The Ultimate Guide to the Best CRM for Small Cleaning Businesses: Streamline Your Operations and Watch Your Business Soar

Running a small cleaning business can feel like a whirlwind. You’re juggling appointments, managing client communications, tracking invoices, and trying to find time to actually, you know, clean! In the midst of all the chaos, it’s easy for things to slip through the cracks, and before you know it, you’re losing clients and revenue. That’s where a Customer Relationship Management (CRM) system comes in. Think of it as your digital assistant, your organizational guru, and your secret weapon for business growth.

This comprehensive guide will delve into the world of CRMs specifically designed for small cleaning businesses. We’ll explore the benefits, dissect the key features to look for, and, most importantly, recommend some of the best CRM solutions available, helping you find the perfect fit to propel your business forward. Get ready to streamline your operations, boost client satisfaction, and watch your small cleaning business thrive!

Why Your Small Cleaning Business Needs a CRM

You might be thinking, “I’m a small business; do I really need a CRM?” The answer is a resounding YES! In today’s competitive market, a CRM is no longer a luxury; it’s a necessity. Here’s why:

- Improved Organization: A CRM centralizes all your client data – contact information, cleaning schedules, service history, payment details, and communication logs – in one easily accessible place. No more scattered spreadsheets or sticky notes!

- Enhanced Customer Relationships: By having a complete view of each client, you can personalize your interactions, remember their preferences, and provide exceptional service. This leads to increased customer loyalty and positive word-of-mouth referrals.

- Streamlined Communication: CRM systems often include features for automated email marketing, appointment reminders, and follow-up communications, saving you valuable time and ensuring you stay top-of-mind with your clients.

- Increased Efficiency: Automation features, such as automated invoicing and payment processing, free up your time to focus on what matters most: growing your business and providing top-notch cleaning services.

- Better Lead Management: CRM systems help you track potential clients, nurture leads, and convert them into paying customers. You can monitor where your leads are coming from and what strategies are most effective in attracting new business.

- Data-Driven Decision Making: A CRM provides valuable insights into your business performance. You can track key metrics like client acquisition cost, customer lifetime value, and service profitability, enabling you to make informed decisions and optimize your strategies.

- Professionalism and Credibility: Using a CRM demonstrates to your clients that you are organized, professional, and committed to providing excellent service. This can give you a competitive edge in the market.

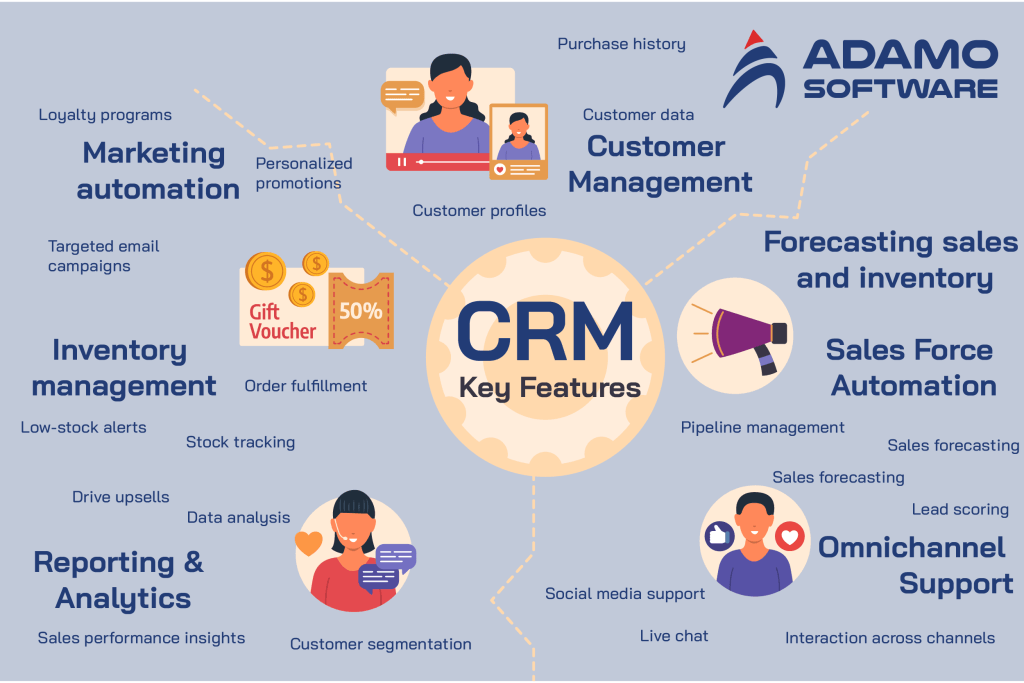

Key Features to Look for in a CRM for Cleaning Businesses

Not all CRMs are created equal. When choosing a CRM for your cleaning business, consider the following essential features:

- Contact Management: This is the core of any CRM. It should allow you to store and easily access all your client information, including contact details, addresses, special instructions, and communication history.

- Scheduling and Appointment Management: The ability to schedule appointments, assign cleaners, and send automated reminders is crucial for managing your cleaning schedule efficiently. Look for features like calendar integration, recurring appointments, and mobile access.

- Client Communication Tools: Your CRM should facilitate seamless communication with clients. This includes email marketing capabilities, SMS messaging, and the ability to track all communication interactions.

- Invoicing and Payment Processing: Integrate your CRM with an invoicing system to generate and send invoices automatically. Ideally, it should also integrate with payment gateways to allow clients to pay online, streamlining your cash flow.

- Task Management: Assign tasks to your employees, set deadlines, and track progress to ensure everything runs smoothly.

- Reporting and Analytics: Gain insights into your business performance with detailed reports on sales, client acquisition, service profitability, and other key metrics.

- Mobile Accessibility: Choose a CRM that offers a mobile app or is optimized for mobile devices, allowing you to manage your business on the go.

- Customer Portal: A customer portal where clients can request services, view schedules, and manage their accounts can enhance customer satisfaction and reduce administrative tasks.

- Integration with Other Tools: Consider how well the CRM integrates with other tools you use, such as accounting software, email marketing platforms, and payment processors.

- Ease of Use: The CRM should be user-friendly and intuitive, with a simple interface that your team can easily learn and adopt.

- Scalability: Choose a CRM that can grow with your business. It should be able to accommodate an increasing number of clients, employees, and features.

Top CRM Solutions for Small Cleaning Businesses

Now, let’s dive into some of the best CRM solutions designed specifically for small cleaning businesses. These recommendations are based on their features, ease of use, pricing, and overall suitability for the cleaning industry.

1. ServiceTitan

ServiceTitan is a comprehensive CRM solution specifically designed for home service businesses, including cleaning companies. It offers a robust suite of features that cover all aspects of your business, from customer relationship management and scheduling to invoicing and payment processing. While it might be more expensive than some other options, ServiceTitan’s extensive features and powerful capabilities make it a top choice for businesses looking for a full-fledged solution.

Key Features:

- Comprehensive Customer Management: Centralized customer database, communication history, service history, and job details.

- Advanced Scheduling and Dispatching: Optimized scheduling, real-time tracking of technicians, and automated dispatching.

- Integrated Invoicing and Payments: Seamless invoicing, online payment processing, and automated payment reminders.

- Marketing Automation: Email and SMS marketing campaigns, automated follow-ups, and customer segmentation.

- Detailed Reporting and Analytics: Track key performance indicators (KPIs) and gain insights into your business performance.

- Mobile App: Access all features on the go with the mobile app for technicians and office staff.

Pros:

- Highly specialized for home service businesses.

- Extensive feature set.

- Powerful reporting and analytics.

- Excellent customer support.

Cons:

- Can be expensive for smaller businesses.

- Steeper learning curve due to the extensive features.

2. Jobber

Jobber is a popular CRM and field service management software that is well-suited for cleaning businesses. It offers a user-friendly interface and a comprehensive set of features to manage all aspects of your operations, from lead management and scheduling to invoicing and payments. Jobber is known for its ease of use and affordability, making it a great option for small and growing cleaning businesses.

Key Features:

- Lead Management: Track leads, manage quotes, and convert them into customers.

- Scheduling and Dispatching: Drag-and-drop scheduling, job assignments, and automated reminders.

- Client Communication: Automated emails, SMS messaging, and client portal for easy communication.

- Invoicing and Payments: Create and send invoices, accept online payments, and track payments.

- Mobile App: Access all features on the go with the mobile app for technicians and office staff.

- Customer Portal: Allows clients to request services, view schedules, and manage their accounts.

Pros:

- User-friendly interface.

- Affordable pricing.

- Comprehensive features.

- Excellent customer support.

Cons:

- May not have as many advanced features as ServiceTitan.

3. Housecall Pro

Housecall Pro is another excellent CRM solution specifically designed for home service businesses, including cleaning companies. It offers a user-friendly interface, a comprehensive feature set, and affordable pricing. Housecall Pro is designed to simplify your operations and help you grow your business.

Key Features:

- Customer Management: Centralized customer database, communication history, and service history.

- Scheduling and Dispatching: Drag-and-drop scheduling, job assignments, and automated reminders.

- Invoicing and Payments: Create and send invoices, accept online payments, and track payments.

- Online Booking: Allow clients to book services online through your website or social media.

- Marketing Tools: Email and SMS marketing campaigns, customer segmentation, and automated follow-ups.

- Mobile App: Access all features on the go with the mobile app for technicians and office staff.

Pros:

- User-friendly interface.

- Comprehensive features.

- Affordable pricing.

- Online booking capabilities.

Cons:

- May not have as many advanced features as ServiceTitan.

4. Connecteam

Connecteam is a great option for cleaning businesses looking for a more employee-focused solution. It helps you manage your workforce effectively, streamline communication, and boost employee engagement. While it offers some CRM features, its primary focus is on employee management.

Key Features:

- Employee Communication: Send announcements, updates, and chat with your team.

- Scheduling: Create and manage employee schedules, track time and attendance.

- Task Management: Assign tasks, track progress, and provide feedback.

- Training and Checklists: Create training materials and checklists for your employees.

- Forms and Surveys: Collect feedback from employees and clients.

Pros:

- Excellent for employee communication and management.

- User-friendly interface.

- Affordable pricing.

Cons:

- Not as focused on traditional CRM features as other options.

- Limited customer management capabilities.

5. monday.com

monday.com is a versatile work management platform that can be customized to fit the needs of a cleaning business. While it’s not a dedicated CRM, its flexibility and powerful automation capabilities make it a viable option for managing client relationships, scheduling, and other business processes.

Key Features:

- Customizable Boards: Create custom boards to manage clients, projects, and tasks.

- Workflow Automation: Automate repetitive tasks, such as sending emails and creating invoices.

- Collaboration Tools: Collaborate with your team on projects and tasks.

- Integrations: Integrate with other tools you use, such as email marketing platforms and payment processors.

- Reporting and Analytics: Track key metrics and gain insights into your business performance.

Pros:

- Highly customizable.

- Powerful automation capabilities.

- Excellent collaboration tools.

- Integrations with other tools.

Cons:

- Not a dedicated CRM, so some features may be limited.

- Can be overwhelming for beginners.

Choosing the Right CRM: A Step-by-Step Guide

Choosing the right CRM is a crucial decision for your cleaning business. Here’s a step-by-step guide to help you make the right choice:

- Assess Your Needs: Before you start evaluating CRM systems, take the time to understand your specific needs and pain points. What are your biggest challenges in managing your business? What features are most important to you?

- Define Your Budget: Determine how much you are willing to spend on a CRM system. Pricing varies widely, so it’s important to set a budget before you start shopping.

- Research CRM Options: Research different CRM solutions and compare their features, pricing, and reviews. Consider the options mentioned above and any other CRM systems that might be a good fit for your business.

- Request Demos and Trials: Most CRM providers offer free demos or trial periods. Take advantage of these opportunities to test the software and see if it meets your needs.

- Consider Ease of Use: Choose a CRM that is easy to use and intuitive. The easier it is to use, the more likely your team will adopt it.

- Evaluate Integrations: Make sure the CRM integrates with the other tools you use, such as your accounting software, email marketing platform, and payment processor.

- Check Customer Support: Look for a CRM provider that offers excellent customer support. You’ll need assistance from time to time, so it’s important to choose a provider that is responsive and helpful.

- Read Reviews: Read online reviews from other cleaning businesses to get an idea of what to expect from each CRM system.

- Make a Decision: Once you’ve evaluated your options, make a decision and choose the CRM that best meets your needs and budget.

- Implement the CRM: Once you’ve chosen a CRM, it’s time to implement it. This involves setting up your account, importing your data, training your team, and customizing the system to fit your needs.

Tips for Successfully Implementing a CRM

Implementing a CRM system is a significant undertaking, but with the right approach, you can ensure a smooth transition and maximize its benefits. Here are some tips for successful implementation:

- Involve Your Team: Get your team involved in the selection and implementation process. Their input and buy-in are essential for successful adoption.

- Provide Training: Provide comprehensive training to your team on how to use the CRM system. The more familiar they are with the system, the more likely they are to use it effectively.

- Import Your Data: Import your existing client data into the CRM system. This will save you time and ensure that all your information is in one place.

- Customize the System: Customize the CRM system to fit your specific needs and workflows. This includes setting up custom fields, creating automated workflows, and integrating with other tools.

- Set Clear Expectations: Set clear expectations for your team on how to use the CRM system. This includes defining roles and responsibilities, establishing data entry standards, and setting goals for CRM usage.

- Monitor and Evaluate: Monitor your team’s use of the CRM system and evaluate its effectiveness. Make adjustments as needed to ensure that it is meeting your needs.

- Provide Ongoing Support: Provide ongoing support to your team to address any questions or issues they may have. This includes providing training, troubleshooting problems, and offering tips and best practices.

- Stay Consistent: Encourage your team to use the CRM consistently. The more they use it, the more valuable it will become.

- Celebrate Successes: Celebrate successes and recognize team members who are using the CRM effectively. This will help to motivate your team and encourage them to continue using the system.

The Benefits of a CRM: Beyond the Basics

While we’ve covered the core benefits of a CRM, let’s delve deeper into some of the more nuanced advantages that can significantly impact your cleaning business:

- Reduced Administrative Burden: CRM systems automate many of the administrative tasks that consume your time, such as sending invoices, scheduling appointments, and sending payment reminders. This frees up your time to focus on more strategic activities, such as growing your business and providing excellent customer service.

- Improved Cash Flow: CRM systems can help you improve your cash flow by automating invoicing and payment processing. This ensures that you get paid on time and reduces the risk of late payments or bad debts.

- Enhanced Marketing Efforts: CRM systems can help you improve your marketing efforts by providing you with valuable insights into your clients’ preferences and behaviors. You can use this information to create targeted marketing campaigns that are more likely to convert leads into paying customers.

- Better Customer Retention: CRM systems can help you improve customer retention by providing you with a complete view of each client’s service history and preferences. This allows you to personalize your interactions and provide exceptional customer service, which can lead to increased customer loyalty.

- Increased Revenue: By streamlining your operations, improving customer relationships, and enhancing your marketing efforts, a CRM system can help you increase your revenue.

- Scalability: A good CRM system is scalable, meaning that it can grow with your business. As your business grows, the CRM system can accommodate an increasing number of clients, employees, and features.

- Improved Team Collaboration: CRM systems provide a centralized platform for your team to collaborate on client projects and tasks. This improves communication, reduces errors, and ensures that everyone is on the same page.

- Better Decision-Making: CRM systems provide you with valuable insights into your business performance, allowing you to make informed decisions and optimize your strategies.

Conclusion: Embrace the Power of CRM

Choosing the right CRM is a game-changer for your small cleaning business. By streamlining operations, enhancing customer relationships, and providing valuable insights, a CRM can help you take your business to the next level. From the comprehensive power of ServiceTitan to the user-friendly approach of Jobber and Housecall Pro, or even the employee-focused strategy of Connecteam and the versatility of monday.com, there’s a CRM solution out there to fit your specific needs and budget.

Don’t let the complexity of running a cleaning business overwhelm you. Embrace the power of CRM and unlock the potential for growth, efficiency, and unparalleled customer satisfaction. Take the first step today: assess your needs, research your options, and choose the CRM that will help you build a thriving cleaning business. Your future success awaits!