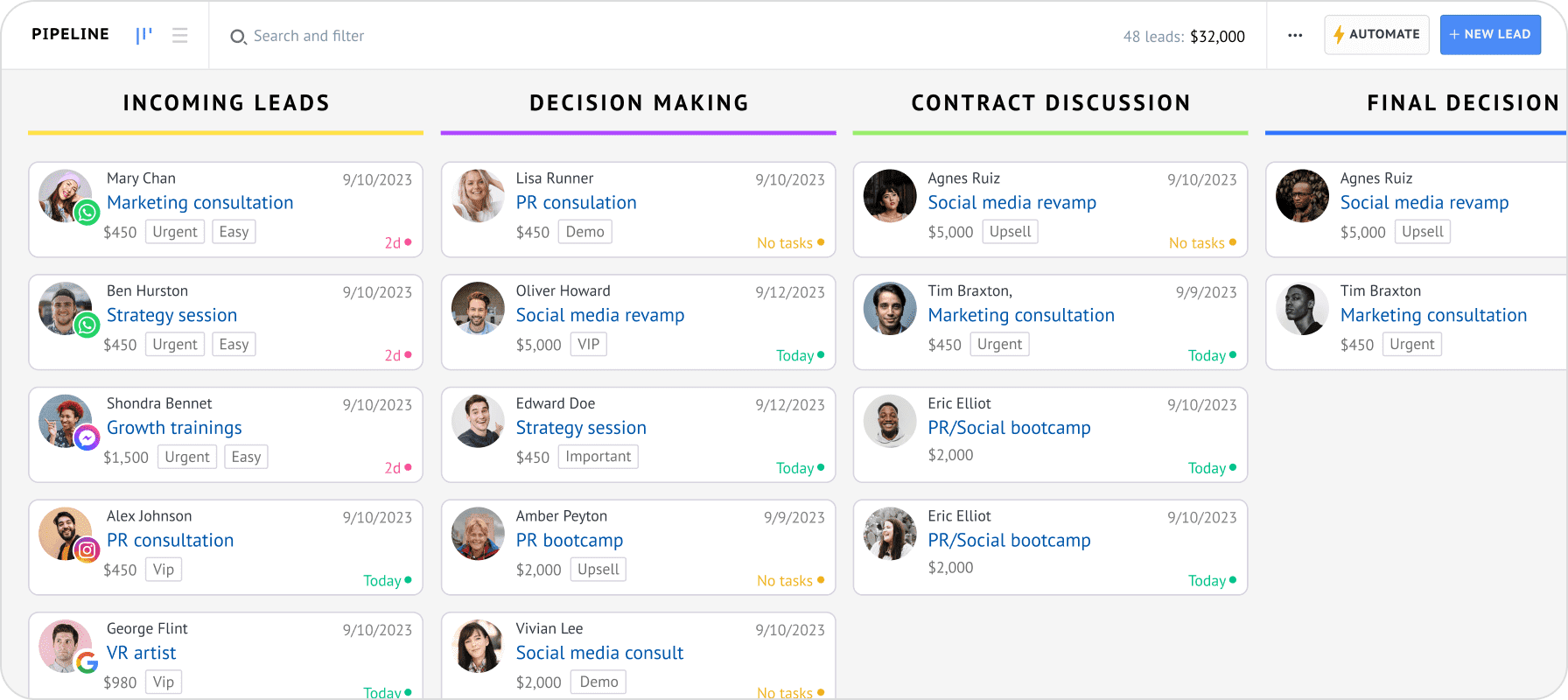

Pipedrive

Pipedrive is a sales-focused CRM platform that is known for its user-friendly interface and pipeline management features. It integrates with PayPal through third-party integrations, such as Zapier. Pipedrive is designed for sales teams and is a great option for businesses that want to streamline their sales processes and close more deals.

Freshsales

Freshsales is a CRM platform that offers a range of features for sales teams, including lead management, contact management, and sales automation. It integrates with PayPal through third-party integrations. Freshsales is known for its ease of use and its focus on providing a comprehensive sales solution. It is a good choice for businesses that want a CRM platform that is easy to set up and use.

When choosing a CRM for PayPal integration, consider the following factors:

- Integration Capabilities: Does the CRM offer native integrations with PayPal or require third-party integrations?

- Features: Does the CRM offer the features you need, such as sales automation, lead management, and reporting?

- Ease of Use: Is the CRM user-friendly and easy to learn?

- Cost: What is the cost of the CRM, including any add-ons or integrations?

- Scalability: Can the CRM scale to meet your business’s future needs?

By carefully evaluating these factors, you can choose the right CRM for your business and ensure a successful PayPal integration.

Troubleshooting Common Integration Issues

Even with careful planning and execution, you may encounter issues during the CRM integration process. Here are some common troubleshooting tips:

Connection Errors

If you’re experiencing connection errors, double-check your API credentials and ensure that they are correct. Verify that your PayPal account is active and that you have the necessary permissions to connect to the CRM. If you’re using a third-party integration platform, check its status and ensure that it’s functioning correctly.

Data Synchronization Problems

If data is not syncing correctly between your CRM and PayPal, check the data field mappings to ensure that the fields are correctly aligned. Verify that the data formats are compatible between the two systems. If you’re using a third-party integration platform, review its logs to identify any errors.

Workflow Automation Issues

If your automated workflows are not functioning as expected, check the triggers and actions to ensure that they are configured correctly. Verify that the workflows are activated and that any required conditions are met. Review the workflow logs to identify any errors.

Payment Processing Errors

If you’re experiencing payment processing errors, verify that your PayPal account is configured to accept payments in the correct currency. Check that your payment gateway settings are correct. Review the error messages to identify the root cause of the problem.

Consult Support Resources

If you’re unable to resolve the issue on your own, consult the support resources for your CRM and PayPal accounts. These resources may include documentation, FAQs, and online forums. Contact their support teams for assistance.

The Future of CRM and PayPal Integration

The integration of CRM systems with payment gateways like PayPal is constantly evolving, with new features and capabilities being added regularly. Here are some trends to watch for:

AI-Powered Automation

AI-powered automation is playing an increasingly important role in CRM and payment processing. AI can be used to automate tasks such as payment tracking, fraud detection, and customer service. AI can also be used to provide personalized recommendations and insights to sales and marketing teams.

Enhanced Personalization

Businesses are increasingly focused on providing personalized customer experiences. CRM and PayPal integration can be used to personalize marketing efforts, offer targeted promotions, and provide customized customer service. This leads to increased customer engagement and loyalty.

Mobile Optimization

Mobile optimization is becoming increasingly important as more and more customers make purchases on their mobile devices. CRM and PayPal integration can be optimized for mobile devices to provide a seamless and user-friendly experience. This includes mobile-friendly payment pages, mobile-optimized dashboards, and mobile-enabled workflows.

Integration with Emerging Technologies

CRM and PayPal integration is expanding to include integration with emerging technologies, such as blockchain and cryptocurrencies. This allows businesses to offer new payment options and streamline their payment processes. Businesses are also exploring the use of CRM and PayPal integration to manage and track digital assets.

Focus on Data Security

Data security is a top priority for businesses of all sizes. CRM and PayPal integration will continue to focus on data security, with enhanced security features and compliance with data privacy regulations. This includes secure payment processing, fraud prevention measures, and data encryption.

Conclusion: Embracing the Power of Integration

CRM integration with PayPal is a powerful strategy for businesses looking to streamline their operations, enhance customer experiences, and drive revenue growth. By automating payment tracking, improving sales cycle management, and gaining valuable insights into customer behavior, businesses can unlock significant benefits. By following the steps outlined in this guide and staying up-to-date on the latest trends, you can successfully integrate your CRM with PayPal and take your business to the next level.

Embrace the power of integration and unlock the full potential of your CRM and PayPal accounts. The seamless flow of data, the automation of tasks, and the enhanced customer experience will undoubtedly contribute to your business’s success in today’s competitive market.