Top CRM Systems for Small Accounting Firms: Boost Efficiency and Client Relationships

Introduction: Why Small Accounting Firms Need a CRM

Running a small accounting firm is a juggling act. You’re managing client accounts, deadlines, compliance, and the constant pursuit of new business. In this whirlwind, it’s easy for client relationships to get lost in the shuffle. That’s where a Customer Relationship Management (CRM) system comes in. It’s more than just a contact list; it’s the central nervous system for your client interactions and a powerful tool for driving growth.

For small accounting firms, the right CRM can be a game-changer. It can streamline your processes, improve client communication, and ultimately, boost your bottom line. This guide will explore the best CRM options specifically tailored for small accounting firms, helping you find the perfect fit for your needs and budget.

The Benefits of CRM for Accounting Firms

Before diving into specific CRM solutions, let’s examine the compelling reasons why a CRM is essential for your accounting practice:

- Improved Client Management: CRM systems provide a centralized repository for all client information, including contact details, financial records, communication history, and project status. This 360-degree view of your clients allows you to provide personalized service and anticipate their needs.

- Enhanced Communication: CRM tools facilitate seamless communication through email integration, task management, and automated reminders. You can keep clients informed about deadlines, payment schedules, and other important updates, fostering stronger relationships.

- Increased Efficiency: Automation is a key benefit. CRM systems automate repetitive tasks, such as data entry, appointment scheduling, and follow-up emails. This frees up your time to focus on more strategic activities, like client consultations and business development.

- Better Lead Generation and Management: CRM systems help you track leads, nurture prospects, and convert them into paying clients. You can segment your leads based on their needs and preferences, tailoring your marketing efforts for maximum impact.

- Data-Driven Decision Making: CRM systems provide valuable insights into your client base, marketing performance, and overall business operations. You can track key metrics, identify trends, and make data-driven decisions to improve your profitability.

- Compliance and Security: Many CRM systems offer features to help you comply with data privacy regulations, such as GDPR and CCPA. They also provide robust security measures to protect your client data from unauthorized access.

Key Features to Look for in a CRM for Accountants

Not all CRM systems are created equal. For small accounting firms, certain features are particularly important. Here’s what to look for:

- Contact Management: The ability to store and organize client contact information, including names, addresses, phone numbers, email addresses, and relevant financial details.

- Lead Management: Features to track and nurture leads, from initial contact to conversion. This includes lead scoring, pipeline management, and automated follow-up sequences.

- Task and Calendar Management: Tools to schedule appointments, set reminders, and manage tasks related to client projects and deadlines.

- Email Integration: Integration with your email provider (e.g., Gmail, Outlook) to track email communication and send automated email campaigns.

- Reporting and Analytics: Dashboards and reports that provide insights into your client base, sales performance, and other key metrics.

- Integration with Accounting Software: Seamless integration with popular accounting software, such as QuickBooks, Xero, or Sage, to streamline data exchange and eliminate manual data entry.

- Workflow Automation: The ability to automate repetitive tasks, such as sending invoices, following up on overdue payments, and sending appointment reminders.

- Security and Compliance: Robust security measures to protect client data and ensure compliance with data privacy regulations.

- Mobile Accessibility: A mobile app or responsive design that allows you to access your CRM data and manage your client relationships from anywhere.

- Customization Options: The ability to customize the CRM to fit your specific business needs, including custom fields, workflows, and reports.

Top CRM Systems for Small Accounting Firms

Now, let’s explore some of the best CRM systems specifically designed or well-suited for small accounting firms:

1. HubSpot CRM

HubSpot CRM is a popular choice for businesses of all sizes, including accounting firms. It offers a user-friendly interface, a wide range of features, and a generous free plan.

Key Features:

- Free Plan: HubSpot offers a robust free plan that includes contact management, deal tracking, email marketing, and basic reporting. This makes it an excellent option for small firms just starting with CRM.

- Sales Automation: Automate repetitive tasks like email follow-ups and task creation, saving you valuable time.

- Email Marketing: Create and send professional email campaigns to nurture leads and engage clients.

- Contact Management: Easily organize and manage client information, including contact details, communication history, and deal stages.

- Integration: Integrates with many popular accounting software and other business tools.

- Reporting and Analytics: Track key metrics and gain insights into your sales performance.

- Ease of Use: HubSpot is known for its intuitive interface and ease of use.

Pros: Free plan, user-friendly interface, extensive features, strong integrations.

Cons: Limited features in the free plan, can be overwhelming for very small firms.

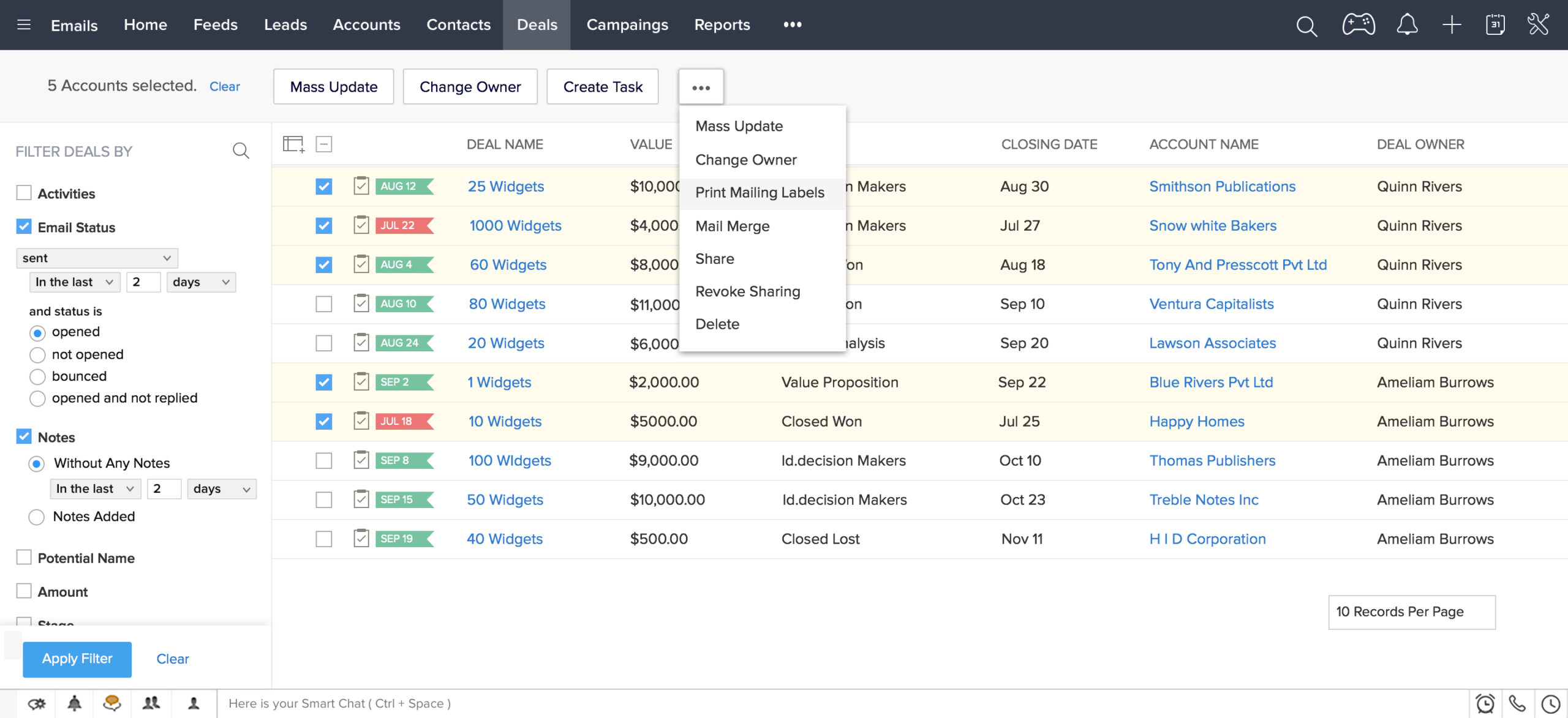

2. Zoho CRM

Zoho CRM is another strong contender, offering a comprehensive suite of features at a competitive price. It’s particularly well-suited for businesses that want a highly customizable CRM solution.

Key Features:

- Customization: Zoho CRM offers extensive customization options, allowing you to tailor the system to your specific needs.

- Workflow Automation: Automate complex workflows to streamline your processes.

- Sales Force Automation: Manage your sales pipeline, track deals, and forecast revenue.

- Marketing Automation: Automate your marketing campaigns and nurture leads.

- Integration: Integrates with a wide range of apps, including accounting software and other business tools.

- Reporting and Analytics: Create custom reports and dashboards to track your key metrics.

- Pricing: Zoho CRM offers different pricing tiers to suit various business needs and budgets.

Pros: Highly customizable, affordable pricing, extensive features.

Cons: Can have a steeper learning curve than some other CRM systems.

3. Pipedrive

Pipedrive is a sales-focused CRM that is known for its simplicity and ease of use. It’s an excellent choice for accounting firms that want a CRM that is primarily focused on lead management and sales.

Key Features:

- Visual Sales Pipeline: Pipedrive’s visual sales pipeline makes it easy to track deals and manage your sales process.

- Deal Tracking: Track deals through different stages of your sales pipeline.

- Activity Tracking: Track your sales activities, such as calls, emails, and meetings.

- Automation: Automate repetitive tasks to save time.

- Reporting and Analytics: Track your sales performance with customizable reports.

- Integrations: Integrates with a variety of tools, including email providers and other business apps.

- Ease of Use: Pipedrive is known for its intuitive interface and ease of use.

Pros: User-friendly, visual sales pipeline, strong sales-focused features.

Cons: May lack some of the features found in more comprehensive CRM systems.

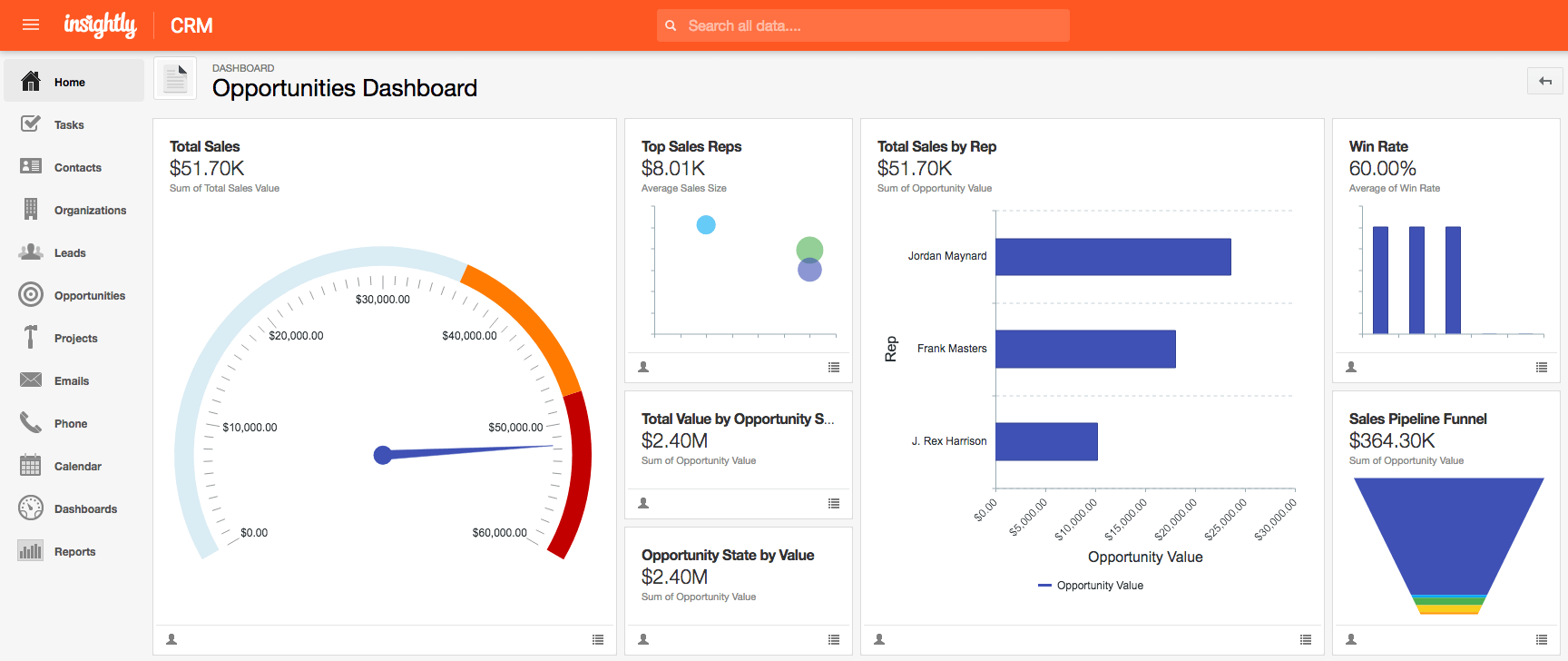

4. Insightly

Insightly is a CRM designed specifically for small businesses, offering a good balance of features and affordability. It’s a great option for accounting firms that want a CRM that is easy to set up and use.

Key Features:

- Contact Management: Manage your contacts, including contact details, notes, and related records.

- Lead Management: Track and nurture leads through your sales pipeline.

- Project Management: Manage projects related to client work.

- Workflow Automation: Automate repetitive tasks to save time.

- Reporting and Analytics: Track key metrics and gain insights into your business performance.

- Integrations: Integrates with popular apps, including Google Workspace and Mailchimp.

- Ease of Use: Insightly is known for its intuitive interface and ease of use.

Pros: User-friendly, affordable, strong project management features.

Cons: May lack some of the advanced features found in more comprehensive CRM systems.

5. Freshsales (formerly Freshworks CRM)

Freshsales is a sales CRM with a focus on ease of use and affordability, making it a good option for smaller accounting firms. It’s part of the Freshworks suite of products, which also includes customer support and marketing automation tools.

Key Features:

- Built-in Phone and Email: Make calls and send emails directly from the CRM.

- Lead Scoring: Prioritize your leads based on their behavior and engagement.

- Workflow Automation: Automate tasks like lead assignment and follow-up emails.

- Reporting and Analytics: Track your sales performance with customizable reports.

- Mobile App: Access your CRM data and manage your sales from anywhere.

- Integrations: Integrates with popular apps, including accounting software.

- User-Friendly Interface: Freshsales is known for its intuitive interface.

Pros: User-friendly, built-in phone and email, affordable pricing.

Cons: May not have as many features as some other CRM systems.

6. Keap (formerly Infusionsoft)

Keap is a CRM and sales and marketing automation platform designed for small businesses. It’s a powerful tool that can help you automate your sales and marketing processes and grow your business.

Key Features:

- Marketing Automation: Automate your marketing campaigns and nurture leads.

- Sales Automation: Automate your sales processes, from lead capture to deal closing.

- Contact Management: Manage your contacts and track your interactions with them.

- E-commerce: Sell products and services online.

- Reporting and Analytics: Track your key metrics and gain insights into your business performance.

- Integrations: Integrates with a wide range of apps, including accounting software and other business tools.

- Advanced Features: Keap offers advanced features such as email marketing, landing pages, and sales pipelines.

Pros: Powerful marketing and sales automation, comprehensive features.

Cons: Can be more expensive than some other CRM systems, steeper learning curve.

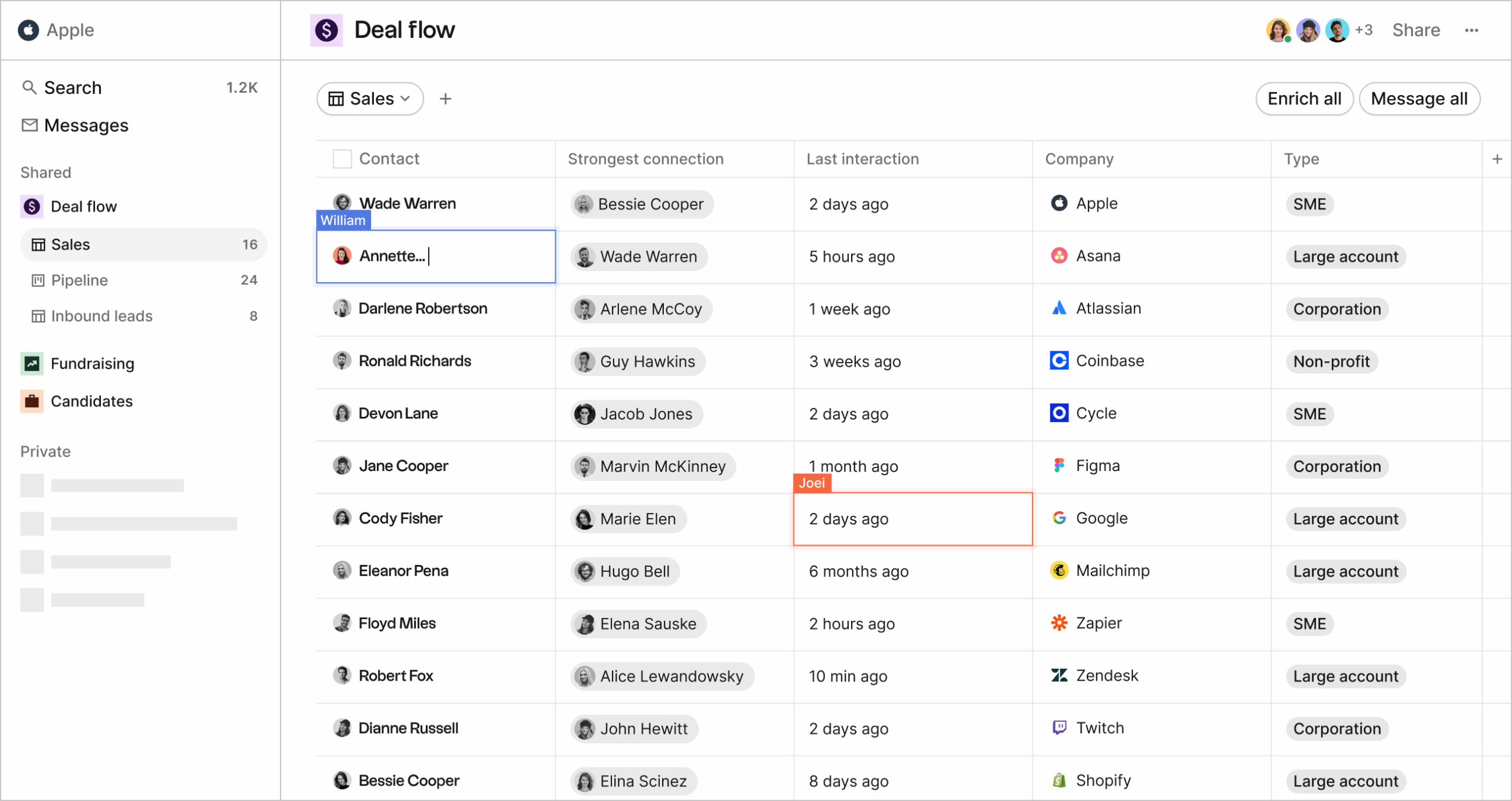

Choosing the Right CRM for Your Firm

Selecting the right CRM is a crucial decision. Here’s a step-by-step approach to help you choose the best CRM for your small accounting firm:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to understand your specific needs. What are your pain points? What are your goals for implementing a CRM? What features are most important to you? Consider the size of your firm, the number of clients you serve, and the complexity of your processes.

- Define Your Budget: CRM systems vary in price, from free plans to enterprise-level solutions. Determine how much you’re willing to spend on a CRM system. Consider the monthly or annual fees, as well as any implementation costs.

- Research Potential CRM Systems: Once you have a clear understanding of your needs and budget, research potential CRM systems. Read online reviews, compare features, and consider the integrations offered. The options listed above are a great place to start.

- Evaluate Key Features: Prioritize the features that are most important to your firm. Do you need robust contact management, lead management, sales automation, or reporting capabilities? Make sure the CRM system you choose offers the features you need.

- Consider Integrations: Determine which integrations are essential for your business. Does the CRM system integrate with your accounting software, email provider, and other business tools? Seamless integration will streamline your processes and eliminate manual data entry.

- Try Free Trials or Demos: Most CRM systems offer free trials or demos. Take advantage of these opportunities to test the systems and see if they are a good fit for your needs. Get your team involved in the evaluation process to gather feedback.

- Consider Scalability: Choose a CRM system that can grow with your business. As your firm expands, you’ll want a CRM system that can accommodate your changing needs and increased client base.

- Check for Security and Compliance: Ensure the CRM system you choose offers robust security measures and complies with data privacy regulations. This is essential for protecting your client data.

- Get Training and Support: Once you’ve chosen a CRM system, invest in training and support to ensure your team can use the system effectively. Look for CRM providers that offer training resources and responsive customer support.

- Implement and Optimize: Once you’ve chosen a CRM, implement it carefully. Migrate your data, configure the system to meet your needs, and train your team. Continuously monitor and optimize your CRM system to ensure it’s meeting your goals.

Implementation Tips for Accounting Firms

Once you’ve selected a CRM, successful implementation is key to realizing its benefits. Here are some tips to ensure a smooth transition:

- Plan Your Implementation: Develop a detailed implementation plan that outlines the steps involved, timelines, and responsibilities.

- Clean Your Data: Before importing your data into the CRM, clean and organize it to ensure accuracy and consistency.

- Train Your Team: Provide comprehensive training to your team on how to use the CRM system.

- Customize the System: Customize the CRM to meet your specific needs, including custom fields, workflows, and reports.

- Integrate with Other Tools: Integrate the CRM with your accounting software, email provider, and other business tools.

- Monitor and Optimize: Continuously monitor your CRM system to ensure it’s meeting your goals. Make adjustments as needed to optimize its performance.

- Get Feedback: Gather feedback from your team on how the CRM system is working and make adjustments based on their input.

Conclusion: Embrace CRM for a More Efficient and Client-Focused Future

Implementing a CRM system is a strategic investment that can transform your small accounting firm. By centralizing client data, automating tasks, and improving communication, a CRM empowers you to deliver exceptional client service, boost efficiency, and drive business growth. Take the time to research your options, choose the right CRM for your needs, and implement it effectively. The results – stronger client relationships, increased productivity, and a more profitable practice – will be well worth the effort. Don’t delay; start exploring the possibilities today and position your firm for a successful future.